When Work Is Punished: Did The ‘Generous’ CARES Act Just Guarantee High Unemployment Is Here To Stay?

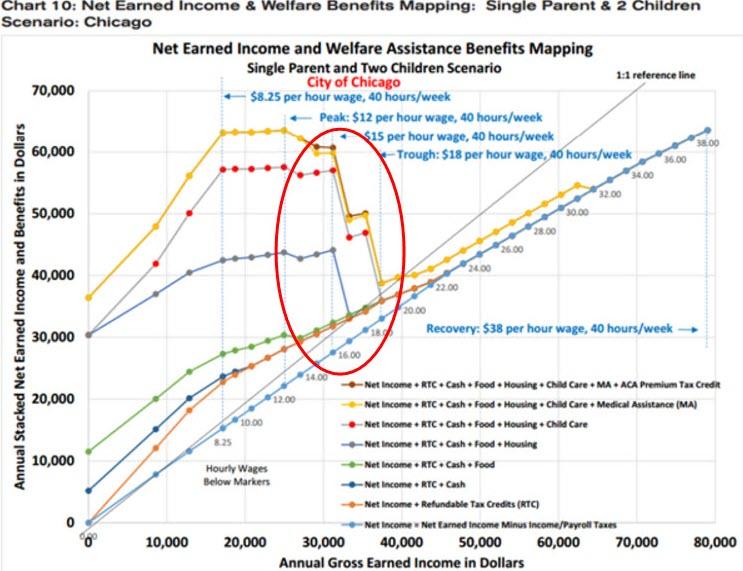

A number of years ago, we first introduced the topic of a ‘welfare cliff’ at which more work was punished – i.e. the ‘generosity’ of the package of welfare benefits creates a perverse incentive not to work any harder…

As we wrote at the time, one of the tragedies of America today is that so many adults of sound mind and body do not support themselves and their families. It’s a tragedy not because they suffer material want; indeed, relatively few suffer so, because government assistance satisfies many of their material needs.

It’s tragic because one of the keys to human happiness is earned self-respect, which requires, as Charles Murray has written, making one’s own way in the world. The vast majority of poor people don’t want welfare; they don’t want handouts; they want a good job with which they can support themselves and their families comfortably.

The tragedy of the American welfare system is that it traps so many people in dependency on government, by hindering them from getting on and climbing up the job ladder, and thereby earning self-respect and happiness.

* * *

Our fear now, confirmed by excellent research from Kathy Morris & Chris Kolmar at Zippia.com, is that the ‘generosity’ of the CARES Act (and the fact that politicians are loathed to remove any policy that could possibly make their voters upset) has the potential to create an entire new generation of welfare serfs, subsisting on significant welfare benefits with no incentive to ‘get back to work’, even after the lockdowns are lifted.

