Corporate Revolvers Reach A Tipping Point: Here Are All The Companies That Have Drawn Down Their Bank Loans

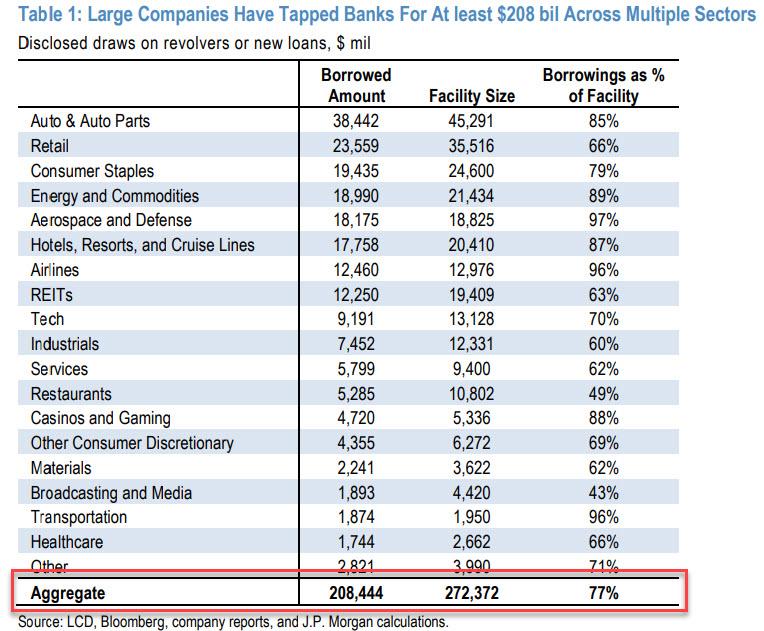

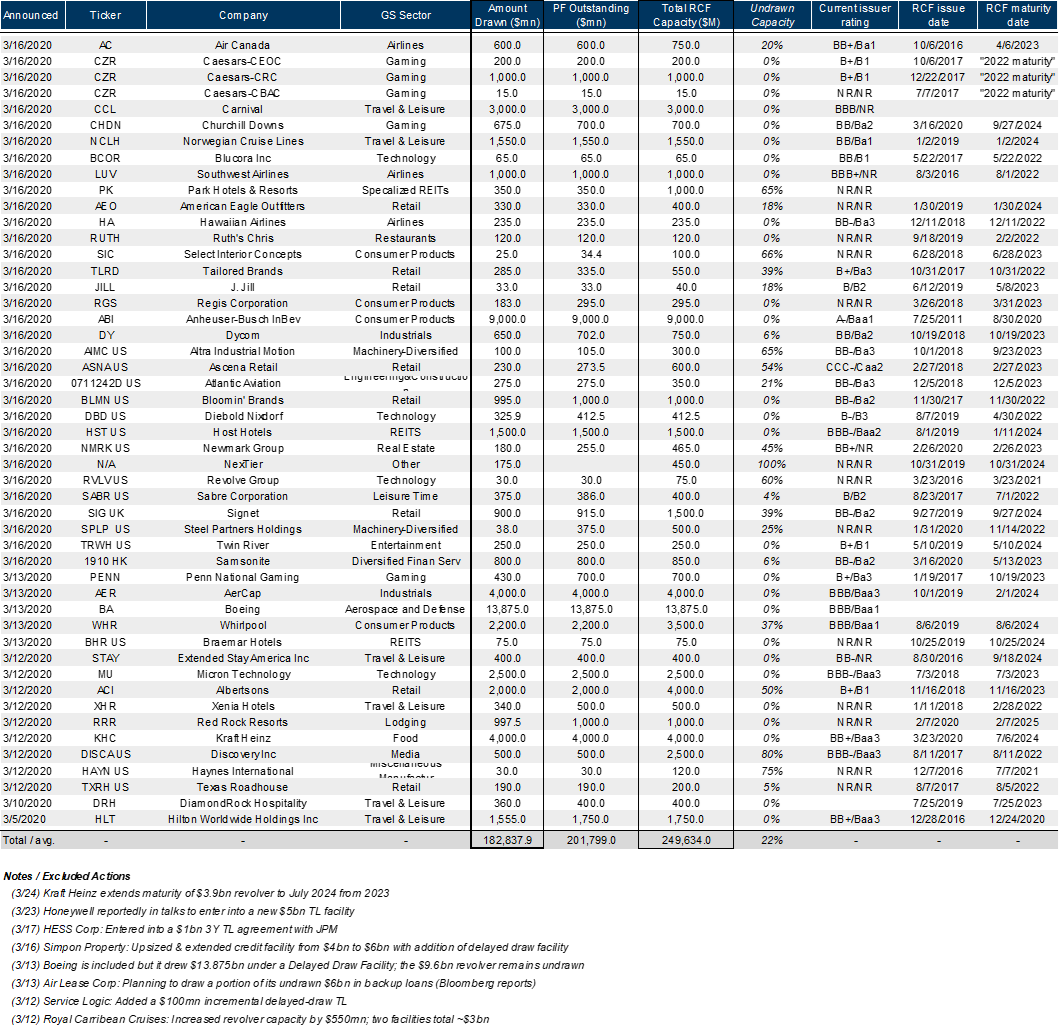

Over the weekend, when we last looked at the unprecedented frenzy by corporations both big and small to draw down on their revolver as they rushed to take advantage of the last traces of liquidity in a market that may soon slam shut all funding windows, we showed that according to JPMorgan’s revolver tracker, corporates that have tapped banks for funding rose to a record $208 billion on Thursday, up $15 billion from $193 billion on Wednesday and $112BN on Sunday. In other words nearly $100 billion in liquidity was drained from banks in the past week.

Putting that number in context, according to JPM, the current aggregate corporate borrowings represent 77% of the total facilities.

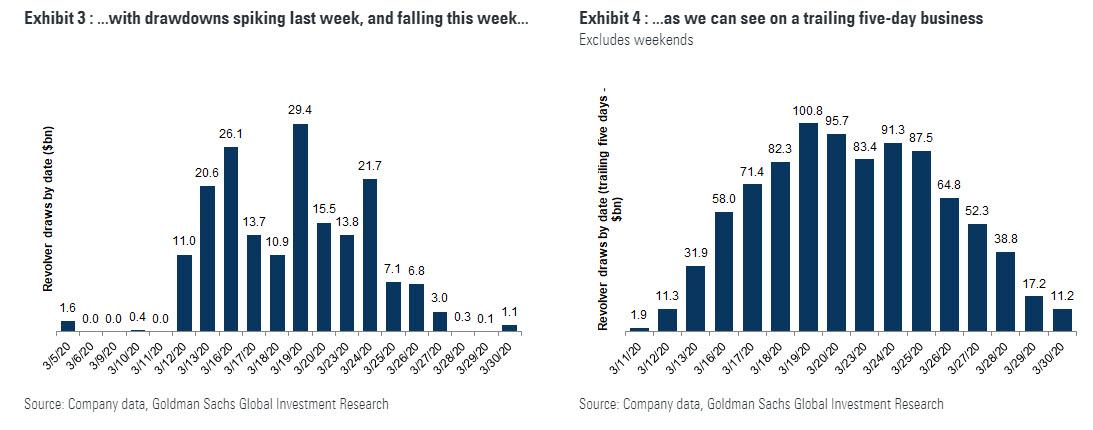

And since by implication almost all companies have now drawn down on their full revolver, it stands to reason that the bank liquidity draining activity will slow down, and sure enough, according to a report from Goldman Sachs, that’s precisely what is going on.

