Futures Tumble As Best Rally Since Great Depression Crumbles

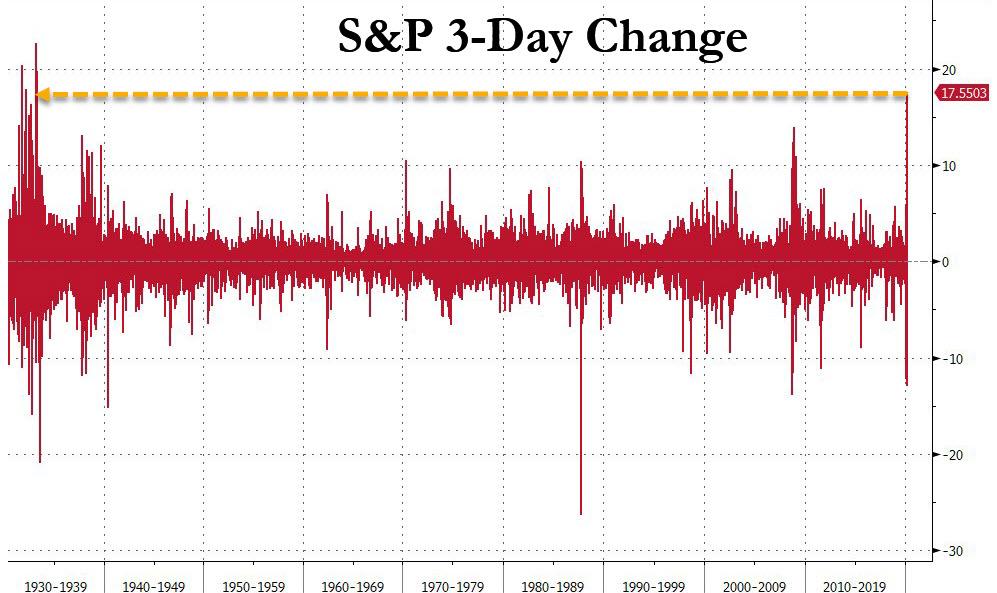

The market moves are coming fast and furious now, and after plunging 36% from its all time highs about a month ago, stocks staged a furious rebound, rising 20% in just the past four days and entering a new bull market, with the return in just the past 3 days a stunning 18%. The last time stocks were up so much, so fast? In 1931… the depths of the great depression.

But the euphoria is fading fast as the US becomes the new epicenter of the coronavirus, surpassing China, and after surging in the last 10 minutes of trading on Tuesday following a near record $7BN MOC amid a flood of pension rebalancing, futures have slumped and are down almost 3%, with Europe’s Stoxx 600 down over 3%, and the UK’s FTSE 100 down 4.1%, the drop accelerating following news that Boris Johnson tested positive for the coronavirus.

The drop takes place as debate on the fiscal stimulus bill aimed at flooding the country with cash in a bid to counter the economic impact of the intensifying coronavirus outbreak, is scheduled to start in the U.S. House of Representatives later on Friday.

On Thursday, the United States became the country with the most coronavirus cases, surpassing even China, where the flu-like illness first emerged late last year. Policymakers may need to offer more stimulus as the virus slams the brakes on economic activity and increases healthcare spending.

“I’m not sure what measures are left, but the reaction in stocks shows some people hoping for more stimulus thought the market was a little oversold,” said Yukio Ishizuki, FX strategist at Daiwa Securities in Tokyo. “Currencies tell a different story. The dollar is the lead actor. The mad rush to buy dollars due to liquidity concerns is starting to fade.”

European stocks also slumped, dropping more than 3% and led lower by banks and real estate shares after the region’s leaders struggled to agree on a concrete strategy to contain the fallout of the pandemic, leaving key details to be ironed out in the coming weeks.

Earlier in the session, Asian stocks gained, led by industrials and utilities, although markets in the region were mixed, with Jakarta Composite and Japan’s Topix Index rising, and Australia’s S&P/ASX 200 and Taiwan’s Taiex Index falling. The Topix gained 4.3%, with Kaneko Seeds and Segue rising the most. The Shanghai Composite Index rose 0.3%, with Guirenniao and Shanghai La Chapelle posting the biggest advances.

The recent surge in risk appetite (which according to Morgan Stanley was just a furious short covering spree) will promptly be tested by the continuing spread of the coronavirus and the crippling effect of business closures. Tokyo is now seeing a surge in cases, while global deaths from the pandemic surpassed 24,000. The Reserve Bank of India on Friday became the latest central bank to step up emergency action to cushion the economic impact.

