BMO: The Market Ponders If This Is “The Spanish Flu” Or “The Great Depression”

For the past week, it’s been virtually non-stop: one central bank after another has fired a bazooka, rushing to frontrun its peers in hopes of big impact, only to find no response from the market, forcing it to fire another, even bigger bazooka. Consider that just over the past 24 hours we have gotten the following (via Nomura):

-

Fed announced a new emergency program (MMLF) to aid money markets

-

ECB “no limits” bazooka (“Pandemic Purchase Program w/ $820B of QE)

-

RBA 25bps cut to ELB, introduces QE and targeted YCC

-

Japan discussing $276B packed including “cash payouts” to households

-

S Korea new $40B package

-

Brazilian 50bps rate cut

-

US Senate passes 2nd stimulus bill and negotiating the 3rd ($1.3T)

-

BOE emergency rate cut to 0.1% and GBP200BN QE expansion

And yet, as BMO’s rate strategist Ian Lyngen writes this morning, “central bank intervention continues to mount, but its effectiveness in containing the fear evident throughout financial markets appears to be diminishing.”

The ECB has unveiled a €750 bn bond-buying program (to run at least until year-end) which will target sovereign debt, including Greek bonds, and is in direct response to this week’s spike in Italian yields. The Fed has also followed-through with another emergency effort; through the Market Mutual Fund Liquidity Facility (MMLF) “the Federal Reserve Bank of Boston will make loans available to eligible financial institutions secured by high-quality assets purchased by the financial institution from money market mutual funds.” Providing another source of liquidity for the cash market is a crucial step in assuring the stability of the broader system, even if – as with all the efforts of monetary policymakers – it is not going to flatten the Covid-19 curve.

And, as Lyngen adds, to accomplish this objective, federal and local governments are increasingly the focus of investor angst. The initial phase of trading the official response was “wow – didn’t know things had gotten so bad. Better sell equities.” After a few weeks of gauging the actions of governments both domestically and abroad, a second phase has emerged; “wow – there isn’t enough being done or that can be done. Better sell equities.”

In short, the theme is clear – the market is pondering whether the situation is akin to the Spanish flu or the Great Depression, however facing this dire dilemma, BMO finds itself with a slightly different interpretation as the severity of the price action itself has given the bank pause. Here’s why:

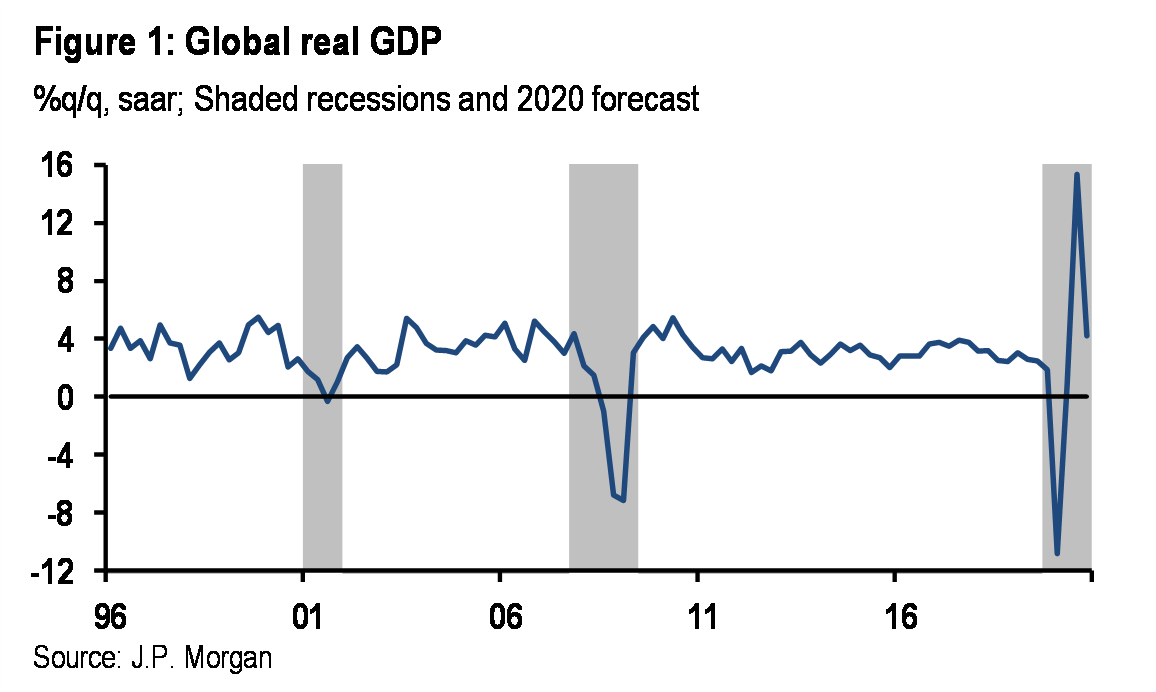

It’s now well-known that the first half of 2020 is going to experience dismal real economic growth; that much is certain. In fact, JPMorgan now predicts a depression-like plunge in US GDP of -14%.

The operating assumption is that once the coronavirus curve has finally peaked (similar to what appears to be occurring in China), cities will reopen and consumption will return anew. This is also the basis behind JPM’s very optimistic assumption of a V-shaped recovery.

However, whether this indeed triggers a v-shaped recovery or a u-shaped one will depend on three unknowns:

-

Fed/government liquidity measures,

-

ability of authorities to contain or slow the spread of Covid-19 and

-

length of the economic lockdown.

Essentially, the first ‘unknown’ is coming into focus as Powell delivers and the White House cobbles together a fiscal package that can make it through Congress.

The second, is even more difficult to judge because as more people are tested, more cases are discovered – the timeline of actual infections is unlikely to be definitively established. Said differently, even a ‘perfect quarantine’ of untested individuals will see a rise in ‘known’ cases as the testing commences.

The third element, the period of economic disruption, is the most angst inducing for investors. Every trading session that passes without either a turn in the pace of infection or a hope-inspiring development has resulted in a downward repricing of risk assets. As an alternative to the more dramatic reading of Spanish flu versus Great Depression, BMO suggests that investors are facing either Y2K (econ-ageddon that never was) or a severe v-shaped recession; akin to the 2009 financial crisis without the same degree of systemic risks.

In the near-term, the details coming out of Washington related to the fiscal response will inform the next leg for risk assets. Helicopter money has become an assumption at this point; however, the ability of businesses to stay viable during the shutdown is even more relevant.

To a large extent, this will depend on how money is funneled to small businesses and whether it is in the form of cheap financing or an outright grant. As an astute member of upper management highlighted, it isn’t in the best interest of firms to load up on debt owed to the government during a mandated closure only to use those moneys to pay workers. Why not simply furlough and rehire the workers; thereby creating a more direct path (via unemployment benefits) to the federal funds? Business owners could then simply negotiate with their landlords and creditors for bridge funding/forbearance until the economy reopens. Food for thought as the details slowly emerge on the >$1 trillion package. Punchline; grant and not cheap financing.

And speaking of the stimulus package, it is worth conetmplating what form the fiscal response from Washington will take. While the details are still unknown, some combination of a direct cash infusion, extended tax payment deadlines, money fund guarantees, and various industry bailouts are on the table. Regardless of how large the spending ultimately is, it will be funded via massive increases in Treasury issuance. This will be focused in the bill market, where the historically larger volatility in offering sizes will bear the brunt of ramp-up in borrowing. Several cash management bills of substantial heft would also follow intuitively. While on the margin, such increases in supply introduce a bearish relative value risk for the front-end, this should be at least partially offset by the flood into government money funds.

As BMO concludes, “as long as the dollar maintains its position as the global reserve currency, even with gargantuan supply sizes, a structural bid will continue to exist for Treasuries, a notion supported by 10s trading below 1.50%.”

Tyler Durden

Thu, 03/19/2020 – 20:55

via ZeroHedge News https://ift.tt/2QvubQK Tyler Durden