Here Is A Breakdown Of The $12 Trillion In Global Stimulus Passed This Month

A favorite phrase of Bank of America’s chief investment strategist, and certainly an accurate one, is that “Markets stop panicking when policy makers start panicking.”

Seen in this light, the only question is whether policymakers have panicked enough in response to the current coronavirus crisis which has ground the global $86 billion economy to a halt.

Addressing this question, BofA has calculated the policy response to date, calculating that so far following the “fastest crash, deleveraging, recession, policy panic in history” global policy makers have not only cut rates 65 times so far in 2020, but also pledged some $12 trillion, $7 trillion in monetary and $5 trillion in fiscal stimulus “to reduce volatility and credit spreads, allowing credit to lead vicious bear market rally.” This is as the big five central banks (excluding China) have already bought $13tn of financial assets since Lehman…set to buy further $7tn this year.

Here is a recap of the big numbers so far via BofA:

- $7tn: announced/promised global central bank liquidity to address 2020 crash & recession.

- $5tn: announced/promised fiscal stimulus to address 2020 crash & recession (to be underwritten by central banks).

- $13tn: Fed, ECB, BoJ, BoE, SNB have already bought $13tn of financial assets since Lehman…set to buy further $7tn this year.

- 853: central banks cut interest rates 853 times since Lehman…and 65 rate cuts in 2020.

