“This Is The Largest Economic Shock Of Our Lifetimes”: Goldman Sees Negative Prices Amid Oil Devastation

Over the weekend, we reported that with the oil industry oversupplied by a mindblowing 20 million barrels daily as roughly 20% of total global output ends up unused in a world economy that has ground to a halt, and instead has to be parked in storage either on land or sea, the unthinkable is about to happen: oil storage space is about to run out, and as that happens the price of oil will continue sliding ever lower and lower until it finally goes negative as some such as Mizuho’s Paul Sankey predict it will, over the next few months, leading to an unprecedented shockwave across the global energy market.

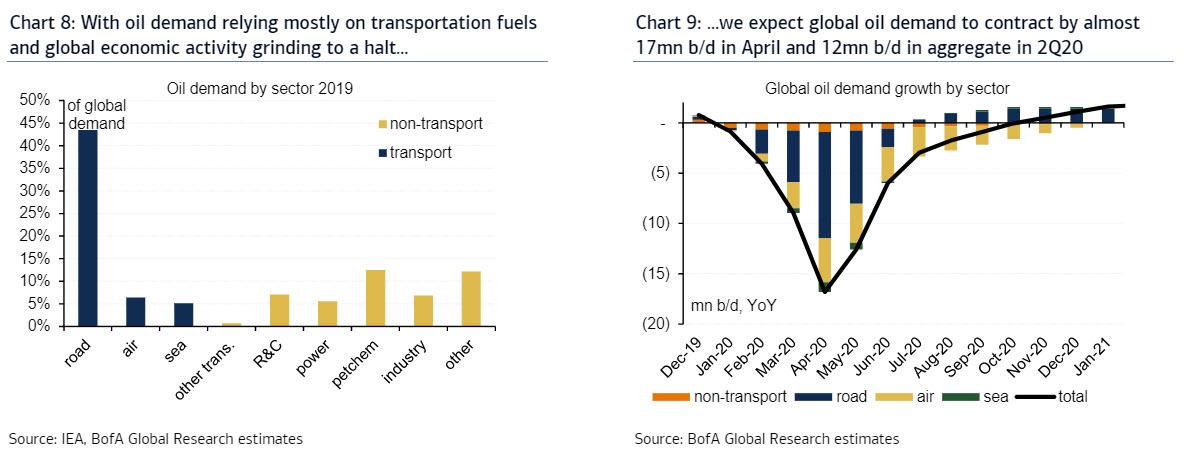

Then overnight, more eulogies for the oil market emerged, with Bank of America writing that oil has now slumped “into the abyss” and it expects to see the “steepest decline in global oil consumption ever recorded, with our base case reflecting a 12mn b/d drop in 2Q20 and a 4.5mn b/d contraction on average for the year” and on a net basis, BofA now expects global oil demand to contract by almost 17mn b/d in April with consumption recovering modestly into 3Q20 and beyond.

The bank also adjusted its oil price forecasts for 2020 and 2021 down to $37 and $45/bbl for Brent and to $32 and $42/bbl for WTI respectively, but in the near-term, it sees both benchmarks temporarily trading in the teens in the coming weeks.

However, by going all “there will be blood” on oil, BofA has only caught up where Goldman has been for the past two weeks, ever since it predicted that the “physical end was near.” Meanwhile, in a note of unprecedented gloom, Goldman now says that “the physical end is here” as the coronacrisis goes global.

As Goldman’s Jeffrey Currie calculates, the oil surplus generated by an unprecedented demand shock has begun to hit physical constraints at refineries, pipelines and storage facilities, “leading to at least 0.9 million b/d of announced shut-ins at the wellhead, with the true number likely higher and growing by the hour.”

With social distancing measures now impacting 92% of global GDP, the ultimate magnitude of these shut-ins which is still unknown will likely permanently alter the energy industry and its geopolitics, restrict demand as economic activity normalizes and shift the debate around climate change.

In other words, what is taking place now is “not only is this the largest economic shock of our lifetimes” but from a practical perspective, “carbon-based industries like oil sit in the cross-hairs as they have historically served as the cornerstone of social interactions and globalization, the prevention of which are the main defense against the virus.”

Accordingly, oil has been disproportionately hit, likely more than 2x economic activity, with demand this week down an estimated 26 million b/d or c.25%.

As a result, and picking up on what we said over the weekend, Goldman now warns that “this shock is extremely negative for oil prices and is sending landlocked crude prices into negative territory.” Of course, it is only a matter of time before this ultimately creates an inflationary oil supply shock of historic proportions because so much oil production will be forced to be shut-in, but first we need to see prices close to zero… or below it.

