Q2 Begins On The Back Foot

Submitted by Saxo Bank’s Elizabeth Creagh

With the slate cleared of month/quarter end flows and pension fund rebalancing, Asia equity markets begin mixed. At the time of writing, ASX 200 +1.71%, Nikkei 225 -1.14%, KOSPI +0.40% and US futures heading lower on light volumes in the Asia session.

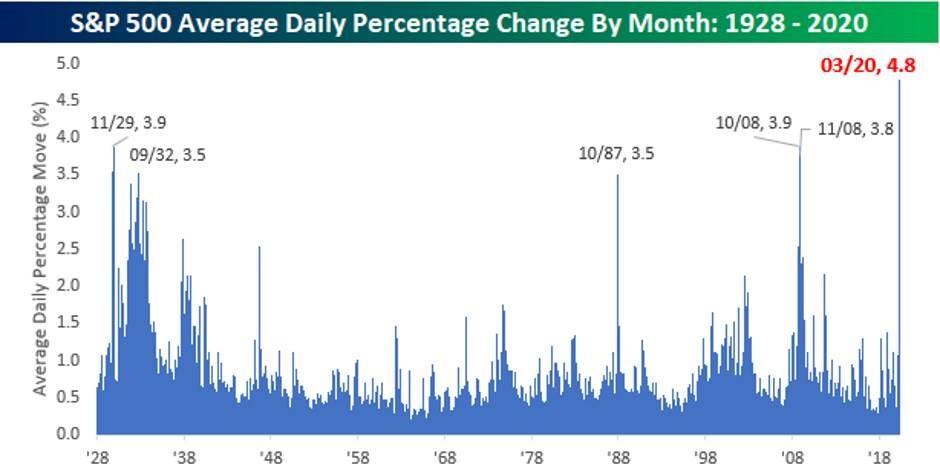

This after declines across the board on Wall Street as stocks slumped into the Q1 finish line. The S&P 500’s 38.2% Fibonacci retracement at 2650.89 is proving a tough nut to crack with the bear market rally meeting some temporary resistance around this level. The quarter finishing on a dour note, now the S&P 500’s worst quarter since 2008 and the DJIA’s worst quarter since 1987, with the month of March being the most volatile month ever for the S&P 500.

Following overnight declines, stocks began trading cautiously in the Asia session and the White House coronavirus briefing added fuel to that fire. Taking the positives, the good news is the administration are no longer hoping for an Easter resumption and have heeded the advice of medical professionals with respect to containment measures in the attempt to flatten the COVID-19 infection curve. However, unfortunately, we are still in the early stages of the infection cycle in the US and the briefing confirmed this notion. Clearly, examining modelling estimates and they are just that (estimates), relative to the current death toll of almost 4000 vs. the models projections of 100,000 – 240,000 it is unlikely that we have seen the worst in the US yet. President Trump corroborating this, warning that the country faces a “painful two weeks” ahead.

A host of Asia manufacturing PMI’s released today have done little to buoy sentiment, as they illustrate the abrupt slump in economic activity, deteriorating employment outlook and declining forward outlook as lockdowns are ramped up and in some cases extended. Asia’s factory outlook has not only suffered the extent of China’s lockdown but is now being dealt a second wave of headwinds as demand from Europe and the US collapses.

- Jibun Bank Japan March Manufacturing PMI 44.8 vs 47.8 in Feb.

- Markit South Korea March Manufacturing PMI 44.2 vs 48.7 in Feb.

- Markit Taiwan March Manufacturing PMI 50.4 vs 49.9 in Feb.

- Markit Thai March Manufacturing PMI 46.7 vs 49.5 in Feb.

- Markit Indonesia March Manufacturing PMI 45.3 vs 51.9 in Feb.

- Markit Vietnam March Manufacturing PMI 41.9 vs 49 in Feb.

- Markit Malaysia March Manufacturing PMI 48.4 vs 48.5 in Feb.

- Markit Philippines March Manufacturing PMI 39.7 vs 52.3 in Feb.

- Markit Myanmar March Manufacturing PMI 45.3 vs 49.8 in Feb.

The exception, the Australian AIG manufacturing PMI, which rebounded back to expansionary levels. However, before getting too excited, the accompanying analysis from AI Group poured cold water on the rebound, stating the result was “almost entirely due to a huge surge in demand for…food, toilet paper, cleaning products and other household essentials”. So a direct result of the fear induced panic buying and hoarding from Australian consumers.

Also a dampener in the Asia session the news that both Standard Chartered and HSBC will suspend dividend payments. This pressuring the Hang Seng lower. Reminding investors that in the current environment for some companies, elevated dividend yields will not be sustainable and investors should maintain a highly selective approach when picking high yielding stocks for their portfolios. Over the coming months as company earnings are pressured, many dividend payments will be suspended or cut. This as company balance sheets are hit by the simultaneous demand and supply shock the COVID-19 crisis brings. And in this scenario companies value a strong balance sheet over maintaining payout ratios. It will be more important to maintain liquidity and stay solvent whilst revenues and operating incomes are hit. Another factor at play with respect to reduced dividends, the impending regulatory pressure emerging as governments globally weigh suspending the payment of dividends, and company buybacks for those companies seeking bailouts. Why privatise gains, but socialise losses for taxpayer to bear the brunt.

Another story to watch, with China being the first country to come through the peak of the COVID-19 crisis, and the first to stabilise the contagion, there will be important notes to be gleaned from the post COVID-19 picture. How quickly the economy is able to resume normal activity levels and the toll the virus outbreak takes on consumers will likely offer clarity to the trends we can expect to see emerging in Europe and the US post lockdown. As we noted last week, there are signs of weakness in China’s consumer credit market which could become the reality in the US and Europe over the coming months as the jump in unemployment cascades into consumer credit market. As Bloomberg notes a worrying trend is emerging with respect to consumer behaviour, even as lockdowns are lifted consumers are reluctant to head out and many are still concerned about their financial situation which will likely keep pressure on the marginal propensity to spend. This sort of lasting shock to consumer activity and sentiment will clog the transmission of fiscal stimulus measures as fearful consumers pocket cash and save in favour of spending.

Tyler Durden

Wed, 04/01/2020 – 07:35

via ZeroHedge News https://ift.tt/2ULx696 Tyler Durden