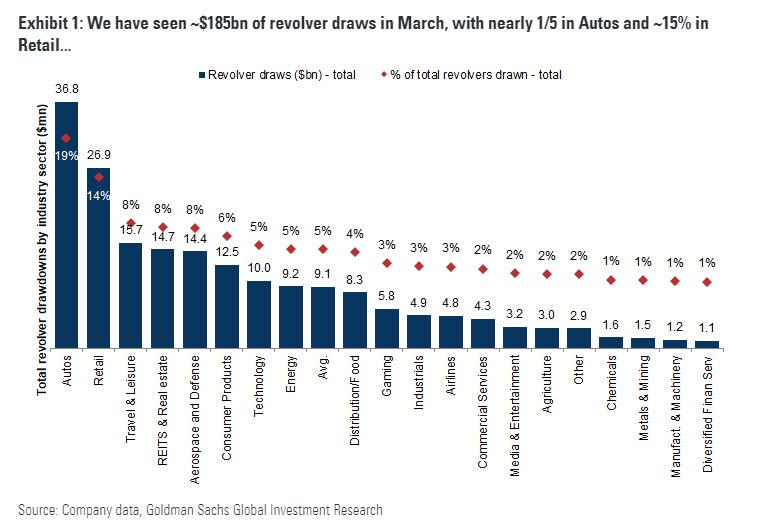

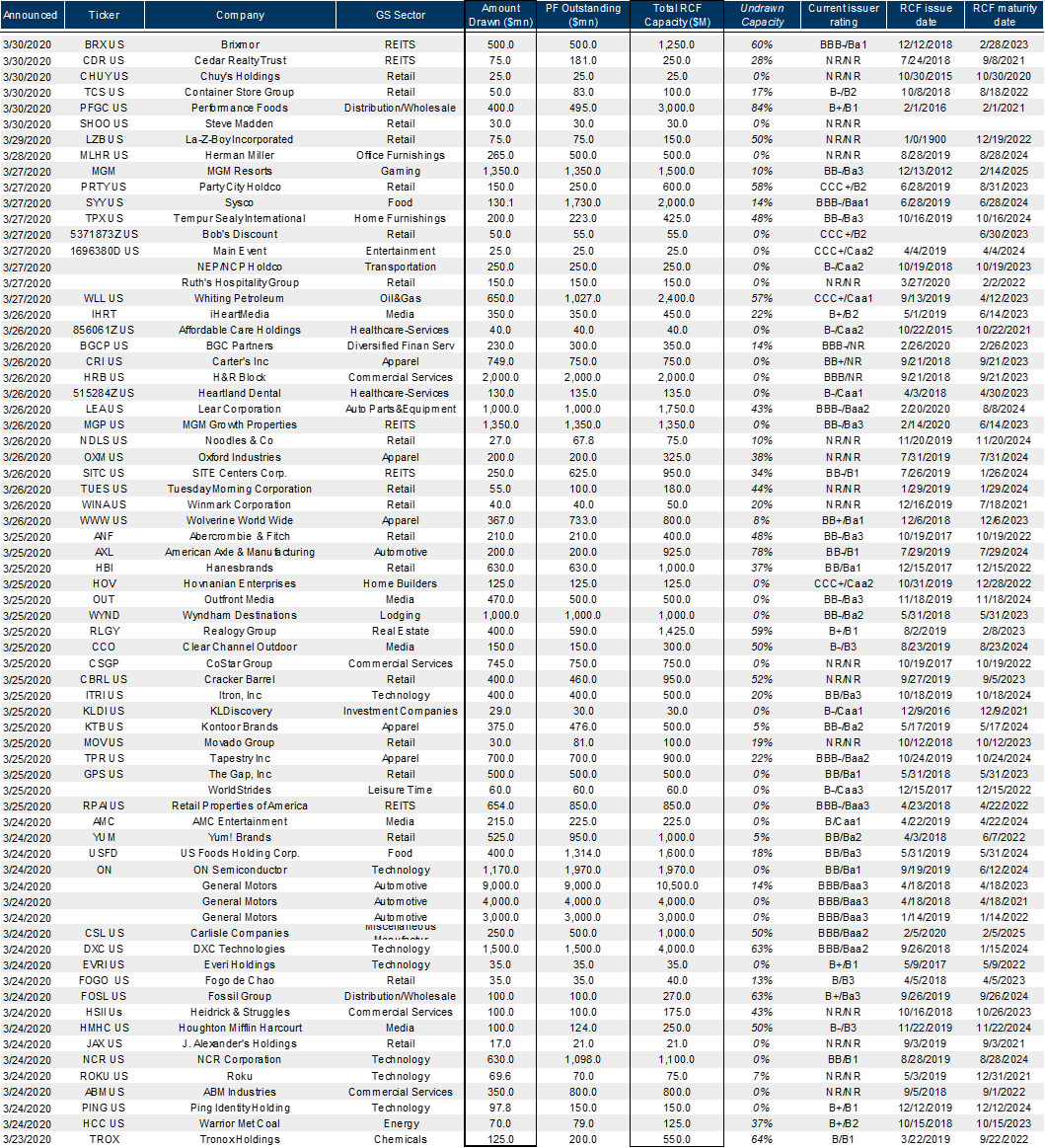

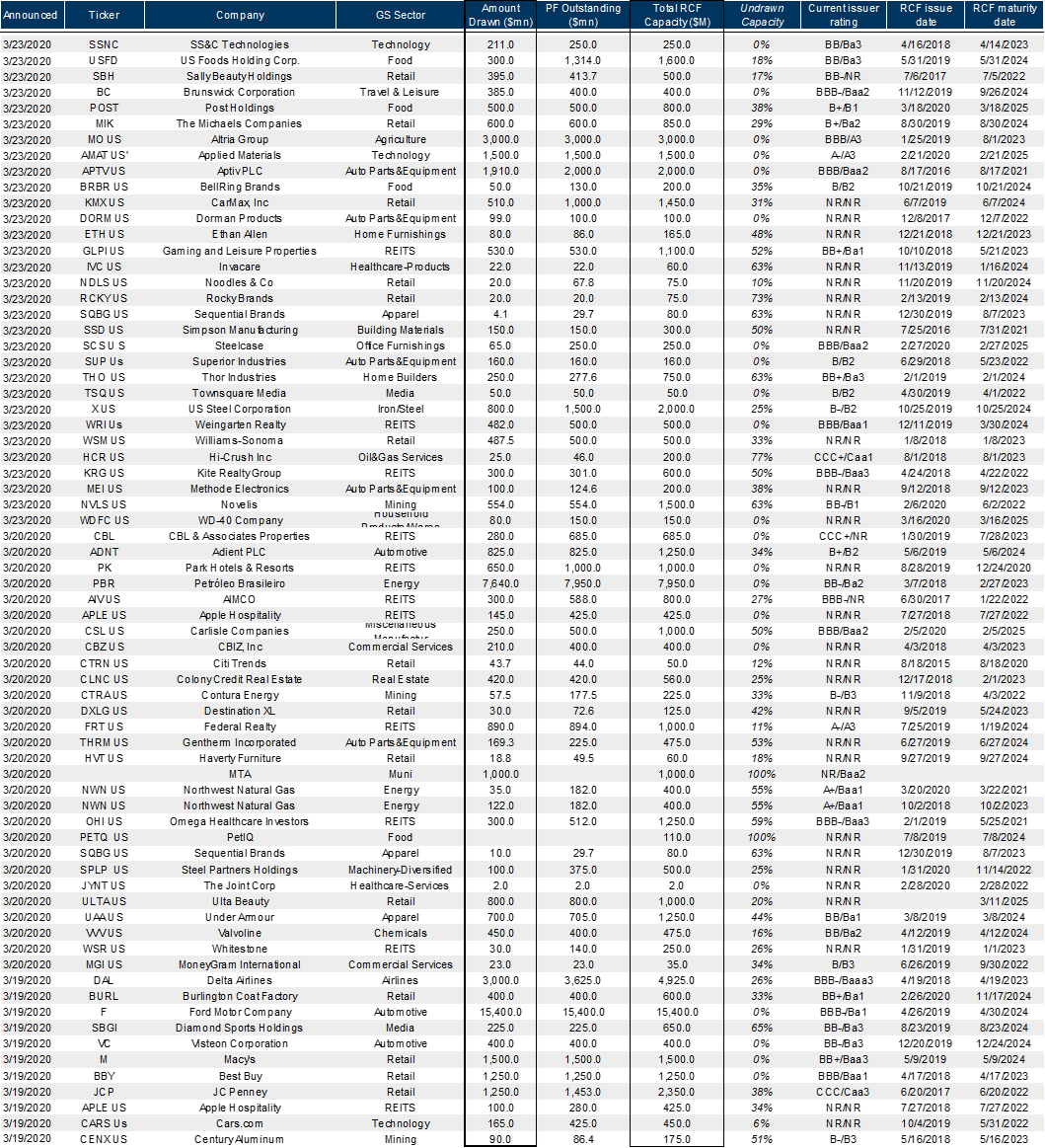

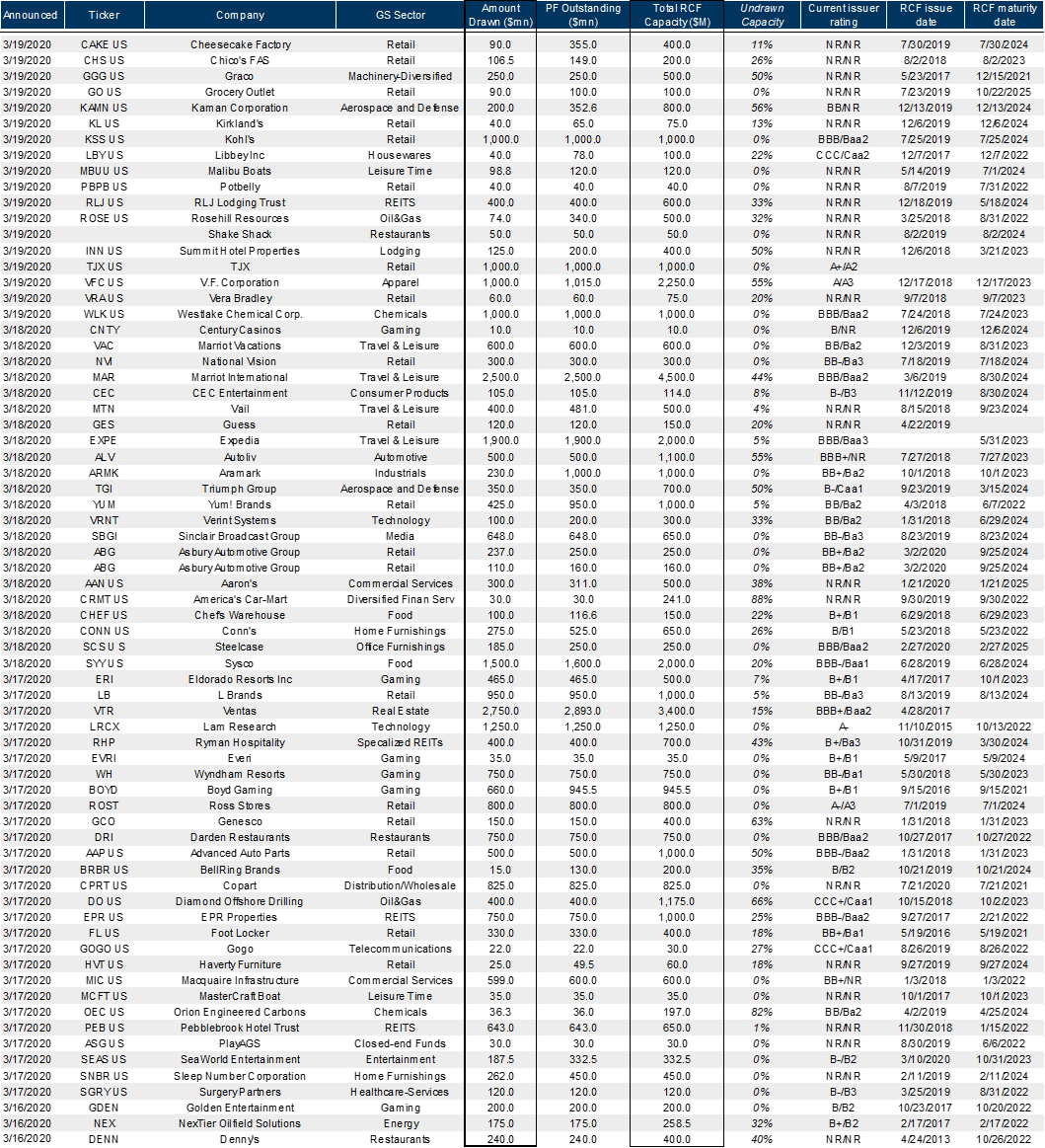

Confirming that the month of March was indeed an unprecedented frenzy for bank credit facility departments, Goldman calculates that as April 1, we have seen $183bn of line draws, up from $76bn last week, with 20% of these in the auto sector, and 14% in retail (other sectors are all <10%).

