RIP Bond Vigilantes: World Of Endless QE Is Here

Authored by Bloomberg macro commentator, Garfield Reynolds

The Federal Reserve just moved us toward a world where central banks hold so much of government bond markets that nothing else matters. That’s a world where yields will stay lower forever not just for longer.

The Fed pledged to add $700 billion of bond buying after cutting rates back to the zero bound, and market reaction that followed hinted toward QE ad-infinitum.

The ECB will likely have to continue with its re-energized balance-sheet expansion and the BOJ at the very least is stuck with gradually adding to an already impressive pile of JGBs.

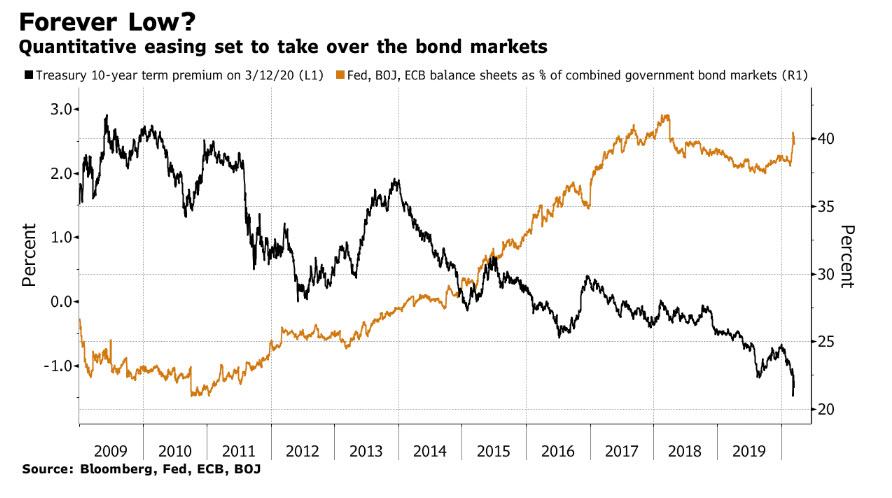

New Zealand’s central bank stands ready to turn to QE, and Australia’s says it is ready to do so too. Soon there may be no corner of the developed world where bonds aren’t being bought by local monetary authorities. The G-3 central banks’ aggregate balance sheet peaked at about 42% of their combined government bond markets in March 2018, before dipping to 37% last September; now the figure is 40% with a breakout to fresh highs anticipated.

Whatever the economic justifications for central bank stimulus, the impact on markets has been a regime shift, with the U.S. now seen likely to join Germany and Japan with yields below zero sooner rather than later.

Meanwhile, the deeply negative term premium for U.S. 10-year notes emphasizes that bonds are being transformed into price instruments not yield ones, casting doubt on how accurate expected inflation gauges such as breakeven levels can be.

The more bonds central banks buy, the harder it becomes for them to walk away, particularly with fiscal stimulus looming.

With governments being encouraged to borrow more and central banks set to dominate the market, we can say goodbye to bond vigilantes when it comes to the developed world at least.

Central bankers will find it well-nigh impossible to riskWhat central banker is going to risk letting yields rise substantially in the future, when doing so would harm governments, creditors and risk-asset sentiment.

Yields look like staying lower forever, not just for longer, as central banks march toward a world where they hold more than half of all government bonds and are unable to let go.

Tyler Durden

Mon, 03/16/2020 – 08:46

via ZeroHedge News https://ift.tt/2TVPptb Tyler Durden