The Day The Fed Nationalized The Bond Market: The Complete Summary Of Everything The Fed Did Today

Two weeks after the Fed stunned markets by doing something not even Ben Bernanke dared to do, start buying investment grade corporate bonds, today the Fed’s nationalization of the entire bond market was complete when the Fed – with the blessing of the Treasury – threw the kitchen sink at the most vulnerable verticals of the bond market – junk bonds, munis and CLOs and… waved it in. And with that the only thing missing from the Fed’s total takeover of capital markets is equities, which the Fed will start buying after the next crash.

Until we wait here is a complete summary of everything the Fed announced this morning, when it released the details of the $2.3 trillion in loans and purchases to “support the billionaires economy”, which will consist of:

- Main Street Lending Program,

- Paycheck Protection Program Lending Facility,

- New Municipal Liquidity Facility,

- Expansion of existing primary and secondary corporate bond buying facilities.

These Fed’s loans and facilities are based on the additional capital the Treasury has made available under the CARES Act (see below). Of the total $454bn that Congress appropriated to backstop Fed facilities, this morning’s announcements commits $195bn, leaving the majority of funds available for other purposes – like stocks – or to expand these programs if necessary. That said, the programs the Fed announced this morning cover essentially all of the areas in which we have expected the Fed to act, so we do not expect the Fed to announce any further facilities for the time being.

As we explained previously, this is part of the Fed’s “Multitrillion Dollar Helicopter Credit Drop“, whereby the Treasury provides the Fed with $454 billion set aside in the passed $2.2 trillion aid package for Treasury to backstop lending by the Fed. The Treasury’s contribution, can be thought of as “equity” — that is, Treasury will stand in a “first loss” position on every loan made to corporate America.

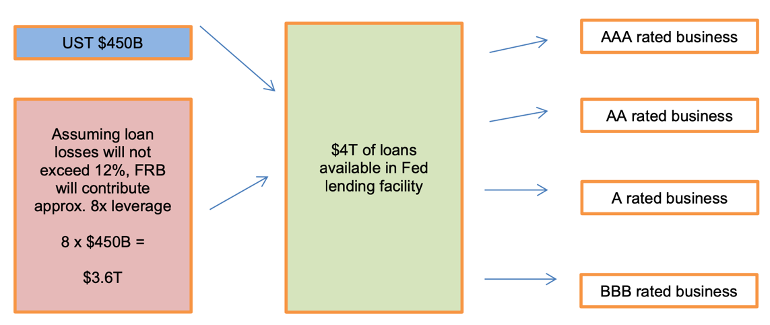

The Fed then contributes the “leverage” — the money that will help make loans using the Treasury’s equity and be levered 10-to-1. Such leverage assumes no more than 10% capital losses (on “AAA-rated” paper), as the Fed is not allowed to be impaired. Of course, in a real crash the losses will be far greater but we’ll cross that particular bailout of the bailout when we get to it. The loan fund, now levered up ten-fold thanks to the Fed’s own $4.1 trillion, will then make loans to businesses.

“Effectively one dollar of loss absorption of backstop from Treasury is enough to support $10 worth of loans.” Fed Chair Powell said in in a rare nationally-televised interview two weeks ago. “When it comes to this lending we’re not going to run out of ammunition” and he is right – the Fed can apply any leverage it wants; after all the value of the collateral it lends against is whatever the Fed decides!

Visually, the magic of the Fed’s 10x leverage looks as follows:

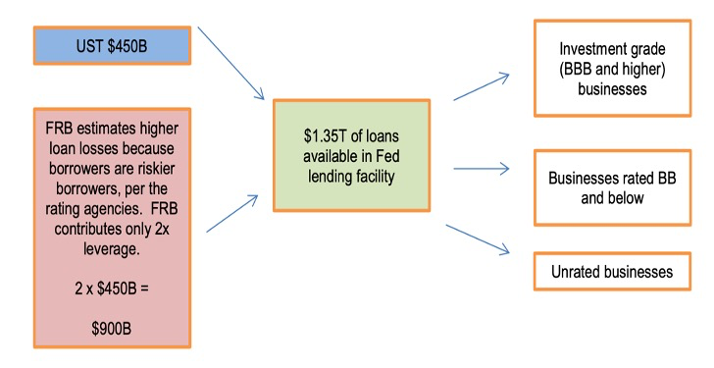

The overall size of the Fed-Treasury loan fund depends on how much Fed money will be supplied for every dollar of “equity” the Treasury contributes.

