Whiting Petroleum Files For Prepackaged Bankruptcy

Talk about a coincidence: just as we were discussing why April would be “apocalyptic” for the oil industry, as Saudi Arabia just unleashed an unprecedented record amount of oil to buyers in a scramble to put its high-priced competitors out of business, warning that “countless oil producers would file for bankruptcy”, former shale darling Whiting Petroleum did just that, filing a pre-packaged Chapter 11 deal in the Southern District of Texas Bankruptcy Court after reaching an agreement with certain note holders to pursue a “comprehensive” and “consensual” financial restructuring.

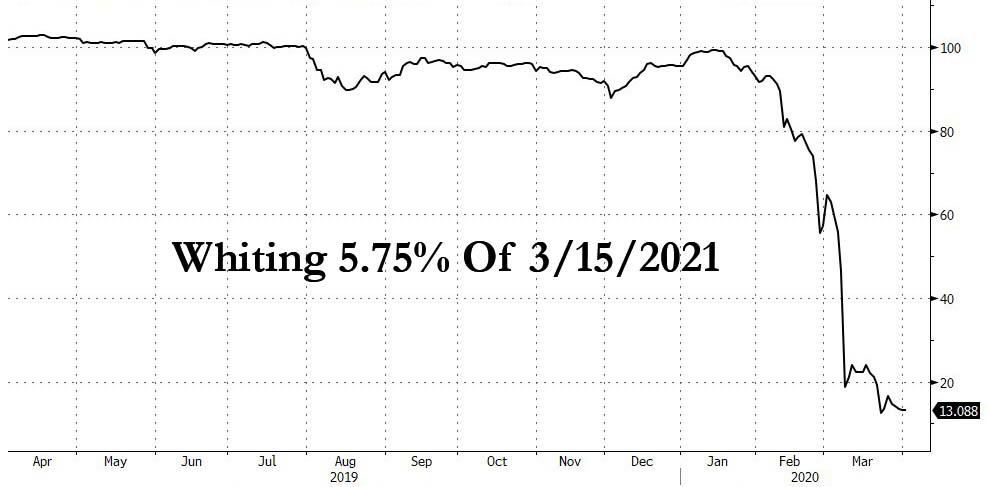

Whiting, which in Q4 pumped 123,000 bpd of which 80,000 bpd was nat gas, said it concluded that given a “severe downturn” in oil and gas prices resulting from the Saudi Arabia-Russia oil price war and COVID-19-related impact on demand a financial restructuring was the “best path forward.” Creditors may disagree: the company’s bonds due March 2021 were trading at par as recently as mid-January, even though we warned as far back as 2015 that it would be the first company to go under: truly a testament to how idiotic the junk bond market has been for the past 4 years.

The company said that the plan provides for de-leveraging of capital structure by more than $2.2 billion, and listed $1-$10 billion in debt and more than $585 million of cash on its balance sheet, noting that it expects to have sufficient liquidity to meet its financial obligations during the restructuring without the need for additional financing.

More importantly, it will continue to operate its business and pump oil for the duration of the Chapter 11 proceedings, meaning that oil production won’t decline by even one drop.

The bankruptcy press release is below:

Commences Chapter 11 Reorganizational Process to Right-Size Capital Structure

DENVER–(BUSINESS WIRE)–Apr. 1, 2020– Whiting Petroleum Corporation (NYSE: WLL) and certain subsidiaries (collectively, “Whiting” or the “Company”) today announced that they had commenced voluntary Chapter 11 cases under the United States Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). The Company has more than $585 million of cash on its balance sheet and will continue to operate its business in the normal course without material disruption to its vendors, partners or employees. Whiting currently expects to have sufficient liquidity to meet its financial obligations during the restructuring without the need for additional financing.

The Company has also reached an agreement in principle with certain holders (the “Supporting Noteholders”) of its 1.25% convertible senior notes due 2020, 5.750% senior notes due 2021, 6.250% senior notes due 2023, and 6.625% senior notes due 2026 (collectively, the “Notes”) regarding a term sheet (the “Term Sheet”) that contemplates a comprehensive restructuring. The proposed financial restructuring, the terms of which will be set forth in a forthcoming restructuring support agreement between the Company and the Supporting Noteholders, would significantly reduce the Company’s debt and establish a more sustainable capital structure pursuant to a consensual chapter 11 plan of reorganization (the “Plan”) that would be supported by the Supporting Noteholders on the terms of such restructuring support agreement.

The Plan will provide for, among other things: (1) significant de-leveraging of the Company’s capital structure by over $2.2 billion through the exchange of all of the Notes for 97% of the new equity of the reorganized Company to be issued pursuant to the Plan; (2) payment in full in cash and/or refinancing of the Company’s revolving credit facility; (3) the payment in full in cash of all other secured creditors, tax and other priority claimants, and employees; and (4) the Company’s existing equity holders receiving 3% of the new equity of the reorganized Company and warrants (as described in the Term Sheet). Consummation of the Plan will be subject to confirmation by the Bankruptcy Court in addition to other conditions to be set forth in the Plan and related transaction documents.

Bradley J. Holly, the Company’s Chairman, President and CEO, commented, “In 2019, we took proactive steps to reduce our cost structure and improve our cash flow profile. We continue to build on these actions in 2020. The Company has also explored a wide variety of alternatives to address our balance sheet and looming note maturities in a highly capital constrained market environment.

Given the severe downturn in oil and gas prices driven by uncertainty around the duration of the Saudi / Russia oil price war and the COVID-19 pandemic, the Company’s Board of Directors came to the conclusion that the principal terms of the financial restructuring negotiated with our creditors provides the best path forward for the Company. We are pleased to have secured a highly constructive restructuring framework with a critical mass of our noteholders. Through the terms of the proposed restructuring, we believe a right-sized balance sheet will enable us to capitalize on our enhanced cost structure, high-quality asset base and successfully compete in the current environment.”

Mr. Holly continued, “I want to express my gratitude to the employees for their continued dedication and hard work, and to our service providers and business partners for their ongoing support during this time. Following the restructuring process, we look forward to having substantially less debt and a significantly improved outlook for our Company and its stakeholders.”

Moelis & Company is acting as financial advisor for the Company, Kirkland & Ellis is acting as legal advisor, Alvarez & Marsal is acting as restructuring advisor and Jeffrey S. Stein of Stein Advisors LLC is the Company’s Chief Restructuring Officer.

PJT Partners is acting as financial advisor for the Consenting Noteholders and Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal advisor.

End result: Whiting will emerge from bankruptcy in a few weeks, leaner and meaner, with almost no debt, yet pumping as much oil as before.

For those confused, this is confirmation that companies can and will continue to operate even under bankruptcy, something which the airline and cruise industry may want to realize, or perhaps the Trump admin, because if any company is to be bailed out, the existing equity has to be wiped out, period end of story.

Here is Whiting’s bankruptcy filing:

Tyler Durden

Wed, 04/01/2020 – 09:20

via ZeroHedge News https://ift.tt/2UxpzvK Tyler Durden