The US 2020 Fiscal Deficit Will Explode To 18%, Unseen Since World War II

Authored by Chetan Ahya, Morgan Stanley chief economist

A Full-Court Policy Press

I hope that you and your families are well. The past few weeks have been challenging both personally and professionally. Covid-19 is at once a human tragedy and unparalleled synchronous shock, affecting both the demand and supply sides of the global economy.

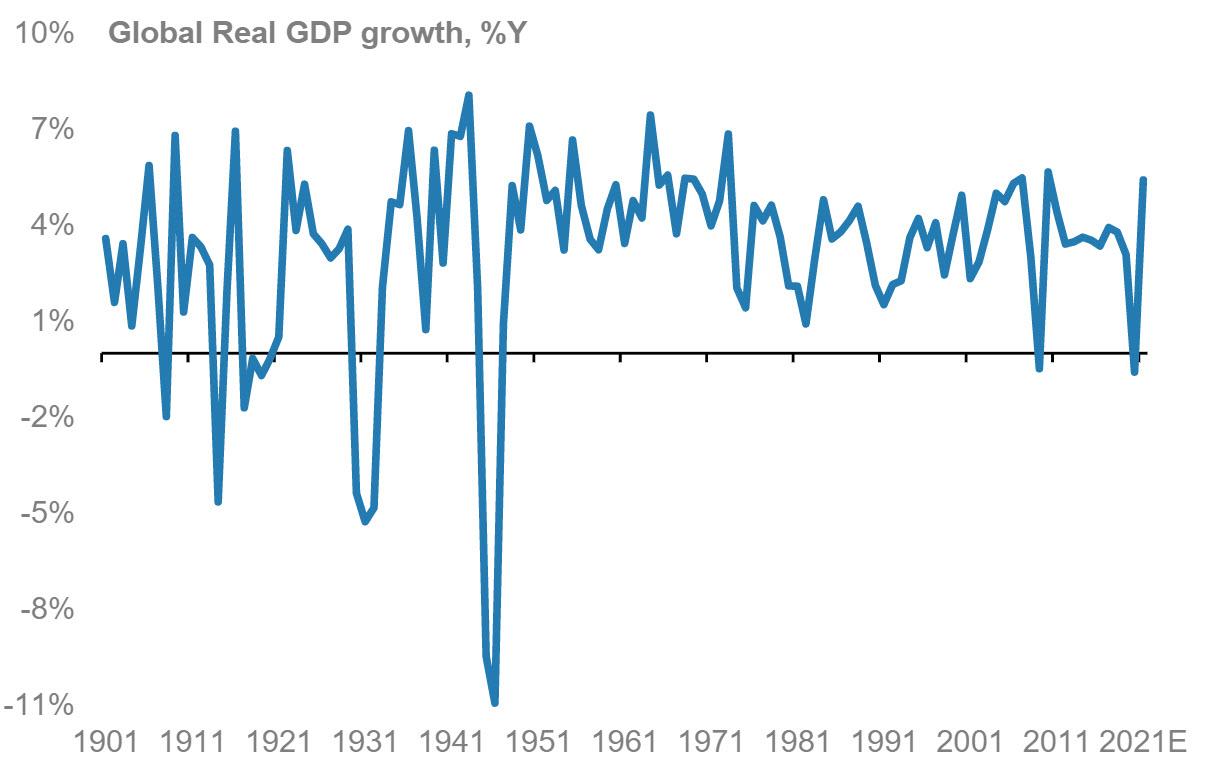

Given the scale of disruption to economic activity, we expect a deep global recession in 1H20, with growth contracting by 2.3%Y in 1H20. Assuming the outbreak peaks by April/May, this will likely set the stage for a recovery in 2H20, to 1.5%Y by 4Q20. For the US, we expect an unprecedented drop of 30.1%Q SAAR in 2Q20 with the unemployment rate also rising to a record 12.8% (since data collection began in the 1940s) before we see it bouncing back at a 29.2%Q SAAR pace in 3Q20. However, global growth for full-year 2020 will still see a decline of 0.6%Y, past the 0.5%Y rate of contraction we saw during 2008 and, on our estimates, the weakest pace of growth during peacetime since the 1930s.

