Timing The “Crossover Point”: The Fed Will Soon Monetize The Entire Fiscal Stimulus Package… What Happens Then

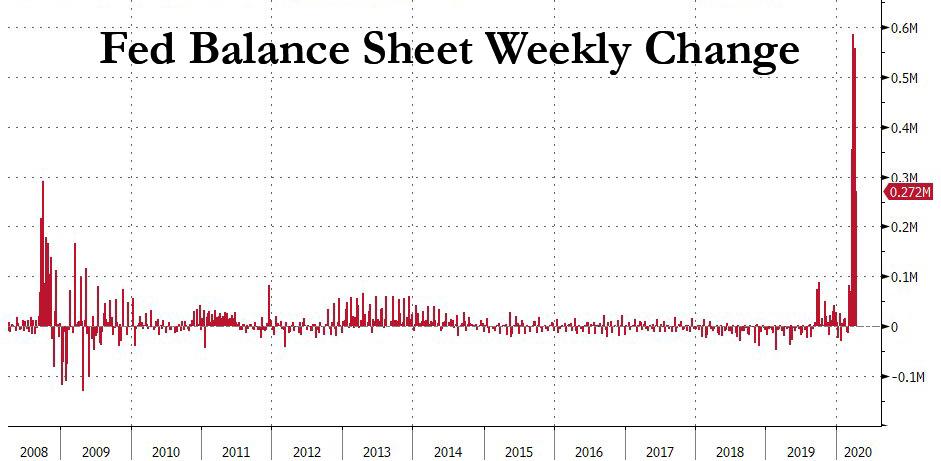

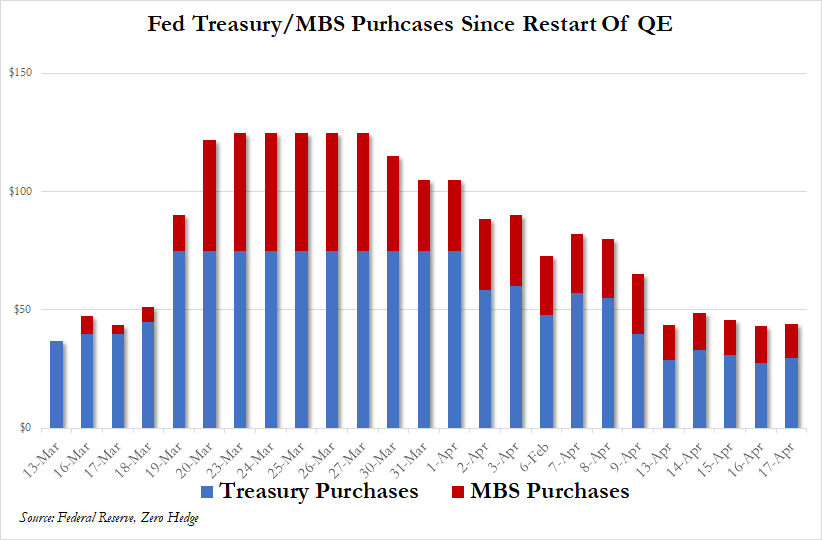

As we noted late last week, the Fed’s money printer has been going brrrr in overtime, and in the past month alone, Powell & Co. has purchased nearly $2 trillion in Treasury and MBS securities, far more than during any of the previous QE episodes (either in the first month or their entirety)…

… which together with the Fed’s POMO schedule which sees the Fed purchasing another $225BN in securities this week…

