“This Crisis Is Every MMT’ers Wet Dream”

Authored by Sven Henrich via NorthmanTrader.com,

Answers

The year is 2020. A new virus is spreading across the planet like a wildfire. More lethal than the flu, highly contagious with no cure. Stocks markets collapse, global economies are shutting down with billions of people quarantined to their homes and millions losing their jobs overnight. What do you do? What DO you do?

While it sounds like the script of a bad disaster movie, it is nevertheless the world we suddenly find ourselves in. If you’d outlined this script to anyone just a couple of months ago nobody would’ve believed you.

But here we are and everyone has to adapt and get on with it.

Everyone searches for answers. Is it a short term thing and a big recovery is just around the corner with the help of unprecedented monetary and fiscal stimulus, or will the monetary and structural consequences be so severe that a larger recession, depression even, is inevitable?

The Big Battle is unfolding right in front of us.

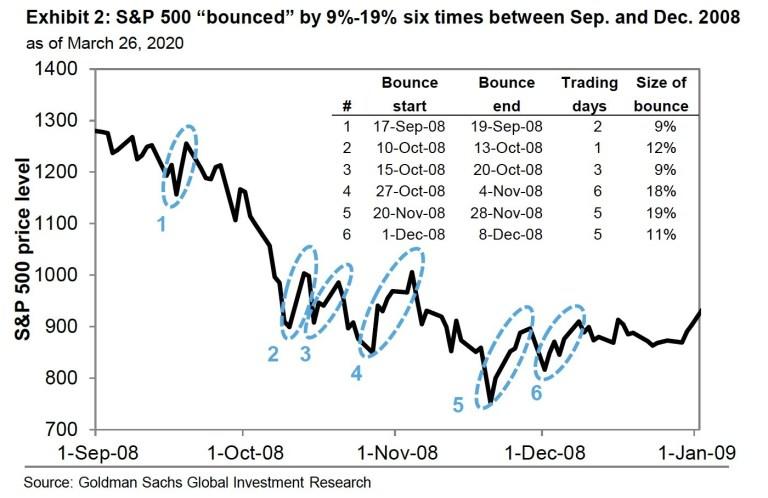

Markets, following the biggest crash off of all time highs since 1929, also just managed the sharpest rally since 1933. A bear market rally similar to many seen during the 2008 crisis?

Or a V shaped bottom similar to December 2018?

A retest of the lows for a “W” bottom, or the beginnings of a much more sinister stair step descent to new lows? Lots of questions, but few answers amid evolving data points that do not offer clarity where the current shock will settle.

Fact is the long term monetary and fiscal consequences of the current interventions will reverberate for years to come. Fact is also the global recession that was already at risk of playing out in 2019, but was delayed by aggressive global central bank action, but has now come to fruition anyways. Sparked by a trigger that has rendered all these policy actions of the past year ineffective and meaningless.

And now the forces of intervention have gone straight the MMT route. I urge caution once again:

This crisis is every MMT proponent’s wet dream.

Don’t let them lead you astray with promises of magic money.

They are even more dangerous than the easy money hacks that have steered us into this latest disaster.— Sven Henrich (@NorthmanTrader) March 28, 2020

Since the advent of cheap money the crashes are getting worse. 2000 was bad, 2008 was worse and now 2020 is even worse than 2008. The trend is your friend? Not so. The trend suggests ever cheaper money, ever more debt and ever more interventions lead to ever more severe consequences and all is reliant on the forces of intervention to retain their efficacy and double, triple, quadruple down, a proposition whose wisdom is highly debatable.

Many now say the shock will be short lived and the market is a forward discounting mechanism and will look to brighter things to soon to come. If the market is a forward discounting mechanism why did this just happen:

If markets were forward looking they wouldn’t have made all time highs on February 19th.

— Sven Henrich (@NorthmanTrader) March 28, 2020

My view: Flexibility over certitude. Anyone expressing certitude about what will or will not happen has access to information I don’t have or perhaps they are simply projecting of what they would like to see happen.

What I do know is that technicals are working and they help guide us through this complex jungle and I’ll demonstrate that in the video below. But technicals also have to negotiate the complex web of artificial liquidity which is now entering markets to a degree never before seen in human history, even dwarfing the interventions of 2008/2009.

This week’s technical market assessment:

* * *

Please be sure to watch it in HD for clarity. To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Sun, 03/29/2020 – 13:05

via ZeroHedge News https://ift.tt/2UGdT8W Tyler Durden