“Asking For The World’s Depositors”: Is It Time To Worry About The Banks?

Until now, the media and financial commentariat had been very careful to frame the coronacrisis as merely a one-time shock to the global economy and a non-recurring hit to corporate earnings as the world is put into an induced coma, with hopes that once the coronavirus pandemic passes, the world can simply be woken up and a V-shaped recovery can commence.

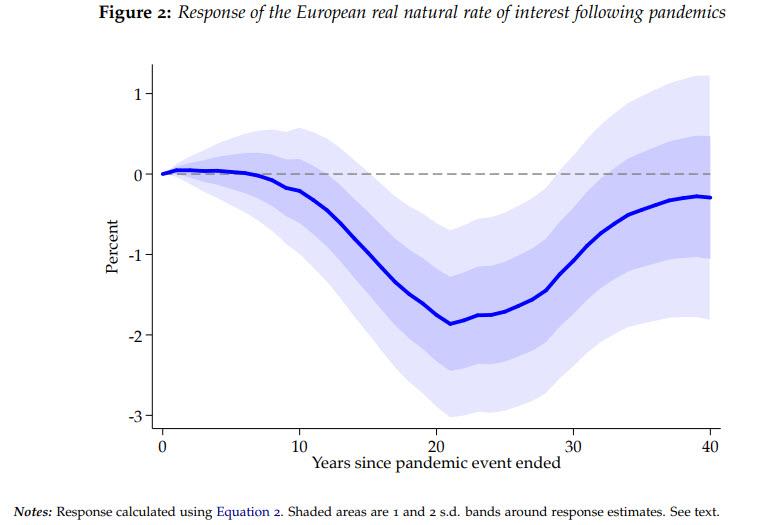

Alas, the longer the coma lasts, the more unlikely the recovery is V-shaped, something a recent research report from the San Fran Fed admitted by looking at the aftereffects of some of the world’s most notable pandemics, to wit: “Significant macroeconomic after-effects of the pandemics persist for about 40 years, with real rates of return substantially depressed.”

Bloomberg confirmed as much today in “Trump’s Dire Forecast Reinforces Outlooks for Deep Economic Hit.”

And yet while the debate rages on whether the economy and corporate profits are due for a V-shaped recovery or instead a W- or even L-shaped “recovery” is more appropriate, so far nobody had mentioned, or rather dared to mention, the possibility that beyond a one-time economic shock, the corona-crisis could also affect the financial sector. Read: the banks. After all, the last thing the crippled economy needs now is a bank run to go with the total shut down of most businesses and cash flows.

That changed today when none other than CNBC anchor-at-large Bill Griffeth unexpectedly asked a “serious question” on behalf of bank depositors:

Was a global pandemic one of the scenarios in the bank stress tests?? Asking for the world’s depositors

Serious question: Was a global pandemic one of the scenarios in the bank stress tests?? Asking for the world’s depositors. @WilfredFrost @kaylatausche

— Bill Griffeth (@BillGriffeth) April 1, 2020

We know the answer to this rhetorical question: after all all banks passed the Fed’s latest stress test without a glitch. here another CNBC anchor, Kayla Tausche helpfully chimed in reminding us just how laughable, in retrospect, was the Fed’s “severely adverse” scenario. In a nutshell, the banks were expected to have no problem with an outcome in which:

