Goldman: After The Crash Of 2020, Corporate Earnings Won’t Recover Until 2023

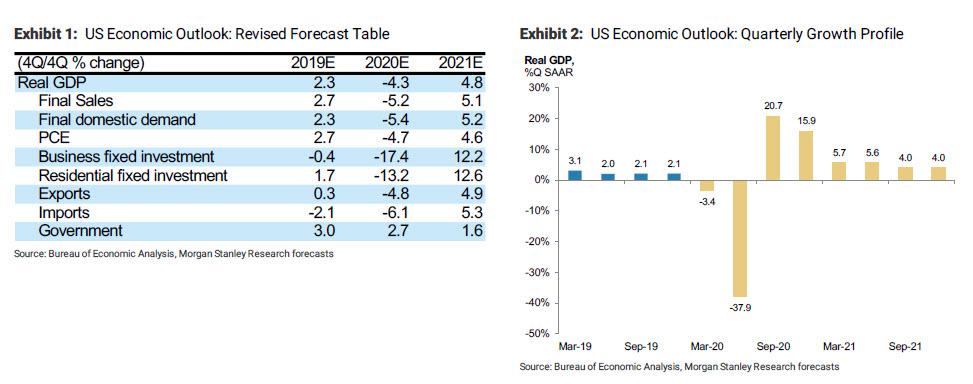

On Friday morning, around the time of the dismal payrolls report which was not only the first negative print in a decade ending the longest streak of positive jobs reports in history, but was 7x worse than consensus, as sellside desks scrambled to update their daily apocalyptic GDP forecasts, Morgan Stanley did two things: it released a Q2 GDP forecast of -38%, the most depressionary of all investment banks…

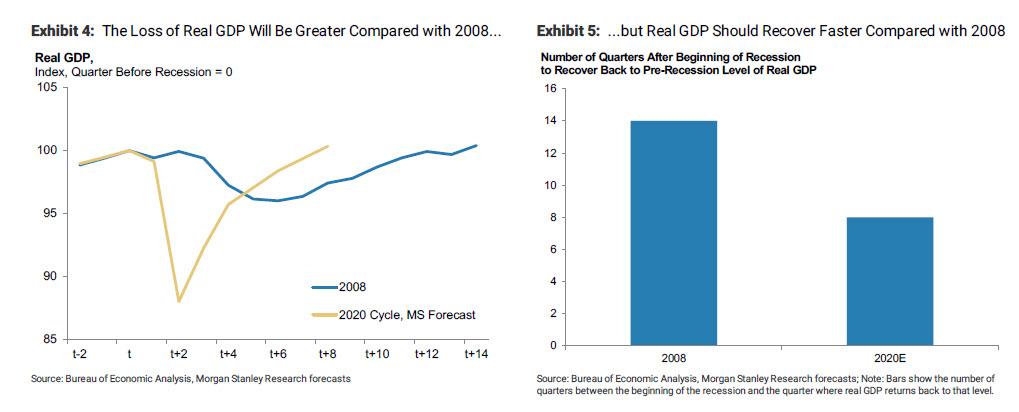

… but more importantly, it killed the still lingering idea of a V-shaped recovery for good, warning that the level of real activity in its forecasts remains below its 4Q19 level until the end of 2021: a sharper loss of real GDP compared with the 2008 recession.

So if the economy will take at least 18 months – in a best case – to get back to normal, what does that leave for that 1st derivative of the broader economy, namely corporate profits.

The answer, according to a new report from Goldman’s Peter Oppenheimer, is that it would take roughly 4 years for earnings to get back to where they were at the start of the year.

