“This Is It!”

Authored by Kevin Smith and Tavi Costa via Crescat Capital,

This is it!

It’s the market and economic downturn we have been preparing for since late 2017. That’s when we first showed that the US stock market was in historic bubble territory across a composite of valuation and leverage measures. We believe the swiftness of the decline now unfolding is a strong justification for why we insisted on staying positioned net-short ahead of it in our hedge funds. This allowed our clients to reap the benefits while others scramble to unwind and reposition under severe stress. Our macro model is what guided us.

We adopted a bearish view and significant tactical net short equity position in our hedge funds in late 2017. That positioning enabled us to have two of the world’s top performing hedge funds in 2018.

Then came 2019. The Fed curtailed its interest rates hikes after the Q4 2018 slip in the markets. The downturn in the business cycle that we were expecting failed to materialize in 2019. We certainly did not expect the market to push to new highs last year. Our 16-factor macro model and many other indicators continued to warn us that the market was extremely overvalued and the economic expansion overextended. After the US Treasury yield curve inverted more than 70% in August amidst a major repo liquidity crisis, we were as convinced as ever that a significant bear market was imminent. August indeed was a big month for Crescat as the Chinese yuan broke down, breaching the 7 level on USDCNY, and our long precious metals positions screamed higher, two key legs of our Macro Trade of the Century. Global equity shorts, including US stocks, are the third leg. But in the wake of a repo liquidity crisis, late-cycle bulls twisted the new Fed money printing into an excuse to drive the stock market even higher. From October onward, the S&P 500 just kept melting up to new highs. All the while, corporate earnings in the US were already turning down and China was hurtling toward recession. The economic downturn was so threatening that Trump and Xi agreed to a panic Phase 1 trade deal to try to stem the downward spiral. That only made stocks go higher.

We made risk control sacrifices (partial buy to covers) to stay in the game without abandoning our core positioning. We maintained our significant net short equity positioning throughout. 2019 ended down for Crescat’s hedge funds despite success on the long side of the portfolios and in our long-only separately managed accounts. Then January 2020 came along. Speculation was still running rampant on the hype of the trade deal despite continued deteriorating macro and fundamental data globally. The down performance in our hedge funds that month just added insult to injury.

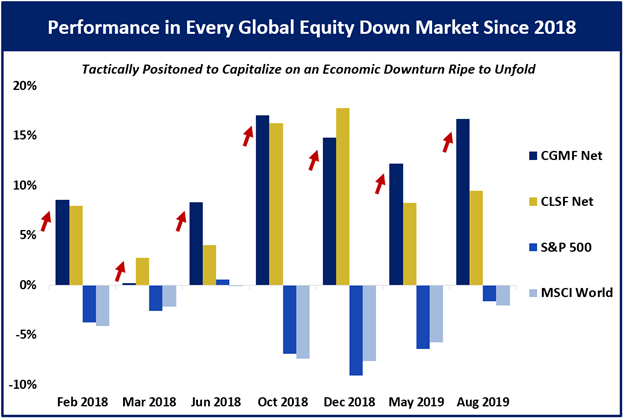

We continued to try to instill confidence in our hedge fund clients based on the intrinsic value of our portfolios. We were convinced that our shorts were worth substantially less than market pricing and longs worth much more. We said were positioned for an economic downturn that was ripe to unfold. We warned extensively about the high probability of a severe bear market and recession coming soon in our letters and social media posts. We showed how our hedge funds would likely perform in a bear market based how they rose in the down months for global stocks over the last two years. For instance, we showed this chart in our Q4 Quarterly Investor Letter published on January 29.

Then came February 2020. It was a month of rabid insanity as the stock market frothed up even higher. Meanwhile our value-oriented long hedges failed miserably. It was like January’s madness all over again. All the while the coronavirus threat was intensifying.

We gave a webinar presentation for our clients warning of the substantial risks in the market and pounded the table on the opportunity in our funds on February 13 and 14th. We laid out the case for the macro set up of the century. We did the same presentation to the world on YouTube livestream on February 21:

Then, finally, through no timing genius, just grit perseverance, the market gapped down on Monday, February 24 and plunged all week. There have been a few big one-day bounces since then, but the steep downturn only continued. It’s was the steepest 22-day decline for US stocks ever, and stocks are down again today even after Powell’s “whatever it takes” pronouncement.

