S&P Futures Soar Limit Up As Dollar Tumbles, Gold Soars

With the market losing all gains since the Trump election on Monday, on Tuesday – assuming this rally holds – we may again see Dow 20,000 again… for the first time since the start of 2017.

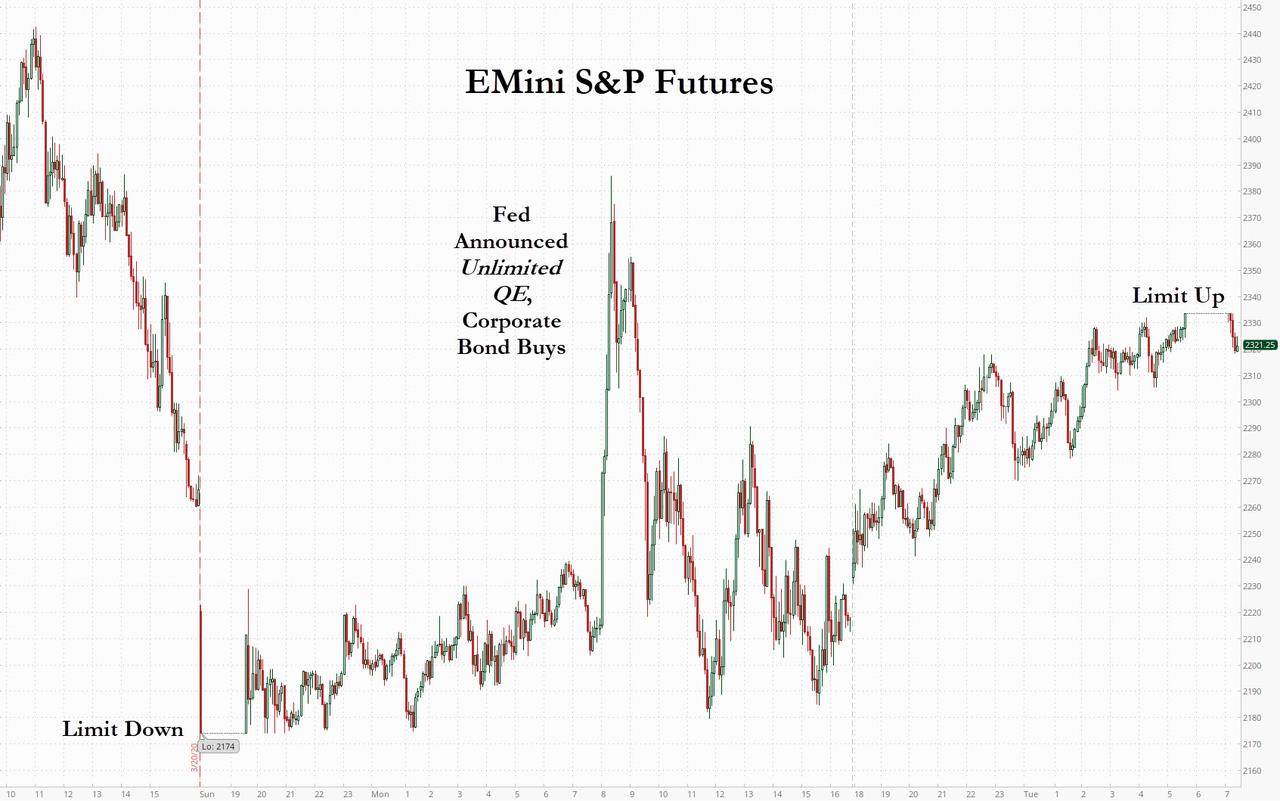

One day after futures hit limit down to start the Monday session, when traders freaked out after Senate failed to pass the virus bailout bill, something it also failed to do on Tuesday, S&P futures have soared on Tuesday in a global relief rally following a delayed reaction from the Fed’s unlimited QE, and rising limit up to 2,333.5.

