Gold Jumps As Stocks & Oil Dump From Exuberant Open

After the best week in decades for stocks…

Consumer sentiment just suffered the largest single-month decline on record as Americans became increasingly rattled by thousands of business closings and millions of layoffs across the country. Not only did the University of Michigan’s main gauge of confidence take a big hit from the swift reversal of fortunes, but so did a measure of buying conditions. The share of respondents who said times were “good” plunged in April to the lowest level since May 1980… despite the biggest surge in The Fed Balance Sheet ever…

Source: Bloomberg

What a let-down!

The message from the markets for “interventionists” is clear…

A “historic” OPEC+ deal utterly failed to inspire…

And The Fed’s “unprecedented” action from Thursday has now been completely erased from The Dow’s memory…

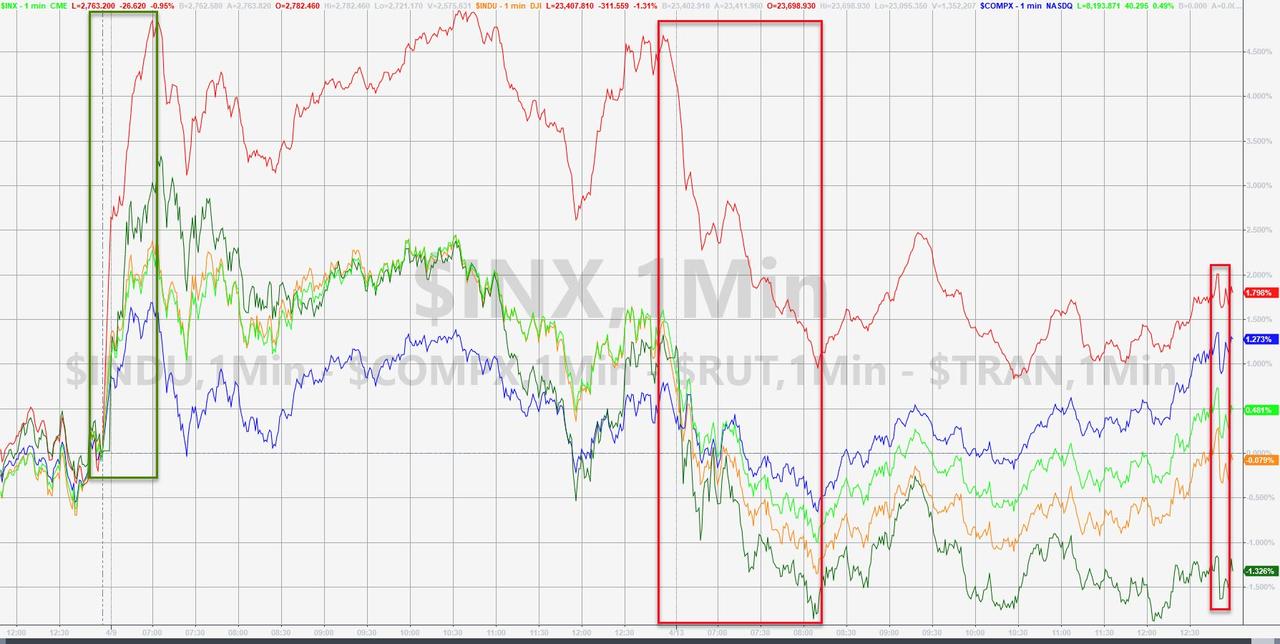

Nasdaq And Small Caps managed to hold on to gains, Trannies and The Dow were worst… a late-day liftathon helped rescue some of the gains but the last few minutes saw an ugly hit…