Currie next focuses on the storage conundrum we discussed yesterday, and how – as we warned – this will lead to negative oil prices:

The global economy is a complex physical system with physical frictions, and energy sits near the top of that complexity. It is impossible to shut down that much demand without large and persistent ramifications to supply. The one thing that separates energy from other commodities is that it must be contained within its production infrastructure, which for oil includes pipelines, ships, terminals, storage facilities, refineries, and distribution networks. All of which have relatively small and limited spare capacity. We estimate that the world has around a billion barrels of spare storage capacity, but much of that will never be accessed as the velocity of the current shock will breach crude transportation networks first, which we are already seeing evidence of around the world. Indeed, given the cost of shutting down a well, a producer would be willing to pay someone to dispose of a barrel, implying negative pricing in landlocked areas.

The good news, however, is that from the devastation that will follow in the coming months, a new – and far more viable – industry will emerge, or as Currie puts it “the current oil crisis will see the energy industry finally achieve the restructuring it so badly needs. We have long argued that it is the supply and demand of capital that matters, not the supply and demand of barrels; as long as there is capital, companies can withstand difficult periods and the barrels always come back.”

The rest of his full note is below:

Waterborne crudes like Brent will be far more insulated, staying near cash costs of $20/bbl with temporary spikes below. Brent is priced on an island in the North Sea, 500 meters from the water, where tanker storage is accessible. In contrast, WTI is landlocked and 500 miles from the water. This illustrates an important point. Shut-ins will be not be based upon where wells sit on the cost curve but rather on logistics and access. High-cost waterborne crude oil that can reach a ship (storage we have historically never ran out of), are better positioned than landlocked pipeline crude oil sitting behind thousands of miles of pipe, like the crude oils in the US, Russia and Canada. In 1998, when surpluses last breached storage capacity, it was these landlocked crude oils that were the hardest hit. So while markets like WTI, particularly WTI Midland, or Canada’s WCS can go negative, Brent is likely to stay near cash costs of $20/bbl. Ultimately, the market never hits nameplate capacity, as other bottlenecks are also at play. During 2008 and also in this crisis, dollar funding and credit constraints that prevent oil owners from accessing storage and transportation capacity also played a role. We believe that the Fed’s actions last week alleviate some of this risk, but oil itself creates dollar liquidity given its importance in global trade and setting the price of other traded goods and another sharp drop in oil prices could create additional dollar shortages.

The oil price war is made irrelevant by the large decline in demand and has made a coordinated supply response impossible to achieve in time. A month ago, the logic of the price war made sense when the demand shock was c.5.0 million b/d. It gave OPEC and Russia the first opportunity since 2012 to completely undercut shale, and finally reverse the production cut in 2016 which we believe never made economic sense to begin with. Not only did OPEC producers sacrifice $220 billion in lost revenues (annually at $60/bbl Brent) and market share, but so did the equity and debt shareholders of higher-cost producers. The artificially higher prices distorted incentives for oil investment, leading to inefficient capital spending by these companies that, by our estimates, destroyed roughly $1.0 trillion worth of market cap since 2016. The policy of production cuts was a strategic error, not only to OPEC+ countries, but to all equity and debt owners in the industry. Now the question is: can the US and OPEC save this market? The demand shock has become so large that they can’t do it alone, a fact they have acknowledged, stating that a balanced market would require a coordinated global production cut — a policy which appears impossible at this point, too late to stop the current surplus and far below other initiatives on the agenda right now.

The key to how quickly prices rebound after this supply shut-in will depend on how much inventory is built. Markets are already hitting transportation bottlenecks without having filled storage capacity. Oil in Canada is now near $5/bbl and WTI Midland $13/bbl with Cushing inventories still only half full. The quicker and harder these capacity constraints are reached, the quicker and more violently the market will rebalance when production shuts in, and the quicker deficits return to the market, putting upward pressure on prices. In the bear market of 2015/16 production shut-ins were based upon a producer position on the supply cost-curve. Unlike then, the logistical nature of the shut-ins suggest they will be completely indiscriminate, inflicting substantial damage on the wells that in some cases will be permanent. Once economic activity begins to normalize, the deficits will likely be substantial as the rebound in demand will be constrained by supply that has been damaged by the shut-ins. This could potentially require continued destruction of commuting and jet fuel demand. Net, if pipelines get clogged up as refineries shutdown, inventories cannot build, reducing the cushion and creating a very quick risk reversal towards oil shortages that could push prices far above our $55/bbl target for next year.

This will likely be a game-changer for the industry. Once you damage the capital stock in oil it is an expensive and time-consuming process to rebuild, assuming it can be rebuilt at all. This contrasts with the rest of the economy where the capital stock is sitting idle and ready to restart, which is why it is expected to exhibit a V-shaped recovery. In contrast, we believe the upstream sector could lose as much as 5.0 million b/d of oil supply capacity. With that much supply loss the industry will unlikely be able to rebound even close to old demand levels without creating substantial price appreciation, the scale of which will be determined by how much inventory is built in the coming weeks. In addition, the geopolitical landscape is also changing. We note the current political situation in Venezuela, where further US sanctions have been imposed for over half a year and where Rosneft divestitures of oil assets occurred over the weekend. At the same time, Iran has been heavily impacted by the coronavirus, which follows the rise in tensions between the US and Iran in January, during which oil reached its recent peak of $70/bbl. On top of this, there could be further geopolitical instability generated by the extreme economic conditions forced upon the many oil producers in Africa and Latin America.