Boeing rose nearly 9% and was the top gainer among Dow components. Meanwhile, a surge in oil prices lifted energy stocks, with oil majors Exxon Mobil Corp and Chevron rising more than 7%. Big U.S. banks including Goldman Sachs, JPMorgan and Citigroup rose about 6%, tracking a modest increase in the 10-year Treasury yield.

If the overnight carries through to the cash index when it reopens at 930am, it will be the third week running that the S&P 500 has rebounded following a Monday drop.

Four main reasons were cited for Tuesday’s move higher:

- Comfort in the Fed unleashing a tsunami of monetary easing which included unlimited QE and corporate bond purchases

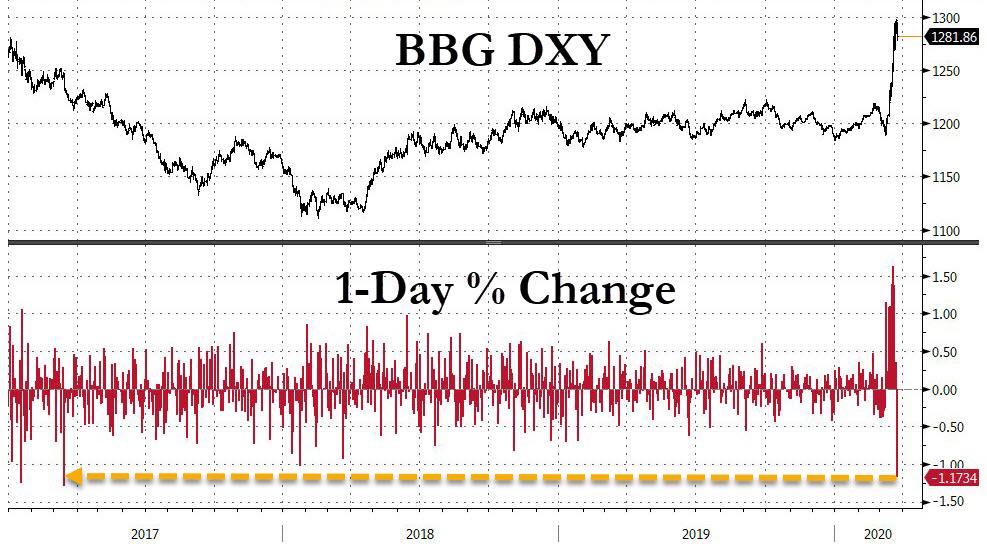

- A return of liquidity to the funding market, which sent the dollar plunging the most in three years following a 10-day winning streak.

- Hope that the Senate will finally pass a deal today as late on Monday night, Politico reported that Treasury Sec. Steven Mnuchin has agreed to “significant oversight” of $500b exchange stabilization fund in proposed coronavirus rescue package

- Renewed focus on the slowdown in new coronavirus cases in Italy, where as we reported yesetrday for the 2nd day both new cases and new deaths have declined in Italy and the Lombardy region.

Here is where today’s circuit breaker levels stand during US trading hours

- Futures have no limit up

Limit Down (M0 Futures)