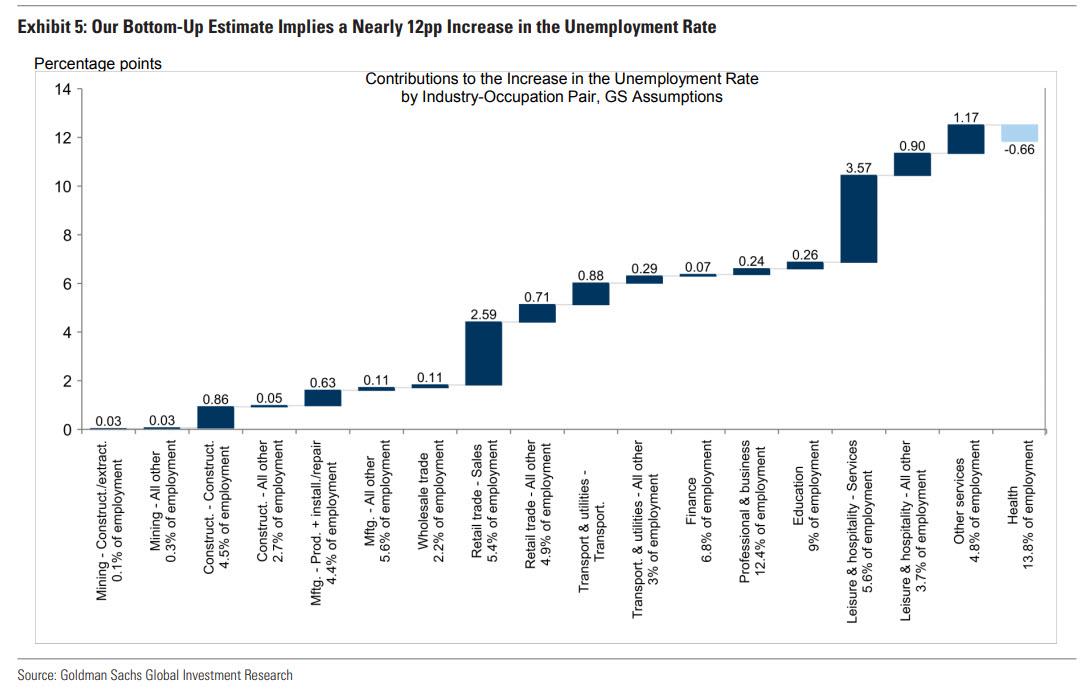

- Unemployment jumps to 10%

- GDP falls -8.5%

- The US 10Y “plunged” to 0.75%

Here are the Fed’s scenarios for this year. https://t.co/ZuTUNYrmD8

A pandemic wasn’t a scenario, per se, but the “severely adverse” picture included:

* 10% unemployment

* GDP falling -8.5%

* US 10Y at 0.75%This could be worse than that. https://t.co/0tPocI3ilT

— Kayla Tausche (@kaylatausche) April 1, 2020

Under the severe scenario, banks would lose $410 billion if there were another severe global recession, but would maintain enough capital to keep lending to companies and individuals.

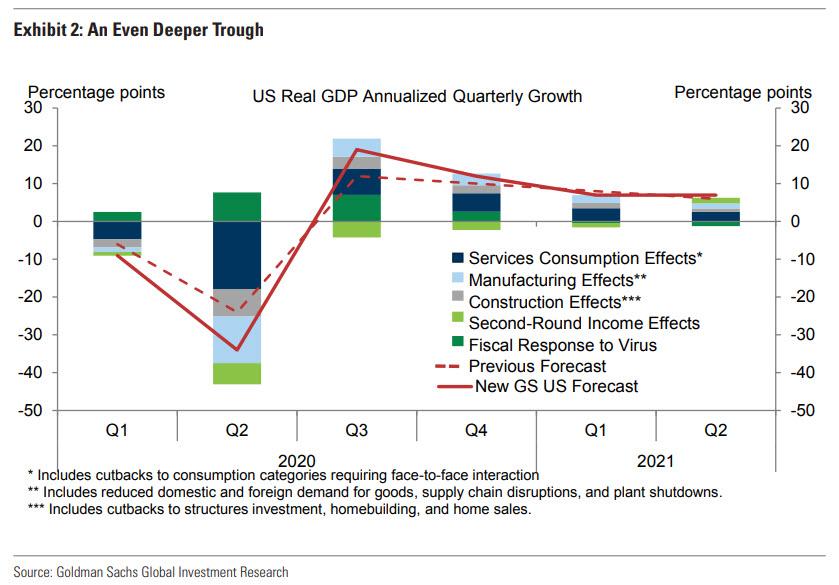

But what happens if there is a global pandemic that results not in a severe global recession, but an outright depression. Which, as a reminder, is what Goldman’s latest forecast for at least Q2 is, when the bank expects GDP will plunge to -34%…

… and the unemployment rate soars to 15%.

In that scenario, which the world is now living through, nobody knows what happens to the banks, or perhaps hasn’t bothered to get the answer, because the last thing the “world’s depositors” want to hear is that not only are they quarantined at home, but a trip to the local ATM may reveal no cash in stock.

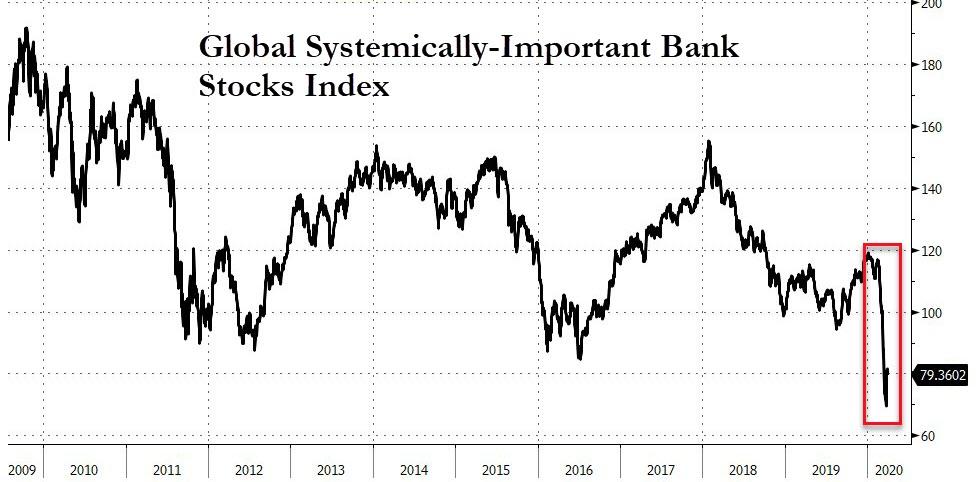

While we don’t know the answer to Bill Griffeth’s question, it appears that the market is trying to come up with one, and is not happy with what it is seeing, because not only is the stock index of GSIBs, or global systematically-important banks tumbling…