Oil and gas fields are far different from other manufacturing processes. They are organic deposits and as such have decline rates, having shut an older well it may not be economic to bring it back online. Most of these older, more depleted and less productive wells are onshore, not offshore, which makes them the most vulnerable to shut-ins. We believe shut-in economics will be driven by three factors: 1) crude net-backs (driven by local infrastructure constraints and crude quality); 2) variable cash costs (highest in mature fields with low flow rates); 3) decommissioning liabilities (most material for offshore deep-water fields). As such, we believe that shut-ins are most likely at onshore, mature, depleted, heavier and sourer oil reservoirs in countries like Canada, the US, Russia, Latin America and China. Offshore fields are least likely to be affected, due to their generally higher crude quality, lack of infrastructure constraints and high decommissioning liabilities. Mature, heavier oil, high water-cut reservoirs will also suffer the most from a prolonged shut-in and may not return to their pre-shut-in production capacity once oil demand increases.

We believe the current oil crisis will see the energy industry finally achieve the restructuring it so badly needs. We have long argued that it is the supply and demand of capital that matters, not the supply and demand of barrels; as long as there is capital, companies can withstand difficult periods and the barrels always come back. The difference between today and 2015/16 is that shale and high-cost oil producers were already facing sharply higher costs of capital over the past year due to persistently poor shareholder returns. Indeed, these capital restrictions have only been exacerbated by recent events, whereas in 2015/16 capital never dried up – making the likelihood of capitulation by US E&Ps and EM producers much higher today. Further, the rebalancing phase in our New Oil Order framework was cut short in 2016 by Chinese stimulus that boosted demand followed by OPEC+ production cuts that curtailed supply. In the end, we never saw the final regeneration phase of rationalized assets that would have created a more sustainable industry over the longer term.

Today, we have already seen uneconomic firms shut off from capital. This suggests that the overdue rationalization of the industry is finally set to occur. We believe it will be very selective with a clear focus on upgrading portfolios: Big Oils will consolidate the best assets in the industry and will shed the worst assets. There will be local consolidation amongst E&Ps, and when the industry emerges from this downturn, there will be fewer companies of higher asset quality, but the capital constraints will remain. Capital markets focused on de-carbonisation and lack of visibility over long-term demand will constrain the remaining firms, leading to structural underinvestment and higher corporate returns, bringing an end to energy’s lost decade. Only a significant supply shortfall once demand recovers could slow this much-needed industry consolidation and rationalization. A large, sustained deficit would lead to much higher prices until even marginal shale producers respond, as they remain the fastest cycle source of supply.

The climate change debate will almost certainly take a different course when the global economy emerges from this and is faced with the prospect of having to make large-scale investments into carbon-based industries. The silver lining of the coronacrisis is that the virtual shutdown of key carbon industries – autos, airlines and cruise ships –

is likely to cause carbon emissions to fall this year, with initial data from China pointing to a c.20%+ fall during the peak of the shutdown. It is important to emphasize how the current shock is hurting the unsustainable industries but encouraging sustainable industries. The aircraft and migrant workers that used to bring the world fresh fish, fruit and vegetables have been stopped.Technological hysteresis is already occurring. People are adapting to a more local existence and living off more sustainable activities, consuming less globally-produced fresh food, producing less waste with a more conservative approach to consumption, all of which may have lasting impacts on demand. Further, commuters and airlines account for c.16.0 million b/d of global oil demand and may never return to their prior levels. While oil prices are low today and physical constraints are forcing the behavioral changes, as oil shortages develop once economic activity normalizes, the high oil prices will likely accelerate the energy transition by constraining demand. For example, commuting and jet demand destruction may still be needed to cope with the supply shortage that is likely to occur once significant supply capacity is hampered. Higher oil prices would also greatly improve the relative economics of EVs and hydrogen. But from the supply side, capital markets’ push for de-carbonization is likely to prevent the broad investment the industry will need to get out of this crisis and will reinforce a tight physical market beyond 2020.

Low returns in energy and commodities have been referred to as a lost decade. Oil has handed investors losses of about 8% per year since 2010. However, we believe that a bottom will be carved out in the coming weeks or months that will serve as the foundation for solid future returns similar to 1999. Combining these potential supply constraints with the large fiscal stimulus in response to the virus, we believe that physical inflationary concerns – with the dollar starting near an all-time high – will finally dominate the financial asset inflation that was a feature of the past decade that acted as a drag on energy and commodity returns. In the very near-term, however, we would play it from the short side. Nonetheless, we must keep in mind the fact that each downturn has become increasingly shorter in duration as the system has been able to adapt more quickly, and although oil prices are likely to further decline in the coming weeks, it is important to start focusing on the transition.

Tyler Durden

Mon, 03/30/2020 – 10:20

via ZeroHedge News https://ift.tt/2JogXkP Tyler Durden