- Level 1: 7% fall to 2065.50

- Level 2: 13% drop to 1931.50

- Level 3: 20% decline to 1775.00

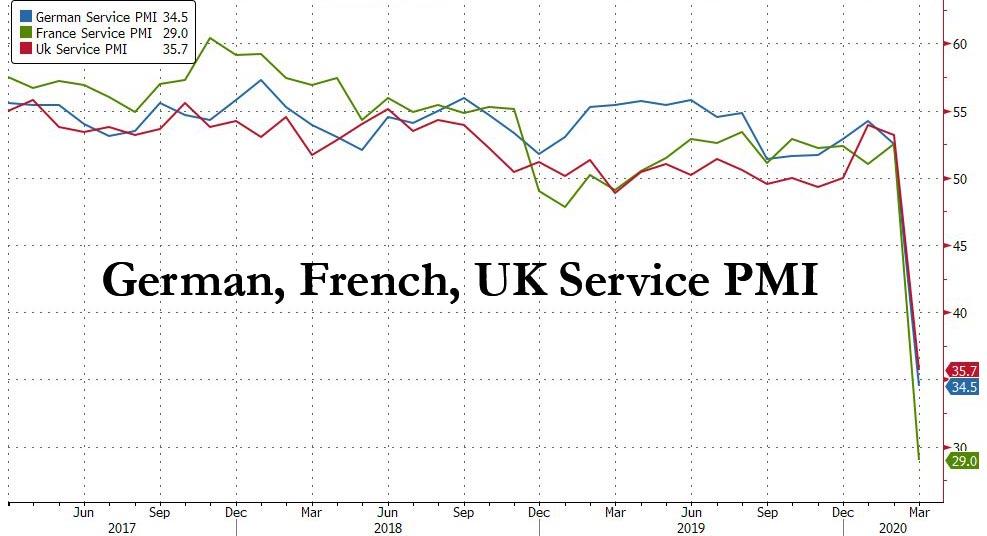

Europe followed along with the Stoxx Europe 600 Index also soaring, led by insurers and energy companies, even as the latest catastrophic PMI data showed that Europe is now officially in a recession as both manufacturing and service components crash, as a result of the coronavirus pandemic.

Benchmarks in Tokyo, Hong Kong and Sydney all climbed at least 3% while Korean shares soared almost 9% as the government announced measures to stabilize financial markets. Asian markets surged, led by IT and energy, after falling in the last session. Most markets in the region were up, with South Korea’s Kospi Index gaining 8.6% and Singapore’s Straits Times Index rising 5.2%, while Jakarta Composite dropped 1.2%. Japan’s Topix gained 3.2%, with Raccoon Holdings and CKD rising the most, as the BOJ continues to buy record amount of equity ETFs.

The Shanghai Composite Index rose 2.3%, with Eastern Gold Jade and Hefei Metalforming Intelligent Manufacturing posting the biggest advances.

Emerging-market stocks jumped alongside their currencies.

Perhaps the biggest driver for the move was the plunge in the dollar which slumped against developed and emerging currencies for the first time in 11 days amid growing expectations for the U.S. lawmakers to agree on an economic stimulus package…

… in a clear sign the Fed’s tsunami of liquidity has succeeded in reduced stress after the greenback’s steepest appreciation since the global financial crisis and longest winning streak since 2012.

Tuesday’s gain in risk assets follows an unprecedented move by the Federal Reserve to backstop large swaths of the U.S. financial system. Actions on the fiscal side remain pending, with Congress so far unable to agree a compromise spending deal.

“The Fed pulling out all the stops by removing the quantitative cap on QE is a start to a weaker USD and firmer currencies elsewhere,” said Vishnu Varathan, Mizuho’s head of economics and strategy. “Improved risk appetite due to the Fed as well as hopes of the U.S. fiscal stimulus coming together add to the lift in the markets.”

“Sentiment has improved, but to call it a turning point is too strong a word for now,” said James McCormick, global head of desk strategy at NatWest Markets. “It is more of a tug-of-war. Policy bazooka is in place, but will be fighting against very weak data and still worrying trends on Covid-19 data. We are more neutral on risk assets now.”

Treasuries were mixed, with European bonds tracking US paper modestly lower.

In commodities a relief rally swept across the energy complex as prices piggy-back on the overall current market sentiment, with WTI and Brent front-month futures both posting gains in excess of 5%, with the former inching closer to USD 25/bbl and the latter gaining ground north of USD 28/bbl.

Spot gold soared yesterday the most since the financial crisis following the Fed QEternity announcement and the yellow metal continues on its upwards trajectory as USD eases and liquidity concerns fade. The metal extended its gains above USD 1550/oz, having briefly topped its 21DMA (USD 1591.46/oz) to print a current peak above 1600/oz.