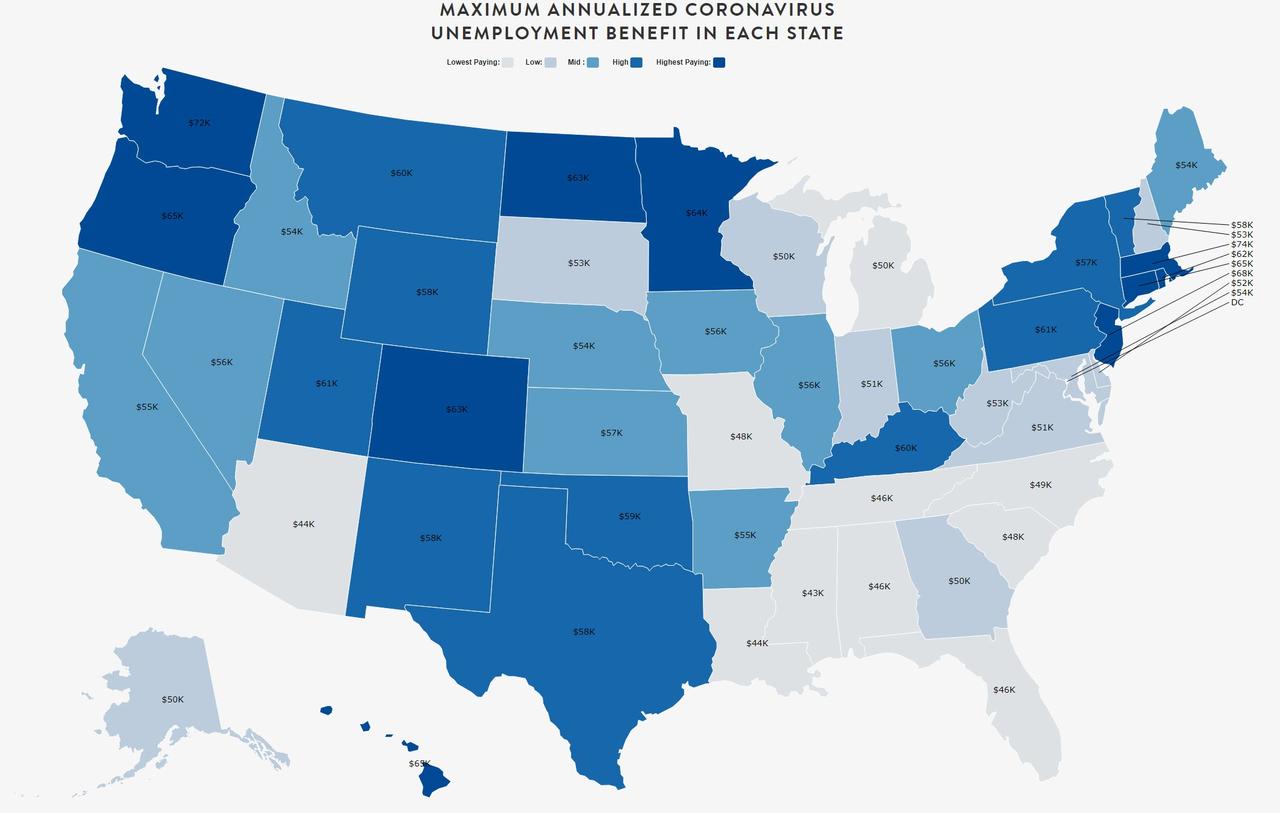

So, detailed below from Morris and Kolmar, is the maximum, annualized salary you can expect under the new Coronavirus unemployment benefit in each state.

The past month has seen a record breaking surge in unemployment. Millions of American workers have unexpectedly lost their jobs in an uncertain job market where many businesses are shut down.

Understandably, the newly unemployed masses have turned to unemployment to help scrape by. Fortunately, the new coronavirus stimulus package has provisions to help the unemployed during this difficult time.

Under the CARES Act, Americans laid off due to the coronavirus receive an additional $600 a week for the next four months, ending July 31st or upon employment. In addition, the unemployment window has been increased in each state by 13 weeks.

No doubt, the passage of the stimulus has many laid off workers breathing a sigh of relief.

However, many still working may be frustrated to realize their weekly paycheck is less than they would receive in unemployment.

We hit the data to determine how much unemployed workers can expect to receive under the stimulus — and the amount in each state where you would make more money not working at all.

HOW WE DETERMINED UNEMPLOYMENT UNDER THE STIMULUS

Each state has its own complex, intricate (sometimes unnecessarily so) unemployment laws. Typically, they amount to around .09-1.1% a week of your annual salary, up to the weekly maximum.

Some states have special clauses for dependents we included in the calculator. Often this additional cash is pretty low. If you have one kid in Michigan, for example, you receive an extra $6 a week.

In addition to slogging through each state’s unemployment policies to determine each state’s unemployment pay outs, we added the $600 a week included in the new stimulus package.

Depending on the distribution of your quarterly pay, the results may vary from your actual unemployment. However, this number is a good indicator of what you can expect.

To determine the salary threshold in each state where workers would make more on unemployment we simply took the state’s weekly max and added the new $600 stipend to find the annual salary that exceeds the unemployment pay out.

THE SALARY IN EACH STATE WHERE YOU’D MAKE MORE ON UNEMPLOYMENT

While many have speculated on the number of minimum wage workers who would be better off financially working for minimum wage, the number of skilled workers has been underestimated. For example, Massachusetts generous unemployment policies combined with the stimulus means all workers making under $73,996 would receive more a week unemployed than they do from working.

Many of these salaries outstrip the state’s median income, meaning the majority of workers would receive more from an unemployment check than a paycheck.

Of course, no one will be receiving unemployment benefits for a year (no state’s unemployment duration goes past 39 weeks) and many displaced workers are no doubt eager to secure a new job. It is also important to point out that the extra $600 a month only lasts until July 31st. After these four months, the unemployed will be back to receiving only what the state provides — about 50% of their previous pay- and be faced with trying to find employment in a rough job market.