Meanwhile, traders argue that even with the jump in stocks, sentiment hasn’t reversed enough for the rally to be sustainable with the number of companies trading above the 200DMA still at crisis levels.

Leaders of the Group of 20 major economies pledged on Thursday to inject over $5 trillion into the global economy to limit job and income losses from the coronavirus.

In rates, the 10Y yield was about 10bps lower, trading to 0.75%, down from 0.85% overnight: “The market is pricing in a fairly short duration of weakness” for the economy, Priya Misra, global head of rates strategy at TD Securities, said on Bloomberg TV. “A month from now when we realize we are still stuck at home and the data is not looking any better, that is when you can get a further downside move in yields.”

In Europe, Italian bonds slid amid German opposition to coronabonds, underperforming euro-area peers which all advanced, as the latest stimulus figures fell short of its peers. BTPs bear-flattened, widening the spread to bunds by 16bps to 174bps; Rome’s latest stimulus figures, which fall short of peers, will have to be self-funded without the backstop of a euro-area bond. Elsewhere, bunds bull-flattened as equities slide, matching Treasury gains. Gilts bull-flatten ahead of next week’s BOE buyback schedule due at 4pm London time. German 10y yield -9bps to -0.45%; bund futures 126 ticks to 172.33; France 10y -8bps to -0.06%; Italy 10y +7bps at 1.30%.

Overnight, India’s RBI became the latest bank to slash rates by 75bps to 4.4%; voting 4-2 to cut rates as the reverse repo rate lowered to 4.15%. Governor Das said the move was designed to mitigate effects of the virus, revive growth and preserve financial stability. He added that the RBI’s response must involve conventional and unconventional measures. Das noted that inflation was running higher than projections in January and February, and that aggregate demand may weaken, and ease inflation further due to Covid-19. Das also said projections for growth and inflation will be dependent on how Covid progresses; he noted that uncertainties in the outlook and explained that is why the MPC has refrained from providing growth and inflation forecasts. Das also announced targeted long-term repo operations, offering up to INR 1trln.

In FX, the Bloomberg Dollar Spot Index headed for its biggest five-day drop on record, even as the gauge was set to gain for Friday’s session and appeared to be reversing upward, inversely proportional to risk sentiment. Traders pointed to a confluence of reasons, ranging from less stress in funding markets, the repatriation of funds as the quarter ends and the worsening coronavirus outbreak in the U.S. The dollar reversed Asia-session losses and advanced versus most Group-of-10 peers as month- and quarter-end flows came into play; the greenback traded around 1.10 per euro while the Norwegian krone led declines, slipping by almost 1%;

Elsewhere, Norway’s krone was set for its biggest weekly advance versus the U.S. dollar on record.The Yen rose on strong demand from Japanese exporters ahead of the country’s fiscal year end on March 31. The Aussie was set for the biggest weekly gain since 2011 as U.S. dollar weakness spurred early month-end hedging from exporters and momentum buying from investors.

To the day ahead now, and data releases out include personal income and personal spending data for February, along with that month’s PCE core deflator. The US will also see the final University of Michigan sentiment reading for March, and over in Washington, the House of Representatives are scheduled to vote on the coronavirus rescue package.

Market Snapshot

- S&P 500 futures down 1.5% to 2,569.75

- STOXX Europe 600 down 1.9% to 315.34

- MXAP up 1.7% to 137.67

- MXAPJ down 0.06% to 432.76

- Nikkei up 3.9% to 19,389.43

- Topix up 4.3% to 1,459.49

- Hang Seng Index up 0.6% to 23,484.28

- Shanghai Composite up 0.3% to 2,772.20

- Sensex up 0.3% to 30,040.00

- Australia S&P/ASX 200 down 5.3% to 4,842.43

- Kospi up 1.9% to 1,717.73

- German 10Y yield fell 6.5 bps to -0.426%

- Euro down 0.09% to $1.1022

- Italian 10Y yield fell 31.5 bps to 1.057%

- Spanish 10Y yield fell 4.5 bps to 0.524%

- Brent futures down 0.3% to $26.25/bbl

- Gold spot down 0.7% to $1,619.67

- U.S. Dollar Index up 0.2% to 99.50

Top Overnight News

- U.S. President Donald Trump and China’s Xi Jinping pledged in a phone call to cooperate in the fight against the coronavirus pandemic, signaling a fresh detente between the two countries after weeks of rising tensions

