US Manufacturing Slumps To Biggest Contraction Since Financial Crisis

After a bloodbath in European PMIs (and a ‘surprise’ surge back to growth in China), and following some serious collapses in regional Fed surveys (and this morning’s tumble in Canadian PMIs), today’s US manufacturing survey data was expected to slide further into contraction (though not as much as the Services surveys collapsed).

-

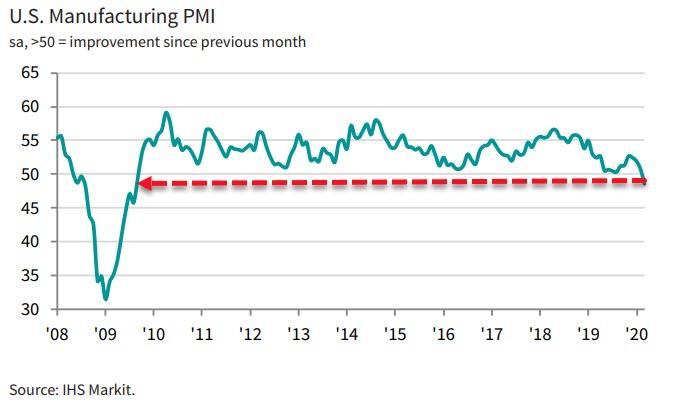

Markit’s US Manufacturing PMI fell modestly from 49.2 to 48.5 in March (modestly better than the 48.0 flash print) – a considerably smaller drop than many expected.

-

ISM’s US Manufacturing survey fell modestly from 50.1 to 49.1 in March (far better than the 44.5 print expected)

Source: Bloomberg

This move follows the carnage seen in US Services PMI and shows very little relative declines (perhaps the survey was premature)…

Source: Bloomberg

Once again, the driver of this relatively positive print is the same as has caused problems with surveys since the crisis began – supplier delivery times rising at the fastest pace since 2005 – typically seen as a sign of expansion. However, in this case it is caused by collapsing global supply chains, and along with prices paid rising rapidly means a stagflationary collapse in global trade… not exactly the positive signal the index is trying to send.

Chris Williamson, Chief Business Economist at IHS Markit said:

“The final PMI data for March are even worse than the initial flash estimate, with manufacturing output slumping to the greatest extent since the height of the global financial crisis in 2009.

“Growing numbers of company closures and lockdowns as the nation fights the COVID-19 outbreak mean business levels have collapsed. While some producers reported being busier as a result of stockpiling and anti-virus activities, notably in the food and healthcare sectors, these are very much the minority, and most sectors reported a rapid deterioration in demand and production.

“Orders for capital equipment have deteriorated at a rate not seen since data were first available in 2009 as firms stopped investing in machinery. Companies have meanwhile reined-in spending on inputs and households have pulled back sharply on many forms of spending, especially for non-essential and big ticket items. With export sales also sliding, factories are facing a broad-based slide in demand which is already resulting in the largest job losses recorded since the global financial crisis.”

Finally, manufacturers cut their workforce numbers at the sharpest rate since October 2009, reporting an increase in redundancies and the need for lower operating capacity. Specifically, looking at ISM’s Employment sub-index – at 2009’s lows – suggests Friday’s payrolls data will be extremely ugly (despite ADP’s miraculously timed survey)…

Source: Bloomberg

We give the last word to Williamson: “Worse is likely to come as consumer spending falls further in coming months as lockdowns intensify and unemployment spikes higher.”

Tyler Durden

Wed, 04/01/2020 – 10:05

via ZeroHedge News https://ift.tt/2WZDlsP Tyler Durden