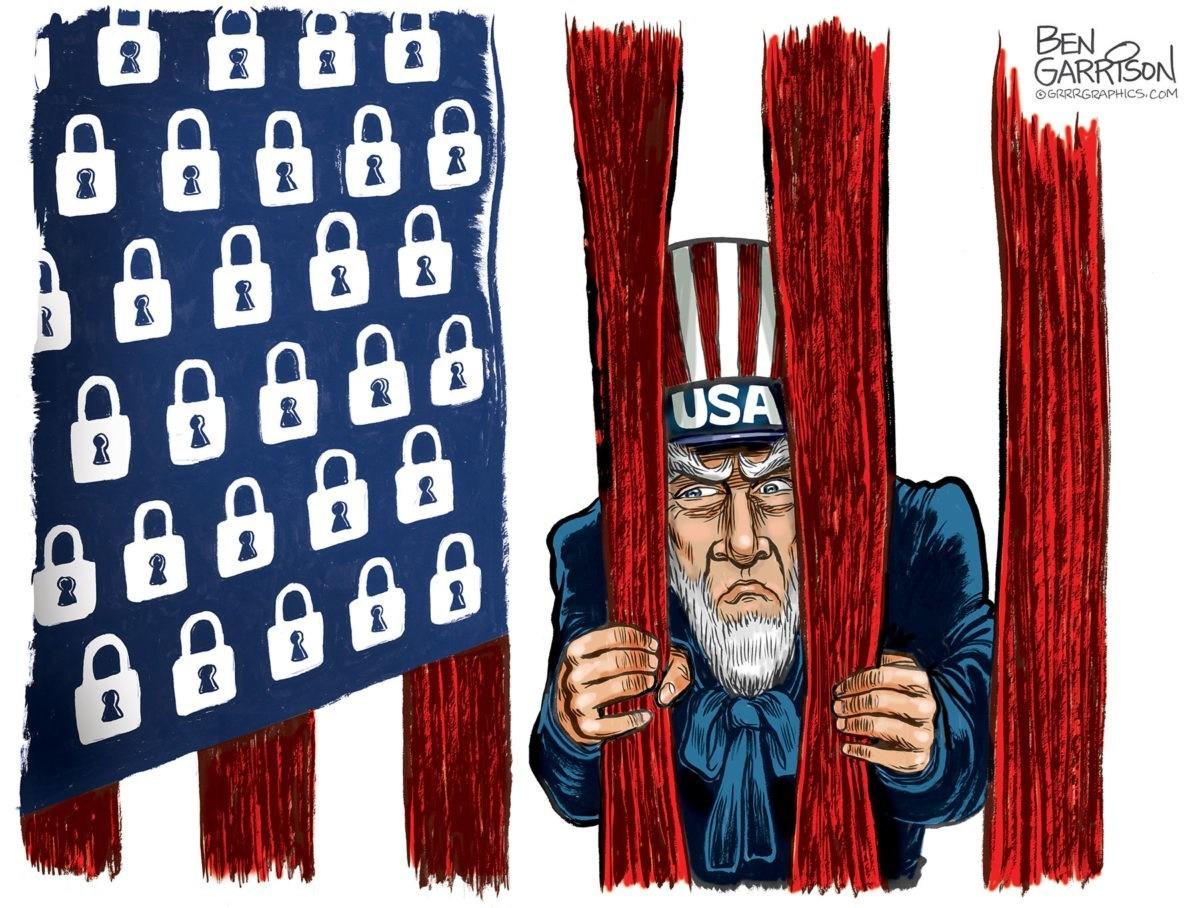

America’s In A “Twilight Zone Between Stupor & Fury”

Authored by James Howard Kunstler via Kunstler.com,

Risings and Failings

In the corkscrewing anguish of the social sequester, with careers, savings, futures, and dreams whirling down the drain, voices rise above the din of conflicting statistics to ask: what is going on here? To some, it looks like a deliberate attempt to demolish what’s left of the economy for political advantage. Clouds of suspicion gather over the two medical superstars of the Daily Briefing show, Doctors Fauci and Birx, as they somewhat sheepishly revise their numbers for contagion and death downward and attempt to “balance” the formula of modeled projections versus mitigation efforts. Was the stay-at-home panic necessary, after all? Will it save the day or kill off modern life as we knew it?