Market Snapshot

- S&P 500 futures up 4.7% to 2,323.25

- MXAP up 4.8% to 127.37

- MXAPJ up 5.1% to 406.77

- Stoxx Europe 600 up 3.3% to 289.70

- German 10Y yield unchanged at -0.374%

- Euro up 1.1% to $1.0841

- Brent Futures up 1.9% to $27.55/bbl

- Italian 10Y yield fell 5.0 bps to 1.409%

- Spanish 10Y yield rose 0.2 bps to 0.761%

- Nikkei up 7.1% to 18,092.35

- Topix up 3.2% to 1,333.10

- Hang Seng Index up 4.5% to 22,663.49

- Shanghai Composite up 2.3% to 2,722.44

- Sensex up 4% to 27,021.98

- Australia S&P/ASX 200 up 4.2% to 4,735.66

- Kospi up 8.6% to 1,609.97

- Brent Futures up 4.6% to $28.29/bbl

- Gold spot up 1.8% to $1,581.13

- U.S. Dollar Index down 0.8% to 101.63

Top Overnight News

- China’s Hubei province said it will allow transportation to resume for the city of Wuhan on April 8, effectively lifting a mass quarantine over the city where the coronavirus first emerged in December

- U.K. Prime Minister Boris Johnson’s government has allocated a total of almost 57 billion pounds ($66 billion) in direct support since the Budget on March 11, according to Treasury estimates and calculations by Bloomberg Economics. That’s more fiscal stimulus than during the global financial crisis

- Chancellor Angela Merkel’s government is evaluating a stimulus program to help revive the German economy after the coronavirus crisis subsides, according to a person close to the discussions

- Japan’s Government Pension Investment Fund will raise its investment allocation for foreign bonds by 10ppts to 25% as it seeks to boost returns amid Japan’s negative interest rates, Nikkei reports, without attribution

- Continental Europe’s labor-market model is experiencing rare praise from economists because it may help prevent massive job losses during the coronavirus pandemic

- With rates near zero already, increasing the speed of the Bank of England’s new 200 billion pounds ($231 billion) of bond purchases is one lever policy makers could pull if they want to boost the impact of the current package of measures, without following the Federal Reserve in moving to unlimited buying

- The first signs that India’s $790 billion sovereign bond market is cracking under the strain of the coronavirus pandemic showed up on Tuesday. For half an hour after trading started, nobody bought or sold a bond on the Reserve Bank of India’s platform

Asian equity markets were higher across the board as the region received much-needed reprieve from the recent sell-off and reacted to the Fed’s announcement for open-ended Treasury and MBS purchases, despite Wall St failing to sustain the gains amid the ongoing stalemate at the Senate on the coronavirus relief bill. Nonetheless, US equity futures have performed better after-hours with the Emini S&P and DJIA back above the 3k and 19k levels respectively following recent comments by President Trump who suggested that America will be open for business sooner than 3-4 months and as negotiators were said to be near a deal on the coronavirus stimulus bill. ASX 200 (+4.2%) and Nikkei 225 (+7.1%) rallied from the open with Australia led higher by gold miners after the precious metal surged above USD 1500/oz in the wake of the Fed’s QE bazooka, while SoftBank shares extended on the prior day’s outperformance and posted its largest intraday gain of more than 21% amid plans to offload USD 14bln of Alibaba shares. Elsewhere, Hang Seng (+4.5%) and Shanghai Comp. (+2.3%) joined in on the broad rebound with Hong Kong outperforming the mainland as participants also digested earnings releases which was the main catalyst for the biggest moving stocks. Finally, 10yr JGBs are higher and attempted to reclaim the 152.00 level after the bull flattening seen in USTs in the aftermath of the Fed’s asset purchase announcement, while the enhanced liquidity auction for 2-20yr JGBs also attracted greater demand.