- President Donald Trump offered a plan to restore normal business by ranking counties by their virus risk. China seals borders to most foreigners starting Saturday

- European leaders struggled to agree on a concrete strategy to contain the fallout from the deadly coronavirus, leaving key details to be hammered out in the weeks ahead

- Treasury Secretary Steven Mnuchin reiterated that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he’s focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain

- Oil was buoyed by a wider risk rally driven by monetary and fiscal responses to the coronavirus to head for its first weekly gain in five, despite a continued deterioration in demand

- S&P Global Ratings cut its sovereign credit score for Mexico by one notch to BBB, saying shocks from the spread of coronavirus and an oil price rout will harm the country’s already grim economic outlook

- The Federal Reserves dollar swap lines were tapped for more than $206 billion by other central banks as of March 25, while Europe and Japan took another $100 billion in three-month operations which settled March 26. This helped to cool cross-currency basis markets, one of the key borrowing channels

Major APAC indices initially took their cues from Wall Street, rising firmly at the open, amid optimism that policymakers will continue to roll-out stimulus measures to guard economies against covid-induced downside. However, as the European day comes into focus, the picture is mixed, as Aussie shares turned negative, and other bourses off highs. US indices finished up around 6%, with the Dow seeing its strongest three day run since 1931 and re-entering a bull-market, while the S&P had its best three-day performance since 1933. Gains were led by defensive sectors (utilities, telecoms, health care). Equities shrugged-off the highest weekly jobless claims print on record. Some desks also noted that month/quarter-end rebalancing will see 850bln of flows into equities. US equity futures opened firmer, though subsequently gave up gains, and are trading lower, albeit off worst levels. ASX 200 (-5.3%) was led lower by its heavyweight financial and mining sectors, while the Nikkei 225 (+3.8%) shrugged off a firmer JPY, with some optimism in the country emanating from Japanese Economy Minister Nishimura who stated that there was no need to declare a state of emergency over the outbreak. Elsewhere, Hang Seng (+0.6%) and Shanghai Comp. (+0.3%) remained in positive territory and were buoyed by increased efforts from Chinese officials to stem a substantial second wave of the virus in the country, with reports yesterday noting that airport tests will be ramped up for people arriving from abroad.

Top Asian News

- The Second Virus Shockwave Is Hitting China’s Factories Already

- WeDoctor Mandates Banks for $1b Hong Kong IPO, IFR Reports

- A Grocery Tycoon Races to Keep India Fed and His Company Afloat

- India’s RBI Unleashes $50 Billion of Liquidity, Slashes Rate

- Fearing Next Wave, China Doesn’t Want Its Diaspora Coming Back

A downbeat session thus far for European equities (Euro Stoxx 50 -3.3%) as the bourses look set to snap its three-day rally heading into another risky virus-focused weekend. US equity futures follow suit from Europe with losses currently tallying to around 2% per index – with eyes State-side on the virus bill which is poised to make its passage through the House later today. Back to Europe, UK’s FTSE 100 (-3.9%) underperforms the region with a number of its stocks at the foot of the Stoxx 600 index as caution arises from the prospect of delayed UK/EU FTA negotiations, despite the already-tight schedule – whilst housing and banks names also see headwinds from the UK govt calling for the halt of home purchases/sales. Meanwhile, Italy’s FTSE MIB (-2.3%) continues to feel some support from the ECB dismissing the 33% issuer limit for its emergency program purchases. European sectors reside largely in the red but reflect risk aversion, whilst underperformance is seen in the Energy sector on account of the downside in Brent prices. The sector breakdown meanwhile sees Travel & Leisure pressured on the ongoing virus-induced demand woes for the sector. Looking at individual movers, ProsiebentSat1 (+7.0%) sees upside amid the immediate resignation of its CEO, and with potential tailwinds from work-from-home flows. LafargeHolcim (-3.5%) and Safran (-2.3%) shares are pressured after the Cos withdrew their respective FY targets.

