Rabobank: There Is One Critical Element Missing That Prevents Us From Becoming Even Remotely Optimistic

Submitted by Piotr Matys, Jane Foley and Philip Marey of Rabobank

A corrective rebound in US stocks extended on Thursday as the S&P 500 Index closed 6.24% and the DJIA 6.38% higher. Severely battered EM currencies trimmed their substantial losses and various G10 currencies appreciated versus the dollar as well. The league table so far this week is the mirror image of the last few weeks as the Norwegian krone, the British pound and the Australia dollar are the best performers.

The huge monetary policy bazooka revealed by the Fed earlier this week combined with the fiscal stimulus package worth USD 2trl approved by the US Senate (full analysis available here) are the main pillars supporting this broad relief across markets. Other major central banks also used all tools at their disposal to reduce the risk of a recession transforming into a depression. In this publication we often focus on the largest central banks given the extent of their reach, but it is worth mentioning the efforts of other rates setters. For the first time in their history the RBA, RBNZ and also the National Bank of Poland will start purchasing government bonds. QE is not an unconventional tool anymore and this may raises various issues further down the line.

In addition to monetary and fiscal easing announced by the growing number of countries, G20 leaders – who held a video conference call – pledged to do “whatever it takes” to reduce the economic and social damage from the pandemic.

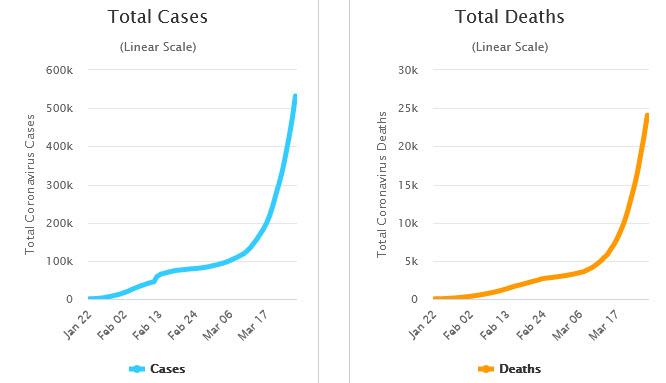

This is reassuring, but there is one critical element missing that prevents us from adopting even the most cautiously optimistic view and declaring that the worst is over for the markets: coronavirus peak. Global cases continue to rise and exceeded half a million with over 24 thousand total deaths.

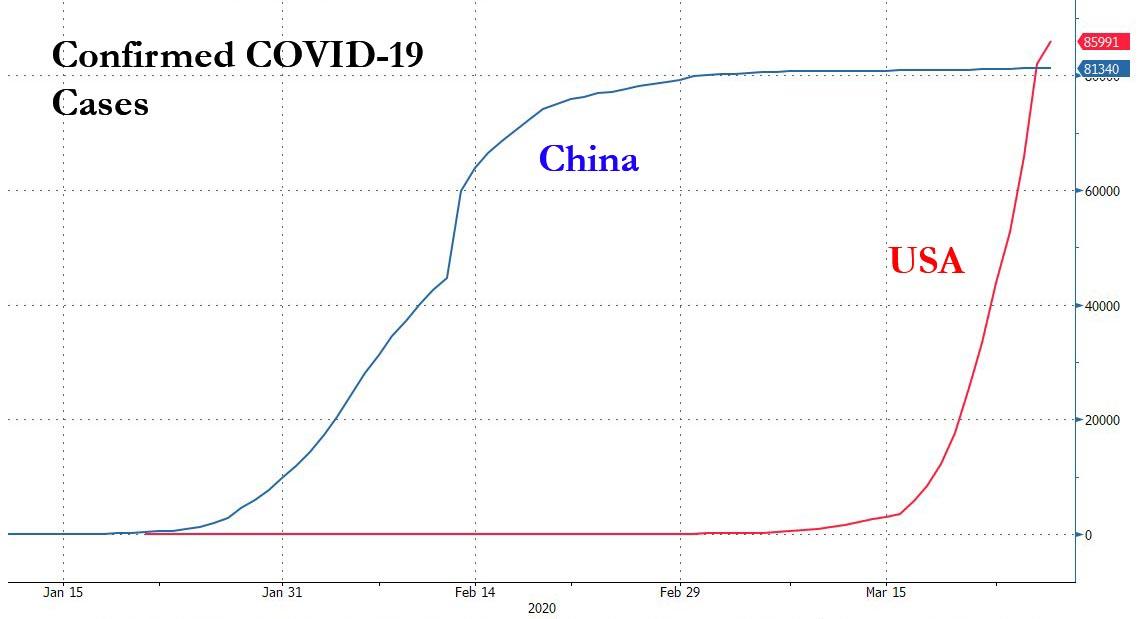

The US has taken over the coronavirus baton from Europe and become the epicentre of the outbreak due to a sharp rise in infections in New York.