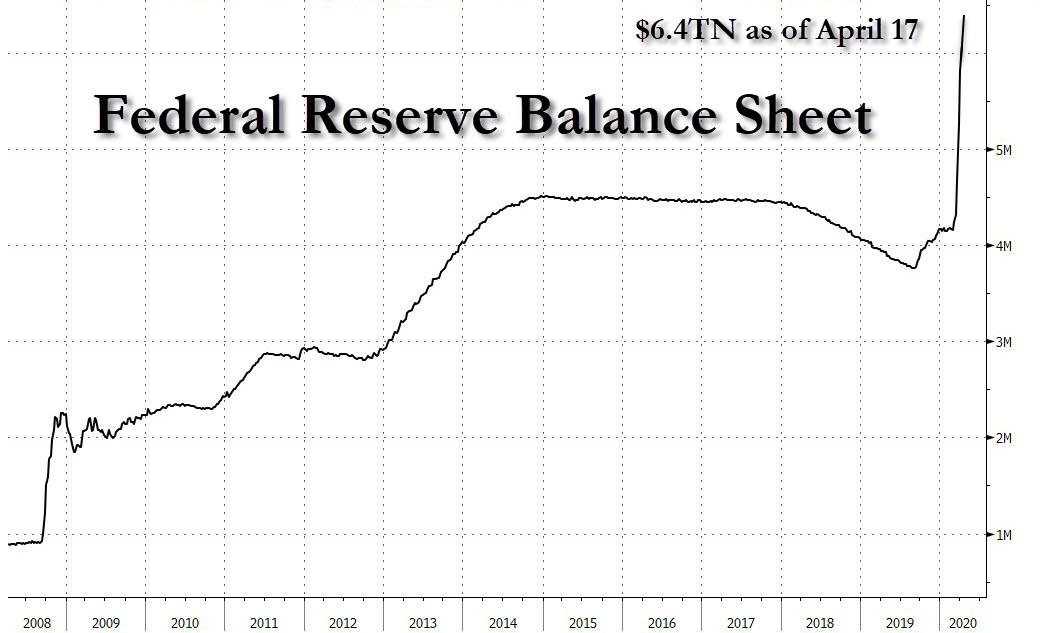

… will push the Fed’s balance sheet (currently at $6.1 trillion) to $6.4 trillion by next Friday, up more than 50% in the span of just weeks.

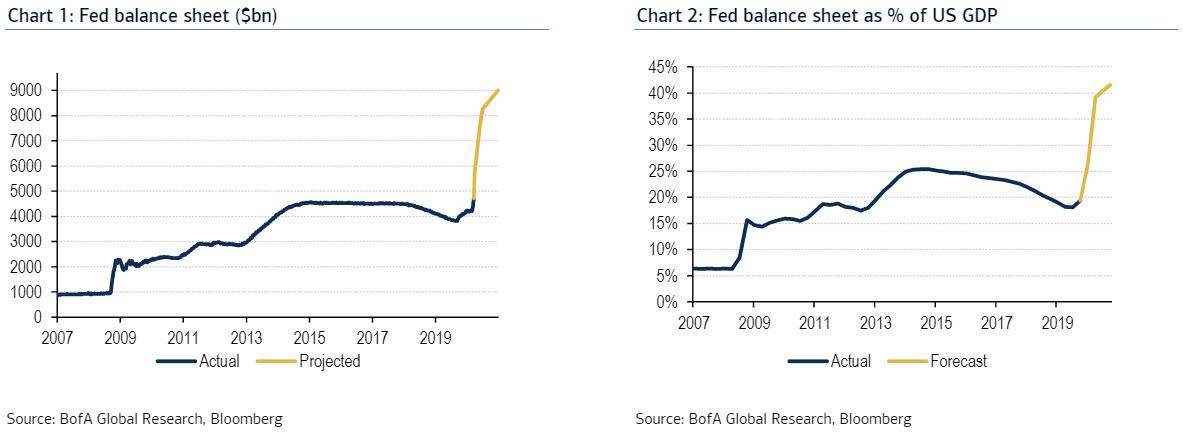

That’s just the beginning, because as we showed two weeks ago, BofA strategist and former Fed guru, Mark Cabana expects the Fed’s balance sheet to double to $9 trillion by the end of the year.

What does this mean for Treasury issuance? Well, for one thing it means that the Fed will monetize not only all the debt issuance for 2020 that was scheduled before the coronavirus pandemic broke out, but also the entire fiscal stimulus package (currently $2.2 trillion, soon $3+ trillion). Which is hardly a surprise: last week the Bank of England became the first bank to officially announce it would openly monetize the UK’s deficit. In other words, the central bank and the Treasury are now one and the same, which also means that helicopter money has arrived, first in the UK and soon everywhere else.

It also means that, as DB’s Stuart Sparks puts it “these are administered markets” (or perhaps “administerrrrrred” markets).

Yet while the Fed has unleashed an unprecedented buying spree across the curve, traders are starting to ask when and how will markets price in a “crossover point” when there is more supply than demand (if such a thing is possible), potentially resulting in a violent bear steepening in the yield curve and a spike in long-term yields as the Fed loses control over long-term inflation expectations.