Top European News

- Europe Bonds Get $340 Billion Orders as Cheap Prices Allay Virus

- ProSieben Jumps After Ousting CEO To Restore Focus on German TV

- Domino’s Pizza to Suspend Final Dividend; Deliveries Accelerate

- Merkel Pleads With Germans for Patience on Lockdown Measures

- Housebuilders Slump as U.K. Government Urges Suspending Deals

In FX, the Greenback has regained an element of composure after yesterday’s slide and extended losses across the board, with some analysts suggesting that the DXY eventually found technical respite in the form of Fib support around 98.840 and others noting that the index is correlating quite well with moves in the VIX. Both theories appear credible and are backed up by price developments given the DXY’s subsequent recovery to 99.500+ and the so called fear gauge climbing to 67 from around 61 at settlement on Thursday. Certainly, traditional fundamentals and data do not seem to be driving sentiment or direction as the focus remains firmly on COVID-19 amidst the backdrop of swings in global stock markets and risk assets vs safe-havens.

- JPY/GBP/AUD – Bucking the overall trend, or resisting the broad Dollar revival to be more precise, as the Yen retains its renowned safe-haven allure above 109.00, while Sterling appears to have formed another higher platform on the 1.2100 handle to probe above 1.2300 and match a key chart resistance level (50% retracement of reversal from 1.3200 to 1.1412), albeit with the aid of Eur/Gbp tailwinds as the cross recoils from almost 0.9100 to sub-0.9000, with month/quarter end positioning cited on top of possible official Pound buying interest. Elsewhere, the Aussie is holding up relatively well and again month-end demand has been touted alongside exporter bids, leverage stops and momentum accounts joining the break of 0.6100 to the overnight highs.

- CAD/EUR/NZD/CHF – The Loonie is underperforming after failing to sustain momentum through 1.4000 and record low Canadian crude prices may be weighing along with contagion from the coronavirus after the huge spike in US weekly claims that is expected to be evident in domestic data given reports that 500k people applied for benefits last week. Similarly, the Euro topped out ahead of 1.1100 and is waning on the ongoing spread of pandemic cases and fatalities across the common currency community, with particular focus on Italy and Spain. However, decent option expiries at the 1.1000 strike (1 bn) may provide a buffer for Eur/Usd. In contrast, the Franc and Kiwi are both rangebound within 0.9645-0.9587 and 0.6126-0.5921 respective bands.

- EM – Broad retracements as the Usd consolidates off its lows, but the Zar also conceding ground in the run up to Moody’s SA ratings review that could well see the sovereign lose its last non-junk standing. Note also, the Rand has been ruffled by the first COVID-19 deaths as the country starts a 3 week lockdown.

In commodities, WTI and Brent front-month futures see divergence, with outperformance seen in the former after yesterday’s -7.7% settlement, whilst ICE Brent closed lower by around 4% yesterday. Today’s narrowing in spread seems to be more of a consolidation of the prior session’s widening – which emanated from reports that the US Department of Energy suspended its SPR refill after the DoE failed to secure funding. ING notes that “The US government was keen to fill up the SPR in a bid to help domestic producers, however, news of the suspension has weighed heavily on WT.” Meanwhile, on the OPEC front, the Algerian Oil minister has called for an extraordinary meeting of the OPEC economic panel to assess current conditions and immediate prospects of the oil market, whilst Russia noted that its oil output could decline by 1.5mln BPD this year if prices meander around USD 30-35/bbl – levels above current oil prices, although communication with OPEC+ members remain. Desks note that production cuts needed to counter the sharp decline in demand would be too much for OPEC+ producers to cope with. WTI futures pulled back from ~USD 23/bbl whilst its Brent counterpart treads water just under USD 26/bbl. Elsewhere, spot gold remains lacklustre above USD 1600/oz as the Dollar recoups some of yesterday’s losses. Copper meanwhile remained largely uneventful around USD 2.2/lb following a mixed APAC session.

US Event Calendar

- 8:30am: Personal Spending, est. 0.2%, prior 0.2%

- 8:30am: Personal Income, est. 0.4%, prior 0.6%

- 8:30am: Real Personal Spending, est. 0.2%, prior 0.1%

- 8:30am: PCE Deflator MoM, est. 0.1%, prior 0.1%; PCE Deflator YoY, est. 1.7%, prior 1.7%

- 10am: U. of Mich. Sentiment, est. 90, prior 95.9; Current Conditions, est. 106, prior 112.5; Expectations, est. 77, prior 85.3

