Stocks Suffer Worst Start To A Year Ever… As Trump Approval Reaches Record High

It’s Official…

Here’s a chart that no one suspected would happen (most of all not the media and the democrats)… as stocks crashed by record amounts in March, President Trump’s approval rating has soared to the highest of his presidency…

Source: Bloomberg

So how bad was Q1?

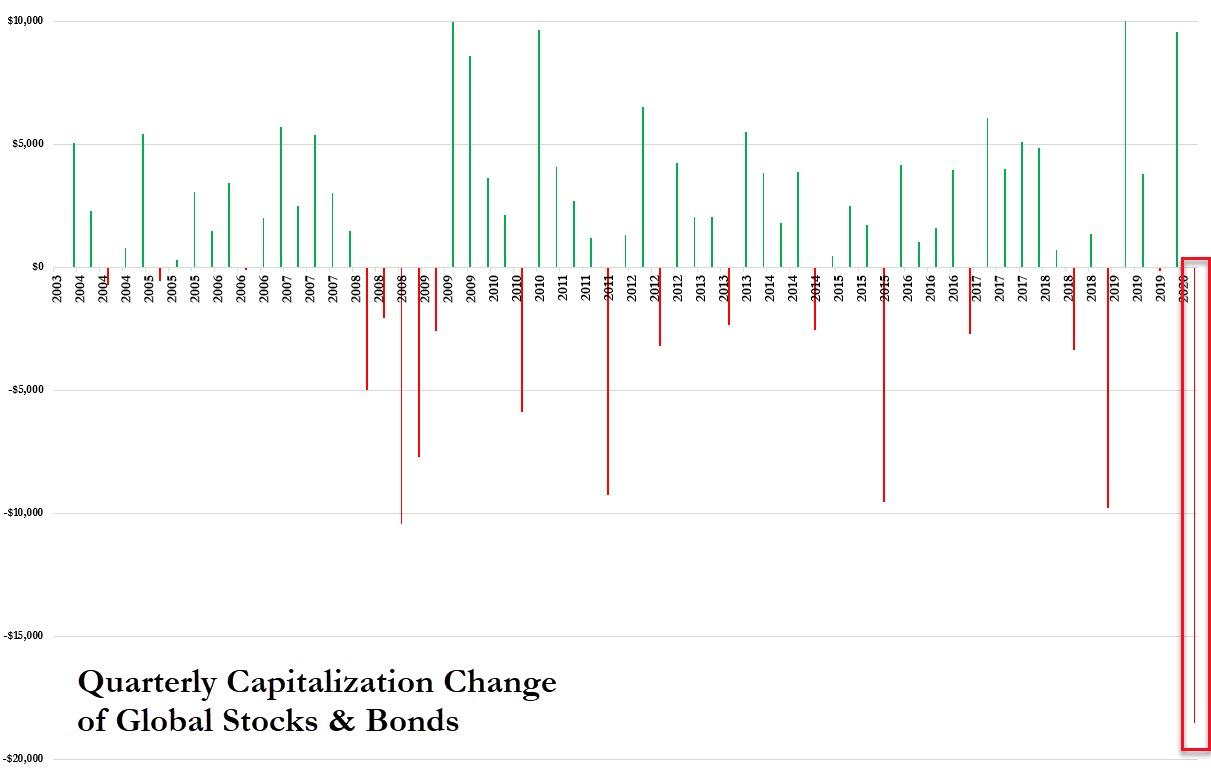

Q1 was the world’s biggest quarterly capitalization loss (in bonds and stocks) ever…

With bonds adding a modest $1.1 trillion while stocks lost a record-smashing 19.6 trillion…

