SEC Uses Coronavirus As Excuse To Abandon Audit Requirement Rules For Small Companies

“Never let a crisis go to waste,” were the famed words of Rahm Emanuel some years back.

And now, it looks like the SEC is abiding by those words. While the rest of the world faces the existential threat of the coronavirus, the Securities and Exchange Commission has spinelessly taken this opportunity to ease audit requirements on smaller companies, according to the Wall Street Journal.

Those pushing for the change say it could allow smaller firms to cut costs and invest in new products and technology. The rule was approved Thursday and applies to companies with less than $700 million in annual revenue. They will no longer need to have an auditor examine their internal controls, a rule that has been in place since the days of Enron and WorldCom.

What could go wrong?

Also, to no one’s surprise, it was also discovered that many people pushing for the rule change had “accounting problems”.

For example, Teligent, Inc.’s CFO wrote that the rule would give it time “to develop high quality and competitive products to treat the nation’s most dire public health concerns.”

But analysis from Joe Schroeder, an accounting professor at Indiana University, found that at least 12 companies supporting the rule change had either restated earnings or had “material weaknesses” flagged by auditors during past audits.

Schroeder found that 11 companies that would benefit from the rule had restated more than $65 million in net income, combined, in 2018 alone.

“These restatements destroyed more than $294 million in shareholder wealth, a figure that dwarfs the $50.36 million in savings that the SEC estimates the rule would provide.” he said.

Schroeder amounts the rule change to companies saying: “We have accounting issues, and we’re asking to get rid of regulation that tells us to improve our accounting.”

For example, Teligent’s own annual report from last April said it needed to “perform extensive additional work to obtain reasonable assurance regarding the reliability of our financial statements.”

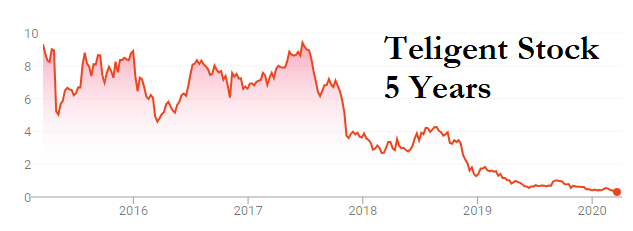

Additionally, Teligent’s stock is down 97% since mid 2017.

And so, one would think it’s obvious why they support the rule change.

Except it either isn’t obvious to the SEC or they are being willingly ignorant.

SEC Hester Peirce used the coronavirus as a diversion for what is a rule change that will obviously help fraudulent and money losing companies bilk retail investors, incapable of reading financials, out of their money:

“With the change, a company trying to develop a vaccine for a fast-spreading virus, something that is now on all of our minds, will be able to pour resources and—importantly—management’s time and attention into that effort rather than into obtaining an internal-controls audit.”

Allison Lee, the lone dissenting commissioner at the SEC, said: “The final rule rests in part on the unsupported hypothesis that relieving companies of modest additional costs will encourage more of them to go public. There just isn’t evidence for this intuition.”

The SEC says about 373 companies could be affected by the rule change.

Tyler Durden

Sun, 03/22/2020 – 15:00

via ZeroHedge News https://ift.tt/2WLAtjl Tyler Durden