In theory, the answer is a function of what is called the “credit box.” If the loan program makes loans only to investment grade companies (those rated BBB or higher), the Fed will contribute more capital than if the loan program makes loans to companies with lower credit ratings or no ratings at all. In other existing Fed loan programs, the Fed supplies about $9 for every $1 of Treasury capital, but in those programs the loans are secured by extremely high-quality collateral (often AAA).

In practice, the Fed – which can “print” an infinite amount of dollars in exchange for any “collateral” including baseball cards, donkey turds, used condoms or oxygen – can lever up 20x, 50x, even 100x or more with zero.

* * *

Ninety minutes after the new policies were announced, Powell spoke in a webinar through Brookings. He reiterated the Fed’s commitment to provide liquidity to the financial system and goal of getting credit to flow through the economy. “The Fed has been swift to adjust the facilities – and introduce new ones – in response to market signals” as Bank of America put it.

Powell also hinted that stocks are next, when he said that the Fed “won’t hesitate” to move into other areas of the markets or adjust the current programs, as needed. Powell also emphasized that the principal focus is on the lending programs and the Fed is not mulling changes to standard monetary policy for at least a couple of months.

The slate of programs announced today was immediately seen as positive for credit & muni markets, if somewhat limited in scope.

- On credit, actions today are positive for the HY market given the Fed’s willingness to purchase “fallen angels” and allow for credit ETF buying that is focused on HY (but at a 7:1 leverage ratio); the Fed’s actions drove the largest point increase in HYG since ’08.

- On munis, the Fed’s actions lowered muni rates and improved confidence in both primary & secondary markets even if they fall short of the calls for more direct intervention, with some urging direct aid to replace lost revenues.

- On ABS, the TALF inclusion of AAA rated tranches of outstanding CMBS & newly issued CLOs is helpful but including all outstanding & new issue paper + lowering the pricing “would have been more useful” said one BofA ABS strategist who was a holder of non-AAA rated tranches .

Overall today’s Fed actions were supportive of credit, munis, ABS & other risk assets, especially in the context of MSLF & PPPLF programs, and helped boost stocks sharply higher as equities now remain the only part of the cap structure that is not explicitly controlled by the Fed.

Updates to Fed facilities (via BofA):

Main Street Lending Program

- Fed will buy 95%, eligible lender will retain 5%, recourse loan up to 4 years.

- Total size: $600bn. Treasury will back it with $75bn

- Eligible borrowers: up to 10K employees or up to $2.5bn in 2019 revenues

- Loan specifics: 4 years, adjustable rate of SOFR + 250-400bp. Minimum loan size of $1 million and maximum the lesser of $150mn or figures derived from outstanding debt levels.

- There are a number of requirements of how to use the loan most of which focus on not using these funds repay other loan balances. The borrower also has to make “reasonable” efforts to maintain its payroll and employees and agree to limits on compensation and stock repurchases.

- On timing, the program has not yet been finalized and comments are able to be received until Apr 16.

Municipal liquidity facility

- Fed will establish a Special Purpose Vehicle (SPV) to purchase municipal notes directly from eligible issuers

- Eligible issuers: US states and the District of Columbia, US cities with population over 1mn and US counties with population over 2mn.

- Eligible collateral: TANs (Tax anticipation notes) TRANs (tax and revenue anticipation notes) and BANs (bond anticipation notes) with less than 2 years of maturity

- Max amount the SPV can purchase is capped at 20% of the issuer’s fiscal year 2017 general revenue and its utility revenue.

- Pricing of the purchase will be based on the issuer’s bond rating (the Fed plans to release more details later) and an origination fee of 10bp of the principal amount must be paid to participate in the facility.

