‘Mark It Zero’ – Triple-Levered Short Oil ETN Crashes To “Complete Loss”

And just like that, it was gone!

Following the biggest daily surge in oil prices ever… and another major surge in prices today, things have gone a little bit slightly turbo for “investors” in one leveraged oil ETN.

Source: Bloomberg

Unprecedented spikes in price along with a record ‘super-contango’ have left the VelocityShares Daily 3x Inverse Crude exchange-traded notes, or DWTIF, worthless, according to Credit Suisse.

Source: Bloomberg

“Because the Closing Indicative Value of the ETNs will be $0 on April 2, 2020 and on all future days…

…investors who buy the ETNs at any time at any price above $0 will likely suffer a complete loss of their investment,” Credit Suisse said.

As Bloomberg reports, that’s one of the final chapters in a once-popular product that amassed more than $1 billion in assets at its peak over four years ago.

Source: Bloomberg

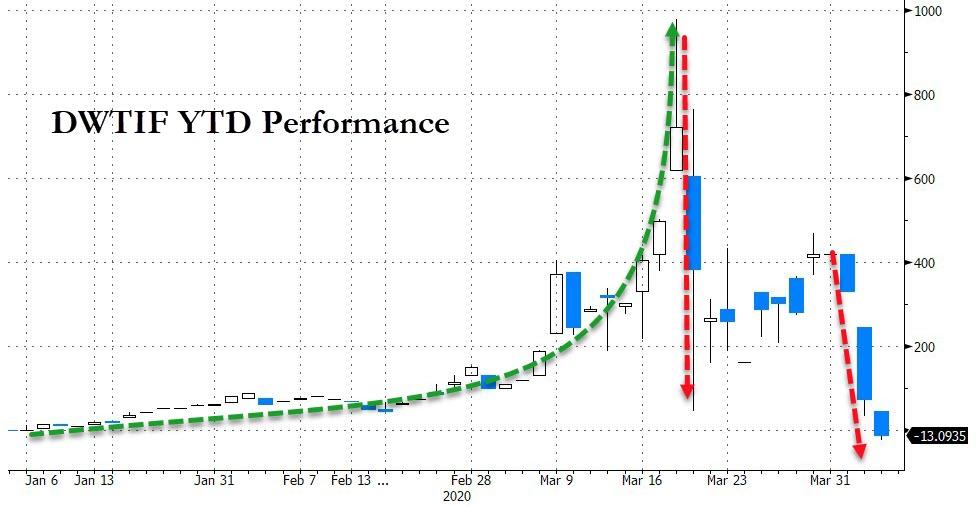

Until the last two days, the bearish triple-leveraged ETN, had screamed higher in 2020 as oil prices have collapsed at a record pace amid a double-whammy of supply- and demand-concerns. At its peak on March 18th, DWTIF was up a stunning 978% year-to-date…

Source: Bloomberg

But now, as Morningstar’s co-head of passive strategy research, Ben Johnson, notes:

“I can say with confidence that this is a bad investment.”

Oh the wonders of leveraged-ETFs…

Tyler Durden

Fri, 04/03/2020 – 13:00

via ZeroHedge News https://ift.tt/3aGZFeS Tyler Durden