These numbers do also not take into account benefits, including health insurance which is usually procured through your employer at a much cheaper rate than employees can get on the market. I think we can all agree a pandemic is a pretty bad time to be uninsured.

UNEMPLOYMENT DURATION CHANGES

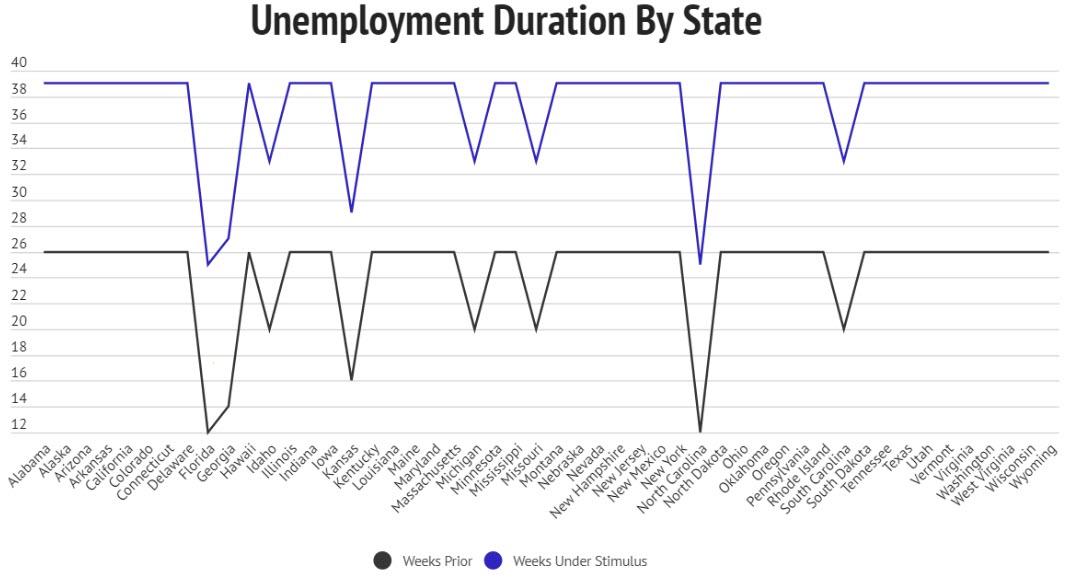

Another side effect of the coronavirus stimulus bill is the increase in the period of time people are able to draw unemployment benefits.

Similar to unemployment benefits, each state sets their own cap on how long the unemployed can draw checks. Prior to the stimulus bill, generous states had a cap of 26 weeks, or 6.5 months. Less generous states such as Florida or North Carolina only allotted 12 weeks.

The stimulus bill increased the unemployment period by adding 13 weeks to each state’s unemployment period. Florida and North Carolina more than doubled their period of time people could draw unemployment.

Even states with the more generous 26 weeks saw an increase to 39 weeks.

SUMMARY ON UNEMPLOYMENT BENEFITS AFTER THE STIMULUS

The stimulus package made significant changes to state unemployment. For the next four months, the unemployed will receive an additional $2,400 a month. Similarly, the added 13 weeks provides people longer to find a job in a new hostile job market.

The new package does mean a good chunk of the workforce are now receiving paychecks smaller than they would on unemployment. This includes workers in essential businesses, including hospitals and super markets, who are putting themselves in harm’s way to keep society running.

For minimum wage and low wage workers the difference between what they are being paid to work and would receive on unemployment is no doubt the most crushing. Many struggle to pay their bills as is and receive no benefits to complicate the equation. While they are dodging coughs and bringing in masks from home for $10 an hour, others who made the same money are now being paid to sit safely at home.

While the situation might create a temporary imbalance, it is important to remember the unemployment boost will end July 31st. Unemployment checks will be back down to the state level, an amount many struggle to exist on. We do not know how long many of these unemployed workers will struggle to find jobs or what shape the economy will be in August.

* * *

Welfare cliffs are of course not the only reason so many capable Americans languish in partial dependency on government assistance. Dreadful government schools in poor areas and systematic obstacles to getting a job, such as minimum wage laws and occupational licensing laws, are also to blame. But the perverse incentives of America’s welfare system really hurt, and the CARES Act may have been a serious tipping point.

Tyler Durden

Thu, 04/09/2020 – 09:55

via ZeroHedge News https://ift.tt/2UW0ACM Tyler Durden