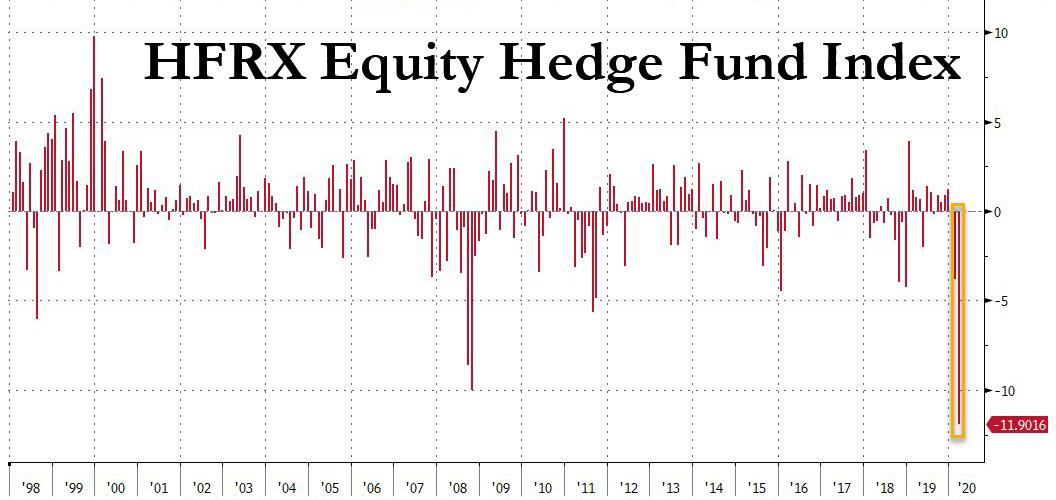

Equity Hedge Funds Suffer Their Worst Month Ever

While Robert Reich may be very badly confused what the word “hedge” means…

Average hedge fund down 9% this year so far.

S&P 500 down 24% so far.

No way hedges could do this without inside information.

When this emergency is over, hedge funds must be investigated.

— Robert Reich (@RBReich) March 22, 2020

… his comment does touch on a valid point, even if it is diametrically the opposite of the one he had hoped to make: according to Hedge Fund Research, the HFRX Equity Hedge Fund index just suffered its worst one-month drop in history.

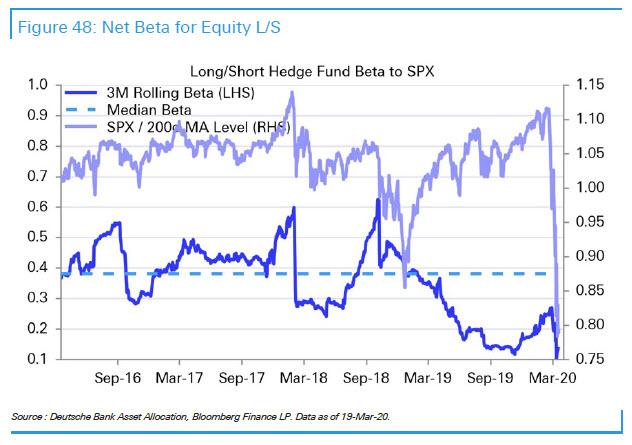

This is mostly the result of the continued chaos in the hedge fund worlds, where hedge funds had taken down their beta to the S&P over the past two years to the lowest level on record, as PMs have no idea what to do in this “market”:

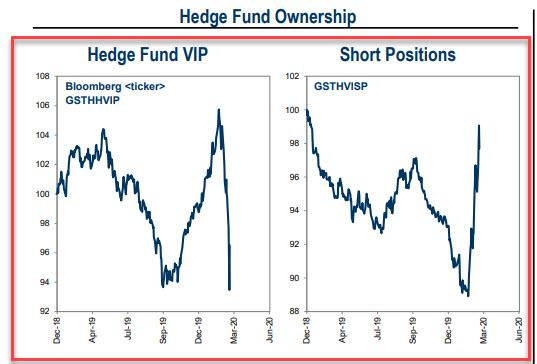

Others, such as Goldman, blame illiquidity for the epic collapse, with Goldman’s David Kostin writing on Friday that “illiquidity likely contributed to the sharp underperformance of popular hedge fund and mutual fund stocks this week as investors reduced risk” noting that whereas “investor positioning remained unusually elevated relative to levels at the bottom of other major S&P 500 corrections”, this week those positions declined sharply.