Even before the coronavirus outbreak, the post-GFC global economy had been facing the triple challenge of demographics, debt and disinflation (the 3D Challenge we have written about previously), which the world last faced in the 1930s. At its core, the outbreak represents a substantial shock to incomes, and the impact on aggregate demand will ultimately create renewed disinflationary pressures. The debt challenge will also become more pronounced in the near term as nominal GDP growth weakens and nations, households and corporates face rising levels of indebtedness. Taken together, we expect these forces to bring the 3D Challenge back to the fore.

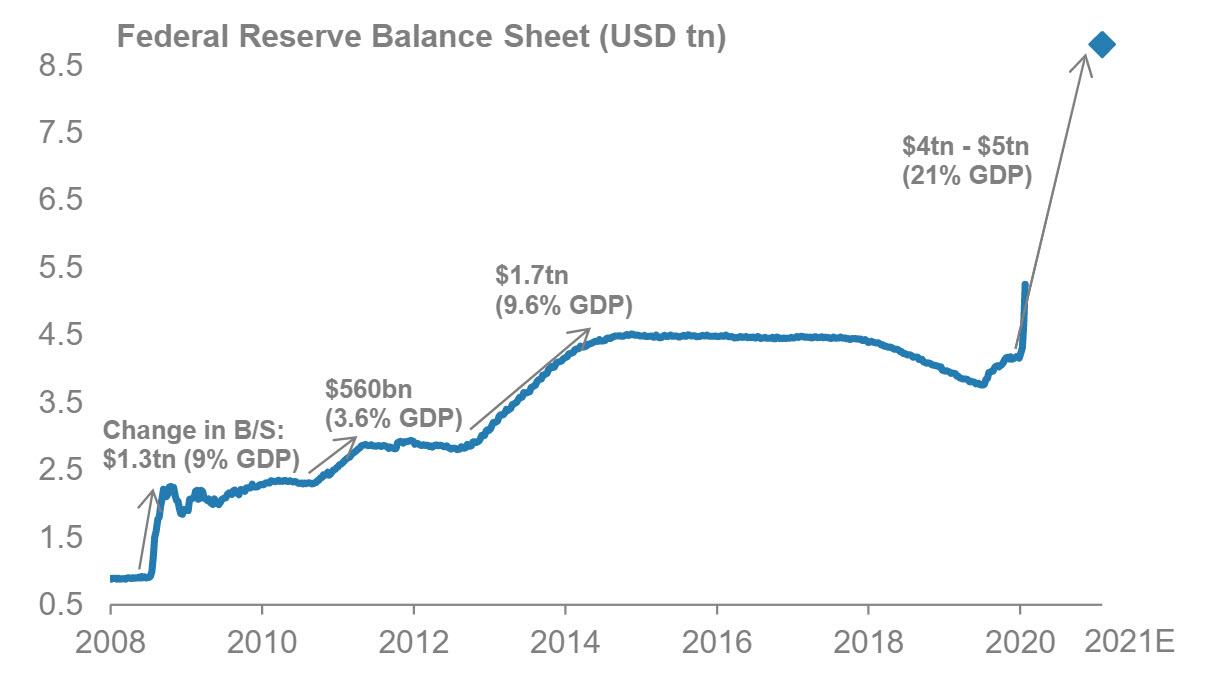

The silver lining is that the coronavirus has elicited a strong coordinated monetary and fiscal response. The pace and magnitude at which these policies have been implemented are also unprecedented. Since mid-January, 23 of the 30 central banks we cover have eased monetary policy. The global weighted average policy rate has declined to below post-GFC lows. All the G4 central banks have now announced aggressive quantitative easing programmes. We estimate that these central banks will make asset purchases of ~US$6.5 trillion in this easing cycle, with cumulative asset purchases of US$4-5 trillion by the Fed alone.

Over the last few days, the pace of fiscal action has also picked up significantly. We now expect that in the G4 plus China, the combined primary fiscal balance will rise by 440bp (~US$2.8 trillion) in 2020. As a percentage of GDP, the G4+China cyclically adjusted primary deficit will rise to 8.5% of GDP in 2020, significantly higher than the 6.5% in 2009 immediately after the GFC.