Top Asian News

- China’s Wuhan to Lift Lockdown Measures April 8

- Infosys Rises After SEC Ends Probe of Whistle-Blower Claims

- Chinese Beauty Mask Maker Said to Weigh Options Including Sale

- Hong Kong Expats Point Fingers Over Who’s Spreading Coronavirus

European stocks mimic the stellar performance seen in APAC as stocks feel some reprieve from the global market rout. Participants point to the barrage of global fiscal and monetary efforts in response to the virus outbreak as the catalyst for the gains in the equity complex, although it is too soon to say we are out of the woods. US equity futures overnight extended on gains but stopped short of hitting their respective limit ups at the time, although ES June futures managed to reach the 5% limit to the upside in early European trade. Back to Europe, cash markets are posting broad-based gains, back around its intrday best levels (Euro Stoxx 50 +5.9%) with no clear standout performers. Sectors are higher across the board with some mild underperformance seen in defensives vs. cyclicals – reflecting a “risk-on” mood, whilst the energy sector leads the gains amid the rebound in the oil complex. Zooming in on the sector breakdowns, basic resources outperform whilst performance across the much-watched Travel & Leisure sector remains somewhat muted as opposed to significant rebound. Individual movers are largely driven by the macro themes – BHP (+11.4%), BP (+13.1%) Shell (+11.8%) are amongst the large-cap movers to the upside. On the flip side, WH Smith (-6.2%) and Marks & Spencer (-0.8%) bare the brunt of non-essential shop closures in the UK.

Top European News

- AB InBev, Pernod Cut Outlooks as Virus Hobbles Drinks Makers

- Norwegian Air Buys Time by Unlocking $27 Million of State Aid

- French Economic Activity Collapses on Coronavirus Containment

- Austrian Virus Cases Jump With Skiing Area Still the Epicenter

In FX, the Greenback has faded again amidst a broad recovery in risk sentiment and dissipating demand for liquidity as new, enhanced Fed swap lines are tapped on a daily basis and the unlimited QE backstop provides more stimulus awaiting a bumper fiscal boost from the US. As a result, the DXY has pulled back from another test of resistance around the 103.00 level to the benefit of G10 peers and other currencies that depreciated markedly when credit conditions were ultra-tight and assets were being dumped in the dash for cash. Even extremely weak preliminary PMIs have not hampered the recovery against the Buck ahead of the looming US Markit surveys, housing data and a speech from Fed’s Bullard.

- AUD/GBP/NZD/EUR/CHF/CAD/JPY – As noted above, the receding Usd has helped rival majors nurse losses as the Aussie reclaims 0.5900+ status with an independent impetus from more RBA funding for the banking sector overnight, while Cable is back within striking distance of 1.1800 irrespective of deep sub-50 UK PMIs and Britain now in a virtual 3 week COVID-19 lockdown. Back down under, the Kiwi has rebounded from just shy of 0.5700 towards 0.5850 following NZ Government and RBNZ business finance guarantees and reduced core bank funding ratios. The Euro is hovering close to decent 1.1 bn option expiry interest at 1.0860, and again not unduly unsettled by worrying French, German and pan Eurozone PMIs even though the periphery is almost certain to lead to downgrades in the final reckoning, with the Franc pivoting 0.9750, Loonie back above 1.4400 amidst firmer crude prices and Yen straddling 110.50, but sharply lagging Gold that has breached the Usd1600/oz mark.

