Is It Time To Buy Stuff?

Submitted by Kuppy via Adventures in Capitalism

It’s said that you want to buy when others are fearful. It sure seems that investors are currently losing their minds. Look, I get it, there’s a virus and there’s a good chance that a lot of us will get it. There’s conflicting data about the overall mortality rate which makes it all worse; especially as its origins in China are terrifying. All sorts of businesses are shuttering operations while the Federal Government seems hopelessly incompetent at fighting this thing. Meanwhile, local governments have created a dysfunctional patchwork of mandatory quarantines and arbitrary rules which will harm businesses and do little to fight the virus as people who don’t follow the quarantines will keep infecting those staying indoors (Full Disclosure: I’ve been staying home, eating my canned tuna and whiskey rations). It’s a complete mess and it is almost certain that economic conditions will get worse before they get better. I get all of that, in fact, it’s been pounded into my head every few minutes by just about everyone I know—which means they all get it as well. At some point, this gets priced in.

The Russell 2000 is now down 40% in a month and is currently at 2013 levels. How is it not getting priced in?

Various companies that I track are down by more than half since the start of the year and many are down by more than 80%. The selling is indiscriminate and it is clear that many large funds are getting liquidated. To me, this all spells opportunity. Sure, you won’t get the low tick, but if you aren’t buying stock down here, you’re simply doing it all wrong.

Investing is about looking forward a few years into a business’s future and figuring out if you’re getting a bargain. I promise you, for most companies, the next quarter or two will be awful. Who cares? I’m buying the next 5 years of earnings. Why do I care about the next two quarters if I get the subsequent 18 quarters at a MASSIVE discount?

Why am I so sure that the next 18 quarters will be so strong? Behind the scenes, all sorts of crazy schemes to prop up the economy are getting worked out. Lobbyists are calling in favors from their favorite congressmen. These things take time and right now, they can’t do much as we’re all told to stay indoors and stop spending. I promise you, by the fall, they’ll be rolling out a scheme a day as we head into the election.

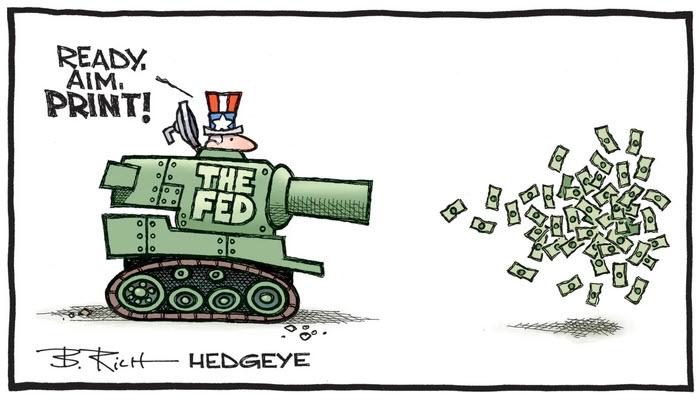

Meanwhile, the big bazookas are owned by the Federal Reserve. Every day last week, friends looked at the tape and told me that QE doesn’t work on a virus. Of course, it doesn’t. You can’t solve a pandemic by printing money. You’re stupid if you thought that. However, the money is now out there. Eventually it will find its way into financial assets—it always does. My friends keep telling me the Fed shot its gun and is out of bullets. Are you kidding me? They own the bullet factory. They’ll come back in a few days with a bigger gun. The history of investing since 2008 is that the Fed will keep throwing solutions at the market and eventually, they’ll find the right combination of tools to arrest the market’s decline—then the market will take off as all that liquidity is out there, looking for a home. The Fed is in the bubble-blowing business. They’ll figure this one out and create a bubble to dwarf all others.

But Kuppy; isn’t the economy going to be in tatters all summer?

Who cares? Venezuela’s economy is in chaos and their market has gone vertical (they don’t have toilet paper either). If you print enough money and target it at the stock market, assets values will increase, regardless of economic conditions.