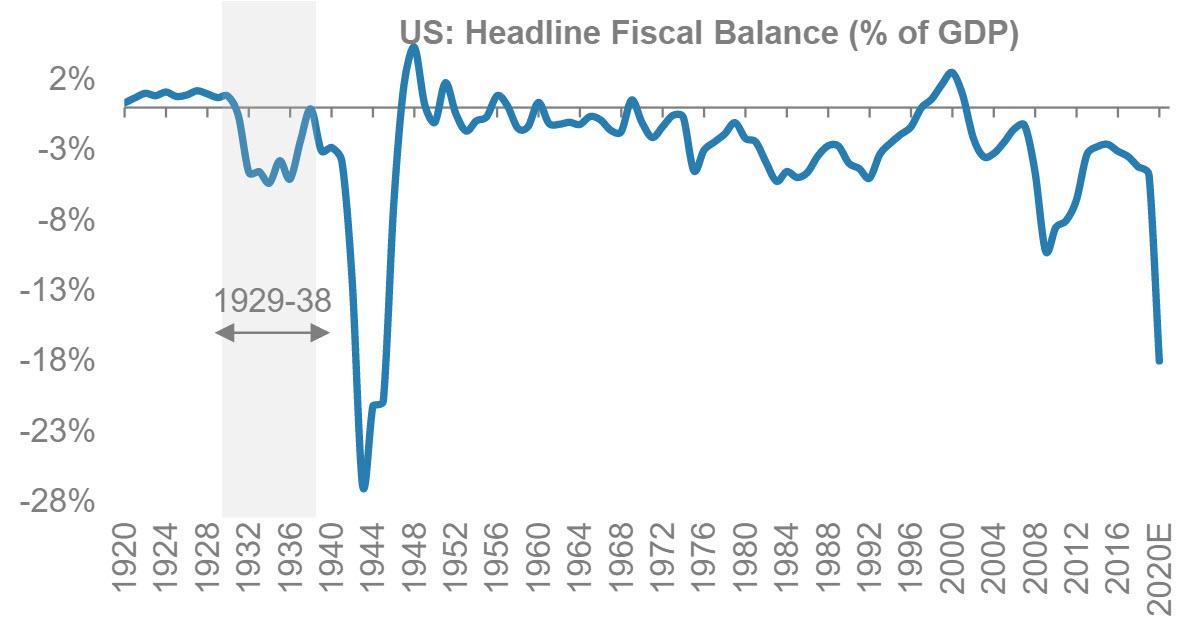

In the US, the speed and magnitude of the policy response have been truly remarkable. The Fed has cut rates to zero and put QE and other lending facilities in place much faster than during the GFC. A fiscal stimulus package has been assembled in a little over a week, compared with two months for the 2008-09 package. In terms of magnitude, we expect the cyclically adjusted primary fiscal deficit to rise to 14% of GDP in 2020 (assuming stimulus of US$2.0 trillion) compared with 7% of GDP in 2009 – the highest level since the 1930s. The headline fiscal deficit will rise to around 18% of GDP in 2020.

Based on the experience of the 1930s and of Japan since the 1990s, this aggressive, coordinated fiscal and monetary easing will be critical in addressing the 3D Challenge. With the help of this extraordinary policy action, and assuming an April/May Covid-19 peak, we expect the global economy to be on the mend from 3Q20 onwards.

However, based on the experience in China, we foresee a tepid pace of recovery initially, and it won’t be until 3Q21 that output reaches pre-Covid-19 levels in the US and euro area.

Hawks will undoubtedly argue (and we’ve already heard murmurings) that these expansionary policies bring the risks of rising inflation and deficits and risks to debt sustainability. However, we take the opposing view and argue that these policies need to remain in place for longer until inflation expectations have systematically risen closer to the central banks’ goals. Again, the 1930s offer a cautionary tale. Because expansionary policies were terminated prematurely in 1936-37, the US economy suffered a double dip in 1937-38 (see Global Macro Briefing: 1937-38 Redux?). Hence, policy-makers must not be too quick to sound the all-clear.

Tyler Durden

Mon, 03/30/2020 – 20:45

via ZeroHedge News https://ift.tt/2WS5Qsp Tyler Durden