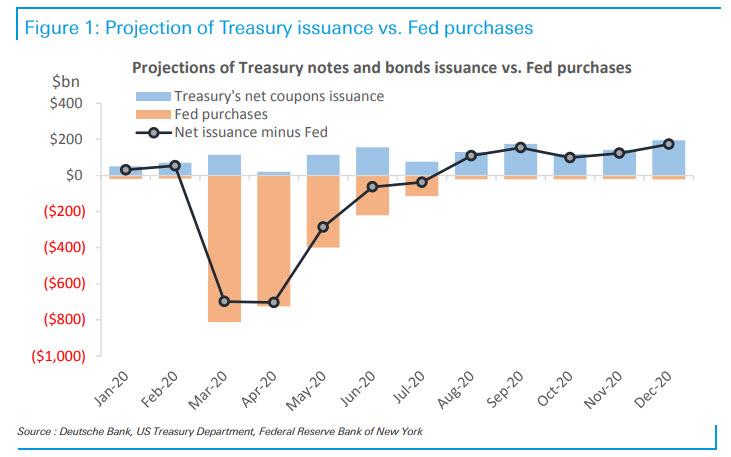

Commenting on this, DB’s rates strategists write that the narrative for bearish curve steepening is rooted in the idea of a crossover point at which the duration impact of additional Treasury supply exceeds that of demand stemming from Fed QE purchases. This is particularly true in the long end, where the Treasury is still expected to begin 20y issuance in the May refunding. The “crossover” argument is illustrated on the chart below: coupon supply net of Fed purchases is likely to turn positive during Q3, even if the Fed monetizes the entire fiscal stimulus package as it currently stands.

That said, the crossover argument is inherently a flow argument, rather than a stock argument. To mitigate fears that the deluge of Treasurys – now that helicopter money has been unleashed – will lead to a chaotic spike in long-rates, Deutsche Bank writes that an immediate issue with the flow argument that increasing Treasury supply will push yields higher and the term premium steeper “is that it ignores the flows between the present and the time at which this crossover occurs.” That is, large purchase volumes at higher than market WAM should flatten the term premium and push yields lower until the crossover point. Yields might rise and the term premium steepen, but from lower and flatter levels.

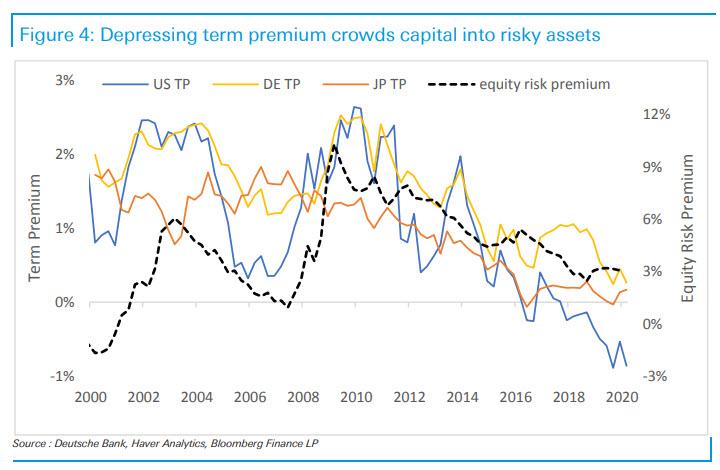

At the same time, the Fed’s thought process around QE is inherently more stock-based (an argument that the Fed lost long ago when it was demonstrated conclusively by the like of Goldman and others that only the flow matters): QE “permanently” reduces the stock of risk free government debt, which should cause that government debt to richen. In order to enhance returns, private investors are then obliged to extend duration, flattening the term premium. When the term premium is flat, investors must move out the risk spectrum to enhance returns. This is the Fed’s portfolio balance channel.

Deutsche take a middle ground, and notes that pragmatically, one would expect the effects of large asset purchases to be cumulative, and to occur at a lag. For this reason QE is something of a hybrid between stock and flow. Intuitively, Fed purchases of, say, $100 billion/month should have a different impact on the market if they were preceded by a period in which the Fed bought $2 trillion in total than they would had the Fed bought nothing previously. Here DB is quick to note that, at its projection of QE demand, the Fed will have fully monetized the first three phases of fiscal stimulus totaling

around $2.2 trillion. Likewise the bank expects Fed purchases to increase to absorb any “phase 4” stimulus as is currently being debated in the US Congress.

In short, without the Fed actively monetizing US debt, the long end would have disconnected long ago.

A second issue is that there is still a reasonable amount of uncertainty about the magnitude of flows on both the supply and demand sides. Let’s start with the supply side.