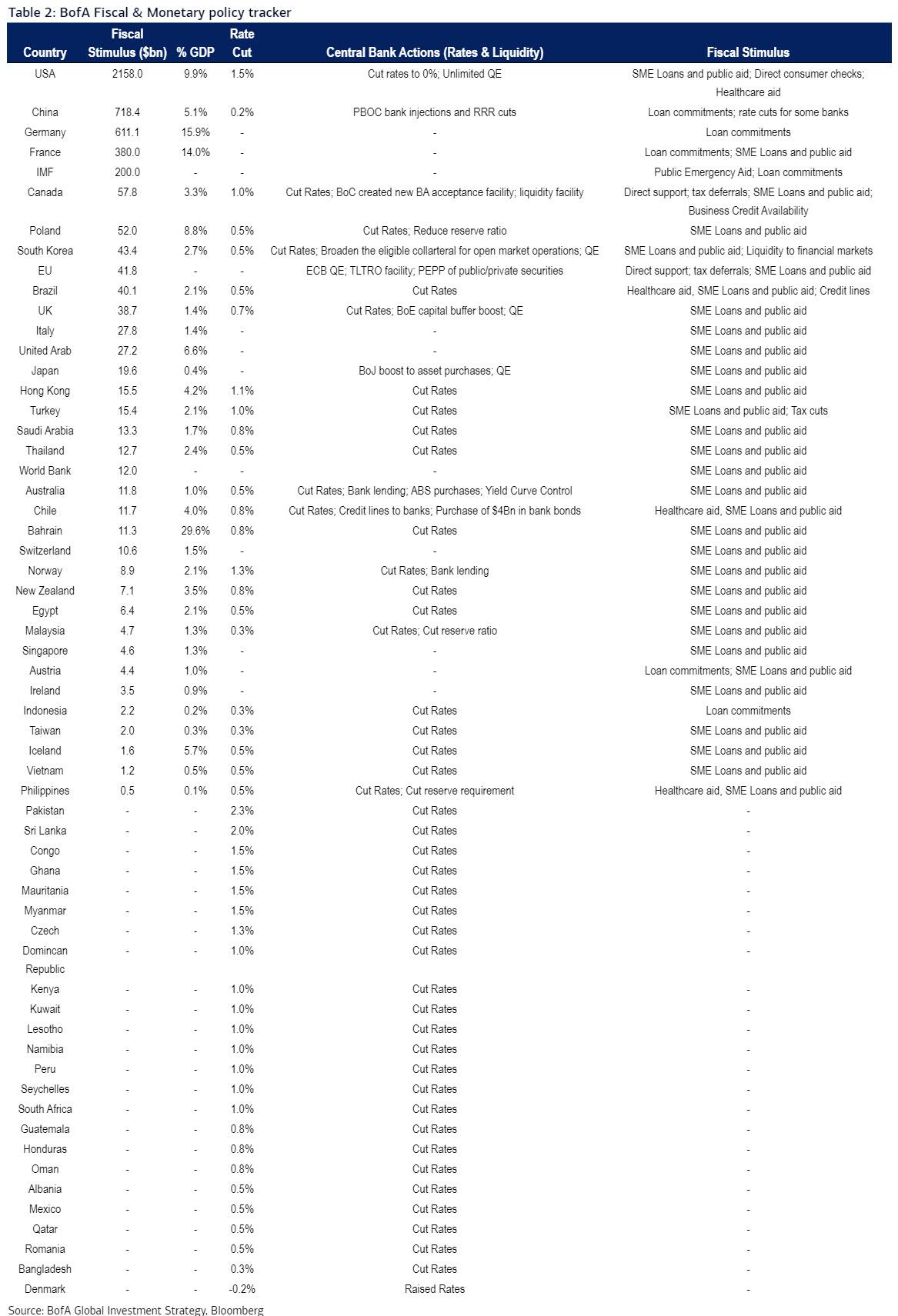

BofA’s policy tracker puts this in context:

If markets conclude that what has been done so far is not enough BofA sees an acceleration toward YCC (Yield Curve Control), UBI (Universal Basic Income), MMT (Modern Monetary Theory), which tell BofA “not that inflation guaranteed to rise but that 2020 sees a multi-year low in inflation expectations”, even thought Deutsche Bank disagrees speculating last week that Helicopter money has set the seeds for hyperinflation.

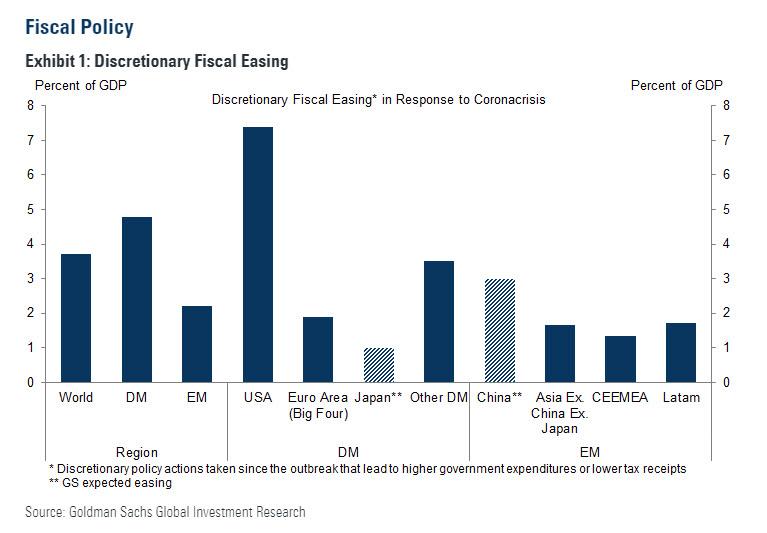

Going back to what has already been done, here is a breakdown of the latest fiscal stimulus via Goldman:

- Following the passage of the “Phase 3” package in the US Senate, we estimate discretionary fiscal policy will ease by around 7½% of GDP in the US this year and by 3¾% of GDP globally. Discretionary fiscal relief more than doubled this week in the UK (to 3½% of GDP), quadrupled in Australia (to 4½%) and quintupled in Germany (to 2%).

- As US jobless claims jumped to a record high, policymakers announced further actions to maintain employment relationships, including forgivable loans to cover small business payrolls in the US and wage subsidies in the UK.

