Putin Responds To Trump Oil Gambit: 10MM Production Cut “Possible” But US Needs To Join

Earlier today we said that ahead of Monday’s (virtual) R-OPEC conference, a new ask had emerged from within the oil producing nations – any production cut would have to include the US, which alongside with Russia, Saudi Arabia and others R-OPEC nations, would to around 10 million b/d.

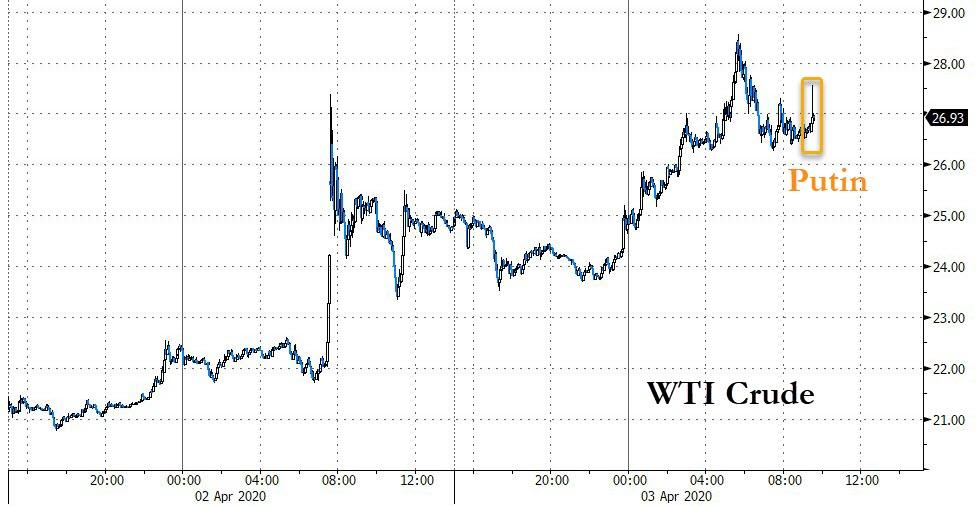

Then moments ago, Vladimir Putin confirmed just that. The Russian president said that he had spoken with US President Trump saying “we are all worried about the situation” and that he is “ready to act with the US on oil markets” with 10mmb/d in oil production needed to be cut, adding that cuts must be taken from Q1 2020 levels which was a jab at Saudi Arabia which is hoping to “cut” by 3 million b/d to go back to where it was in February. And by we, he meant the “we” that includes the US, because as he explained “joint actions” are required on oil markets, i.e., shale too.

Observing that the situation on global energy markets remains difficult and that demand is falling (by 26mmb/d according to Goldman), Putin said that he wants “long-term stability” of the oil market, and that he is comfortable with $42 oil.

The Russian president was also kind enough to summarize the reasons for the oil price collapse which he blamed on the coronavirus, the lack of oil demand and, drumroll, the Saudi withdrawal from the OPEC+ deal.

At this point Russia’s energy minister Novak chimed in and explained what it would take to get such a cut: speaking to Putin, the Russian energy minister said it is necessary to cut oil production for everybody, including Saudi Arabia and the US, and that output should be cut for the next few months and gradually recovered thereafter.

Novak also said that Saudis are still negatively influencing oil market, and that oil storage could be filled for next 1.5 to 2 months only.

Finally, there was some speculation that Russia would not be present at next week’s R-OPEC conference, so Novak defused any confusion, by confirming that the meeting is set for April 6th.

There was no reaction in the price of oil which now awaits to see how Trump will respond to the Saudi/Russian demand that shale join equally in any upcoming production cut.

Meanwhile, as noted earlier, even a 10MMb/d cut is woefully inadequate to restore price stability, because in a world where there is 26mmb/d less demand, cutting supply by 10mmb/d simply means that oil storage capacity will be hit about 30% slower.

Tyler Durden

Fri, 04/03/2020 – 12:52

via ZeroHedge News https://ift.tt/348w9fr Tyler Durden