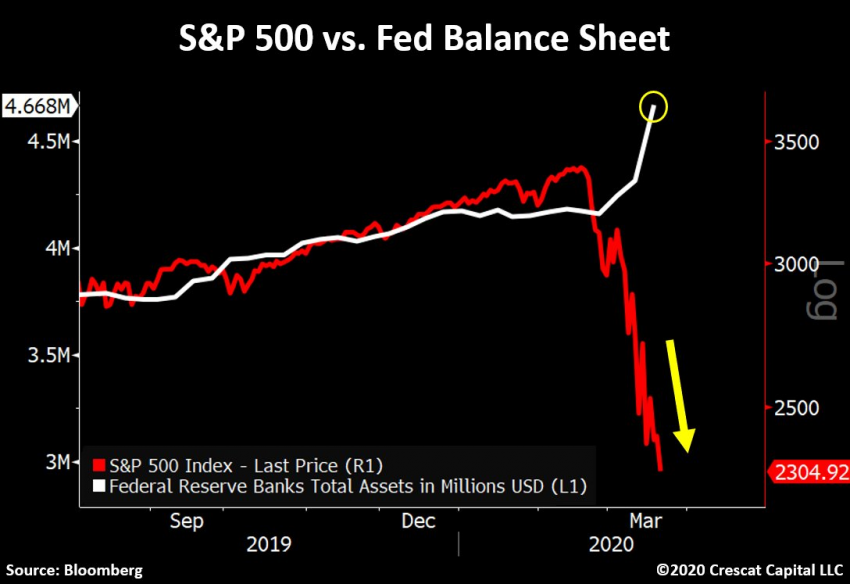

For all those who had been foolishly chasing this late cycle melt-up and thought money printing and stock prices were positively correlated to infinity, welcome to the real world:

The crash was coming with or without the coronavirus pandemic. It started from record highs, historic leverage, and the most fundamentally over-valued composite of multiples ever, higher than 1929 and 2000. It was the longest expansion phase of a US business cycle in history. Now, it’s not just a US, but a global financial market meltdown, predestined by historic global debt to GDP and enormous worldwide asset bubbles. The Chinese banking system, and its currency by association, is largest of all today’s asset bubbles in our view, where there is much, much more to play out still on the downside.

Our performance since the top has been driven by diverse global short positions of over-valued global equities with deteriorating growth fundamentals and often bloated balance sheets. Also, in our global macro fund, our corporate credit shorts and sovereign bond spread trades have performed extremely well. Our shorts have done so well that we have generated these overall high returns at the same time as our precious metals long positions have pulled back substantially. When it comes to the precious metals side, we are convinced that the baby was thrown out with the bathwater.

We believe the precious metals miners are a once in a lifetime buy today, especially the premier small cap ones. In our opinion they are poised for a strong V-shaped recovery. Silver is the cheapest it has ever been relative to gold today.

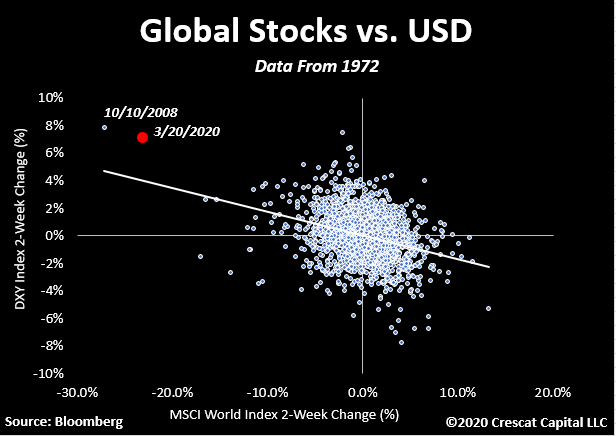

Throughout history, big rallies in the dollar have magnified the selloffs in global stocks. In the last two weeks, that inverse relationship was as intense as the Global Financial Crisis in October 2008 as we show in the chart below. After that episode, USD kept rallying and stocks kept plunging through late November. The Fed at that time had already started a massive QE program in September that continued through early December 2008 adding $1.3 trillion to its balance sheet over three months. Stocks at large did not make their final low until March 2009, but it is important to note that precious metals mining equities made their low for the cycle in October 2008! That was a fire sale buying opportunity with a macro timing set-up very similar to today.

The Road Forward

We think there is much more to play out for all Crescat’s strategies in the near and intermediate term. We haven’t even had the precipitous Chinese currency devaluation and unpegging of the Hong Kong dollar yet, but these moves look ripe. The dollar strength featured above has already been wreaking havoc on emerging market currencies. The yuan looks poised to plunge next in line just like in the prior CNY selloffs since 2015. Our CNH and HKD trades are asymmetric big short opportunities in our global macro fund that we believe are imminent. To express these trades, we are long USD call options with our large US bank ISDA counterparties versus CNH and HKD. This is the equivalent of put options on those currencies. But these contracts are solely with the large US banks and settle in USD.