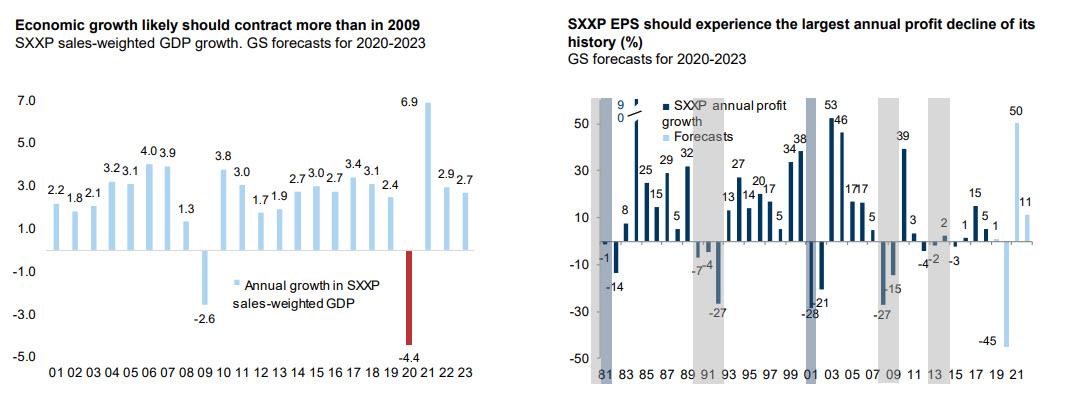

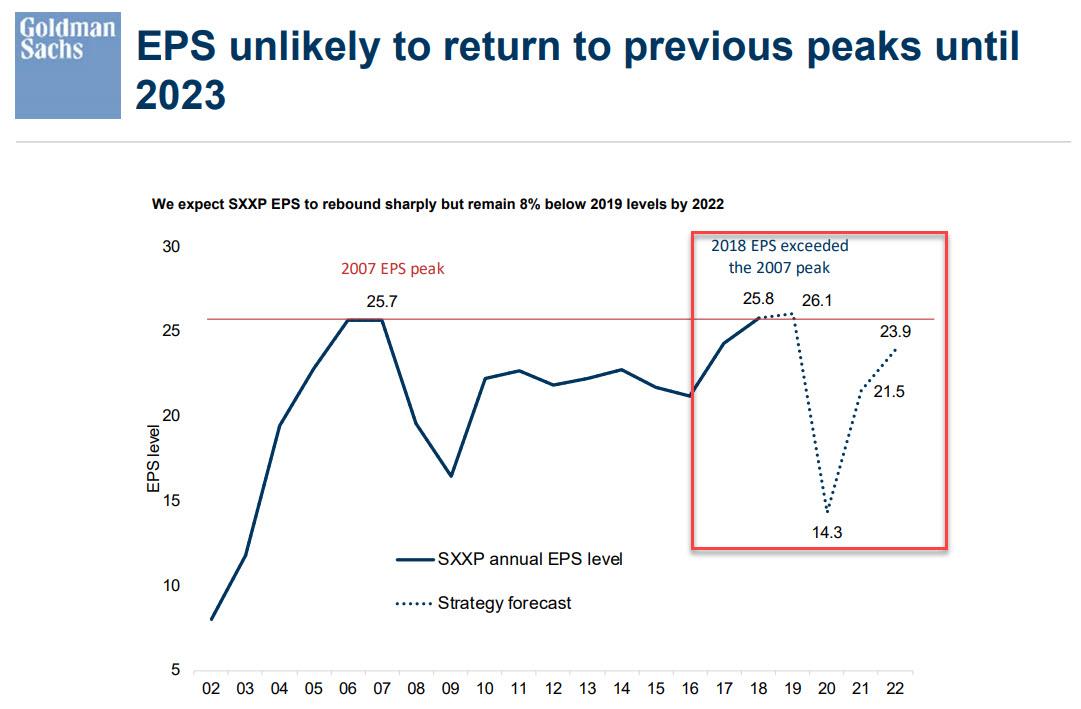

First, the Goldman strategist lays out the bank’s forecast for SXXP EPS for 2020 through 2022, which shows a cataclysmic plunge this year, when nearly half of corporate profits are wiped out, which however is followed by a sharp rebound of 50% and 11% in 2021 and 2022 respectively.

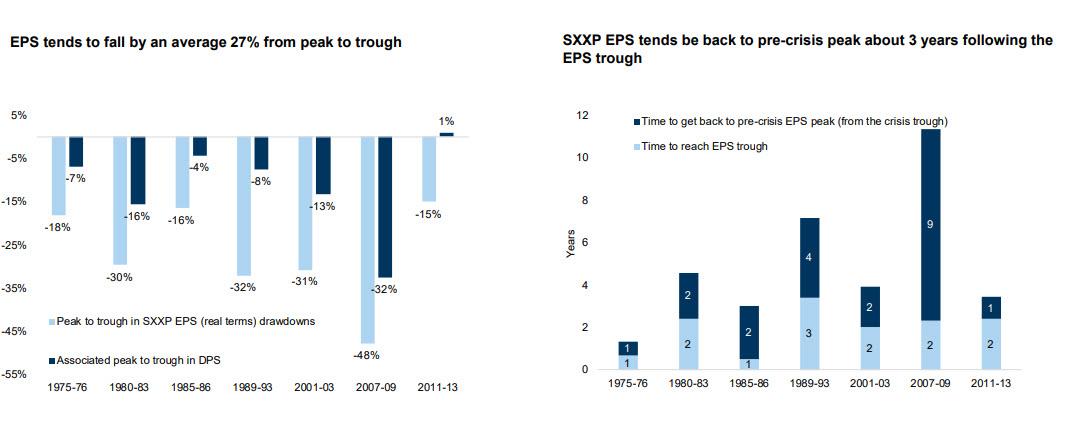

Incidentally, the 2020 contraction will be nearly twice as bad as the global financial crisis, which means that a few years in the future, we will no longer be saying “since Lehman” because “since covid” will be the new catchphrase.