In commodities, a relief rally across the energy complex as prices piggy-back on the overall current market sentiment, with WTI and Brent front-month futures both posting gains in excess of 5%, with the former inching closer to USD 25/bbl and the latter gaining ground north of USD 28/bbl. That being said, fundamentals remain relatively unchanged, with the demand prospect still looking bleak amidst economic activities coming to a halt and airlines indefinitely grounding flights. Meanwhile, the supply side fares no better as Russia and Saudi still remain poised to hike production next month and with Moscow’s meeting with oil executives seemingly bearing no fruits. On that front, Energyintel understands that the Russian Energy Ministry will be convening with energy CEOs on a weekly basis, although no production curtailments were discussed at yesterday’s confab. Similarly, spot gold caught a bid yesterday following the Fed announcement and the yellow metal continues on its upwards trajectory as USD eases and liquidity concerns fade. The metal extends its gains above USD 1550/oz, having briefly topped its 21DMA (USD 1591.46/oz) to print a current peak above 1600/oz, ahead of a Fib level at 1607.19/oz. Finally, copper prices were uplifted during APAC trade on the broader risk appetite, aiding the red metal to gain a firmer footing above USD 2/lb – but supply/demand issues for the base metal haven’t subsided.

US Event Calendar

- 9:45am: Bloomberg Consumer Comfort, prior 63

- 9:45am: Markit US Manufacturing PMI, est. 43.5, prior 50.7; Services PMI, est. 42, prior 49.4; Composite PMI, prior 49.6

- 10am: New Home Sales, est. 750,000, prior 764,000; New Home Sales MoM, est. -1.83%, prior 7.9%

- 10am: Richmond Fed Manufact. Index, est. -15, prior -2

DB’s Jim Reid concludes the overnight wrap

In a parallel universe this wouldn’t be coming from me this week as I would now be on my pre-Easter skiing holiday. However it has obviously been cancelled and we’ve actually been self-isolating over the last few days as the twins have both got coughs. To be fair they have coughs 80-90% of the time anyway so we might be now in self-isolation until humans (or maybe the robots) have cured all known illnesses. We’ve used a slug of the cancelled holiday money to buy a ginormous trampoline for the garden which was supposed to arrive today but I suspect that after the lockdown last night in the U.K., trampoline delivery men will not be seen as essential. With three kids four and under to entertain and me working flat out I’d make a strong case for saying such a service is. We tried to buy a home swing and slide unit but believe it or not people have been panic buying swings given that schools are closed and they’re pretty much all out of stock. I appreciate these are first world problems but I would commit my life savings to ensure we don’t have three kids running amok in the house for the next three months.

Meanwhile markets are continuing to bounce up on the latest policy announcements and then sliding back down as the economic reality of the situation re-emerges. More on this later but a big curiosity today will be the flash PMIs from around the world. While they are unlikely to reflect the full force of the various economic shutdowns around the world to date, the likelihood is that they will show some extremely sharp slowdowns. In February China’s official and unofficial numbers came in between 25 and 40. In a short note released yesterday (link here), we looked at the relationship between PMIs and YoY equity changes seen over the last 20 years, and based on a regression of this relationship, suggested what PMI level is implied given current equity market pricing. To give a spoiler alert we are pricing in high 30s/low 40s today. We also showed where equities should trade if the numbers are 25, 30, 35 and 40.

Ahead of that, in spite of unprecedented monetary action from the Federal Reserve yesterday (details below), the distinct lack of progress on the fiscal side saw US equity markets fall to their lowest levels of the coronavirus crisis yet. With the S&P 500 down -2.93% after yesterday’s session, the index is now over a third lower than its closing peak on 19th February. The Dow Jones Industrial Average fell -3.04% yesterday and is now just over 1% away from where all of its gains since the 2016 Election Day close would be erased. In Europe STOXX 600 closed -4.30% lower after rallying with S&P futures on the news of the Fed stimulus, but then joined US equities lower. Every sector in Europe traded lower, except Oil and Gas.

So with a situation that shows no sign of turning in the short-term, the impasse on stimulus negotiations in the US saw the Senate again fail to garner enough votes Monday afternoon to get a floor vote on the nearly $2tn stimulus package. Minority leader Chuck Schumer noted at the time that while the vote failed, he was still in negotiations with Treasury Secretary Mnuchin and believed that a deal between Schumer’s caucus, the White House, and Senate Republicans would still get passed Monday night. The consensus opinion still remains that a deal will be struck this week, likely in the next couple of days, but the timeline continues to get longer which will be a negative for risk assets, no matter the monetary policy.

