Foreign Central Banks Dump Treasuries For 17th Straight Month, Continue To Hoard More Gold

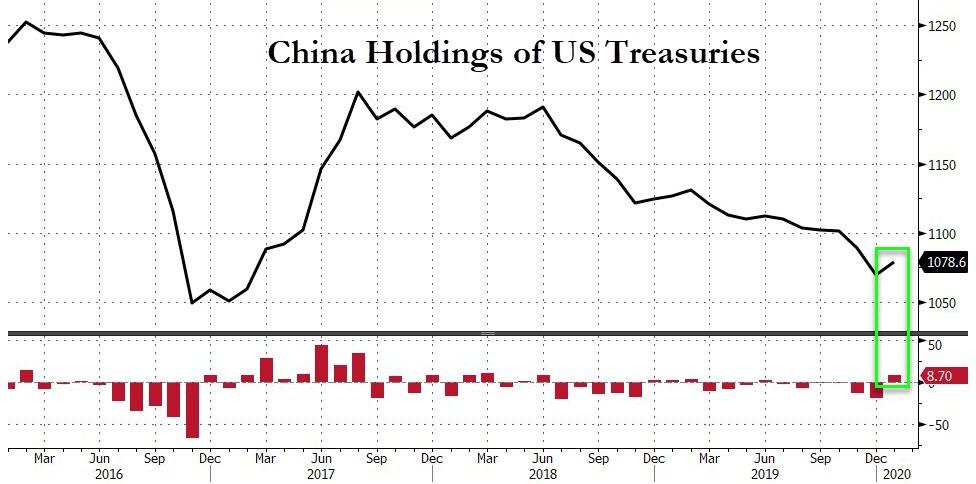

For the first time since June, China added to its US Treasury holdings in January (the latest month from TIC data).

The total for China — the second-largest holder of U.S. government debt after Japan – rose $8.7 billion in January to $1.08 trillion.

Source: Bloomberg

The coming months’ data will help show if the virus’s blow to China’s economy is starting to pressure central bank officials to sell Treasuries to support the yuan, a step they’ve avoided over the past several years, preferring instead to manage the currency via the daily fixing, says Mark Sobel, former IMF and Treasury official and chair of the OMFIF.

If COVID-19 hit the yuan hard, he said, “China might intervene to cushion any decline.”

Japan remains the largest foreign holder with $1.21 trillion, as the value of its holdings rose $56.8 billion at the start of the year, the data showed.

Source: Bloomberg

Overall, Foreigners were net buyers of US assets excluding corporate debt

- Foreign net buying of Treasuries at $25.6b

- Foreign net buying of equities at $2b

- Foreign net selling of corporate debt at $31.8b

-

Foreign net buying of agency debt at $32.3b

But foreign central banks dumped US Treasuries for the 17th straight month…

Source: Bloomberg

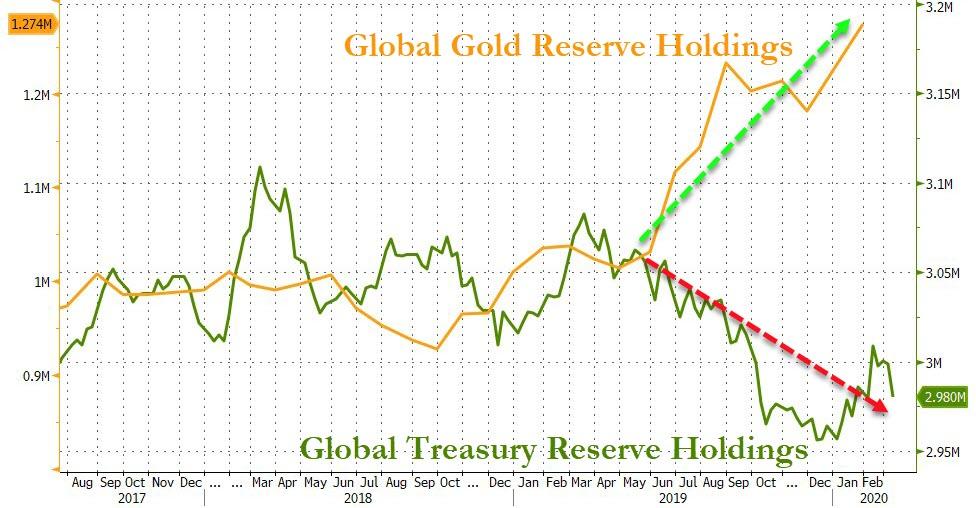

But, while reducing of exposure to US Treasuries continues worldwide, Central banks started out 2020 buying more gold.

Source: Bloomberg

On net, central banks added 21.5 tons of gold to their reserves in January, according to the latest data from the World Gold Council.

Central bank demand came in at 650.3 tons in 2019. That was the second-highest level of annual purchases for 50 years, just slightly below the 2018 net purchases of 656.2 tons. According to the WGC, 2018 marked the highest level of annual net central bank gold purchases since the suspension of dollar convertibility into gold in 1971, and the second-highest annual total on record.

The World Gold Council bases its data on information submitted to the International Monetary Fund.

Turkey was the leading gold-buyer in January. The Turks added 16.2 tons of gold to their reserves.

Russia continued to stockpile the yellow metal, adding another 8.1 tons to their hoard. Russia’s quest for gold has paid off in a big way. The Russian Central Bank’s gold reserves topped $100 billion in September 2019 thanks to continued buying and surging prices.

The Russians have been buying gold for the last several years in an effort to diversify away from the US dollar. Russian gold reserves increased 274.3 tons in 2018, marking the fourth consecutive year of plus-200 ton growth. Meanwhile, the Russians sold off nearly all of its US Treasury holdings. According to Bank of America analysts, the amount of US dollars in Russian reserves fell from 46% to 22% in 2018.

Mongolia and Kazakhstan both added 1 ton of gold to their reserves in January. The only other buyer was Greece at 0.1 tons.

There were two significant net-sellers – Uzbekistan (2.2t) and Qatar (1.6t).

The People’s Bank of China did not report any gold purchases for the fourth straight month It’s not uncommon for China to go silent and then suddenly announce a large increase in reserves.

January’s net gold purchases represented a 57% decline year-on-year. World Gold Council analyst Krishan Gopaul said it was too early to determine what this could mean for 2020.

World Gold Council director of market intelligence Alistair Hewitt said there are two major factors driving central banks to buy gold – geopolitical instability and extraordinarily loose monetary policy.

Central banks are looking toward gold to balance some of that risk. We’ve also got negative rates and yields for a large number of sovereign bonds.”

“This recent trend shouldn’t be ignored. But nor should we also lose sight of the fact that central banks remain net purchasers, even if at a lower level than we have come to expect to in the last two years.”

Peter Schiff has talked about central bank gold-buying. He has noted that the US went off the gold standard in 1971, but he thinks the world is going to go back on it.

The days where the dollar is the reserve currency are numbered and we’re going back to basics. You know, everything old is new again. Gold was money in the past and it will be money again in the future, and central banks that are smart enough to read that writing on the wall are increasing their gold reserves now.”

Ron Paul made a similar point in an episode of the Liberty report. He said foreign central banks are increasingly gravitating to sound money like gold and ripping themselves away from the Fed’s dollar.

The central banks of the world are looking at gold again.”

Tyler Durden

Mon, 03/16/2020 – 16:12

via ZeroHedge News https://ift.tt/3aZ27gs Tyler Durden