Source: Bloomberg

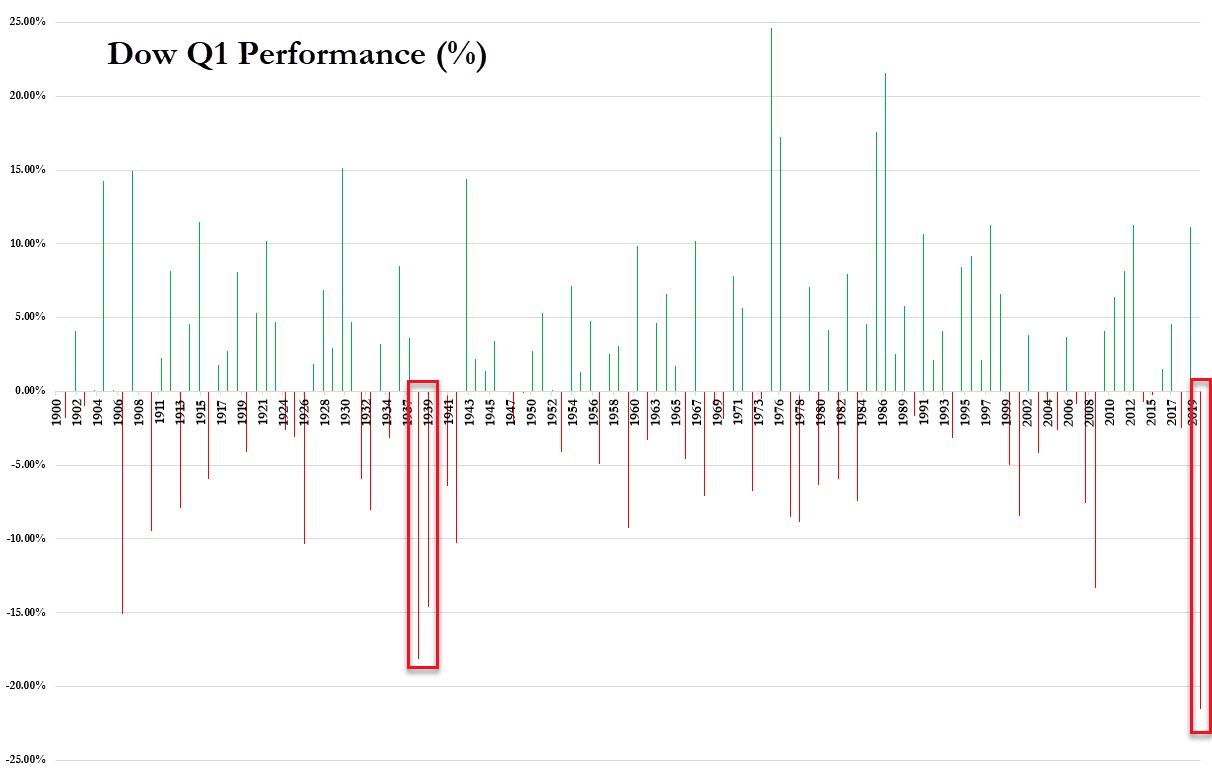

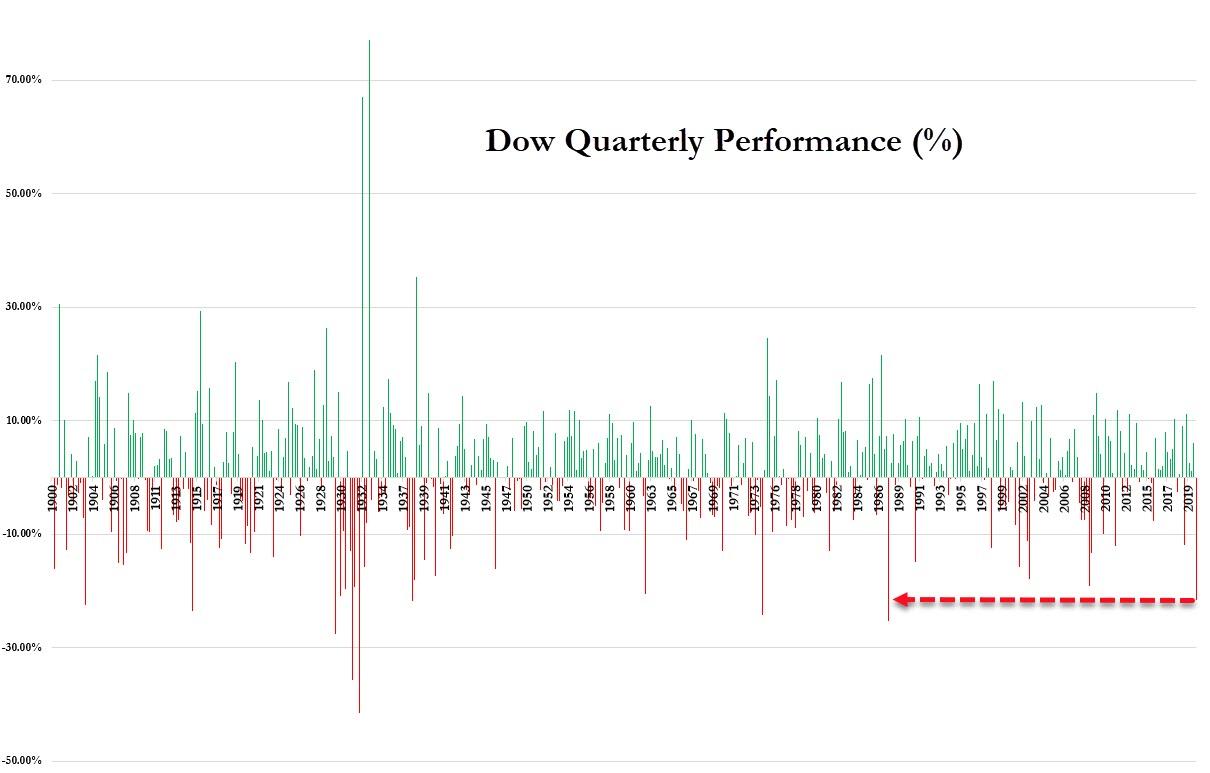

This was The Dow’s worst Q1 ever…

…and worst overall quarter since Q4 1987…

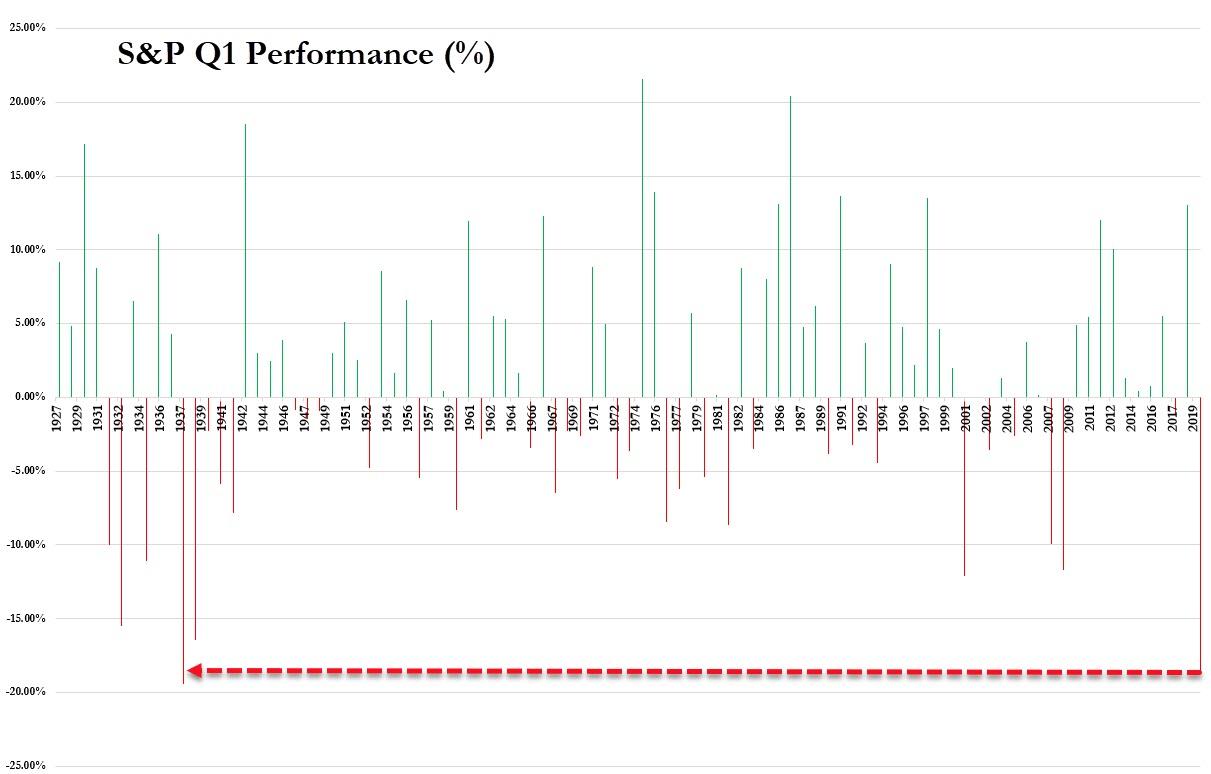

This was The S&P’s worst Q1 since 1938 (and worst overall quarter since Q4 2008) and March was worst month for S&P since Oct 2008.

Additionally, stocks suffered the first back-to-back-to-back monthly losses since Oct 2016.

