The Hedge Fund Bailout Worked: Citadel, Millennium And Point72 Recover Most Of Their March Losses

Last week, Bloomberg finally confirmed what we first reported last December: namely that the return of the Fed’s repo operations, allegedly to “fix” the clogged up repo market, was just a stealthy attempt to prevent a firesale liquidation among massively levered macro hedge funds that had allocated hundreds of billions in regulatory capital to the cash/futures basis trade which had steadily printed money for years and which suddenly went haywire.

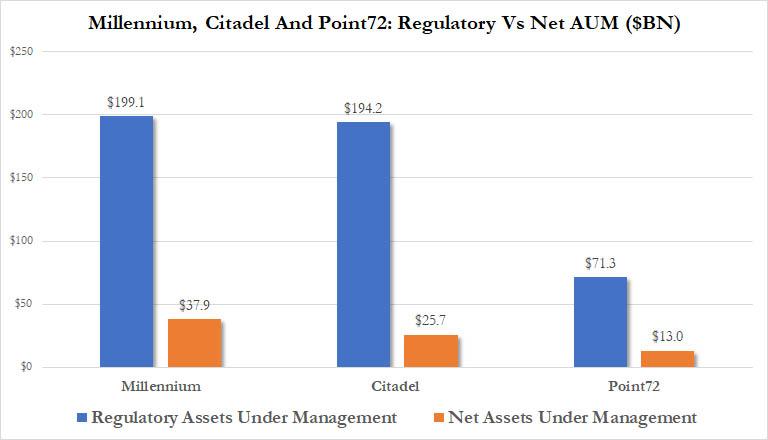

In effect, the Fed was bailing out not one but dozens of LTCM-like funds which had all ended up on the wrong side of an extremely popular basis trade, but a handful of funds were exposed the most. To wit, as we explained last December, “hedge funds such as Millennium, Citadel and Point 72 are not only active in the repo market, they are also the most heavily leveraged multi-strat funds in the world, taking something like $20-$30 billion in net AUM and levering it up to $200 billion. They achieve said leverage using repo.”

Bloomberg finally caught up with the narrative last week. In an article discussing how and why the Fed unleashed its March 12 repo bazooka, Bloomberg writes that “when coronavirus panic kicked off unprecedented turmoil in Treasuries last week, hedge fund leverage was lurking” and goes on to “explain” something we said late last year:

The [hedge funds] use borrowed money from the repurchase market for the popular basis trade, which exploits price differences between cash Treasuries and futures. Though individual firms’ borrowing is a closely guarded metric, people familiar with the transactions said some of them levered up as much as 50 times their own wagers. Leveraged funds’ exposure to the basis strategy could be as much as $650 billion, JPMorgan Chase & Co. strategists said.

Does that sound like “the Fed suddenly facing multiple LTCMs”? Because to us it sure does. And more importantly, what happened in the days ahead of last week’s credit market debacle is precisely what happened ahead of the September repo snafu, only with exponentially more destructive power.

“We’ve had 10 years of a perfect paradise and so people have been picking up pennies thinking there’s no risk in holding strategies like the basis trade,” said Kathryn Kaminski, chief research strategist and portfolio manager at AlphaSimplex Group. “A lot of the strategies, like the basis, that hedge funds tend to use don’t work when markets aren’t stable. You’ll see more of these types of blowouts.”

Of course, the Fed’s massive intervention to the tune of up to $1 trillion per day in repo operations, made sure that all hedge funds that were stuck holding to illiquid Off The Run positions in basis, could repo them back to the Fed in exchange for fresh, brand new and far more liquid On The Runs, as the hedge fund industry quietly got another bailout.

So fast forward to last Friday when courtesy of Bloomberg, we got a update on the performance of the three hedge funds which we identified first in December that were most heavily exposed to the lock up in the repo market, namely Citadel, Millennium Management and Point72 Asset Management, and which were among the funds that struggled in the first half of March as the effects of the Wu Flu pandemic halted the global economy and seized up capital markets.

As Bloomberg explains, “while losses at the largest multi-strategy firms — which invest across a range of assets — were only in the single digits at their peak, the moves were sudden and unexpected, hitting usually dependable trades that use leverage to take advantage of small price differences in related securities. The so-called arbitrage trades were placed on everything from Treasuries to company mergers.”

And then came the Fed’s bailout of well, everything, including billionaire hedge fund managers, as it unleashed an unprecedented series of actions to inject liquidity into markets coupled with Congress’s promise of a $2 trillion economic stimulus package. That combination boosted markets this week – at least temporarily. U.S. stocks had their best three-day run since the 1930s before falling again on Friday.

“Investors can take heart that we’ve counteracted this existential shock with the greatest fiscal and monetary bazooka,” fund manager Paul Tudor Jones said in an interview on Thursday with CNBC. “It’s not even a bazooka — it’s more like a nuclear bomb.”