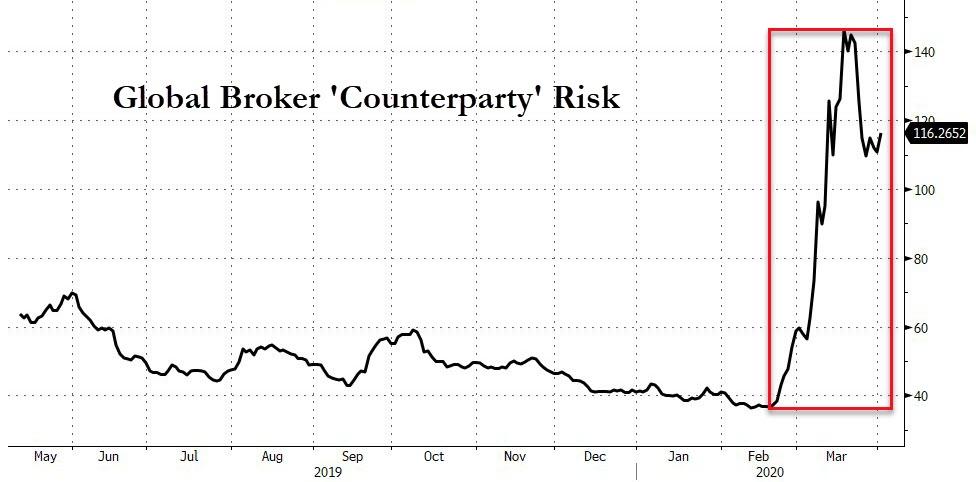

… as global broker counterparty risk soars…

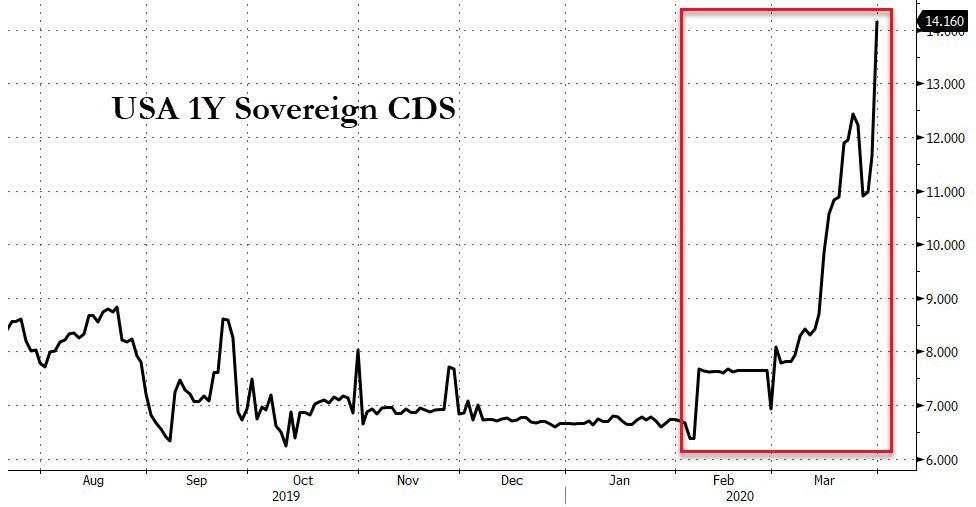

… but most ominously, 1 Year CDS on the US have been on a tear lately, suggesting US default odds – it appears the CDS market is not a fan of that MMT idiocy that a currency issuer can’t default – are surging.

And while we are confident that others will soon start asking questions about whether this is also a financial crisis in addition to an profit and economic one, one thing we don’t know is whether US CDS are surging because of that… or because of the US response to the crisis which will see US debt exploding by $2-3 trillion this year alone with the Fed’s balance sheet doubling to $9 trillion and over.

In other words, is the CDS market starting to sniff out the beginning of the end – the moment when the US dollar is no longer the world’s reserve currency?

Tyler Durden

Wed, 04/01/2020 – 15:13

via ZeroHedge News https://ift.tt/39AOH9k Tyler Durden