In the meantime details have emerged of the House’s counter proposal with a plan that totals $2.5tn. It includes initiatives that would see both retirees and the unemployed receive $1,500, as well as a $600 per week payment to all workers laid off or for self-employed who have lost business due to the coronavirus. The bill also would order the Fed to provide loan services with liquidity to allow borrowers to stop paying their mortgages for up to 360 days. The contents of the bill are more likely going to be demands that get worked into the Senate bill, or that may come as a later stimulus package. The big sticking point was that Democrats want conditions added to the funds provided to airlines and energy corporations, as well as more unemployment funds for workers as well as healthcare costs.

While Congress still couldn’t agree on the overall stimulus package, the US is now home to the largest daily increases in cases amongst the high case countries as confirmed cases passed 40,000, with 20,875 of those in NY State (vast majority of those in NYC). Italy on the other hand, has now seen a declining rate of case growth 5 days in a row and a similar flattening trajectory in announced deaths as the shutdown steps seem to be having an impact as you would expect them to. Elsewhere in Europe there aren’t huge signs at the moment of notable falls in case growth or mortality rates. You would expect this over the next 1-2 weeks as the lagged impact of lockdowns run their course. See the charts and tables in the PDF for the latest. Staying with virus-related news, it’s worth noting that China’s Hubei province has announced that lockdown rules will be lifted including transportation to resume for the city of Wuhan from April 8th.

This morning we’ve already had a few PMI releases out from Asia Pacific. Japan’s preliminary March manufacturing PMI came in at 44.8 (vs. 47.8 last month) while the services reading fell sharply to 32.7 (vs. 46.8 last month) brining the composite PMI to 35.8 (vs. 47.0 last month). Needless to say that is the lowest services reading on record. Meanwhile, Australia’s manufacturing PMI came in at 50.1 (vs. 50.2 last month) while the services PMI fell to 39.8 (vs. 49.0 last month). So, clearly some huge drops in the services readings which shouldn’t be a great surprise.

In terms of how markets are doing, futures on the S&P 500 up +3.84% while most Asian indices have also advanced. The Nikkei (+5.50%), Hang Seng (+3.81%), Shanghai Comp (+1.48%) and Kospi (+6.34%) are all up. The gains for the Kospi come after the government unveiled a $39bn equivalent package to support bond and equity markets including a bond stabilization fund to buy corporate and commercial paper. Elsewhere, the US dollar index is trading down -0.68% this morning after yesterday’s -0.32% decline. Yields on 10y USTs are up c. +3bps to 0.817% and Brent crude oil prices are up +3.03%.

In other news, President Trump said that the American economy can’t remain slowed for too long to fight the coronavirus, declaring that the country “was not built to be shut down.” He added that “America will again, and soon, be open for business. Very soon. A lot sooner than three or four months.” Earlier, the Fed’s Bullard had said that the government should consider shutting down much of the economy for three months to combat the outbreak.

Recapping yesterday, the Fed moved to unlimited QE before the market open, with the FOMC statement saying they “will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions.” The move comes on top of the already-announced $500bn in purchases of Treasury securities and $200bn of mortgage-backed securities, and the Fed also said in their statement that they’d include purchases of agency commercial mortgage-backed securities. US equity futures rallied sharply into positive territory following the news, though even the promise of unlimited QE wasn’t enough for them to sustain the advance, and once markets had opened an hour and a half later, the S&P 500 was in the red for the entire session.