As a result, from Monday to Wednesday, Goldman’s Hedge Fund VIP basket (GSTHHVIP) which Goldman has repeatedly praised in the past for its outperformance of the broader market, “lagged our basket of large shorts (GSTHVISP) by 850 bp (-17% vs. -8%), more than any 3-day period in the nearly 20 years of the baskets’ history.“

In other words, anyone who listened to our reco from exactly one month ago to go long the most shorted names and short the VIP stocks…

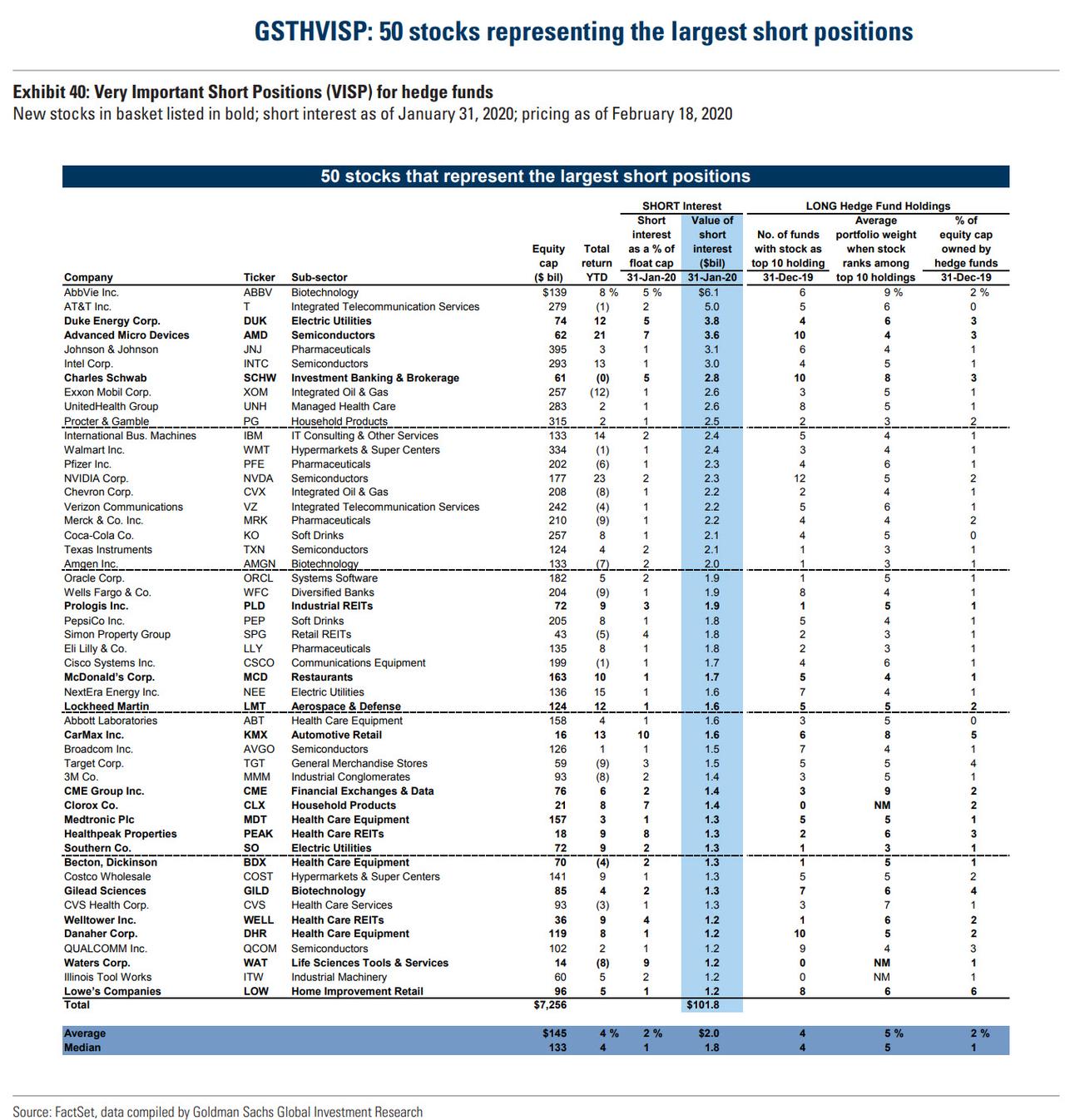

… while the GS VIP list is certainly notable, if only because everyone owns the same 50 or so top stocks, what we find far more fascinating, and a far better source of alpha, is the hedge fund top 50 most shorted – or hated – stocks, which as we have shown year after year tend to significantly outperform the market due to periodic and vicious short squeezes especially in this day and age when the link between fundamentals and asset prices has been terminally severed by central banks, something we described most recently in “Going Against The Wall Street Crowd Has Been The Most Profitable In 5 Years“

… made an absolute killing in the past month. Which is more than we can say for most hedge funds.

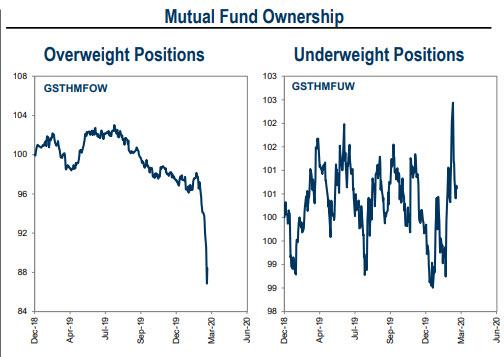

Actually, it’s more than we can say for virtually all funds, period. because as Goldman also notes, “Mutual Fund Overweights (GSTHMFOW) also lagged Underweights (GSTHMFUW).”

More pain is yet to come, because as Kostin concludes “Goldman’s Sentiment Indicator shows that equity positioning has plunged in recent weeks, “additional selling is likely until positioning matches lows reached at the bottom of prior corrections.”

Which brings us back to what Robert Reich said in his tweet – yes hedge funds are down less than the market, but that’s to be expected. The problem is that they are not up! After all, for the past decade, hedge funds underperformed the S&P year after year, sparking an unprecedented wave of redemptions which led to record inflows into cheaper, passive investing alternative such as ETFs. One would think that they would finally compensate investors for all this long-term pain by at least delivering a positive return when the market crashed.