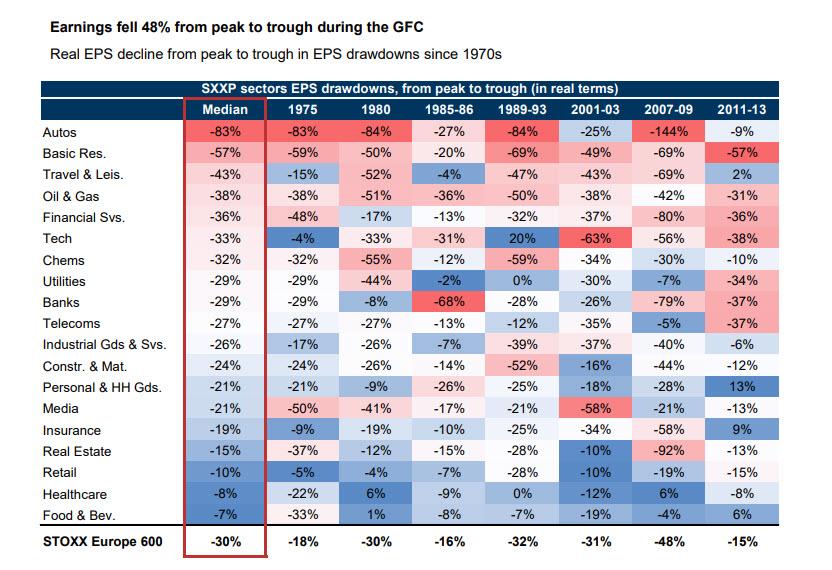

And speaking of “Lehman”, back then EPS plunged 48%, so Goldman’s 45% forecast for the current year may end up being overly optimistic.

So going back to the bank’s near-term forecasts, which a 50% rebound may sound impressive, consider that after a 50% drop one needs a 100% surge to get back to breakeven. And sure enough, even with Goldman’s aggressive optimistic outer year predictions, the collapse in 2020 means that EPS unlikely to return to previous peaks until 2023. Ironically the 2023 “recovery” EPS will be the same level that was reached all the way back in 2007. In other words, between the global financial crisis and the coronacrisis, some 15 years of earnings growth has been wiped out!

To justify it’s dismal outlook, Goldman looks at history and finds that after a crisis, it normally takes 3 years to get back to previous EPS levels.

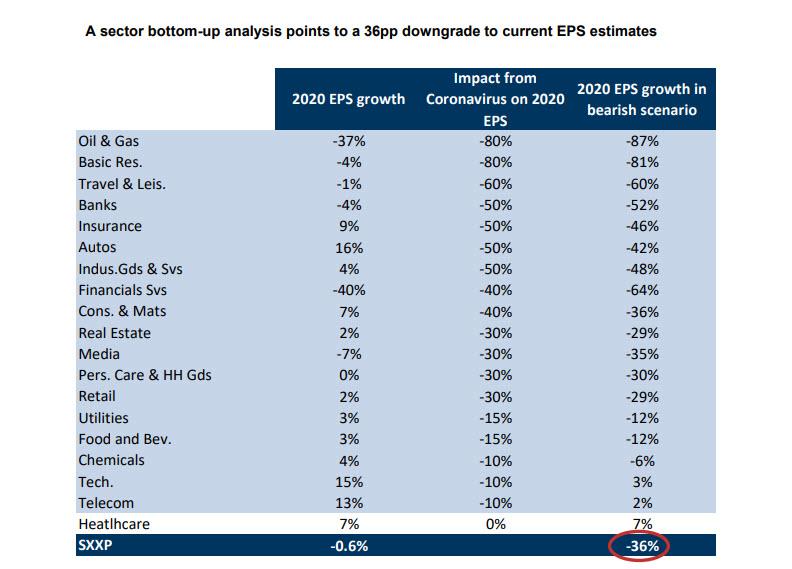

Finally here is a breakdown of which sectors will be impacted the most from the bearish coronavirus scenario.

It’s worth recalling that in 2019 earnings were essentially flat as a result of the whole trade war spat with China (remember that?), in other words, between 2018 and 2023 there will be no earnings growth.

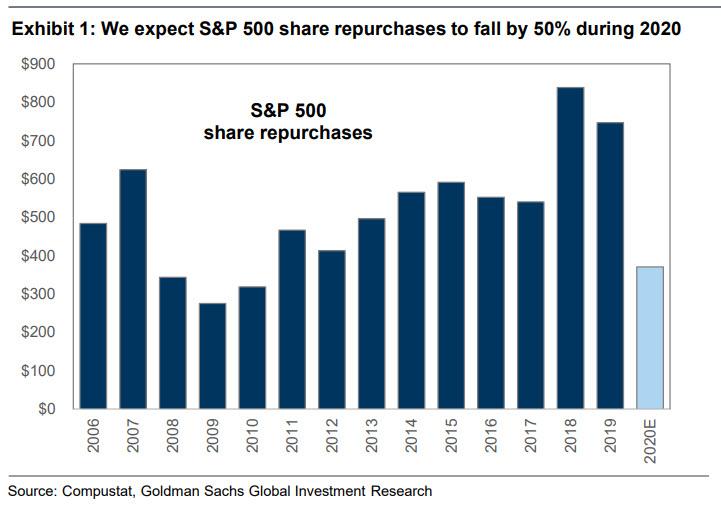

Finally, considering that Goldman now anticipates a 50% plunge in stock buybacks…

… which as Goldman’s David Kostin said “will have a significant impact on the equity market”, and suddenly any bull case forecasts for the next few years look incredibly shaky.

Tyler Durden

Sun, 04/05/2020 – 16:03

via ZeroHedge News https://ift.tt/2JDlf8d Tyler Durden