Nasdaq was the only major index to close the day green, Small Caps were ugly…

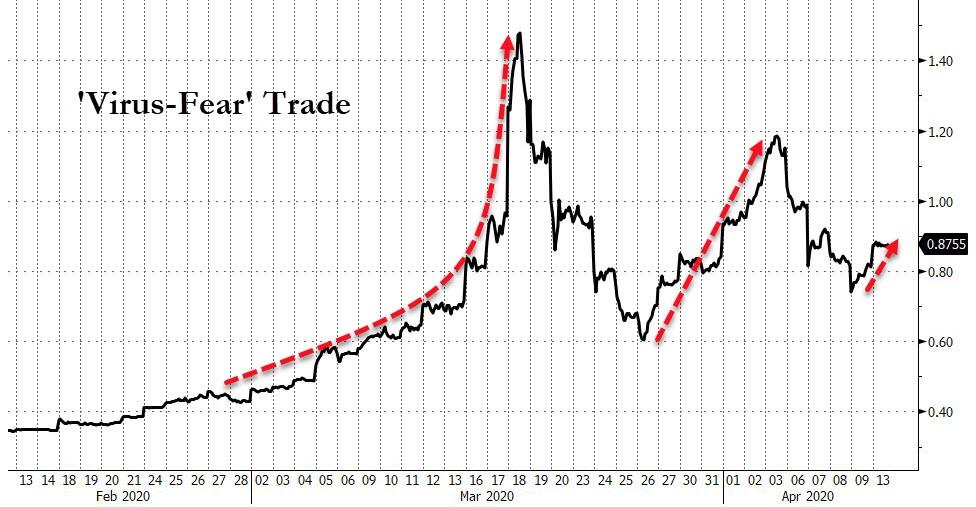

Virus-Fear was resurrected today…

Source: Bloomberg

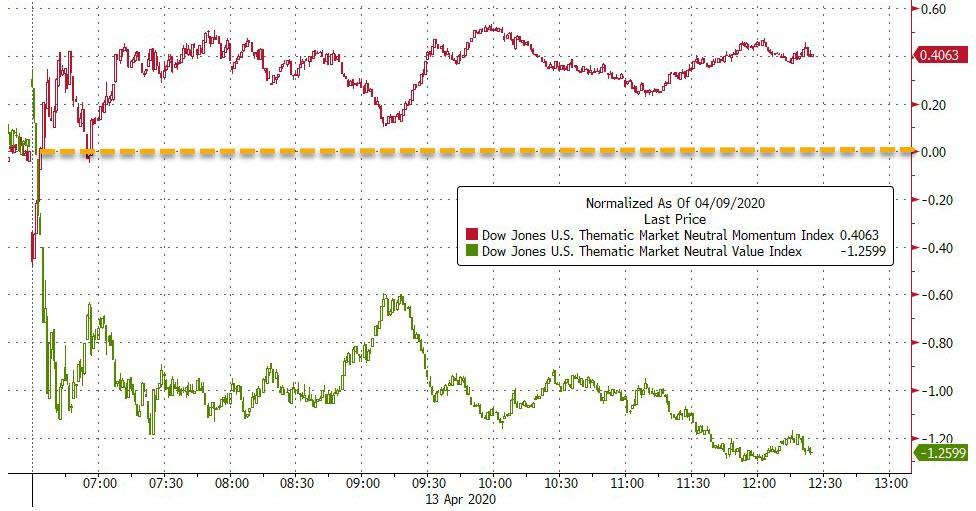

Notable plunge in ‘value’ factor today…

Source: Bloomberg

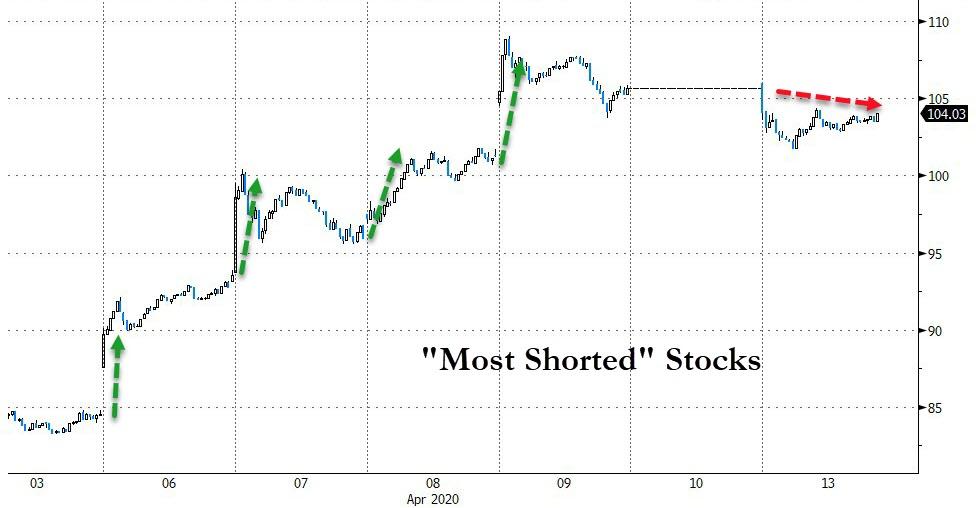

Last week was the biggest weekly short squeeze ever and so it is perhaps not a total surprise that the rampers ran out of ammo…

