Trader: “Maybe We Can’t Handle The Truth After All”

Authored by Richard Breslow via Bloomberg,

Most of us have lower pain thresholds than we would like to admit. And have developed various coping mechanisms to deal with it. We opt to hear what we want to. This tendency is often accommodated by enablers who long ago realized that catering to this preference can win friends and influence people. It contradicts the dictum of under-promising and over-delivering. But is a sleight of hand that often buys time. It can also occasionally lead to heads-I-win, tails-you-lose outcomes, moments of severe disappointment and hurt people.

Today is one of those days. Maybe we can’t handle the whole, unvarnished truth, but would be better served getting more of it and earlier. I don’t want to suggest things are more nefarious than they might really be. But, consider today’s market price action as an example of this in microcosm. It’s also worth pointing out that, at least some of what is going on, is an unwind of the front-running and rote positioning that came with what was a well-advertised and potentially difficult month-end portfolio rebalancing exercise that we just completed. Possibly more than it seems. It won’t take long to find out.

Risk assets are not having a happy start to the quarter. Not horrendous, but certainly discouraging nevertheless. And there are a number of factors that have conspired to drag us down. We were told, yesterday evening, that we are still in the very dangerous stages of surviving the pandemic. “It will be a very difficult two weeks.” Should that have come as a surprise to anyone watching the news? Apparently so. There’s still light at the end of the tunnel, just not as soon as we were told to hope. And with potentially greater human toll. Sometimes, it is just so much better to get out ahead of things. That’s exactly what NIAID Director Anthony Fauci was trying to do. And then he suggested a believable path toward achieving a better result than the models they use suggest.

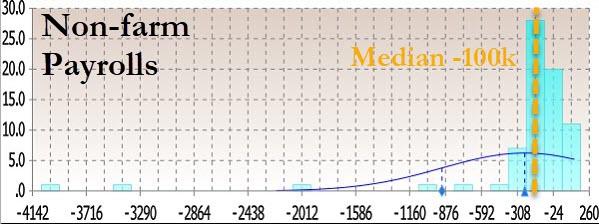

Global economic numbers are going to be disappointing. Today’s certainly were uninspiring. We know we are in recession. Bad data comes with that. The lesson to learn is to follow the trajectory, one way or the other, and not get solely hung up on the absolute levels. We are in danger of slipping from looking beyond the numbers to merely being unnerved by them. Accept that precise estimates are hard to come by and aren’t really the point. Just look at the dispersion of forecasts for Friday’s nonfarm payrolls.

What may have tipped the balance, given our current mood, is the new realization that the V-shaped recovery is unlikely to happen exactly on schedule as we were promised. New realization? It was an unrealistic expectation that shouldn’t have been stated as the base case. Have we not already been discussing a fourth stimulus plan?

European banks are having to cut out dividends and share buybacks. We’ve been discussing the weakness of this sector and other uses for these funds ad nauseam. This can’t have come as a total bolt from the blue. The market’s reaction should be taken as an object lesson in understanding the concept of asking, “whose ox is being gored” more than anything else.

Some fund managers are bearish. Earnings season will be disappointing and revenue expectations too high. Enough said. Although, I did read that cigarette companies seem to be doing just fine.

The point is, we know these are bad times. And sometimes the bad news gangs up on us. That surely can’t come as a surprise, nor should we pretend it does. If that is the case, we aren’t doing enough to overcome the challenges we face.

Tyler Durden

Wed, 04/01/2020 – 10:15

via ZeroHedge News https://ift.tt/2WZkJcv Tyler Durden