- Total size: Facility is being funded initially by $35bn from the Treasury using funds from the Exchange Stabilization Fund (ESF) and the SPV can purchase up to $500bn. As it stands, the SPV will terminate on September 30, 2020.

PPPLF (Paycheck Protection Program Lending Facility)

- Facility established to lend to small businesses under the Paycheck Protection Program (PPP) of the CARES act, taking PPP as collateral and with no recourse to borrower

- Eligible borrowers: Depository institutions that originate PPP loans, likely to be expanded to other lenders that originate PPP loans.

- Rate and Fees: A rate of 35bps applied only to extensions of credit under the facility with no fees

- Maturity date: Credit extended by Fed will have a maturity date equal to the PPP loan but maturity date will be accelerated if underlying PPP Loan goes into default and the eligible borrower sells the PPP Loan to the SBA to realize on the SBA guarantee.

- Regulatory capital treatment: PPP loan assigned a risk weight of 0%, and PPP loans financed by this facility can be neutralized by banking organizations for leverage capital ratios.

TALF (Term Asset-Backed Securities Loan Facility)

- Eligible collateral expanded to AAA CMBS and newly issued collateralized loan obligations. Size of facility remains $100bn. Only static CLOs will be eligible. Single-asset single-borrower CMBS and commercial real estate CLOs will not be eligible.

PMCCF & SMCCF

- Expanded facilities to a combined total of $750bn in size. Treasury invested $50bn to PMCFF and $25bn to SMCFF. Purchases from single issuer capped at 1.5% of total facility size. Excludes issuers who received direct fiscal support from previous and upcoming stimulus bills

PMCFF (Primary Market Corporate Credit Facility)

- Eligible issuers must be rated at least BBB-/Baa3 as of March 22, 2020. May purchase corporate bonds as sole investor in issuance. May purchase no more than 25% of syndicated loan or bond at issuance. Corp bonds & loans levered 10 to 1, other assets levered 7 to 1.

SMCFF (Secondary Market Corporate Credit Facility)

- Eligible issuers must be rated at least BBB-/Baa3 as of March 22, 2020. If downgraded after March 22, rating must be at least BB-/Ba3 on date that the facility purchases the issuance. ETF purchases will be aimed at providing exposure to the US IG credit sector with remainder for ETFs that provide exposure to the US HY credit sector. IG purchases levered 10 to 1 and HY purchases levered 7 to 1. Other assets levered in 3:1 to 7:1 range depending on risk.

Support for the Paycheck Protection Program

- The Fed also announced details of the new Paycheck Protection Program Lending Facility. Depository institutions that originate PPP loans are eligible to borrow from the Fed with the PPP loans – which are guaranteed by the SBA – as collateral. They will be funded at 35bp, essentially serving as a discount window for PPP loans. The loans will remain on bank balance sheet but will not consumer capital – assigned a risk weight of zero percent under the risk-based capital rules. .

- What is the difference between the support from the PPPLF and the MSLF? The MSLF applies to generic bank lending as long as loans meet the criteria: maturity, pricing, size, etc, and the borrower meets criteria such as number of employees and 2019 revenue size. The Fed will buy these types of loans which frees up capital for banks to extend more credit and increase lending. The PPPLF works to free up bank balance sheets for those that are participating in the new PPP program via the SBA through the CARES Act.

Looking ahead, banks continue to anticipate additional tweaks to existing programs such as lower the rate on MMLF & CPFF programs to lower term LIBOR. After all, the Fed used up only about 40% ($195BN) of the as much as $454 billion in seed capital that Congress provided it to “bail out the economy”. That leaves roughly $250 billion it could potentially lever up as much as ten times to bulk up existing programs or buy other assets. And with the Fed now all in, this creeping nationalization of capital markets – which is almost over – will end when the Fed starts buying stocks, both single name and ETFs as well as all cash and futures products. That’s when one can officially ad “SR” to the “US”.

Tyler Durden

Thu, 04/09/2020 – 18:20

via ZeroHedge News https://ift.tt/34nKLI9 Tyler Durden