But no, while hedge funds underperformed the market on the way up, they not only failed to be a real hedge on the way down, but fell the most on record. So why pay them 2 and 20 to suck all the time, failing to keep up with the S&P when stocks are rising, and then also tumble (if a little bit less) when the market crashes?

What exactly are hedge funds “hedging”?

One person who may know the answer, is the chief investment officer of Veritas Pension Insurance, who told Bloomberg he will review the firm’s hedge fund allocation amid “concerns the asset class is adding little to overall returns.“

Kari Vatanen, who started as CIO at the Finnish fund this month, said he can’t guarantee that he’ll continue to allocate 7% to hedge funds, once his review is completed later this year: “I want to see data and evidence,” he said by phone. “I fear they don’t work, but I hope to be proven wrong.”

“Of course there are good funds out there as well,” he said. But the overall takeaway is that “relative to indexes, hedge fund returns haven’t been great since the financial crisis, it’s somewhat of a disappointment,” he said.

Let’s paraphrase that: hedge funds returns have been absolutely catastrophic since the financial crisis, failing to keep up with stocks on the upside, and failing to offset drops when the market tumbles.

Vatanen is hardly the last one to re-evaluate investments in hedge funds in light of their recent catastrophic performance, amid signs that “few strategies really protect portfolios against the kind of panic-driven trading that’s gripped markets in recent weeks”, as Bloomberg wrote.

“Many investors will have to critically evaluate the role of alternative strategies in their portfolio,” Vatanen said, in what was the clearest death knell to all those $10MM+ Tribeca duplexes.

Tyler Durden

Sun, 03/22/2020 – 17:47

via ZeroHedge News https://ift.tt/2QCpLaO Tyler Durden