Source: Bloomberg

Even Fed-Sponsored junk debt fell further today…

Treasury yields rose today, steepening with the long-end up 4-5bps, short-end up 1-2bps…(NOTE – bonds were bid into the EU close)…

Source: Bloomberg

Gold prices surged to new cycle highs…

And the decoupling between London spot (physical) and COMEX futures continues…

Source: Bloomberg

Copper outperformed on the day while silver ended lower…

Source: Bloomberg

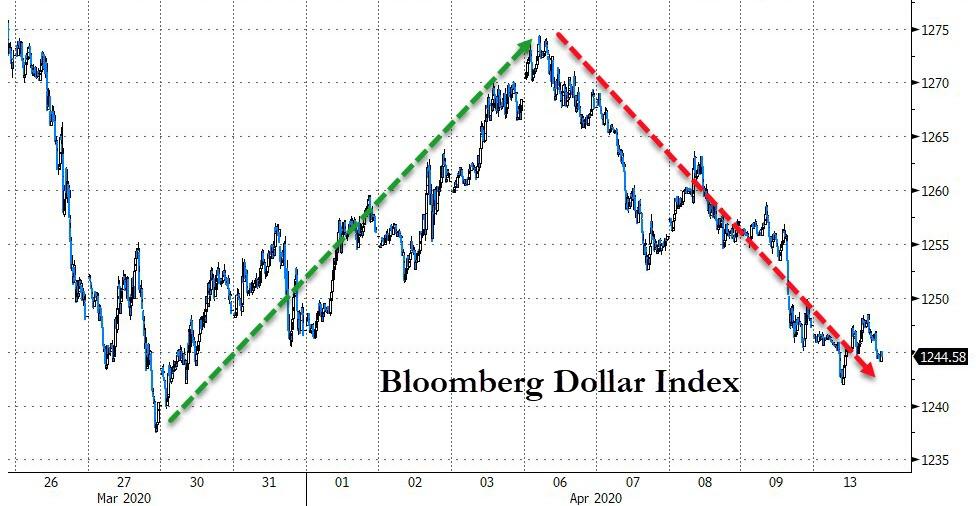

The dollar ended lower for the 5th day in a row…

Source: Bloomberg

Cryptos took a dive overnight…

Source: Bloomberg

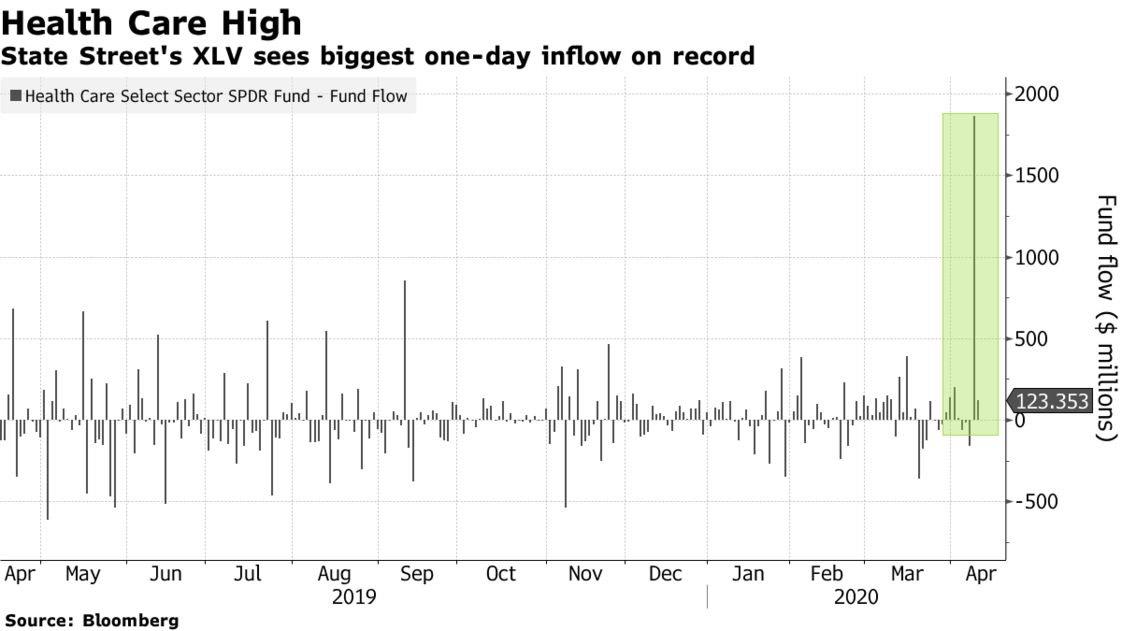

Finally, we return full-circle to the start of today’s wrap. Bloomberg notes that as stocks posted their biggest weekly gain since 1974, skeptical Wall Street veterans shook their heads in amazement. But exchange-traded fund investors did what they always do – they piled in.