- 10am: U. of Mich. 1 Yr Inflation, prior 2.3%; 5-10 Yr Inflation, prior 2.3%

DB’s Jim Reid concludes the overnight wrap

So the second week of working from home comes to an end, and to be honest it’s flown by and I haven’t noticed that I’ve hardly left the perimeter of my house. We’ve been on self-isolation for a week as all three children now have coughs and a slight fever. As a result of the isolation, my wife, who is far more sociable than me, is struggling as she is only interacting with a 4 year old, two terrible two-year old twins and a dog! At least I have numerous conference calls. I pop down for food and drink occasionally and she usually appears frazzled. Thankfully the new trampoline arrived yesterday and my job is to erect it tomorrow. I think this might be even more stressful than the last two weeks as it’s in lots of boxes and when built extends to 16 foot. I’m not sure what’s more likely by Monday, an injury from erecting it or from bouncing on it.

Staying with the remarkable times we operate in, at the start of 2020 if you’d had pulled up a chart of US weekly jobless claims through history (data back to 1967) and seen that we were at around 200k with the highest ever being 695k back in 1982, I wonder what event you would have thought had to happen for there to be a weekly print of 3.28 million less than three months later. All answers welcome! This number yesterday was a more than ten-fold increase on the previous week’s revised 282k reading. We cannot stress enough how unprecedented numbers like this in a single week are. Even in the financial crisis, the peak week in March 2009 was at 665k.

Looking at the state-by-state data, the 2 states that saw the biggest increase in claims were Pennsylvania and Ohio, with a surge of 363k and 181k respectively compared with the prior week. Both are states in the US rust belt and are traditionally swing states in presidential campaigns. Indeed Pennsylvania, where there was the biggest increase in claims, was won by President Trump in 2016 by a margin of less than 1 percentage point. So the fact that they’re seeing the biggest increases in the country is certainly not something that’ll be welcomed by his campaign. Our economist’s previous work has found that jobless claims are the single best real-time indicator of recession (see “Jobless claims claim title for best recession indicator”), so this rise leaves no doubt that the US economy is currently in the midst of a recession. Consistent with the sharp rise in claims, their summary index of these high-frequency indicators has essentially gone into free fall indicating data which is about twelve standard deviations worse than average and consistent with -4% year-over-year GDP growth. This is worse than any readings during the financial crisis.

Given yesterday’s numbers, it was no surprise that Fed Chair Powell said in an interview on NBC’s Today show (a non-business channel) that the US “may well be in a recession”. His address was aimed at Main Street and he added that “When it comes to this lending we’re not going to run out of ammunition.”

Speaking of economic support, the House of Representatives are scheduled to vote on the $2 trillion coronavirus rescue plan today. In a Bloomberg TV interview yesterday, Speaker Nancy Pelosi said that she had “no doubts whatsoever” the package would pass today, which would set up the bill to go to President Trump’s desk for signature. However, overnight, House leader Hoyer has suggested that the legislature may not pass today by voice vote and instead the house could pass the bill by a Roll Call vote but will need quorum for that of typically 218 members. This is a potential thorn which we highlighted yesterday that can result in delaying the passage of bill. Futures on the S&P 500 are trading down -1.69% this morning.

With financial markets hopeful on the prospects for stimulus, global equities moved higher for a third straight day, a phrase that we haven’t said for a while (since February 12th in fact, according to the MSCI all-world index), with the S&P 500 up a further +6.24%. The index’s latest advance means it’s up over 17% from its closing low on Monday. The large gain adds to the run where 16 out of the 19 sessions so far this month have seen the S&P move by at least 2% in either direction. The Dow Jones hit a remarkable milestone of its own yesterday, after its +6.38% advance left the index +21.30% above its Monday low and in technical “bull market” territory!!! European equities also advanced on the day, with the STOXX 600 up +2.55% and nearly +15% since Monday, with every sector gaining on the day led by the most beaten up sector of late namely Travel and Leisure – up +7.47% on the day.

This morning Asian markets are a mixed bag with the Nikkei (+1.95%), Hang Seng (+1.21%) and Shanghai Comp (+1.41%) up while the Kospi is little changed and ASX (-5.30%) is down. In FX, the US dollar index (-0.36%) is on course for its fifth daily decline while in commodities, Brent crude oil is up +0.84%. As for overnight data releases China’s Jan-Feb industrial profits came in at -38.3% yoy, the lowest on record.

