‘Relax, Eat Out & Shop’: China In Desperate Bid To Jump-Start Consumer Economy As Rest Of Globe In Lockdown

As China believes it’s over the coronavirus hump, with signs that “normal” could be just around the corner, leaders in Beijing are attempting to jump-start the economy once again. “Relax, eat out and shop. That’s the latest message from the Chinese government to its people, after months of warning them to stay indoors because of the coronavirus,” Bloomberg writes.

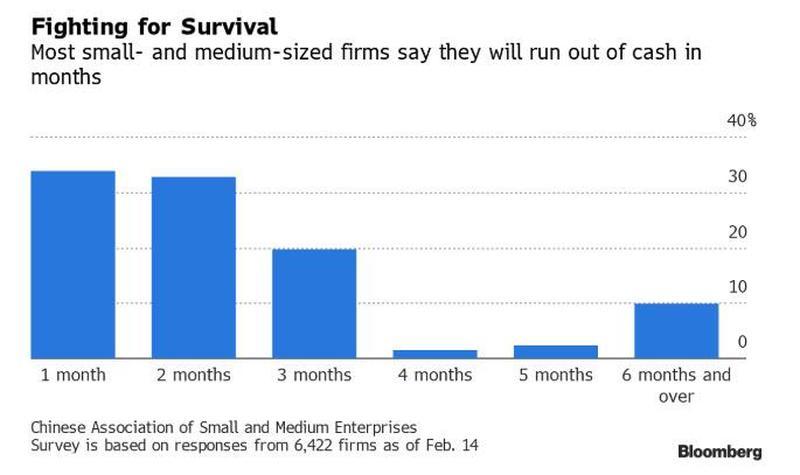

We noted earlier that it’s smaller employers that remain the beating heart of China’s economy, accounting for 99.8% of registered companies in China, employing 79.4% of workers, and contributing more than 60% of gross domestic product and, for the government, more than 50% of tax revenue. The fact that retail sales plunged 20.5% in January and February and once-bustling malls and market spaces remain largely empty means many cash-strapped small businesses are unlikely to survive long enough to see consumers return to the streets in normal numbers.

Yet residents, after months in self-isolation, with whole cities and provinces that were on government enforced lockdown only now opening their gates, might have good reason to be skittish and untrusting about venturing out to cafes, restaurants and malls – given fears a dreaded potential ‘second wave’ could hit – but also given rampant unemployment due to the national shutdown (with some 5 million losing their jobs in the first two months of 2020 alone) will naturally encourage more families to stay in thrift mode, forgoing their regular consumption habits of better times before the outbreak.

It’s a sign that Western nations like Spain, the UK and US could take much longer than leaders expect to open up their economies again, belying such notions and wishes for an “Easter miracle” as Trump recently expressed, but later walked back from.

China’s attempt to get shoppers back out again into once bustling but now largely empty markets and night-life venues has involved unprecedented state-sponsored incentives and perks, including local authorities distributing vouchers to residents akin to ‘freebies’ and coupons, urging companies to allow paid time-off for ‘shopping half-days’, and local governments issuing subsidies on car purchases and other large items.

Nationwide the population has been subject to multi-million dollar ad campaigns geared toward getting people consuming again. “Domestic media are playing up stories of officials venturing out to enjoy local delights like bubble tea, hot pot and pork buns,” Bloomberg reports. “Images of bureaucrats dining out and shopping are a sharp departure from the austerity that resulted from President Xi Jinping’s unprecedented anti-corruption crackdown, which made many cadres scared to be caught doing anything that could be construed as ostentatious.”

“I would be grateful just to keep my job,” one woman employed by a small business told Bloomberg. “For my colleagues and I, we are still eating at home as much as possible. Going to public places doesn’t feel safe.”

Shopkeepers in Wuhan were reopening Monday, but customers were scarce. https://t.co/eWwwJGIHyt

— USA TODAY (@USATODAY) March 30, 2020

In bad news for a country attempting to stave off the coming global consumer default tsunami, people’s instincts on an emotional and psychological level are to react conservatively even as cities and markets open up. As Bloomberg notes, the anticipated so-called “revenge spending” has yet to come to large-scale effect on the ground:

Many in China have been banking on pent up demand they hoped would be unleashed once restrictions were eased, so much so that “revenge spending” has become a buzzword on social media.

The revival on the ground has been more tepid, prompting an influential Chinese economist to call for more direct stimulus such as the cash handouts employed by Hong Kong.

And again, this looks to be the negative blueprint for woes that the West – with its economies still “on pause” and with April essentially ‘canceled’ – still has coming.

“China’s consumer recovery will shed some light on what may happen in the rest of the world as the outbreak eventually peaks and recedes,” Ned Salter, head of equities research at Fidelity International, was quoted in the Bloomberg report as saying.

“There are clear signs of recovery across segments, although the pace of normalization is somewhat slow. We need to see more consumer confidence to sustain the improvement,” Salter added.

Indeed China as the world’s largest consumer market is one that economists, pundits and politicians in the West will keep a very close eye on to see what measures work, and how quickly signs of recovery come, once the pandemic is firmly under control and all major cities are over the hump.

Tyler Durden

Tue, 03/31/2020 – 23:05

via ZeroHedge News https://ift.tt/3bHrKCN Tyler Durden