The Quarter-End Pension Rebalancing Is Over

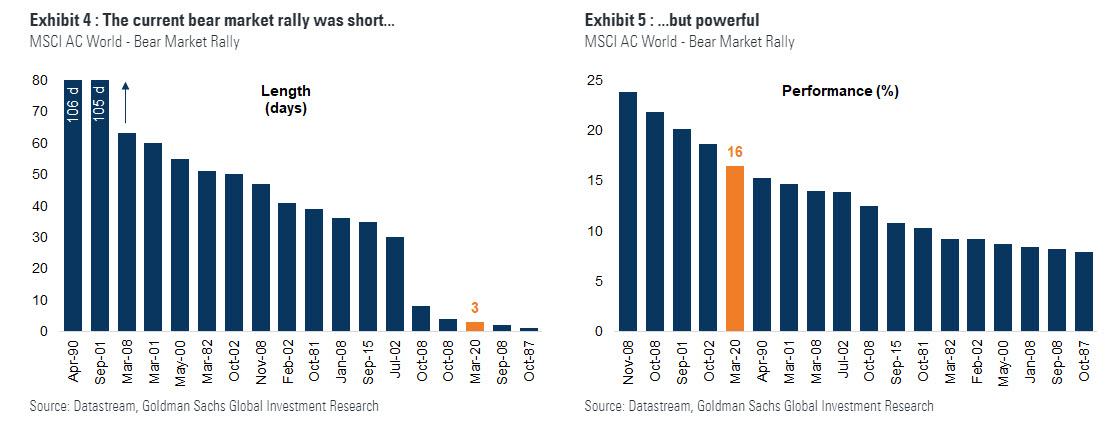

With stocks staging a remarkable bear market rally in the past week (even Goldman now says this is not the bottom and the impressive move of the past week is just another bear market rally), which reversed the fastest ever bear market, and pushed the S&P into a bull market…

… traders have attributed a big part of the move to what we first said more than a week ago would be forced buying by pension funds who were mandated to buy as much as $850BN in stock for quarter end to offset the underperformance of stocks vs bonds.

To be sure, some doubt emerged whether that is indeed the case yesterday when P&I magazine reported that at least one California pension fund, the Los Angeles City Employees’ Retirement System, had temporarily modified its asset allocation and rebalancing policies, which includes allowing the staff to defer rebalancing its asset allocation, a move which many if not all other pension funds are expected to adopt.

That said, it was not clear if the new LACERS policy would take place this quarter or in the future, and so traders kept buying on Monday, frontrunning what they expected was a last minute dash by pension funds to buy stocks.

Well, at least according to Morgan Stanley’s Quantitative and Derivatives Strategist, any residual pension scramble to buy stocks is now over, and this quarter’s rebalance trade is effectively in the history books, to wit:

A week and a half ago QDS forecast $160bn in month-end equity buying as pensions and asset allocators would need to reallocate portfolios. Since then the S&P 500 is up 10% and is up 17% off the Monday lows. Our models now suggest $50bn still to buy globally (with $25bn in the US) and while that figure is still large, much of the impact may already be in the price.

As a result of the pension trade, the market’s low liquidity – “need to start earlier to spread the flow out over more days” – plus an attractive opportunity to monetize the rally in bonds and rotate into equities likely has brought forward some demand according to the QDS strategists who note that dispersion over the last few days has been in the 8th %ile since 2012 suggesting index led moves, and note that conversations with MS clients appear to suggest allocators are looking more favorably on credit than equity now.

In fact, as Morgan Stanley concludes, “equity allocations are likely now less than 1% off of target weights, which may be close enough for many allocators in this uncertain environment.”

This means that any attempt to frontrun pension funds at this point is just a frontrunning of other investors who believe they are frontrunning someone who is no longer buying.

Which brings us to a warning from Morgan Stanley:

While markets can certainly keep going higher (QDS still does forecast net equity demand over the next few days), the risk/reward of being long on asset allocation expectations alone is less clear and QDS is no longer as tactically bullish.

Finally, looking beyond month-end, QDS is concerned about a) retail MF redemptions and b) risk of L/S HF selling of Tech stocks after a strong rally in crowded longs.

Tyler Durden

Tue, 03/31/2020 – 12:38

via ZeroHedge News https://ift.tt/2JrGTMi Tyler Durden