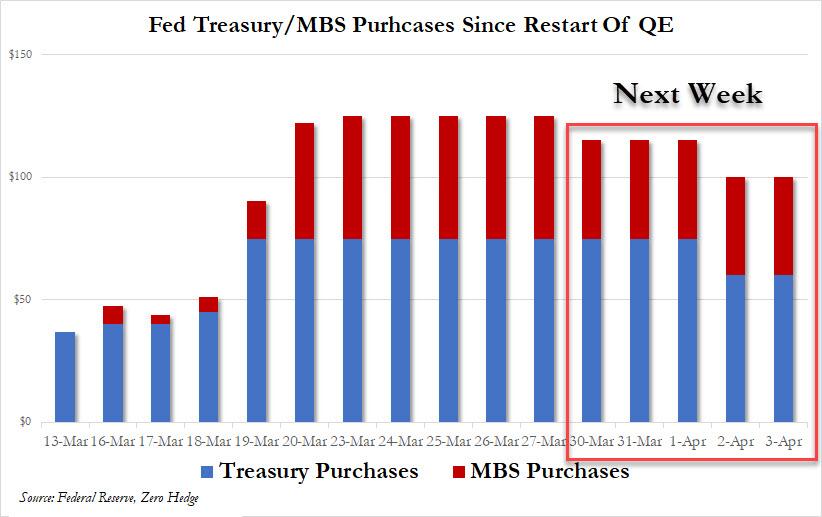

In the meantime, as part of its nationalization of capital markets, by Friday the Fed had bought $1 trillion worth of Treasuries and mortgage-backed securities since the launch of “QE-Unlimited”, the same amount they bought over eight months during the global financial crisis.

The biggest beneficiary of all this?

Not the economy or the middle class, but the trio of hedge funds which as shown in the chart above have regulatory assets of roughly half a trillion dollars among them, and which managed to quietly offload position that could have otherwise forced their liquidation, a la LTCM.

The end result, after suffering major losses in the first few weeks of the month, Millennium, Citadel and Point72 were all nearly back to breakeven:

- Citadel was down 5.3% for the month through March 20. Its performance has since improved.

- The fixed-income heavy ExodusPoint, run by Michael Gelband, had been down 3%, and is now up slightly on the month.

- Millennium had posted a loss of about 5% through March 20.

- Point72’s losses were around 4% through March 20. The fund had taken a hit from its quant trading group Cubist, which had lost 22%.

Then, in a follow up published on Sunday, Bloomberg reports that the $40BN Millennium (which is levered up to over $200BN in regulatory capital), successfully erased its losses this past week, and is now just down 67 basis point for the month, compared with a decline of 5.1% a week earlier. More impressive is that the fund is now up 17 basis points for the year, just as we predicted it would be last weekend, thanks to what is arguably the most draconian back office of any fund in existence. The fund, which had about 230 portfolio managers running individual teams, gained 9.8% last year and has posted annualized growth of 13.7% over the past three decades.

Millennium Management and most other firms struggled in the first three weeks of March as the effects of the spreading coronavirus virtually halted the global economy and seized up markets from stocks to bonds to commodities.

Then came unprecedented moves by the Federal Reserve and the promise of a $2 trillion stimulus bill that was signed by President Donald Trump on Friday. That combination boosted markets last week, with U.S. stocks posting their best three-day run since the 1930s, before falling again on Friday.

So in light of the above “miraculous” recoveries by the “smartest people in the room”, who occasionally are so smart only a Fed bailout can rescue them, perhaps it’s time to finally remove the clearly obsolete “hedge” designator from the description of this particular bailed out industry.

Then again, not everyone came crawling to the Marriner Eccles building. Unlike the macro basis trade funds noted above, several smaller, more nimble firms actually did not need a Fed bailout,having navigated the first half of March without losses. For example, Dmitry Balyasny’s $6 billion pod-based Balyasny Asset Management made money in March through Monday, climbing 1.1% in the month, and 2.2% for the year, after returning about 12% last year. This year it made money in areas including equities and macro trading, according to a person familiar with its performance. At the same time, $1 billion Cinctive Capital Management, a multi-manager stock fund founded by Rich Schimel and Larry Sapanski, was up about 1% after cutting risk going into March, an investor said. It’s up more than 3% for the year. Verition Group, a $1 billion fund run by Nick Maounis – best known for blowing up Amaranth – returned 2% in the month. It uses less leverage and stays away from crowded trades, according to an investor.

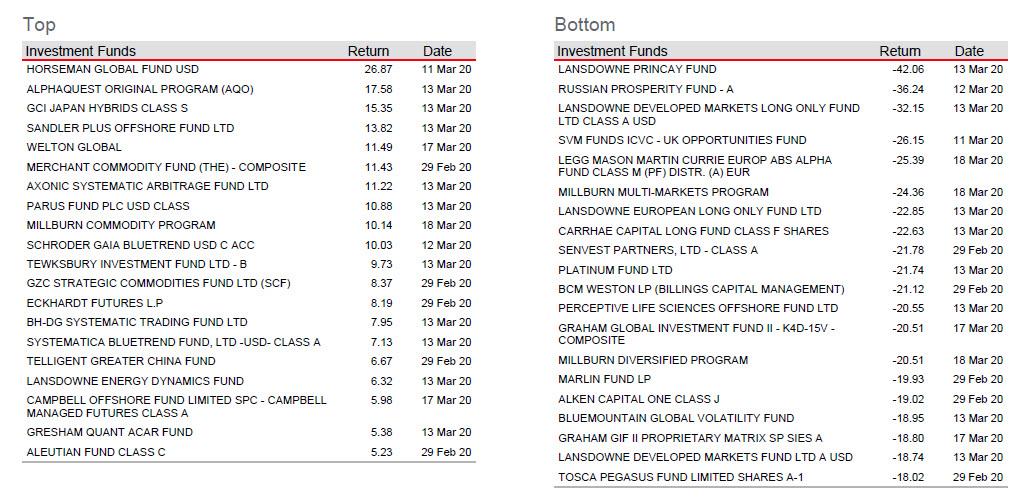

Finally, here are the top and bottom 20 funds are compiled by HSBC through the middle of March; note this table does not capture the sharp rebound in performance observed in the past week.

Tyler Durden

Sun, 03/29/2020 – 14:20

via ZeroHedge News https://ift.tt/2UIwIbK Tyler Durden