Well, everyplace else in the world was shutting down, weren’t they? Did they all go off their rockers, too? At least a hundred doctors died in Italy heroically tending the stricken, so they say. South Korea, Taiwan, and Singapore opted for flat-out medical Gestapo action. Britain, Spain, France, and Germany about the same, but minus testing at the grand scale and tracing of contacts. Honestly, how is it possible the whole planet punked itself?

I certainly don’t know the answer to all this, though readers are twanging on me to declare the whole Covid-19 story “a hoax,” which I’m not ready to do. I do know this: America has become utterly intolerant of uncertainty. And in the absence of certainty, that age-old human cognitive skill called pattern recognition, which has made us such a successful species, kicks into high gear scanning the field-of-view for answers. Any string-of-dots that affords even the slimmest plausibility goes on the table for review, including a lot of stories tagged as “conspiracy theories.”

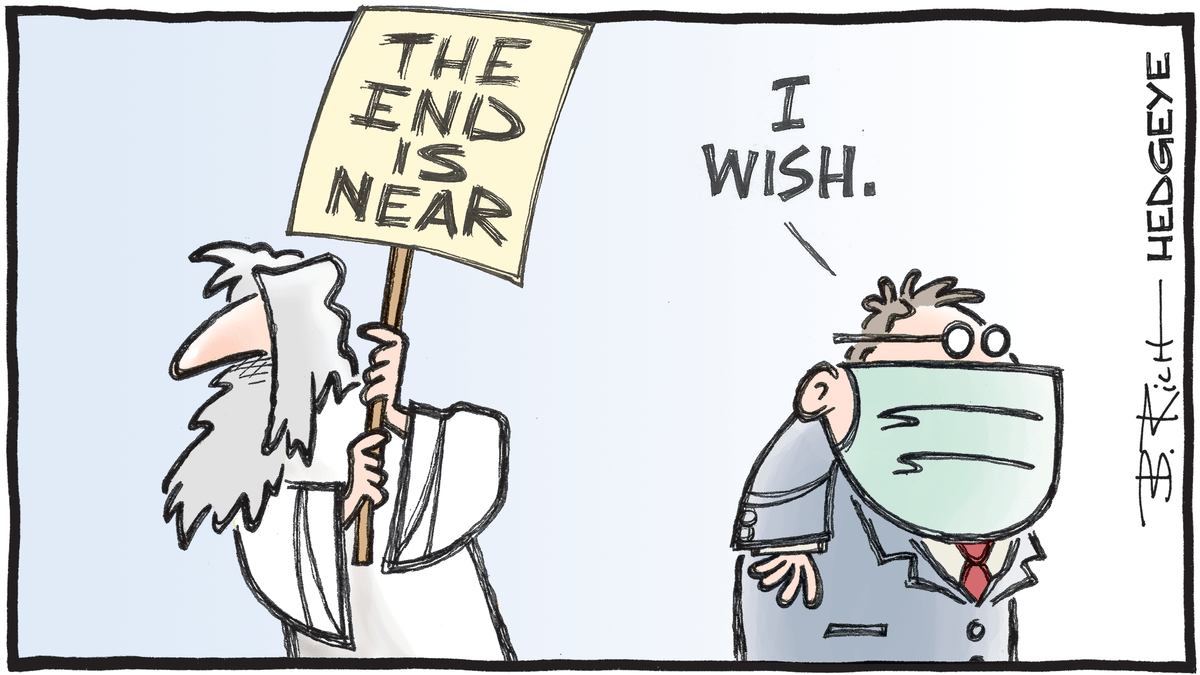

I know this, too: the financial side of the gasping global economy was running off the rails well before Covid-19 flew out of its bat-cave into somebody’s soup bowl… or out of China’s Wuhan virus lab, if that’s how you like it… or before it seeped out of the Bill and Melinda Gates Foundation’s ark of world-saving secrets.

In the USA and Europe, finance had come to mostly eclipse every other human endeavor of wealth production – with the catch that finance actually didn’t produce any real wealth, it only winkled and swindled wealth (or the mere ghosts of wealth) with its asset-stripping magic, from the places where wealth once did truly dwell. Or else it ginned up abstruse rackets that attempted to replace the utility of money with sheer math. Or, when all else failed, it just resorted to plain old accounting fraud… until, finally, there was so much there not actually there, that the whole holographic fantasy flickered out.