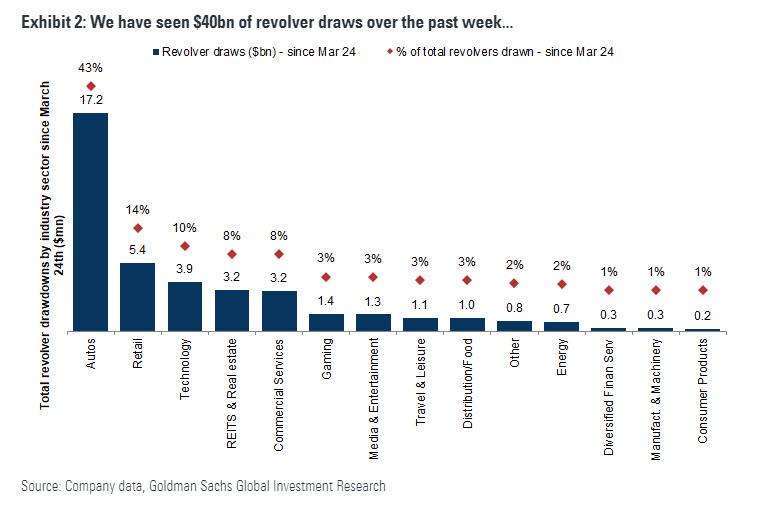

However, in a slightly conflicting conclusion from that of JPM, Goldman then notes that over the last week (since 3/24), there has been a modest slowdown in activity, with $40bn of draws, of which nearly 45% of these have been in autos (all by GM), 14% in retail, and 10% in tech.

Indeed, as Goldman writes, “we note that the pace of revolver draws has slowed nearly 50% so far this week relative to last week, with only $40bn over the last 5 business days, relative to an average trailing 5 business days run rate last week of $75bn.”

Which, as noted above, makes sense: after all by now the only companies that are left hoping to draw down on their revolver, are those that – one way or another – won’t get access to what they are contractually owed, most likely because their bank syndicate deems them a default risk, and with use whatever legal loopholes it needs to avoid wiring even one cent.

Finally, now that the revolver frenzy is almost over, here is the full list of all companies that managed to get their money in time: below are all the corporations that have fully (or almost fully) drawn down on their revolver.

Tyler Durden

Wed, 04/01/2020 – 22:15

via ZeroHedge News https://ift.tt/3bNDR11 Tyler Durden