Private Equity Asset Values May Be Haircut By 50% In The Next 3 Months

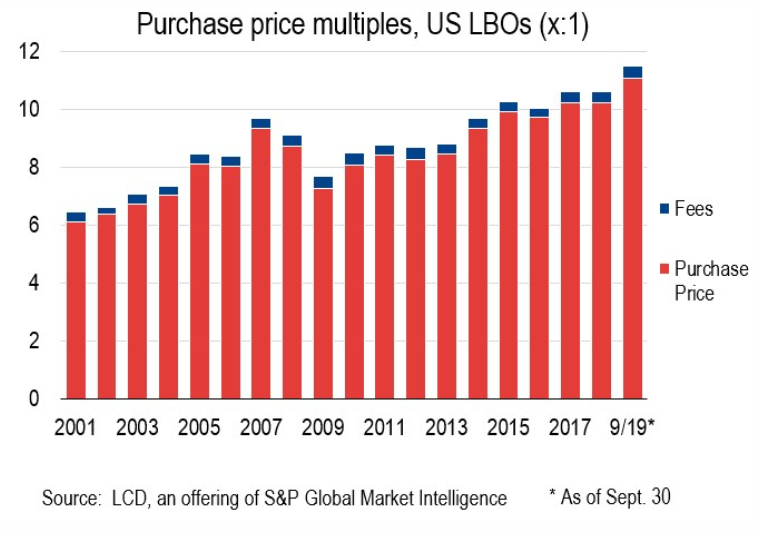

For the longest time, private equity firms seemed like the perfect investment in this market climate: unlike public equity, PE valuations would seemingly increase year after year, and without drawdowns and with no volatility, PE provided an island of stability in a market that was getting increasingly jittery even as stocks hit all time highs. Sure, unlike stocks, PE had virtually no liquidity and carried multi-year lockups, and their portfolio company purchase multiples were absolutely idiotic…

… but why would that matter in a market that seemingly would only go up?

Well, as the events of the past month demonstrated vividly, boy does liquidity and leverage matter. And so, with the US entering a depression, all those pristine PE returns are about to be savaged, the only question is by how much.

The answer – according to a new report from Investec, PE is about to go through a period of violent repricing matched only by the collapse in the global financial crisis: some 50% over the next 3 months!

In the report from Investec’s Fund Finance team, authors Michael Zornitta and Ian Wiese write that valuations will fall this month, with “major adjustments” downward foreseen in June reporting, and that hedging transactions are on the rise as risk management becomes the priority for fund managers. Just one problem: one hedges before the crisis, not after.

“Almost all managers have shifted their focus from deploying capital to defending assets,” Zornitta and Wiese wrote. Managers are looking into “alternative forms of liquidity to prop up companies, prevent breaches and reduce the possibility of having to call any remaining capital” from investors, they wrote.

Ironically, after PE firms were playing down liquidity for much of the past decade, the vital importance of liquidity during the Global Coronavirus Crisis has been underscored by none of the than PE giants Blackstone Group and Carlyle Group which told their portfolio companies to tap bank credit lines and preserve cash. In Europe CVC, EQT and Permira have also urged some companies they own to draw down credit facilities to prevent liquidity crunches if economic prospects worsen.

Apollo Global is one of the few firms that has revealed the impact of the outbreak on its funds so far. It expects to mark down its private equity portfolio by 15% to a “low 20%” figure in the first quarter, Bloomberg reported.

“The next few months will be defining for the industry,” Zornitta and Wiese said. “Defending value and ensuring there is sufficient liquidity will be the name of the game,” which is ironic for an industry that demands its investors accept no liquidity for many years at a time.

So what about all those tens of billions in private equity dry powder, with PE funds furiously raising capital in recent years? Well, as the Friendly Bear said, “it’s a good thing PE has so much “dry powder” – with leverage at 6x EBITDA on average, much of that dry powder will be going into bailing out existing companies…and it would be a good time to ask sponsors what exactly they have been including in “EBITDA”.” A very good time indeed.

Tyler Durden

Wed, 03/25/2020 – 19:47

via ZeroHedge News https://ift.tt/3bpWzf5 Tyler Durden