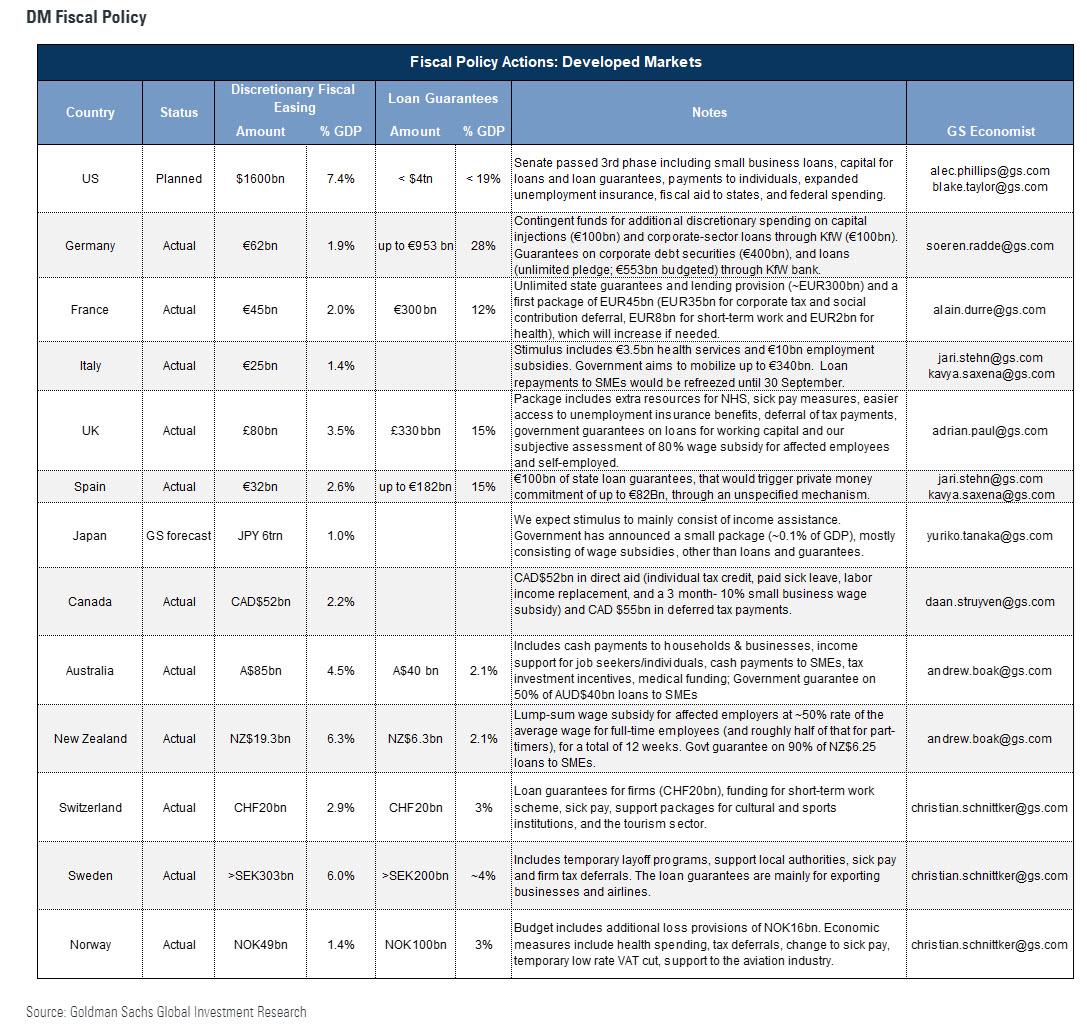

Breaking down fiscal policy responses in granular detail, here is a snapshot of DM fiscal policy by country:

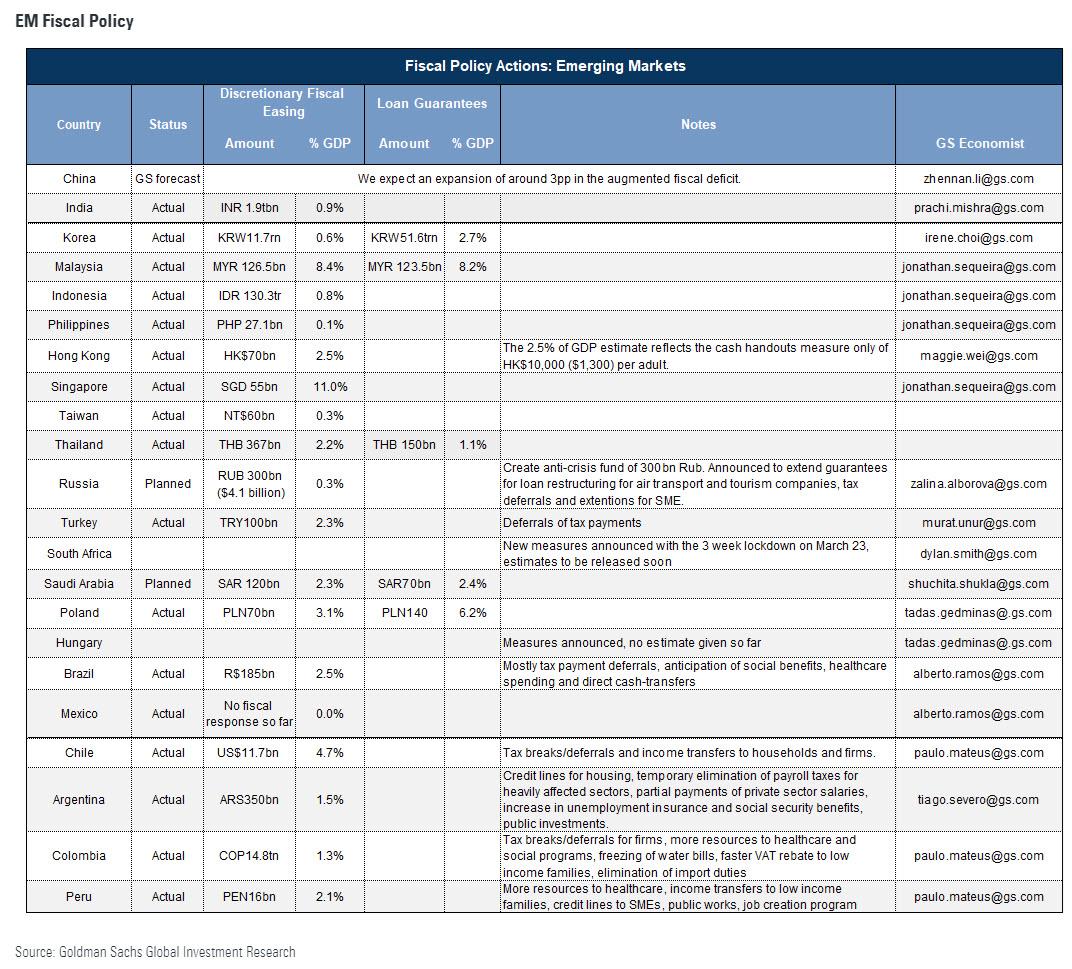

The same for emerging markets:

Next, here is a summary of the key monetary policy changes in recent weeks, also via Goldman:

- Following the 50bp BoC cut to its effective lower bound of 0.25%, most DM central banks are now believed to be at the effective lower bound and seem reluctant to take rates into negative or more negative territory, perhaps reflecting today’s focus on financial market functioning. In EMs, India cut the policy rate by 75p and Mexico cut the policy rate by 50bp.

- Unconventional policies become more forceful this week across the Atlantic. The Fed announced uncapped asset purchases and direct support of the corporate bond market while the ECB geared up the flexibility over purchase limits and country allocations of its Pandemic Emergency QE.

