Japan’s QE On Verge Of Failure As Nobody Wants To Sell To The BOJ

Over a decade since central bankers started a stealthy nationalization of capital markets by purchasing a wide range of securities from Trasuries, to MBS, to corporate bonds, to ETFs and single stocks, their actions are finally catching up to them, and in the process breaking the very markets central bankers have worked so hard to prop up. And nowhere is this more obvious than in Japan, where the shrinking universe of Japanese government bonds (as a reminder the BOJ now owns more than 100% of Japanese GDP in JGBs) is “causing havoc” in Japanese money markets as the Bank of Japan continues to buy while dealers refuse to sell.

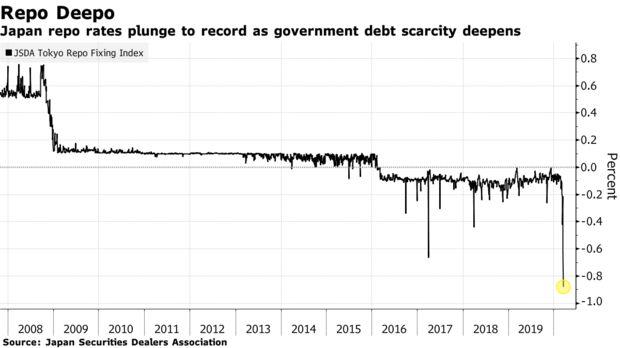

The result is that rates in Japan’s repo market, which traditionally connects holders of bonds with investors looking to borrow them, jumped to a record Tuesday (although they since retreated on Wednesday) because as Bloomberg notes, “the introduction of cheaper, more regular dollar-swap auctions has generated huge demand from U.S. currency-starved dealers who are keeping their JGBs to put them down as collateral.”

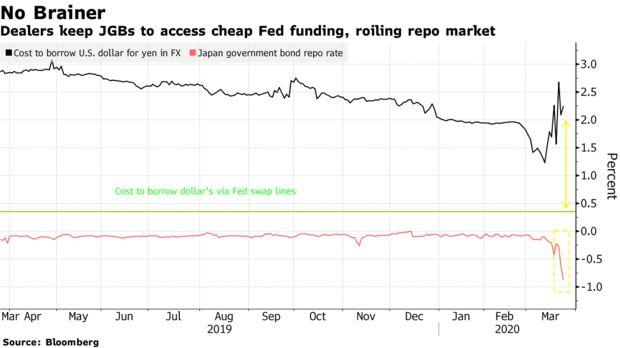

So here is what the math looks like now that the Fed has launched enhanced swap lines with central banks such as the BOJ, allowing local entities to obtain dollar funding at much lower rates: in last week’s first round of the Fed’s revamped dollar-swap auctions, banks borrowed greenbacks for about 3-months at 0.37%, a massive discount to the near 2% it would cost them in the currency swap market. $32 billion was alloted in the first operation.

This huge difference in available borrowing costs, highlighted in yellow in the chart above, means JGB holders who still haven’t offloaded to Kuroda are now unwilling to participate in the BOJ’s bond purchases.

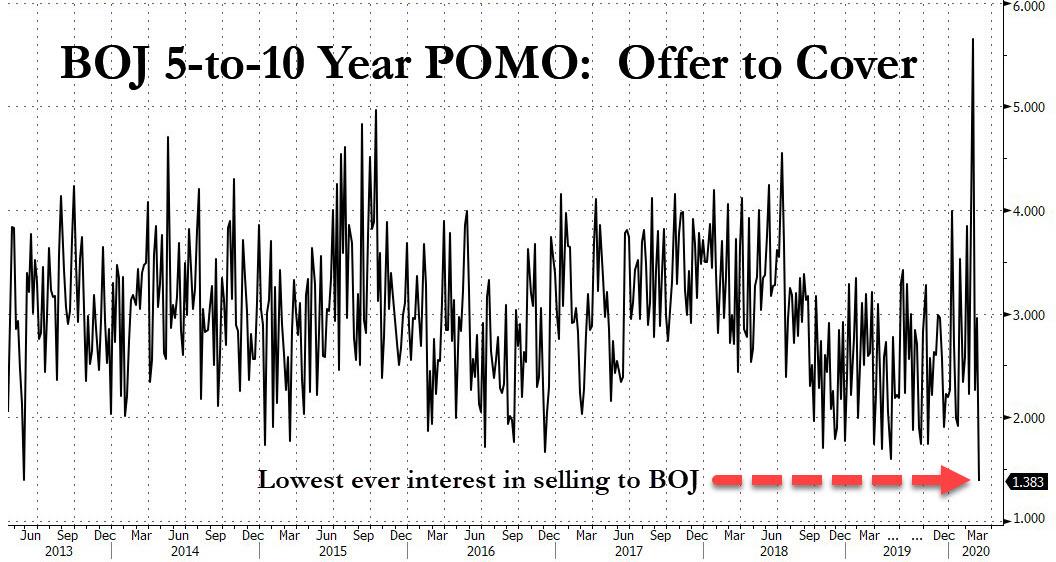

This was readily apparent in Monday’s Rinban operation (i.e., Japan’s POMO) across 5-to10-year bonds which saw the lowest offer-to-cover ratio on record, as dealers refused to sell to the BOJ! Other tenors also saw a sharp drop in the amount of bonds offered to sell.

“Demand for JGBs as collateral and its importance now is heightening.” SMBC Nikko rates strategist Souichi Takeyama told Bloomberg. And here is the big problem that is now facing the BOJ: “There is little incentive to sell to the BOJ because there are more effective ways to make use of JGBs.”

In other words, unless the BOJ provides dealers with a substantial “pick up” in principal relative to market prices, dealers will simply hold on their bonds as they can earn far more by simply renting the bonds out than purchasing any comparable securities. However, that would be frowned upon as it would constitute a clear subsidy to the local banks which, ironically, have been crushed in recent decades by the lack of net interest margin with the entire Japanese yield curve trading flat.

Making matters worse, the surge in demand comes at a time when the Bank of Japan is stepping up its own JGB purchases, in its bid to provide liquidity to financial markets grappling with the worsening coronavirus outbreak. However, with banks now openly refusing to sell to the BOJ, either the Japanese QE will fail, or bond prices will have to rise much more, pushing yields even lower, and further impairing bank interest margin calculations. On net, as Bloomberg notes, “that means less supply available for Japanese banks who have so far tapped over $150 billion in ultra-cheap dollar funding.”

The bottom line, according to Takeyama, is that “there is risk that the BOJ offers may not get sufficient bids.”

In other words, we may have finally hit a point where the market becomes self-stabilizing, as the very mechanism that central banks used to nationalize capital markets results in so much distortion that market participants no longer have an incentive to use it. In short, QE in Japan, which was first among the developed nations to hit the zero bound (and drop below it) and the first to exponentially ramp up bond purchases, is now on the verge of failure.

Tyler Durden

Wed, 03/25/2020 – 11:45

via ZeroHedge News https://ift.tt/2QK6GmZ Tyler Durden