After Bernanke & Yellen Demand ‘Monetize Everything’, Congress Considers Set To Allow Fed To Buy Corporate Bonds

So far in this ‘everything bubble’-burst crisis, the Fed has:

- Cut interest rates from 1.25% to 0.15%.

- Launched over $700 billion in Quarantitative Easing (QE).

- Launched a $1.5 trillion repo program.

- Launched another $1 trillion repo program…. daily!

- Announced it will begin buying commercial paper (short-term corporate debt).

- Allowed primary dealers to start parking assets, including stocks, as collateral in exchange for short-term credit.

- Announced it will begin buying muni debt.

- Opened unlimited dollar-swap-lines to the world.

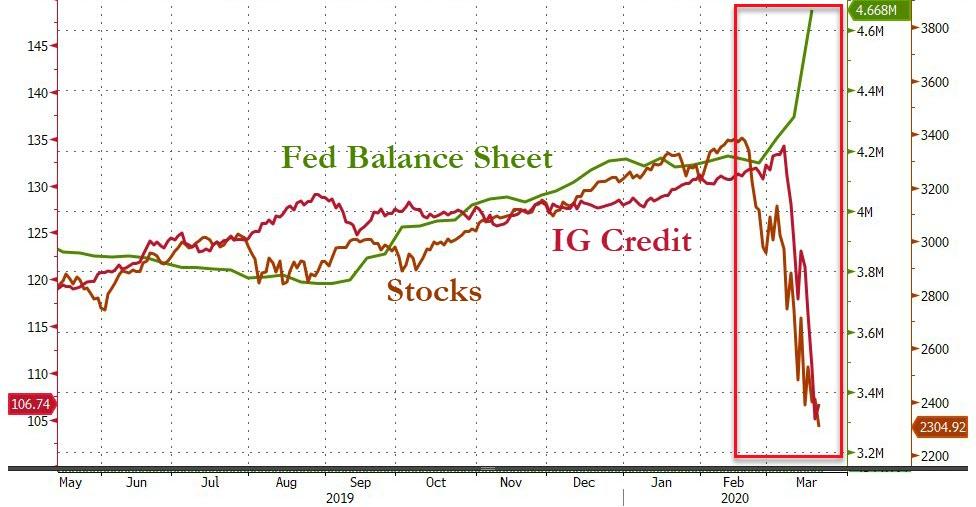

And the result of all this record amount of liquidity provision – almost $30 trillion of global wealth destruction (bonds and stocks)…

And not a glimpse of deleveraging/selling pressure reduce in stocks or bonds…

And every aspect of the credit markets – from short-term munis to long-term commercial mortgage-backeds – is completely frozen.

“It’s brutal. We have never seen such a big move in such a short amount of time… This is the quickest and most severe I have ever experienced, and I was around for 2008.“

Enter former Fed Chairs Ben Bernanke and Janet Yellen, who, as we detailed earlier this week, urged the Fed to begin buying corporate debt and stocks in an op-ed piece in the Financial Times this morning the two former Fed Chairs

The Fed could ask Congress for the authority to buy limited amounts of investment-grade corporate debt. Most central banks already have this power, and the European Central Bank and the Bank of England regularly use it. The Fed’s intervention could help restart that part of the corporate debt market, which is under significant stress. Such a programme would have to be carefully calibrated to minimise the credit risk taken by the Fed while still providing needed liquidity to an essential market.

Currently the Fed is forbidden from doing either as per the Federal Reserve Act. Put another way, congress would need to authorize the Fed to start buying these assets, and the two former Fed Chairs are providing the political cover to do this.

So, it should come as no surprise to anyone that Bloomberg is reporting that Congress is likely to pass legislation Monday clearing the way for more emergency action from the Fed, with lawmakers and Trump adminstration officials on Sunday signaling the package would give the Fed approval to expand its purchases of corporate bonds.

“There’s a very, very large credit facility that we’re standing up,” Pennsylvania Republican Senator Patrick Toomey said about the legislation on NBC’s ‘Meet the Press’.

“It will be done jointly with the Treasury and the Fed.”

Emergency facilities with the Fed would mobilize “up to $4 trillion of liquidity,” Mnuchin said, though it was unclear whether that included programs already announced by the central bank.

According to subsequent reports from the WSJ, the current iteration of the massive bailout Bill being mulled in Congress, has the following provisions:

The economic stabilization bill will include significant funding for the ESF so that Treasury can cover credit losses for Federal Reserve 13(3) lending facilities

One draft of the bill would put $425 billion into the Treasury that the Fed could use to cover losses on lending facilities. Last week, the Fed launched three of these 13(3) facilities, two of them with $10 billion each from the Treasury to indemnify against losses

This would allow the Fed to stand up a new generation of emergency lending programs that could support markets for securitization, investment grade corporates, longer-dated munis or small business loans.

In other words, the Fed is about to have a green light to buy corporate bonds.

Finally, remember just a month ago, Janet Yellen suggested that The Fed should buy stocks in the next crisis.

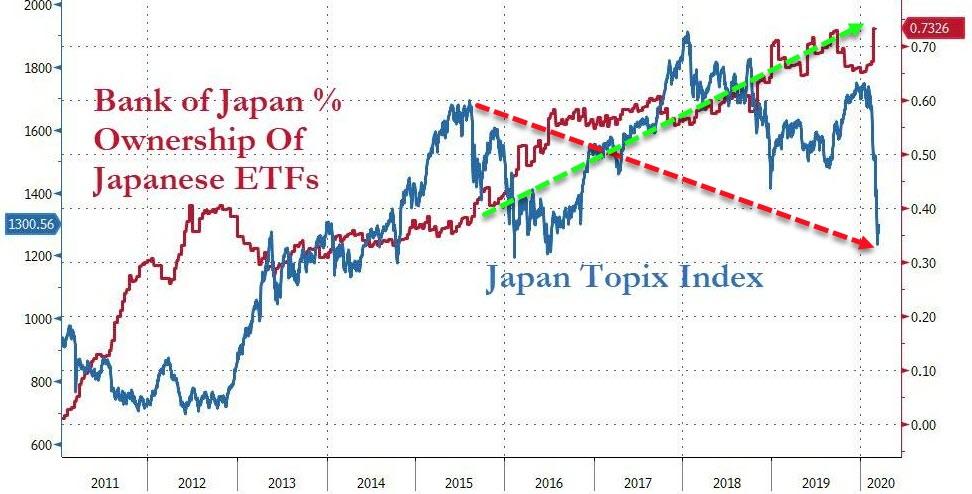

We wonder how long before that is added to The Fed’s mandate explicitly? Of course, buying stocks worked out really well for The Bank of Japan which now faces trillions in losses on its insane ETF buying program.

So, do we go full-Einsteinian-madness – repeating the mistakes (that have not worked at all) of Japan and Europe and expect a different result, or is now the time to bite the bullet, peel off the bandaid, liquidate what has failed and – at the cost of massive political upheaval – embrace the creative destruction and prepare for a new world?

Don’t answer: that was rhetorical.

Tyler Durden

Sun, 03/22/2020 – 17:00

via ZeroHedge News https://ift.tt/3af0R98 Tyler Durden