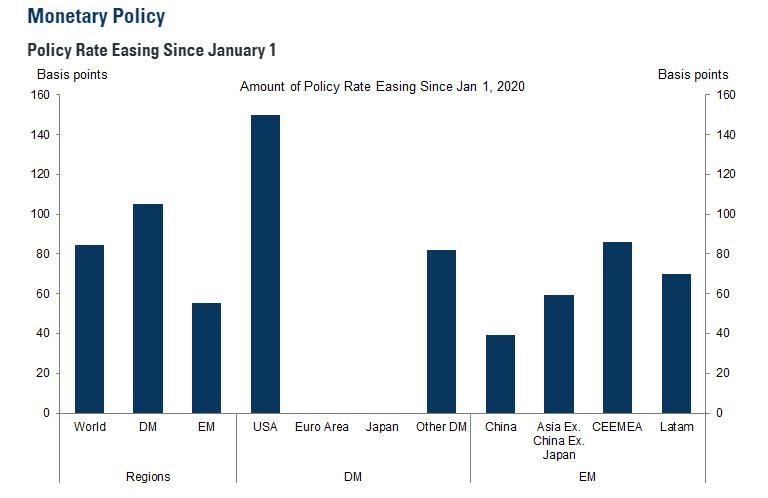

Here is a chart showing the policy rate easing since the start of the year:

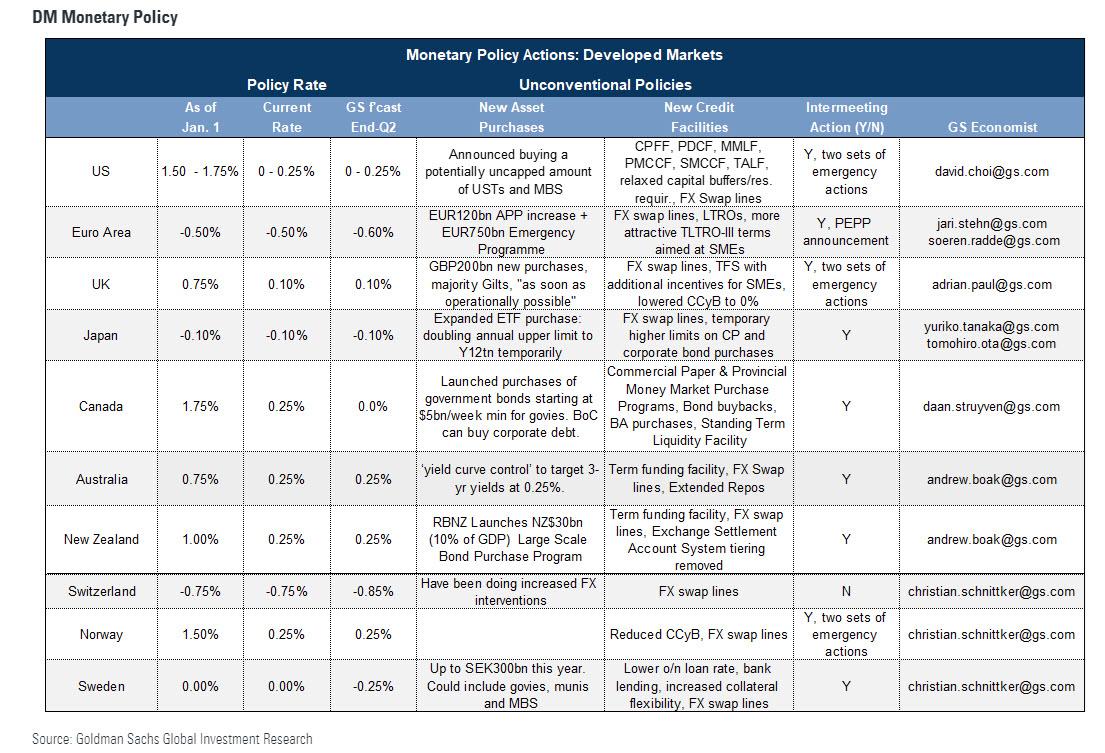

Breaking down monetary policy responses, here is a snapshot of recent actions taken by developed markets:

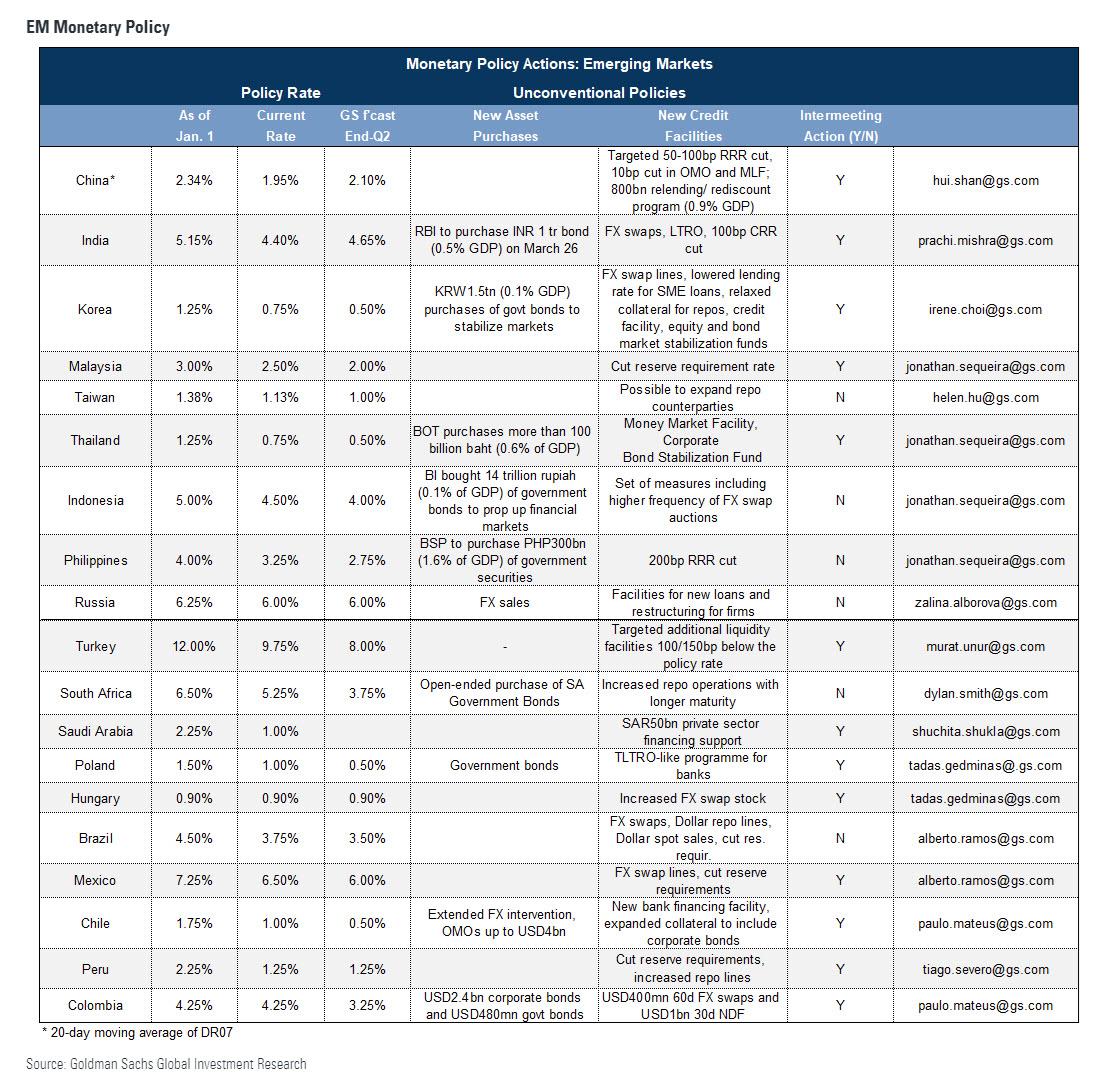

And EMs:

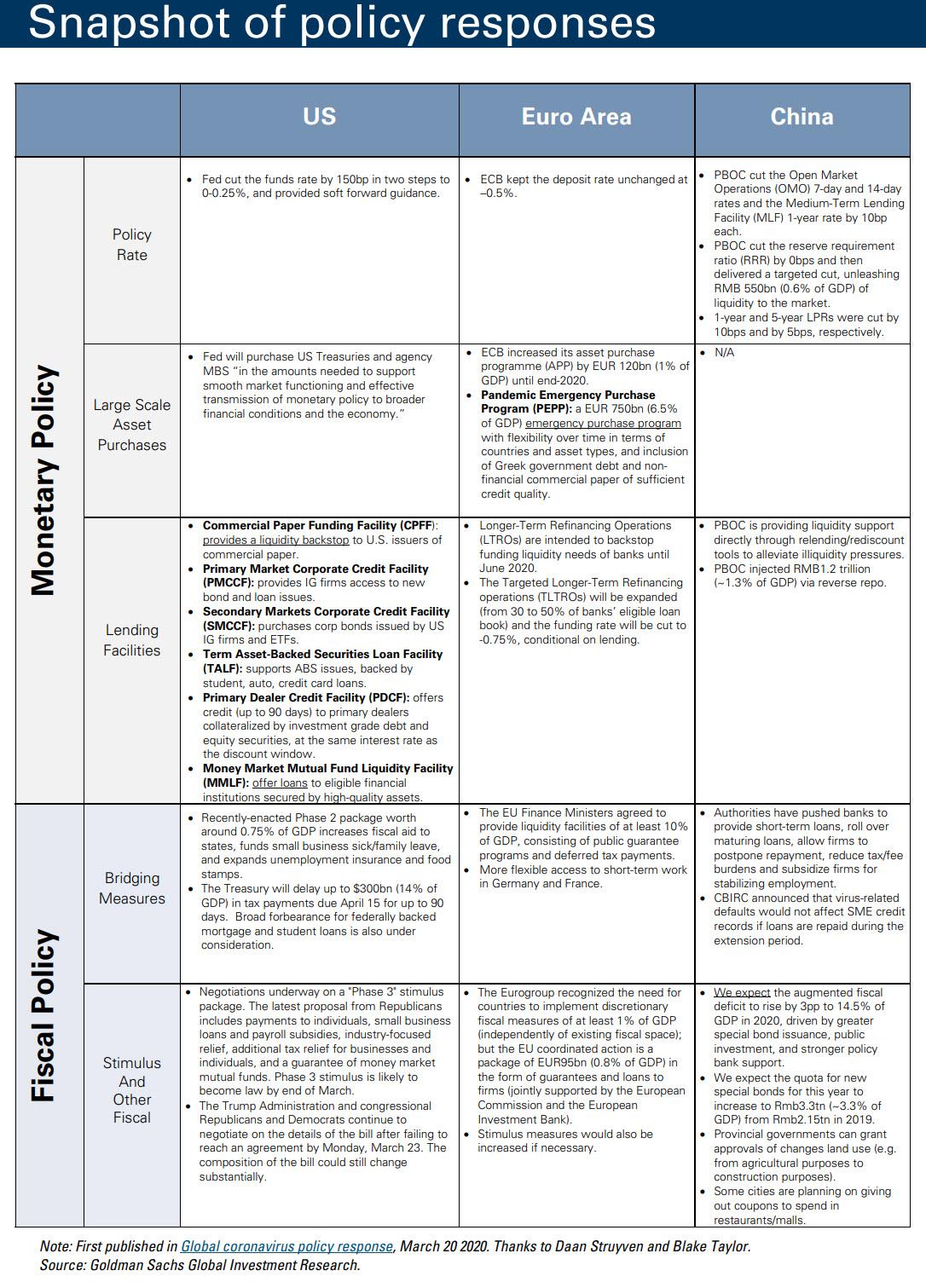

Finally, here is a recap of the detailed combined Policy Responses in the US, EA and China:

Tyler Durden

Fri, 03/27/2020 – 15:05

via ZeroHedge News https://ift.tt/33QK9KE Tyler Durden