The virus is spreading quickly across Africa where health systems are not as sophisticated as in developed countries, which are struggling themselves to cope with the number of cases. The scale of the outbreak outside Asia is so large that China decided to close its borders to foreigners to prevent the deadly virus from resurfacing.

To reiterate the point that our Michael Every has made on numerous previous occasions, this virus will either bring states together or push them apart. In this case, China closing its borders – the complete opposite of what it insisted everyone else did when it had the virus – it still seems more likely to push apart and will have negative consequences for the CNY, if not immediately.

The latest US labour market data provided shocking evidence of the negative impact of the virus as our Philip Marey describes: Initial jobless claims skyrocketed in the third week of March. While the level of jobless claims gives an underestimation of unemployment, because many are not eligible for benefits, if we look at the initial jobless claims in the third week of March and compare them to the continued jobless claims in the second week, this report suggests that the unemployment rate has tripled. Starting from 3.5% in February, that would get us to about 10.5% in March. Note that this is comparable to the peak of unemployment during and after the Great Recession. The actual BLS figure for March to be published next week may not yet fully capture this because it is based on a household survey in the week of the 12th of the month, but this is where we are heading. And it won’t stop there. Not only are the initial jobless claims an underestimation because many unemployed are not eligible for benefits, there may also be a delay between getting unemployed and filing for benefits, especially now that there are queues. What’s more, if we simply look at the occupations in the employment data of the Bureau of Labour Statistics (BLS) that would be affected by lockdown-type measures we get to 20.7% unemployment. If we then add a drop in aggregate demand for goods and services, we would not be surprised to see the unemployment rate reach 20-30% in April or May. These are levels comparable to the Great Depression.

Moving to Europe, as our Jane Foley points out there is nothing like a crisis to highlight both the strengths and weakness of a community. Perhaps it was inevitable that in the Eurozone the topic of Eurobonds is proving to be a fault-line. ECB President Largarde is supportive of the idea based on the view that the region needs to do ‘whatever it takes’ to combat the economic fall-out if the crisis. However, yesterday’s 5 ½ hour video conference between the bloc’s leaders brought clear lines of division. Ahead of the summit, leaders of nine member states wrote to Charles Michel, the European Council president, calling for the creation of Eurobonds, now aptly referred to as coronabonds. The supporters included France, Italy and Spain – the latter two countries suffering the largest human cost of the crisis in the region. Belgium, Ireland and Portugal are also in favour. The Netherlands and Germany remain strongly opposed the concept of burden sharing, with Chancellor Merkel making clear that she prefers the use of the ESM bailout fund as a crisis measure. That said, the leaders did agree that they needed a more ambitious crisis management system and finance ministers have been told to report back in two weeks. Yesterday peripheral Eurozone bonds gained after the ECB began buying debt without issuer limits.

The Italian press are this morning reporting that the country may need new stimulus measures worth EUR30 bln to tackle the crisis. Yesterday UK Chancellor Sunak added to his emergency package measures to support the self-employed. The Australian government has rejected UK style wage payments for displayed workers and is instead looking at ways to hibernate businesses – Australian stocks dropped sharply overnight. In Japan a Y102 trn ‘regular’ budget for fiscal year 20/21 was passed with pressure intensifying for more action.

To sum up, we are sceptical that the relief rally observed this week in stocks, EM currencies and the most battered G10 currencies will prove sustainable as the virus continues to spread and hasn’t reached its peak not only locally, but globally. Powerful rallies are not unusual, especially after sharp falls. But, they should be seen as corrective rebounds within the bearish trend.

Tyler Durden

Fri, 03/27/2020 – 09:30

via ZeroHedge News https://ift.tt/2wG77YR Tyler Durden