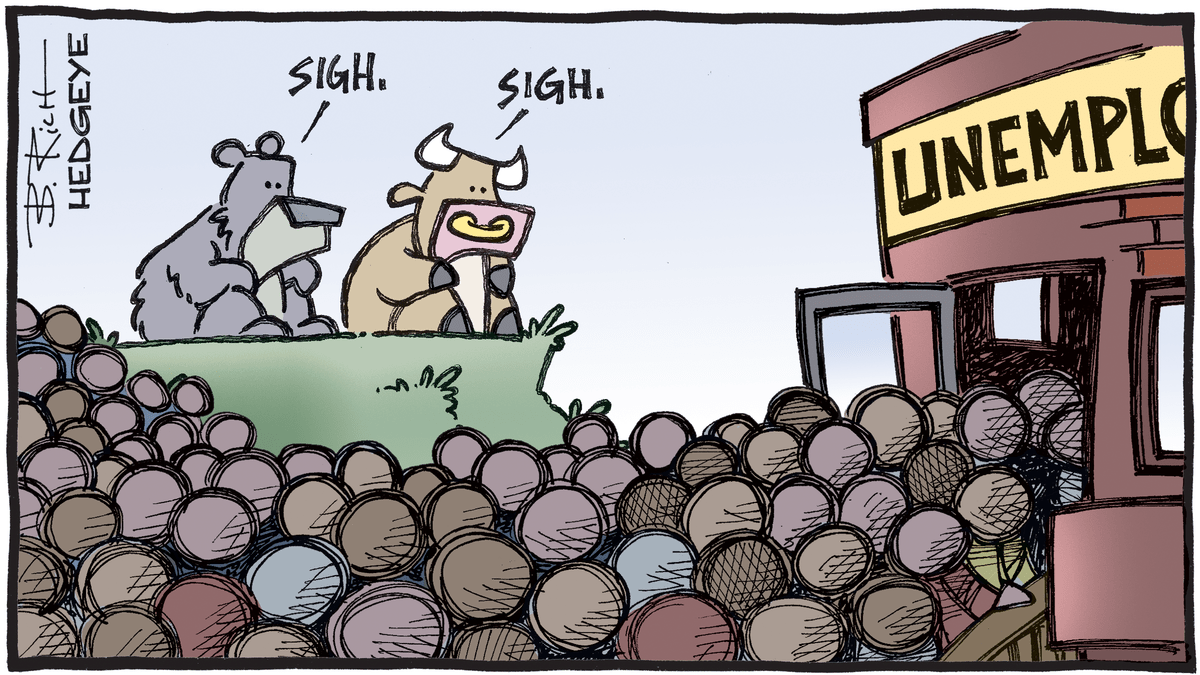

The pre-Easter bear market rally on Wall Street has been a wonder, don’t you think? As the numbers of able-bodied people out-of-work rocketed up past ten million during the same period, the stock indexes shot up three, five, six percent a day? Say, what? You’re telling me that’s based on the prospect of magnificent earnings in the third quarter? With every business on God’s green earth writhing in the dust like squashed bugs? And every supply line for basic goods and the gazillion spare parts for everything… all choked off?

And meanwhile, the American public sequesters and festers, waiting for those $1,200 checks that will fix… everything! Let’s face it: this is a twilight zone between stupor and fury.

Nobody is paying anything to anyone.

All obligations are suspended: rents, mortgages, bills, loans, bets, and vigs, all up in the air somewhere, but definitely not moving to their assigned destinations. The velocity of money is zero and all the various new term facilities and structured vehicles conjured by the Federal Reserve and Congress amount to a mere shadow of money moving – even though they are represented by trillions of brand-new alleged dollars. For every ten points that the Standard & Poor’s rose this week, somewhere down the line as many hedge funders will be dribbled like so many basketballs to the hoop of judgment.

The nation now has the long Easter weekend to stew and ruminate over its fate with spring achingly vivid and beckoning beyond the grim, streaked windows of sequestering. Those little cans of Easter Spam with pineapple rings won’t offer much consolation, combined with the abject discovery that even Netflix only has so many sequels to Frozen for children going catatonic with ennui. Kids are generally not so excited by stock and bond markets, but that’s probably where the genuine melodrama picks up on Monday. The weeks ahead there will give the phrase down-to-earth a whole new meaning.

Tyler Durden

Fri, 04/10/2020 – 12:05

via ZeroHedge News https://ift.tt/2xjrcEE Tyler Durden