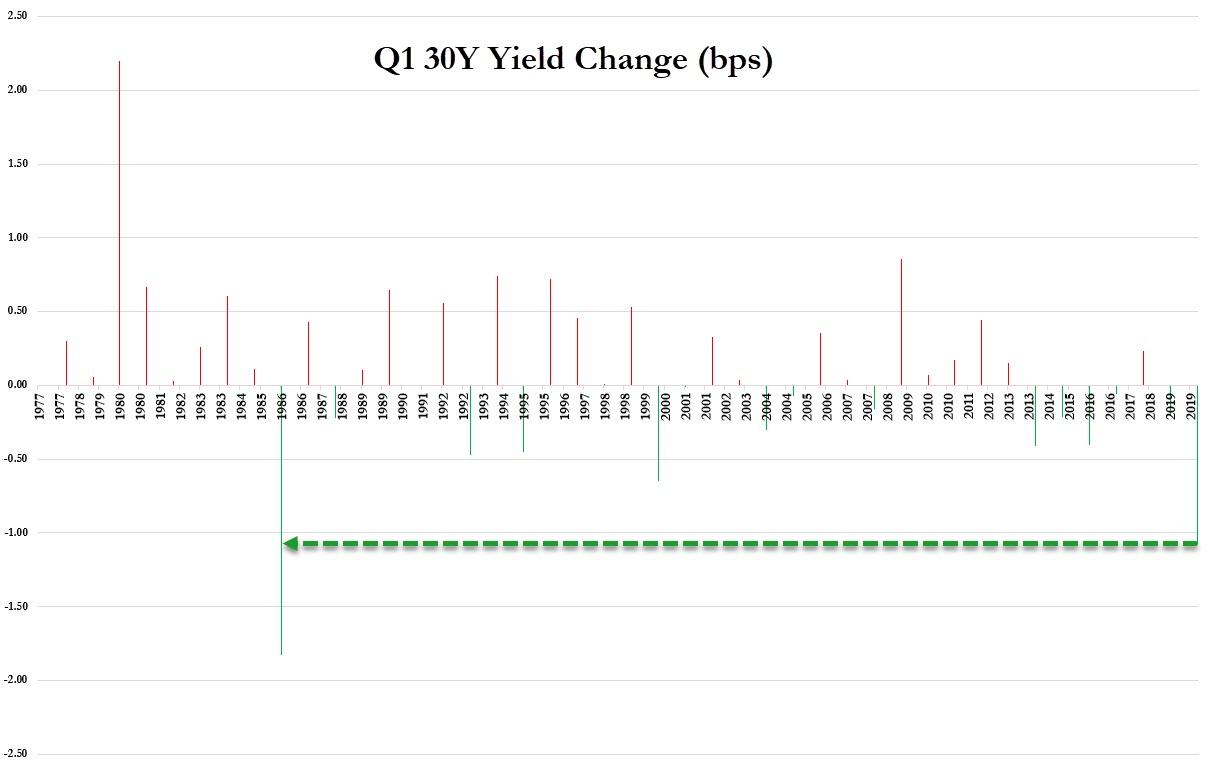

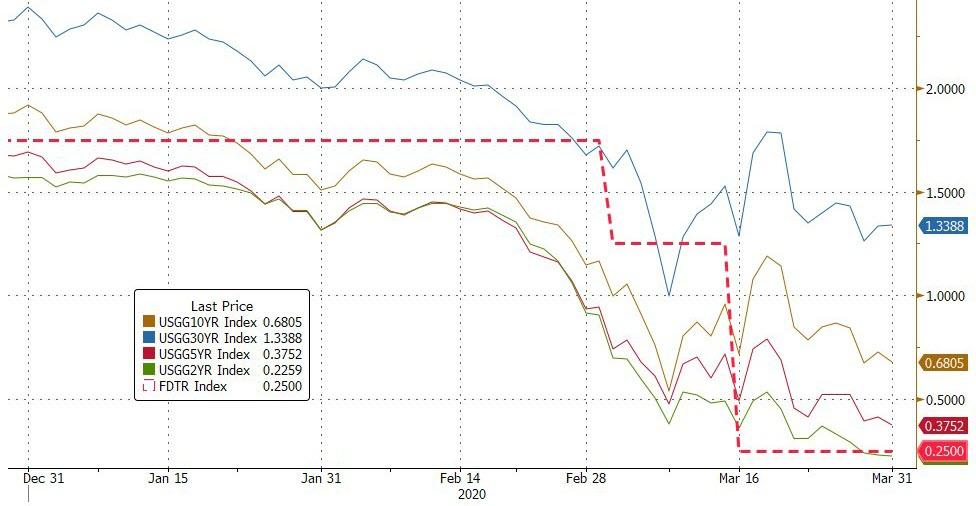

30Y Yields fell in all three months in Q1. This is the biggest Q1 crash in 30Y Yields since 1986 (and biggest quarterly decline in yields since Q3 2011). 2Y Yields plunged 136bps in Q1 (down 6 quarters in a row) – the biggest yield drop since Q1 2008.

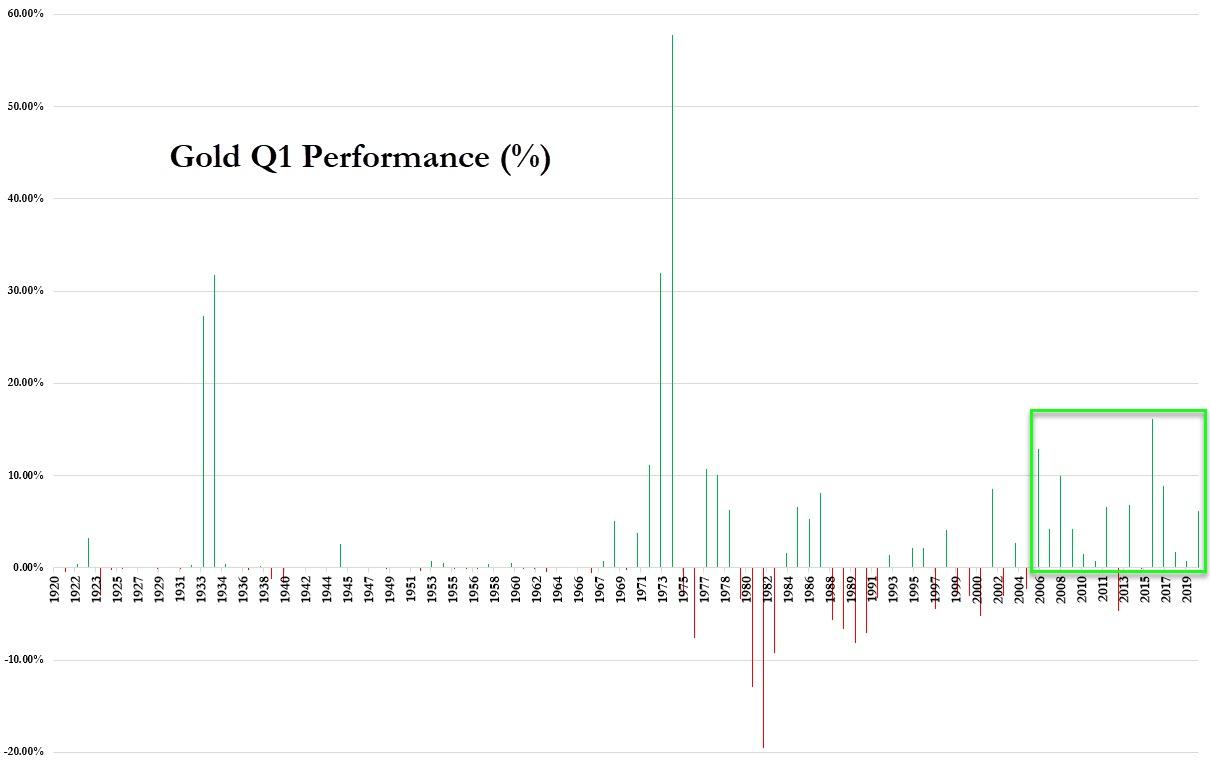

This is the 6th straight quarter of gains for gold (and up 12 of the last 14 Q1s)