But Kuppy; how do you know it won’t go lower first?

I don’t know anything. I know that I’m buying businesses at a fraction of fair value because people have panic sold them. I see no solvency risk in my holdings and I accept the fact that they may drop a lot more first. I also know that once this thing turns, it’s going to be too hard to get on-board the freight train because I’m not the sort of guy who buys something that’s up 10% on the day and we’re going to be up 10% a day for weeks at a time.

But Kuppy; isn’t fiscal stimulus slow because it takes a long time to permit infrastructure programs?

Who said anything about infrastructure? That doesn’t get anyone’s votes. They’re going to do something akin to giving everyone a $5,000 Visa debit card with an October 1 expiration date.

I’ve now heard every reason not to be long. I haven’t seen palpable fear like this in ages. Everyone is sure that half the population will get this thing and a million people will die. Let’s say that is unfortunately the eventual outcome. In 2019, 2.8 million Americans died and the vast majority of them died from pre-existing conditions. Guess what the number one marker for mortality with COVID is? Pre-existing conditions. If 1 million Americans die, the vast majority of those individuals will be those who were likely to die at a different time from their pre-existing conditions. Now, I don’t mean to belittle death and suffering. Rather, I want to say that if the worst-case outcome occurs, I don’t think we’ll be more than a few hundred thousand deaths off trend-line in terms of overall mortality in America—COVID-19 probably won’t even be a 1-sigma event. It’s horribly unfortunate if it’s you, but it won’t change the economic situation here in America.

The only thing that can change the economy is government induced chaos. I suspect that we’ll get a few more weeks of that, but as a result, the rate of infection will slow and go negative—just like in every other country where they’ve eventually figured out how to “flatten the curve.” Then people will go on with their lives, right as the stimulus programs kick in. The ensuing recovery will lead to the biggest bull market run of my career. Now, you can be in the fetal position or you can front-run that. I don’t know what date the market bottoms, no one does. However, I’m pretty damn sure that once it gets going, you’re going to want to be at maximum exposure. I’ve spent the past few days buying stocks. I have the most exposure that I’ve had in years. A month ago, I wrote to warn you to take something off. Now is time to buy everything you always wanted to own, but for a fraction of the cost in January.

I’m not saying to be reckless; make sure the debt is termed out, make sure there’s plenty of excess liquidity, make sure your companies can make it through a lower for longer scenario. However, you don’t get bargains like this during a benign environment. You have to take on a bit of event risk.

I’m buying. My main theme is that deflation is dead—get long inflation. Remember, in investing, your only edge is your ability to cycle capital into something cheaper and take advantage of someone getting liquidated. If you have positions that have done well (bonds for instance), you really ought to be cycling into companies that are down a bunch. If you can’t figure out what to own, just buy gold–Powell intends to launch it to Pluto.

On a final note, I’m by no means saying you need to go “all-in” here. In fact, going “all-in” is what gets people into trouble. What I am saying is that this is the time to be buying, not selling. I took some off a few weeks ago and I put it to work in the past few trading sessions. I was a bit early, but I don’t regret it. As they turn on the fire hose of liquidity, we’re going to have one epic bull market in risk assets. I want exposure to that.

The last time I had a similar message to “buy shares,” was at the lows in 2018. I was about a week early, but the market subsequently rallied 40% over the next year. Back then, we didn’t know where the Fed stood on interest rates. Now we know they’ll do “whatever it takes” to prop up the market. In fact, every day we learn of a different alphabet soup of acronyms designed to prop up the market. I feel pretty confident that they’ll dramatically overshoot the mark this time. It’s time to buy shares, accepting that I may be a bit early once again. I intend to ignore the incredible volatility over the next few weeks and remain confident that a tidal wave of liquidity is coming behind me. The bull market of the second half of 2020 will stun people. I intend to ride it.

Tyler Durden

Mon, 03/23/2020 – 15:45

via ZeroHedge News https://ift.tt/39cKzMs Tyler Durden