VIX Whale Known As “50 Cent” Speaks: “Our Catastrophe Insurance Did Absolutely Everything We Expected”

Since 2017, we have been following the bread-crumbs of the mysterious VIX-whale nicknamed “50-Cent” – so-called for his habit of scooping up super-cheap VIX calls at a price around 50c (and with very good timing):

-

April 2017 – Who Is The Real “50 Cent” – A Mystery Trader Is Systematically Betting Massive On A VIX Spike

-

Feb 2018 – VIX-Trader ’50Cent’ “Steamrolls” XIV-Traders To $200 Million Gain

-

Jul 2019 – Is VIX Whale ’50-Cent’ Back? Volatility Collapse Sparks Huge Bearish Bets

-

Dec 2019 – VIX Options-Whale ’50 Cent’ Re-Emerges As New Short-Vol ETF Appears

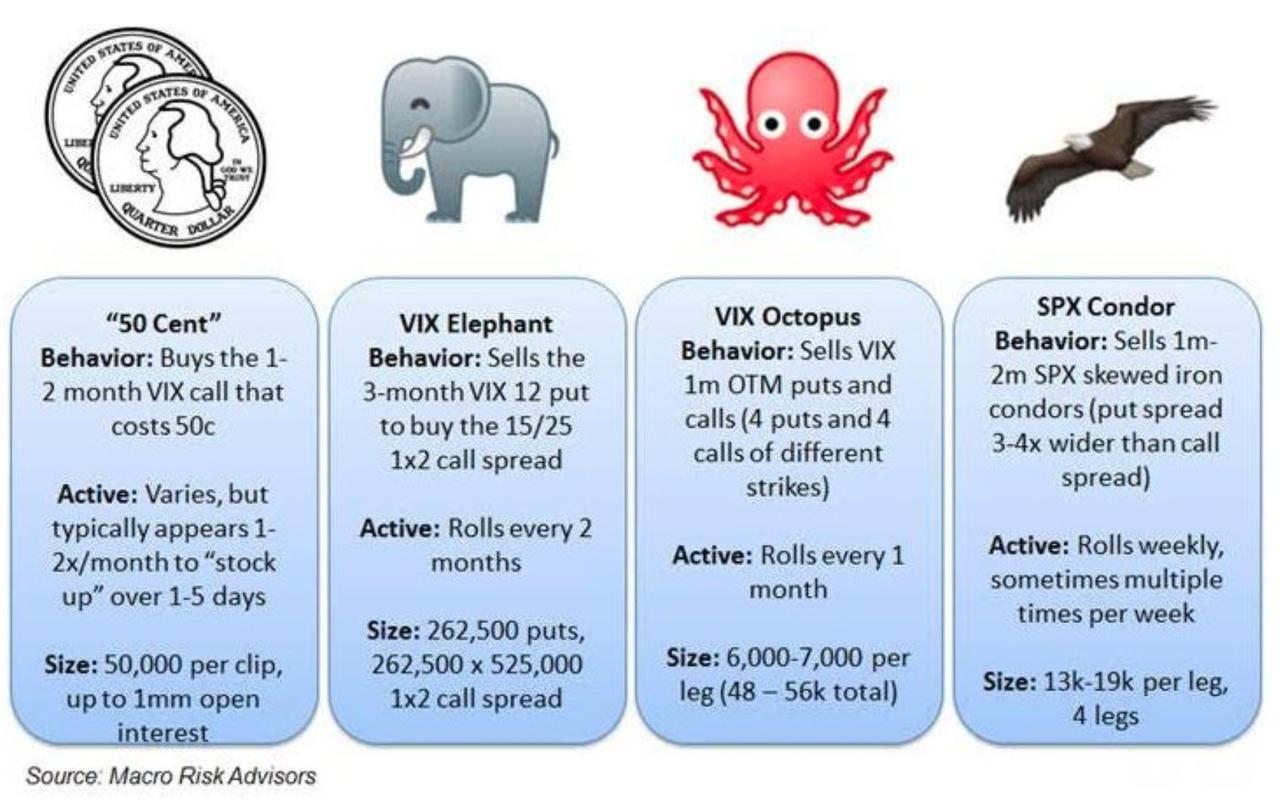

He is among several VIX whales discovered in recent years.

And now, according to The FT, the real ’50-cent’ has stepped forward as Jonathan Ruffer – a London-based fund manager for investment firm Ruffer Capital.