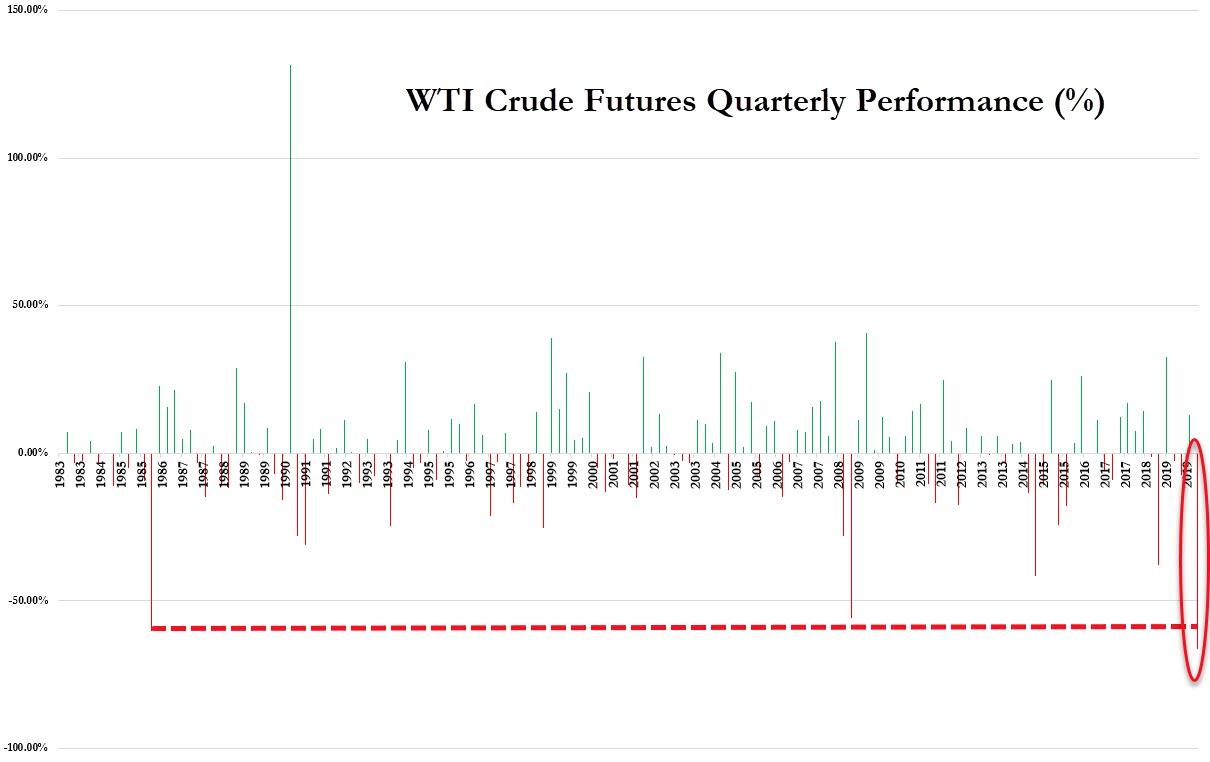

Oil prices plunged all three months in Q1. Q1’s 66% crash in WTI is the worst quarter ever (worse than the 60% oil glut crash in Q1 1986).

But apart from that, Q1 was awesome!!

* * *

The Russell 2000 is the biggest (major) index loser in Q1 (down around 31%) and the Nasdaq the relative winner…

Source: Bloomberg

European stocks were down about as hard as US – 25-to-30% in Q1 led by UK’s FTSE…

Source: Bloomberg

But, in China, tech-heavy and small cap names have outperformed in Q1 (UP over 4%) as the rest of the Chinese stock market is down modestly…

Source: Bloomberg

Directly-virus-affected sectors – airlines, cruiselines, hotels, restaurants – were a bloodbath in Q1…

Source: Bloomberg

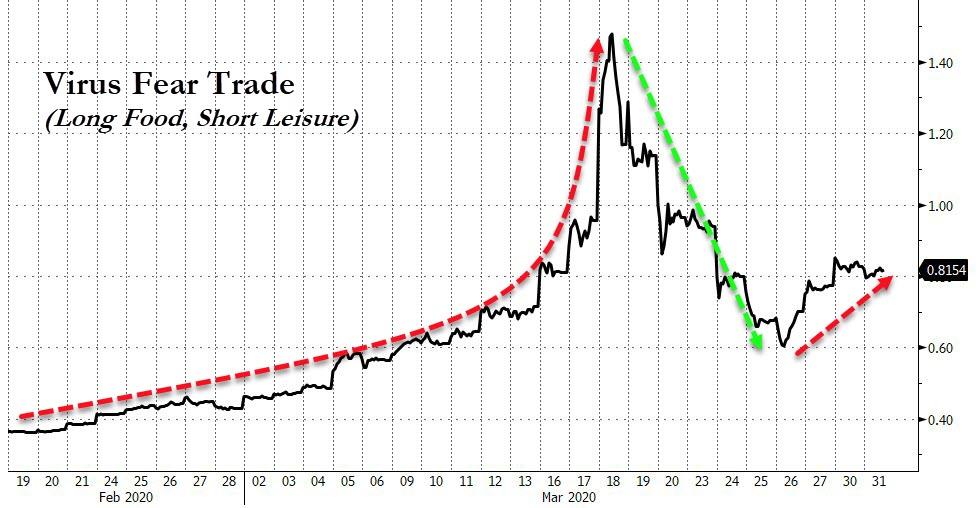

The Virus-Fear Trade – long food, short leisure – has started to deteriorate again this week suggesting all is not well…

Source: Bloomberg

Bank stocks suffered their second worst quarter ever, crashing 41% (Q1 2009 was -44%) with Citi and Wells Fargo worst…

