Mortgage Apps Crash Most Since 2009

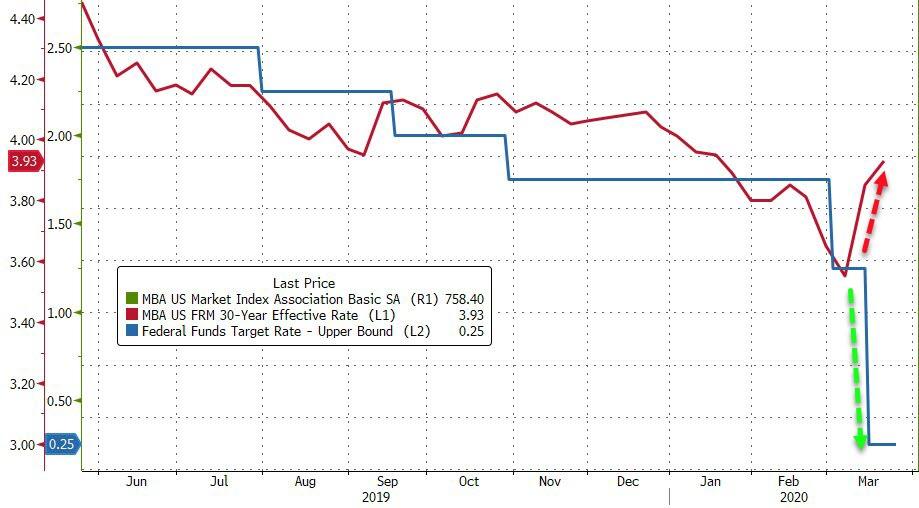

While The Fed cut rates to zero and unleashed unprecedented QE and backstops, mortgage rates have spiked in the last two weeks…

Source: Bloomberg

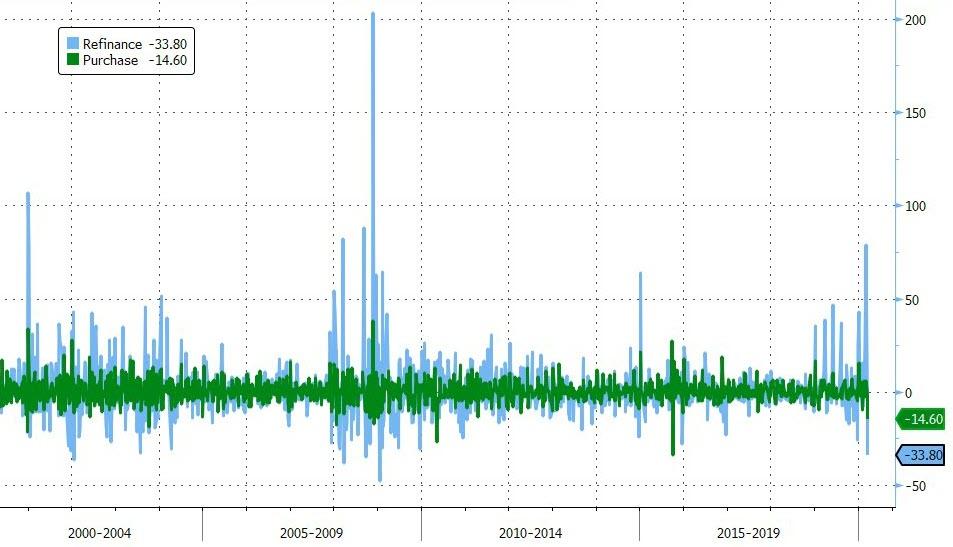

So much for “helping Main Street.” Amid COVID-19 shutdowns and quarantines and related financial turmoil, general anxiety has taken the shine off a renaissance in the housing market as mortgage applications crashed 29.4% week-over-week – the biggest weekly drop since the financial crisis.

Source: Bloomberg

Home-purchase applications dropped by 14.6% while refinancing applications plummeted 33.8%…

Source: Bloomberg

As Bloomberg notes, the decline in applications is an early sign suggesting home sales will slow and that refinancings are coming off a spike. That follows other data indicating a precipitous dropoff in business activity this month as stores and schools shutter to prevent the spread of the virus.

Source: Bloomberg

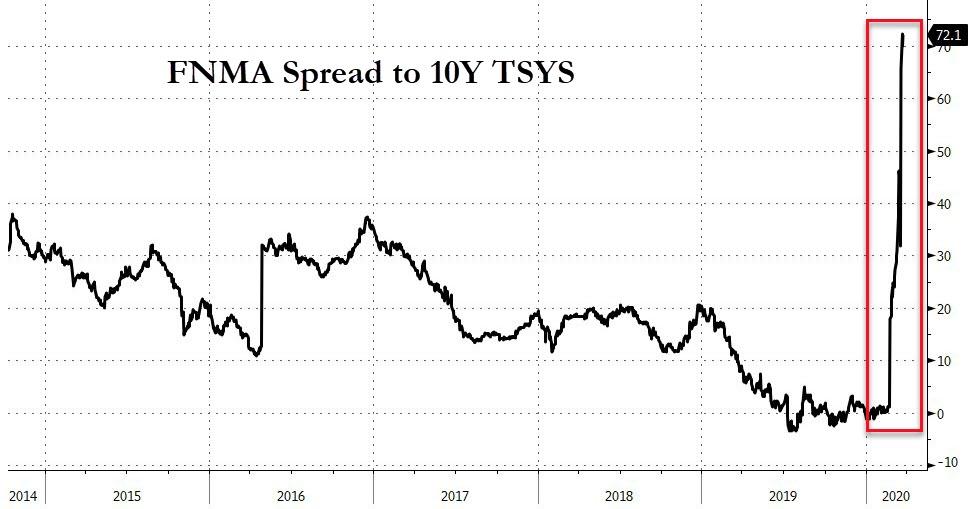

And with mREITs collapsing left and right, amid margin calls and liquidity chaos which sparked a massive decoupling between mortgage rates and Treasuries, one wonders, aside from MOAR unprecedented-er action by The Fed to buy more mortgages and reliquify those that borrowed short to lend long…

Source: Bloomberg

After all, we live in bailout nation – so why not?

Tyler Durden

Wed, 03/25/2020 – 10:11

via ZeroHedge News https://ift.tt/2QLpmCV Tyler Durden