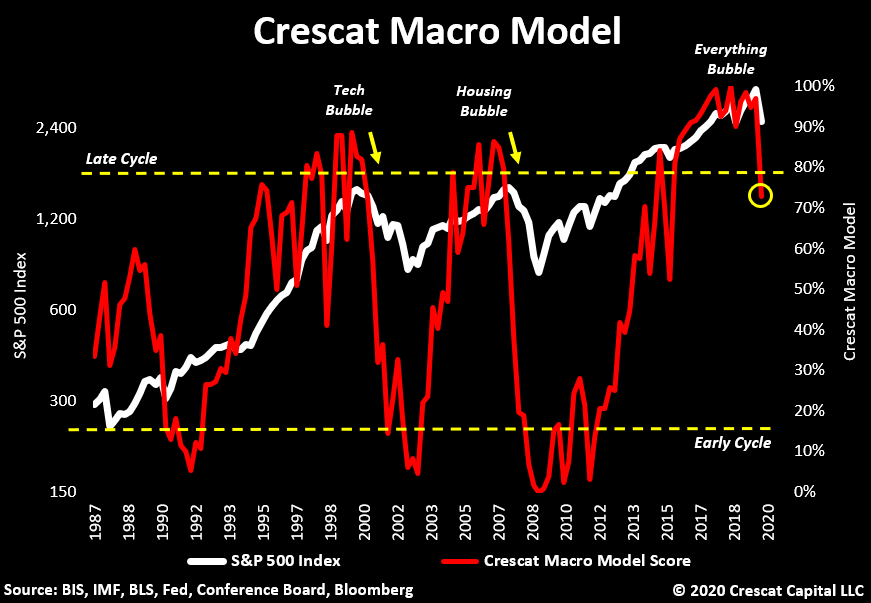

We have taken partial profits in our equity shorts recently to add to the precious metals complex in our hedge funds and to add to our Chinese currency and HKD short exposure in our macro fund. We remain net short equities but with significantly lower gross and net overall equity exposure than we had recently at the top. Still, there remains much more downside for the general equity and corporate credit markets ahead in our strong view. The global recession has only just started. Our comprehensive macro model will tell us when it is a high probability that the markets and economy have hit bottom. We fully plan to become raging bulls at that point. Outside of precious metals, it’s too soon for that now. We presented our macro model below just one week ago showing there is much further likely downside ahead to complete the past-due bear phase of the ongoing business cycle.

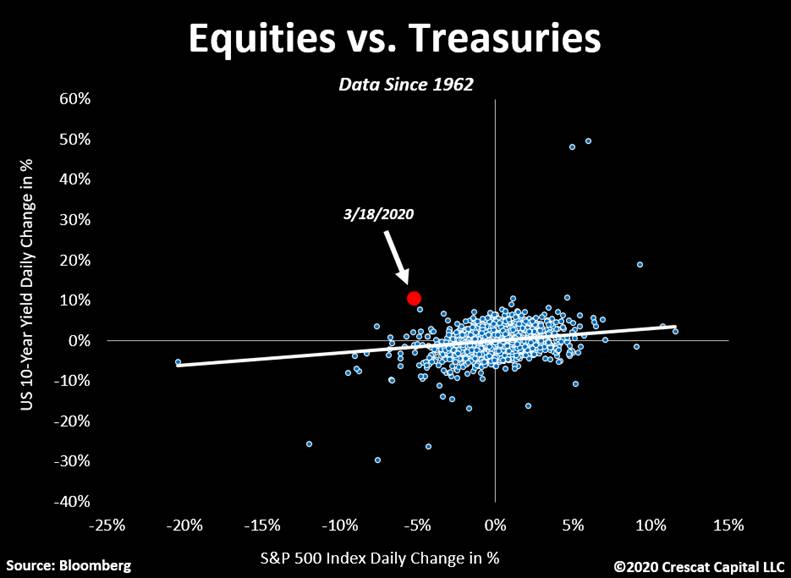

The market at large will bounce along the way, but maybe only after more short-term pain. For instance, in 1929 the S&P 500 and Dow Jones Industrials went down 45% and 48% respectively in the first two months. We are not there yet. The current crash won’t match perfectly but it should rhyme. The S&P 500 is down 32% already in one month. After the two-month plunge in 1929, there were 60% and 50% retracements respectively in the S&P 500 and Dow that lasted about four months through early 1930. We don’t think we are at that comparable point yet where we can get such a strong and enduring relief rally. Risk parity hedge funds that combine long equities with leveraged long bonds for instance are only just beginning to self-destruct.