Source: Bloomberg

2020 has been a one-way street of long-momentum and short-value…

Source: Bloomberg

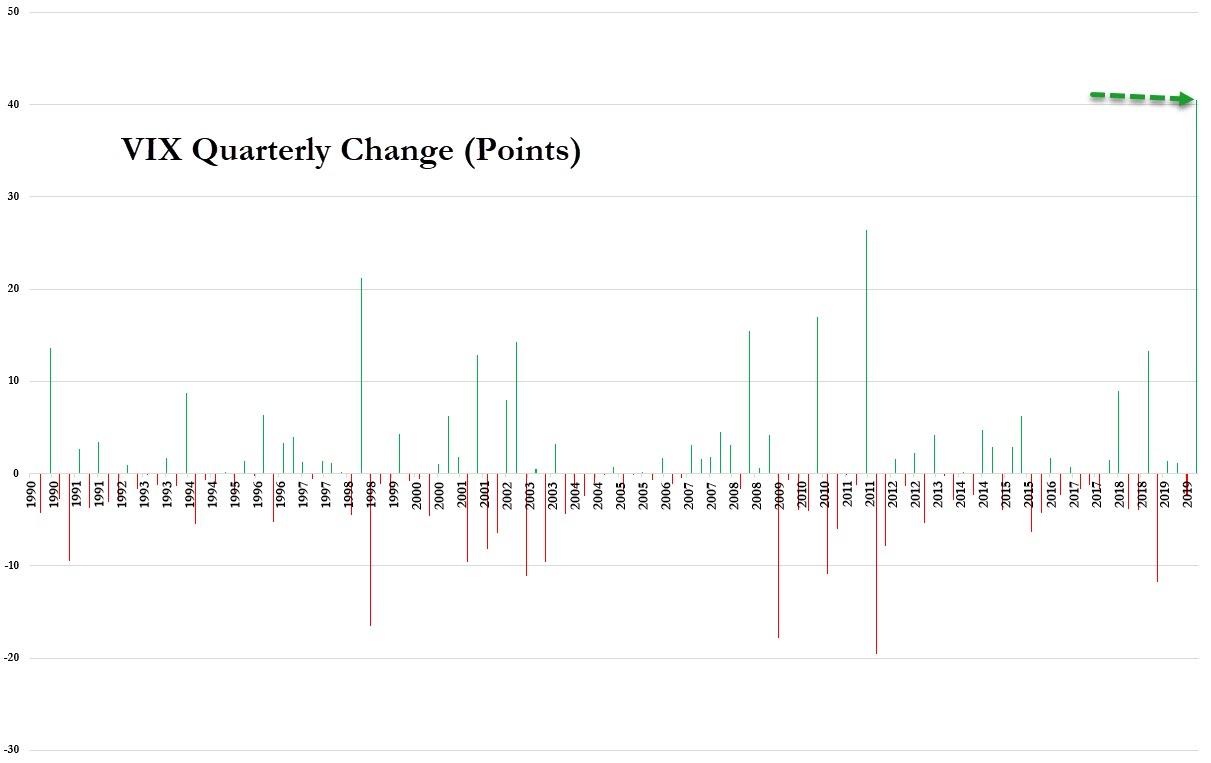

Q1 also saw the biggest quarterly spike in VIX ever…

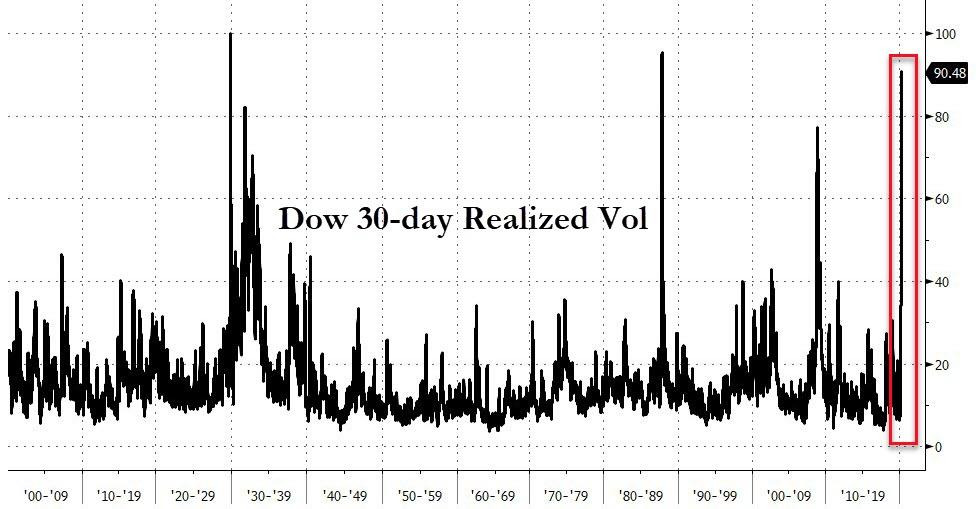

And realized volatility in stocks has only been higher during the Black Mondays in 1987 and 1929…

Source: Bloomberg

Credit markets collapsed at a record pace in Q1 with IG taking the brunt (relatively speaking) until The Fed bailed them out…

Source: Bloomberg

High Yield was ugly though…

Source: Bloomberg

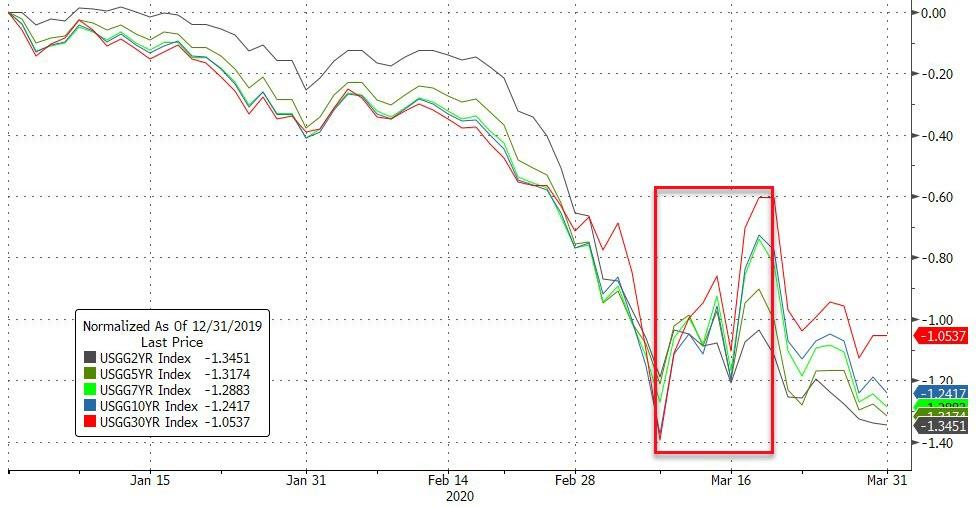

Bond yields collapsed in Q1 led by the short-end (2Y -135bps, 30Y -105bps)…

Source: Bloomberg

2Y Yields are once again back below The Fed Funds rate (even after the massive cuts this quarter)…