In terms of the other measures the Fed announced, there were two facilities to support credit to large employers. First, there was a Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and a Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds. This means that the Fed can follow other central banks in making purchases in the corporate bond market for the first time. My colleague Craig published a note on this entitled “A step in the right direction” (link here) where we basically say that this was necessary but not a panacea. The initial reaction was understandably positive with CDX IG -30bps tighter and a massive out-performance of CDX HY which widened +21bps. On a day where IG tightened that much, in normal times you may expect HY to tighten by around 100bps. The IG vs HY reaction was similar to what we saw last week when the ECB implicitly and massively increased their CSPP program.

If you want a flavour for the problems still to come in credit note that Ford was downgraded by Fitch yesterday to BBB-. It means it is now 1 rating notch away (by an average of the 3 rating agencies) from HY. In terms of context, Ford has around 36bn of USD index eligible debt that could fall and become the biggest fallen angel ever and the new largest HY issuer. With a mass of BBB paper this won’t be the last such story. If you’re looking for good news on credit, Nick in my team put out a piece looking at what’s now priced in in terms of default risk. Generally we’re pricing in much worse than the largest cohort of defaults seen through history including our approximations for that seen during the Great Depression. While that won’t stop spreads from widening it gives a sense of the value that’s returning to the asset class. See here for more.

Back to the Fed and they also established the Term Asset-Backed Securities Loan Facility (TALF) which “will enable the issuance of asset-backed securities backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration, and certain other assets.” Finally, they announced they’d expand the Money Market Mutual Fund Liquidity Facility to “include a wider range of securities”, and also expand the Commercial Paper Funding Facility to “include high-quality, tax-exempt commercial paper as eligible securities.”

Fixed income rallied following the Fed’s new facilities, with yields on US 10yr Treasuries ending the day down -5.9bps at 0.786%, bringing the decline in yields since last Wednesday to -40.2bps. Those on 10yr bunds were also down -5.4bps to -0.38%.

With the latest Fed move and the blockbuster German fiscal package that’s going through Parliament this week, yesterday we updated our special report into the different monetary and fiscal policy responses seen so far across the G20 economies and a few others within our coverage universe. It also includes the containment measures that various countries have adopted to fight the virus. You can read the report here.

If you want to know what DB thinks of the interplay between these policy measures and the current economic malaise, we are going to have a client conference call today featuring heads of research (including me) and trading teams on the state of their respective markets. Click here to register and to get the number for the call at 14:00 GMT. If DB staff could not dial in at this time and instead listen to the replay 60 minutes after please. Like swing manufacturers, conference call providers have capacity problems at the moment and for this call we’re limited on lines. I believe we have a solution for subsequent calls.

Elsewhere in Europe, the main potential policy development came via a Bloomberg story, which reported that Germany was ready to back a rescue plan that would help Italy through its current crisis. According to the report, Berlin’s preferred option was that the ESM grant an enhanced credit line with minimal conditionality. In turn, if Italy got a credit line, this would enable it to take advantage of the ECB’s Outright Monetary Transactions program, for which a prerequisite is that a country has a credit line with the ESM. However, the report also said that Germany wasn’t ready when it came to issuing joint coronavirus bonds.

Incidentally, Euro Area inflation expectations fell to yet another record low yesterday, with five-year forward five-year inflation swaps now at 0.72%. The same instrument is now at 1.48% in the US, and up by 25.2bps since its low on 12 March. An interesting divergence.

In terms of yesterday’s data, there wasn’t an awful lot to write about, though the European Commission’s consumer confidence measure for the Euro Area fell to -11.6 (vs. -13.0 expected), the index’s lowest level since November 2014 and the largest monthly decline on record.

In terms of the day ahead, and the aforementioned PMI releases are likely to be the highlight on the data front. Elsewhere, from the UK there’ll be the CBI’s industrial trends survey for March, while from the US we’ll get February’s new home sales and March’s Richmond Fed manufacturing survey.

Tyler Durden

Tue, 03/24/2020 – 08:20

via ZeroHedge News https://ift.tt/2JdKyxb Tyler Durden