These are massive hedge funds that are down significantly on their recently over-weighted equity side of the boat according to prime broker sources and are facing large redemptions. At the same time, while the bond side has generally worked well, bond volatility is now spiking. It should make for rough month end to March for the market at large which has another seven trading days to play out as large hedge funds are forced to liquidate positions to meet investor redemptions.

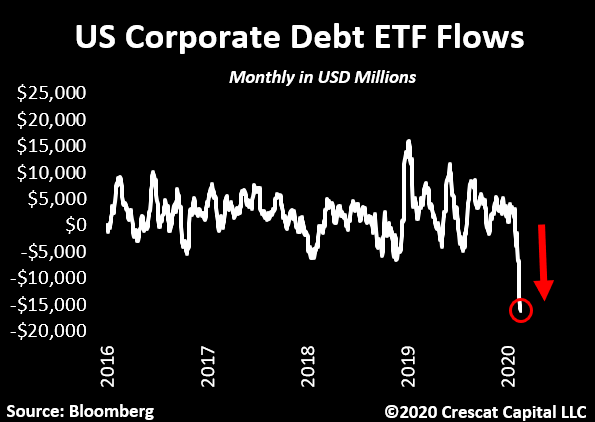

Big passive investment vehicles and ETFs are also imploding. Corporate debt ETF flows, for instance, are drying up fast. We just had the largest monthly outflow in the history of the data.

After the 4-month relief rally into April 1930 during the Great Depression, the market headed down again in a big way before troughing two years later in 1932 with the S&P 500 and Dow down 86% and 89% respectively. We are only one month into this market crash and global recession. We expect stocks to be substantially lower from here before the bottom of this likely to be historic economic downturn. Total market cap to GDP for US stocks is only retesting the levels at “the peak” of the housing bubble as we show below. We are crashing from truly absurd valuation levels!

The relief rally will be here sooner or later though, and we intend to be prepared. The precious metals complex remains our primary long hedge in our funds to play the bounces in the market at large in the meantime. We are buying up all the best gold and silver miners that we can today at their arguably lowest valuations in history. They have the excellent short and intermediate term growth fundamentals. In the inevitable relief rallies to come along the way for the market at large, gold stocks should participate strongly and should outperform. But after such bounces, the general market is highly probable to turn down again. Precious metals stocks, meanwhile, should keep going up based on the massive global monetary and fiscal stimulus that is already coming in and only likely to continue to fight this recession even with more short-term pain ahead for the market at large. The industry may have bottomed already at extreme deep enterprise valuations relative to projected free cash flows for producers, and reserves and resources in the ground for explorers.

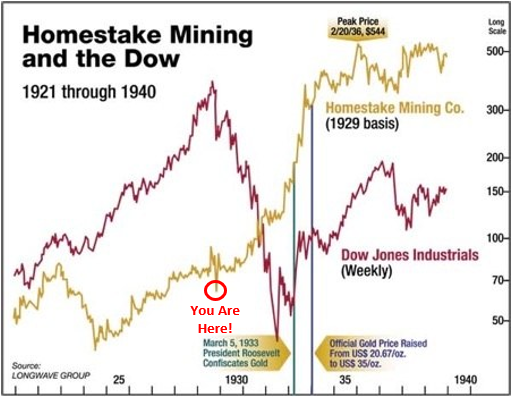

The chart of Homestake Mining versus the Dow Jones Industrial Average during the Great Depression is an excellent one that illustrates the likely value and timing opportunity for precious metals mining stocks today. We have added the “You Are Here” designation to this Longwave Group chart that shows the 1929 Crash along with the blue-chip gold mining stock of the time.

* * *

For those looking to take advantage of the opportunities in the current market environment, Crescat is open for business. We are taking social distance precautions and encourage everyone to do the same to flatten the curve on the spread of Covid-19. The pandemic was indeed a potent catalyst to unwind the record asset bubbles globally that we have been warning about. While the virus continues to spread globally shutting down the world economy, fortunately the death rate remains low. Still, unemployment will be surging and global GDP plunging. It will be challenging for many, but we will get through this recession and global health crisis. Life and a new expansion phase of the global economy will emerge. Crescat’s office remains open, but most of us have been working remotely from home already where we are well set up to operate, almost seamlessly, per our business continuity plan.

Tyler Durden

Thu, 03/26/2020 – 11:55

via ZeroHedge News https://ift.tt/2UQZuHh Tyler Durden