Source: Bloomberg

The Dollar surged in Q1 (its biggest quarter since Q4 2016)

Source: Bloomberg

Q1 was mixed for cryptos with Bitcoin down 9.5% and Bitcoin Cash up 9%…

Source: Bloomberg

While oil stole all the headlines in Q1 with its record-breaking crash, gold managed solid gains…

Source: Bloomberg

Among the precious metals, Palladium outperformed, Platinum was the biggest paggard…

Source: Bloomberg

While some (heavier) crudes actually traded with negative prices in Q1 (Wyoming Asphalt Sour), WTI traded down to a $19 handle at its lows… for now…

Source: Bloomberg

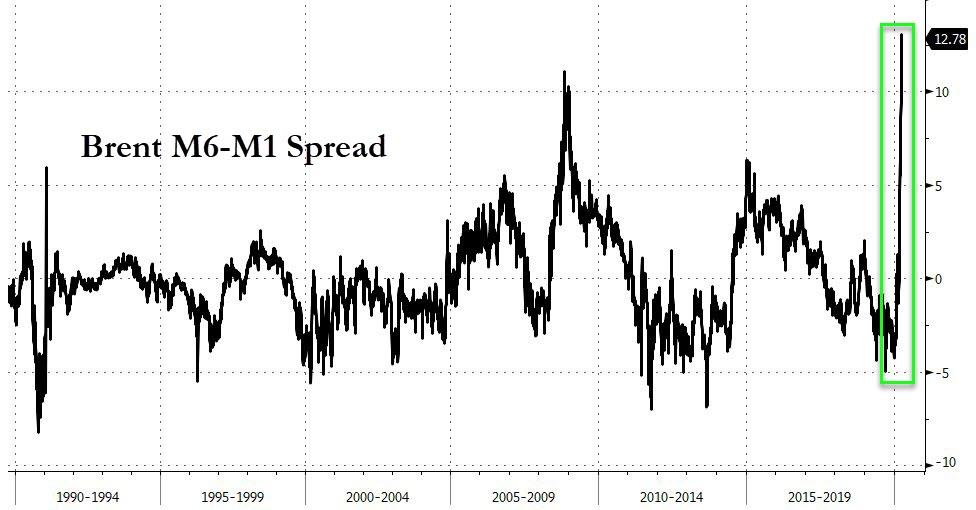

But crude’s contango is the largest its ever been as prices adjust down to desperately try and avoid storage gluts…

Source: Bloomberg

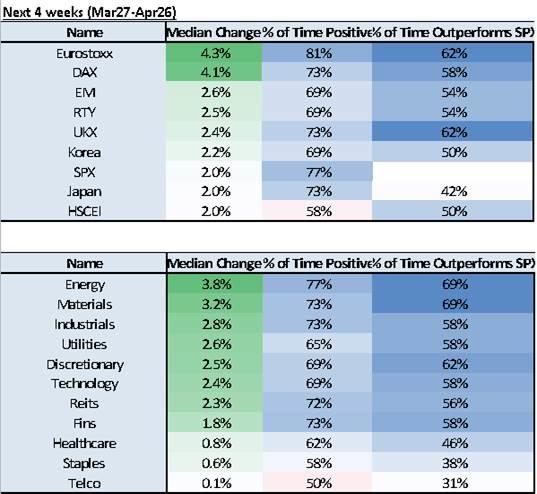

Finally, what happens next? Who knows? But Nomura’s Charlie McElligott has run the historical seasonals and this is what the ‘odds’ say:

Global index performance for the next 4 weeks, the outperformers are Eurostoxx +4.3% with a 81% hit rate, DAX +4.1% with a 73% hit rate, EM +2.6% with a 69% hit rate, RTY +2.5% with a 69% hit rate, worst performers are HSCEI +2.0% with a 58% hit rate, Japan +2.0% with a 73% hit rate, SPX +2.0% with a 77% hit rate, Korea +2.2% with a 69% hit rate, UKX +2.4% with a 73% hit rate

US sector performance for the next 4 weeks, the outperformers are Energy +3.8% with a 77% hit rate, Materials +3.2% with a 73% hit rate, Industrials +2.8% with a 73% hit rate, Utilities +2.6% with a 65% hit rate, Discretionary +2.5% with a 69% hit rate, worst performers are Telco +0.1% with a 50% hit rate, Staples +0.6% with a 58% hit rate, Healthcare +0.8% with a 62% hit rate, Fins +1.8% with a 73% hit rate, Reits +2.3% with a 72% hit rate, Technology +2.4% with a 69% hit rate