His strategy, which is believed to have spent $200m to protect against a rise in volatility in US stocks, saw its strategy pay off during the recent market turmoil.

“That means they’ve made about $400 million mark-to-market this month,” said Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors.

“We don’t know if “Fiddy” has monetised any of their options . . . Regardless, this is still an impressive result.”

Either way, speaking for himself in a letter to investors, Ruffer says that “catastrophe insurance” strategy has run its course extreme successfully.

When the elements speak, elemental forces are unleashed, and it is important, in the middle of this storm, to capture the right tone of voice. Any false attempt to give reassurance, to boast about early success, to bury oneself in clichés, is unhelpful – even worse, it is historic: by the time these words are read, events will have unfolded which make them, as the CD music reviews have it, ‘of historic interest only’. We are a long way from terra firma; at the time of writing, it’s a case of ‘so far, so good’. If this were a tennis match, all we could say is that we’ve had a decent first set.

We have been writing for a long time – too long? – about the cataclysm ahead. If our judgement has been sound, then the maelstrom cannot be put down to a pandemic – utterly unforeseeable, and certainly not predicted by us. The Titanic was sunk by an iceberg; the Ark Royal by a torpedo – both were great surprises, as coronavirus has been.

Another way of looking at the fate of the Titanic and Ark Royal is that the former sank because of inadequate bulkheads, the latter because of a flaw in the siting of the engine exhausts. In the long run-up to market dislocation, we were preoccupied with the ship, not the icebergs or torpedoes. The instruments of destruction are always out there. If markets are resilient, they cope with them. The danger comes when they are not, and this has been the centre of our earnest enquiry: where were things going wrong? Where were they headed?

This is a far harder market to navigate than the crisis of 2008 – or the one before it at the turn of the century; in both cases the market dropped by 50%. In the first, you needed to observe just one rule of the road: avoid the tech and media stocks completely. In the second, you needed to know one thing – that loads of borrowing would give way, dislocatively, to loads of de-gearing. In 2008, we had a single insight: that the many people who had borrowed in Swiss francs and Japanese yen, to take advantage of low interest rates, would in a crisis compete to buy these currencies back, to pay off their loans. As that bloody meerkat says, ‘simples’.

This time round, it is neither ‘simples’ nor ‘easyies’. The problem can be condensed into a single idea – where there is borrowing, there is danger – but this does not come with an obvious solution. Leverage has flooded into every asset class. In the world’s portfolios, the most exposed positions have been the first to tumble. But as investors have struggled to re-establish an even keel, they have had to sell the things which are not obviously wrong, simply because these things are capable of being sold. This is not a surprise, of course, but it does mean that there has been, ahead of this rough water, a good reason for not owning any type of asset at all. In many ways, the battle has been less frightening than the eve of battle, when there seemed no certainties of safety.

Here’s an account of our battle units.

At the forefront was our catastrophe insurance. In a world in which most people didn’t want to spend good money on protecting against what might go wrong, we chose to buy insurance that would benefit from an abrupt fall in the markets. We felt the micro structure of markets left them vulnerable to ‘gap risk’ (something our Chief Investment Officer Henry Maxey highlighted in the 2019 and 2020 Ruffer Reviews).

Insuring against deep trouble in the very near future was relatively cheap, because there were many people who were happy to enter into the other side of the trade – they saw the risk of a tremendous fall in the near future as vanishingly unlikely. Our preferred insurance was in volatility – when markets are racked with fear, they become more volatile, and this is measurable through an index called the VIX. We had a tranche of options which expired, worthless, ten days before the action began. But the next tranche were winners – multiplying in four weeks by around 100 times.

We sold (within inches, again, of being time-expired) when they had yet to put in their final double. We also had puts on the American and European stock markets, which did very well. And we held currency and interest rate swaptions (our positioning that long-dated interest rates would rise more sharply than short-dated rates worked, while our judgement that the Japanese yen would do better than the US dollar didn’t work).

In sum, the catastrophe insurance did absolutely everything that might be expected of it. And it is now spent. It is likely to be some time before this insurance again prices at levels that makes it attractive as a defensive investment.

So, what will Ruffer shift to now as his ‘catastrophe insurance’?

Tyler Durden

Thu, 04/02/2020 – 14:07

via ZeroHedge News https://ift.tt/2R8MQ5k Tyler Durden