In other news, The Reserve Bank of India became the latest central bank overnight to cut rates as it lowered the key lending rate by 75bps to 4.40% from 5.15%. The central bank also reduced the reverse repo rate, the rate at which banks park funds with the RBI, by 90bps to 4% in order to incentivize lending by the banks. Elsewhere, S&P cut Mexico’s credit rating by one notch to BBB, saying shocks from the spread of coronavirus and an oil price rout will harm the country’s already grim economic outlook. The Mexican peso is down -1.23% this morning to 23.2305.

Back yesterday where sovereign debt also rallied strongly, with European sovereign bonds in particular gaining as a result of the ECB news that the limits on buying more than a third of a country’s bonds would not apply to their pandemic emergency purchase programme in certain conditions. For more details on this news see our rates team’s publication from last night here. Spreads narrowed in response, with the Italian 10yr spread over bunds down by -21.8bps to a 3-week low, while Spanish (-20.5bps) and Portuguese (-23.9bps) spreads also saw significant reductions. The biggest outperformer was Greece however, with the spread there falling by a massive -61.4bps. US Treasuries advanced as well, with 10yr yields down by -2.3bps (and a further -4.8bps this morning). Credit continued to rally with US HY cash spreads tightening -82bps, while IG tightened -21bps and Europe HY cash tightened -31bps although IG was flat.

Staying with credit, with all the big announcements of central bank support and fiscal stimulus packages over the last couple of weeks, all eyes in the credit world have been on corporate bond funds, hoping that their recent heavy outflows would finally stop. After the latest weekly fund flow data release overnight, we have published the report “Corporate Bond Fund Outflows Go On But More Slowly” which provide an update and commentary on the latest flows. It also attempts to explain some vastly different headline numbers on US IG corporate bond fund outflows based on data from different providers. You can download the report here.

Moving on. Although the ECB news was a positive, the EU leaders‘ summit late last night didn’t appear to be. A 2-hour scheduled meeting lasted 6 hours with no clear plan for a joint EU response to the crisis. There was no mention of the ESM in the communique which hints at Italy refusing to accept the conditionality this would bring. Italy believes that the virus is a common problem and can’t accept conditionality – which is a legal necessity. In addition “Coronabonds” seem to have hit an early dead end even as nine EU member states (including France, Italy and Spain) had earlier jointly written to the head of the EC requesting for it to be considered. The Eurogroup now has two weeks to come up with alternative proposals. It seems the age old problem for Europe has struck again. The more the ECB do, the less pressure there is on Governments to burden share. In fact the emergency ECB bazooka deployed last week probably helped cause the impasse.

Earlier and across the Channel, the Bank of England also announced their latest rate decision yesterday, voting unanimously to keep rates on hold at 0.1%, in line with expectations. To be honest though, the main BoE action already happened earlier in the month after the two emergency rate cuts saw rates lowered by 65bps in total, as well as the announcement of a further £200bn in QE. A notable line from the monetary policy summary released by the BoE was that “there is a risk of longer-term damage to the economy, especially if there are business failures on a large scale or significant increases in unemployment.” In terms of policy looking forward, there was also the line in the minutes that “If needed, the MPC could expand asset purchases further”, as well as the fact that the MPC “stood ready to respond further as necessary to guard against an unwarranted tightening in financial conditions, and support the economy.”

Turning to yesterday’s other data releases, in France the INSEE’s business confidence measure fell to by 10 points to 95 in March (vs. 97 expected), which was a 5-year low for the reading and the largest monthly decline since the series began. Meanwhile the Kansas City Fed’s manufacturing index in March fell to -17 (vs. -10 expected), which was the lowest reading since April 2009. Other data was more backward looking, with UK retail sales falling by -0.3% mom in February (vs. +0.2% expected). The effect of the coronavirus wasn’t generally visible at that point, though the ONS did remark that “a small number of retailers suggested that online orders shipped from China were reduced because of the impact of COVID-19.” The third reading of Q4 2019’s GDP growth in the US was also confirmed at an annualised 2.1%, unchanged from the second estimate.

To the day ahead now, and data releases out include French and Italian consumer confidence for March, while from the US there’s personal income and personal spending data for February, along with that month’s PCE core deflator. The US will also see the final University of Michigan sentiment reading for March, and over in Washington, the House of Representatives are scheduled to vote on the coronavirus rescue package.

Tyler Durden

Fri, 03/27/2020 – 08:09

via ZeroHedge News https://ift.tt/2vSd7gG Tyler Durden