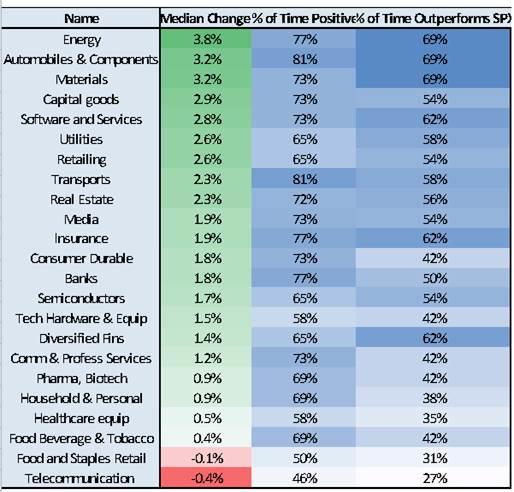

US industry performance for the next 4 weeks, the outperformers are Energy +3.8% with a 77% hit rate, Automobiles & Components +3.2% with a 81% hit rate, Materials +3.2% with a 73% hit rate, Capital goods +2.9% with a 73% hit rate, Software and Services +2.8% with a 73% hit rate, Utilities +2.6% with a 65% hit rate, Retailing +2.6% with a 65% hit rate, Transports +2.3% with a 81% hit rate, Real Estate +2.3% with a 72% hit rate, Media +1.9% with a 73% hit rate, Insurance +1.9% with a 77% hit rate, worst performers are Telecommunication -0.4% with a 46% hit rate, Food and Staples Retail -0.1% with a 50% hit rate, Food Beverage & Tobacco +0.4% with a 69% hit rate, Healthcare equip +0.5% with a 58% hit rate, Household & Personal +0.9% with a 69% hit rate, Pharma, Biotech +0.9% with a 69% hit rate, Comm & Profess Services +1.2% with a 73% hit rate, Diversified Fins +1.4% with a 65% hit rate, Tech Hardware & Equip +1.5% with a 58% hit rate, Semiconductors +1.7% with a 65% hit rate, Banks +1.8% with a 77% hit rate, Consumer Durable +1.8% with a 73% hit rate

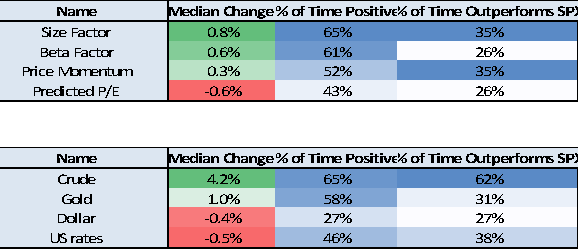

Factor performance for the next 4 weeks, the outperformers are Size Factor +0.8% with a 65% hit rate, Beta Factor +0.6% with a 61% hit rate, worst performers are Predicted P/E -0.6% with a 43% hit rate, Price Momentum +0.3% with a 52% hit rate.

Cross asset performance for the next 4 weeks, the outperformers are Crude +4.2% with a 65% hit rate, Gold +1.0% with a 58% hit rate, worst performers are US rates -0.5% with a 46% hit rate, Dollar -0.4% with a 27% hit rate.

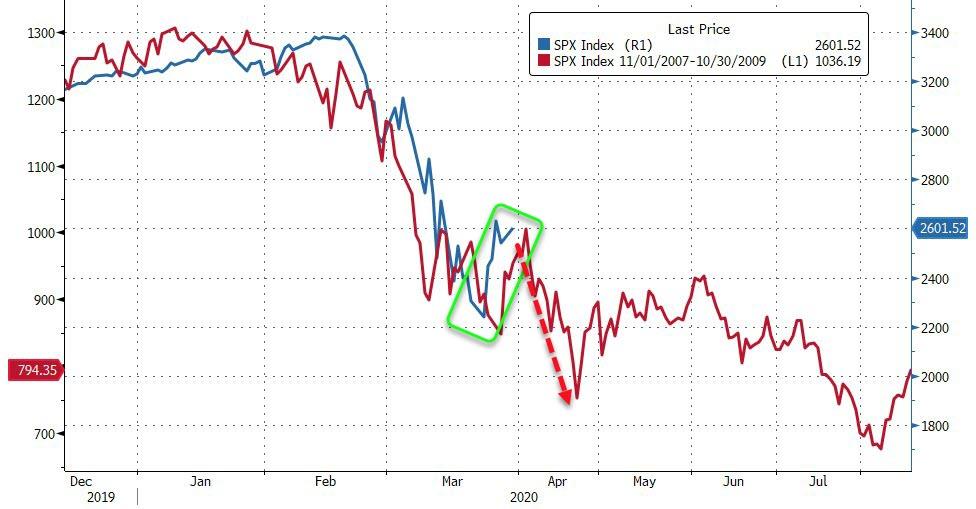

However, the question is – do we replay 2008 after this bounce?

Source: Bloomberg

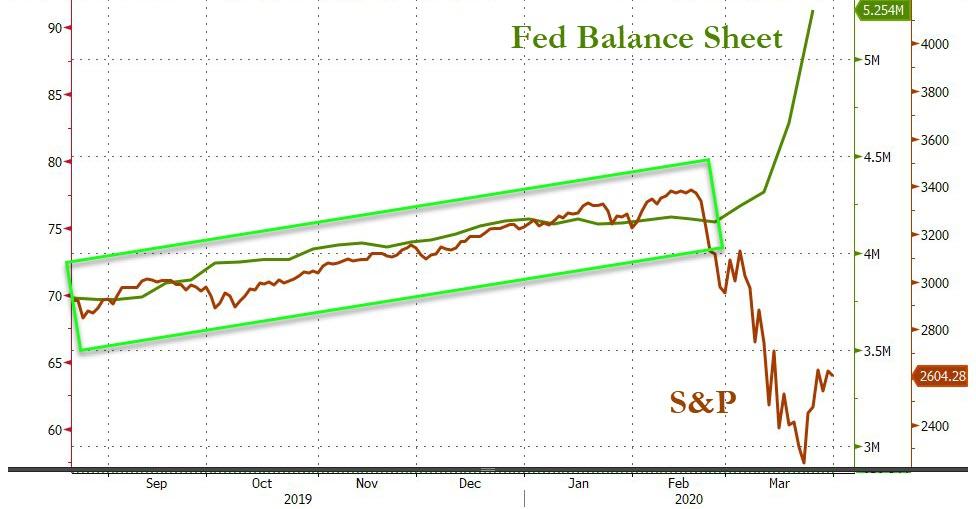

Remember, it’s about the fun-durr-mentals again…

Source: Bloomberg

And top-down macro is even worse…

Source: Bloomberg

As The Feds favorites (and only) tool seems to have stopped working…

Source: Bloomberg

Tyler Durden

Tue, 03/31/2020 – 16:00

via ZeroHedge News https://ift.tt/340kqzv Tyler Durden