Source: Bloomberg

In only seven trading days this month, equity ETFs took in more than $16.5 billion, according to data compiled by Bloomberg. The torrid pace puts inflows on track to exceed the monthly total of $42.5 billion in December, when stocks rallied during what ended up being the tail end of an 11-year bull market.

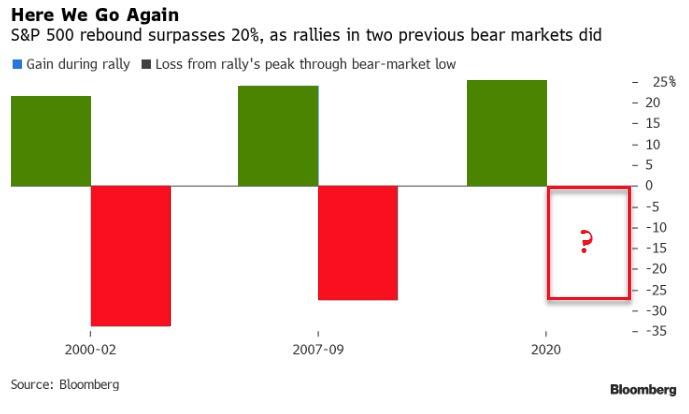

And, as Bloomberg details, assuming a bear market in U.S. stocks has ended because the S&P 500 Index has rallied 25% from its March low, a milestone reached Thursday, flies in the face of recent history. Gains of more than 20% interrupted the 2000-2002 and 2007-2009 bear markets, according to data compiled by Bloomberg.

Source: Bloomberg

The S&P 500 climbed 21% between September 2001 and January 2002, and then tumbled 34% from January’s peak before reaching a low nine months later. There was a 24% advance between November 2008 and January 2009, followed by a two-month drop of 28%. LPL Financial looked at bear-market rallies in a report last week.

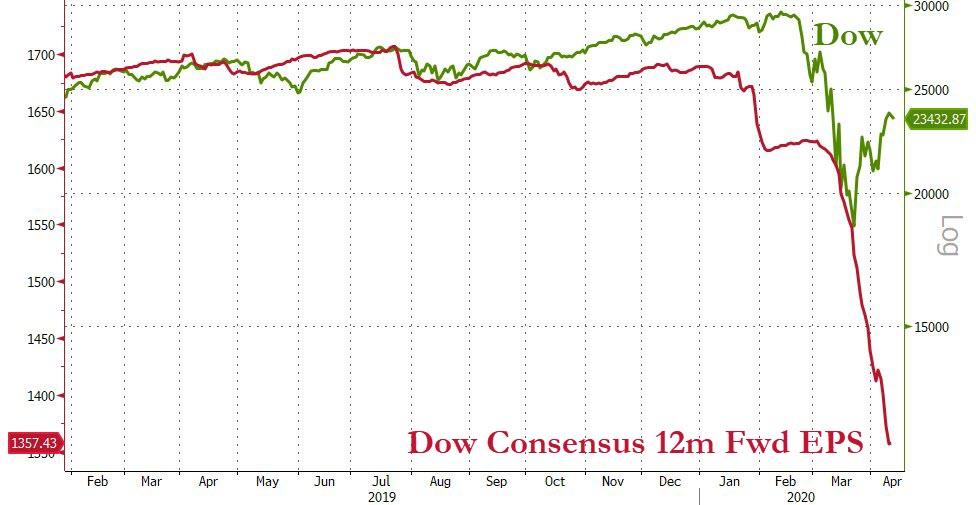

And don’t forget earnings start tomorrow with the big banks…“We’re in for a tough year,” said Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America Corp. in a Bloomberg Television interview. Earnings are going to be down “by about 30%,” she added.

Source: Bloomberg

Tyler Durden

Mon, 04/13/2020 – 16:00

via ZeroHedge News https://ift.tt/3ejOOK0 Tyler Durden