A Ray Of Hope: Usage Of Fed’s Repo Ops Slides

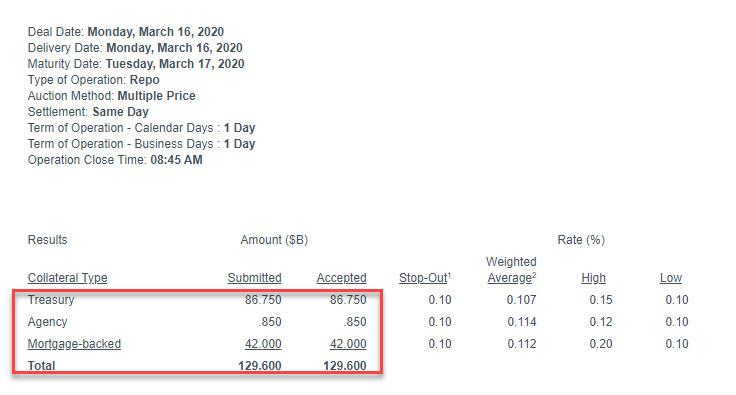

Update: The faint trace of good news from today’s $500BN term repo carried over into the overnight repo, which just like the operation before it (see below), priced undersubscribed, with dealers submitting $129.6BN in securities for today’s $175BN operation.

In total, the Fed has injected $148BN in liquidity this morning, which however may be rather generous considering the Fed not only cut rates to zero but removed all reserve requirements. In any case, if this is indeed good news on the liquidity front it has yet to be noticed by risk markets, with the S&P now trading -11% premarket.

* * *

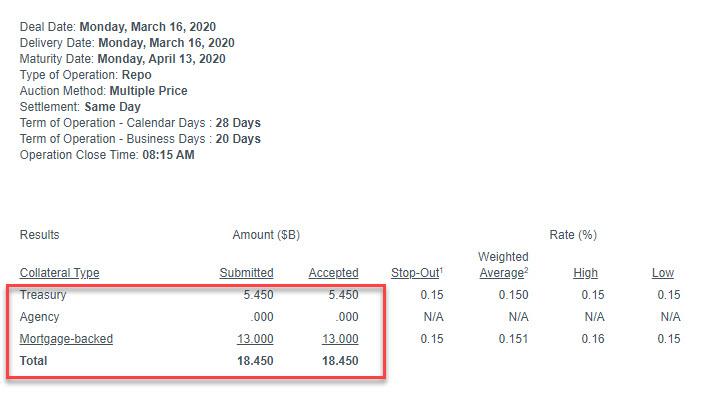

Heading into this morning’s market shitshow, with Emini futures frozen, the SPY trading down 10% and assuring an instant 15-minute trading halt, traders dumping gold, crude and crypto and anything else that isn’t halted, a sense of panic and foreboding has pervaded Wall Street’s trading desks, and heading into the results from today’s Fed term repo, there was angst that the panic would escalate materially if the Fed announced that today’s upsized $500 billion, 28-day repo facility was close to oversubscribed.

Luckily that did not happen, and in perhaps the first ray of hope that the S&P500 won’t just BATS IPO itself to 0 in 50 milliseconds when it reopens, dealers submitted only $18.45BN in securities to today’s massive repo operation, down from $24.1BN on Friday, suggesting that the liquidity clogs may be getting slightly smaller.

Translation: maybe, just maybe, the Fed’s massive liquidity injecting bazooka may have alleviated some dealers funding needs. Or maybe not: if on normalizes the FRA/OIS for Sunday’s rate cut, it emerges that dollar liquidity in the interbank market remains scarce and highly fragmented.

Keep an eye on today’s overnight repo facility for confirmation the funding squeeze may finally be normalizing.

Tyler Durden

Mon, 03/16/2020 – 08:40

via ZeroHedge News https://ift.tt/33kxTlo Tyler Durden