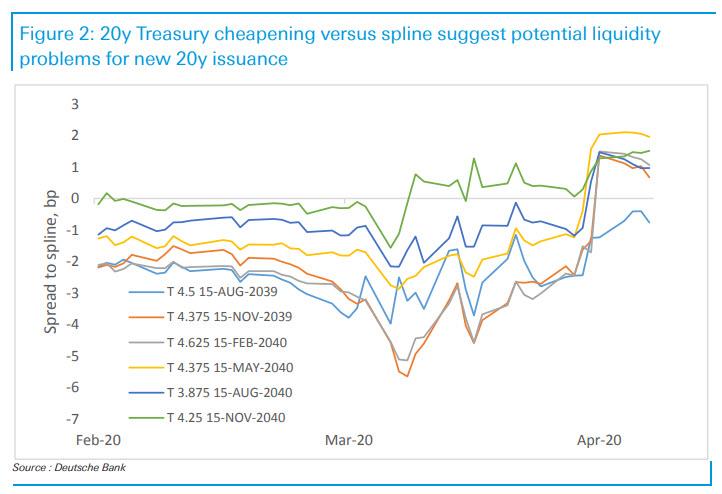

While a fourth installment of fiscal stimulus of $1 trillion or more would clearly add to potential supply, it is somewhat less clear where on the curve it might come. Specifically, there is a possibility that the Treasury might elect to delay its inaugural 20y issue due to poor liquidity and stretched dealer balance sheets. According to DB, the entire 2040 maturity sector is trading extremely cheap to the fitted curve (chart below).

The bank’s view is that the Treasury will proceed, but the “long end supply thesis” is subject to both the risk that the issue will be delayed for better market conditions, and to the risk that if the issue comes, a smaller issue size could reduce long end supply pressures.

Perhaps the key issue in the “crossover thesis” is what is the true goal of the Fed’s QE program. One argument is that the immense initial size of Fed Treasury purchases was intended as a powerful short term market stabilizer, but a “V”-shaped recovery could obviate the need for an extended program to stimulate the economy (not that one is coming as we will discuss in a subsequent post). This argument is perhaps the most consistent with Treasury cheapening as it could be consistent with a rapid taper of QE purchases in the relatively near term. That said, the probability of this scenario is low as the Fed will not do anything to send rate volatility (MOVE) soaring again.

As a result, DB’s central expectation is that while QE purchase volumes are indeed likely to be tapered further, they will remain sufficiently large to exert further downward pressure on the level of real yields and the term premium. In short: once helicopter money start, it can never again stop.

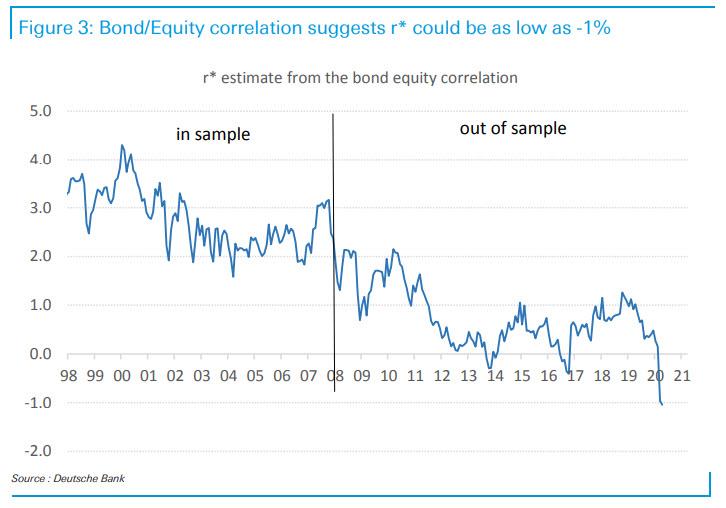

The fundamental reason the Fed will target these variables is that rising real yields and real term premium run contrary to their policy goals. First, the level of r* has likely fallen due to the acute demand shock caused by virus mitigation. As DB strategists argue, the equity/bond correlation suggests that r* could be as low as -1% (chart below).

And with short rates already at the effective lower bound (at least until we get NIRP), the Fed must ease further by growing its balance sheet (i.e., targeting longer maturities). Suppressing the term premium crowds return-seeking investors first out the curve, and ultimately out of Treasuries into riskier assets, which means the Fed is now back to blowing the biggest asset bubble ever. The chart below illustrates that the ACM term premium has been reasonably well correlated with a proxy for the equity risk premium. When the term premium is low, all else equal, equities look cheaper, and price appreciation tightens the equity risk premium.

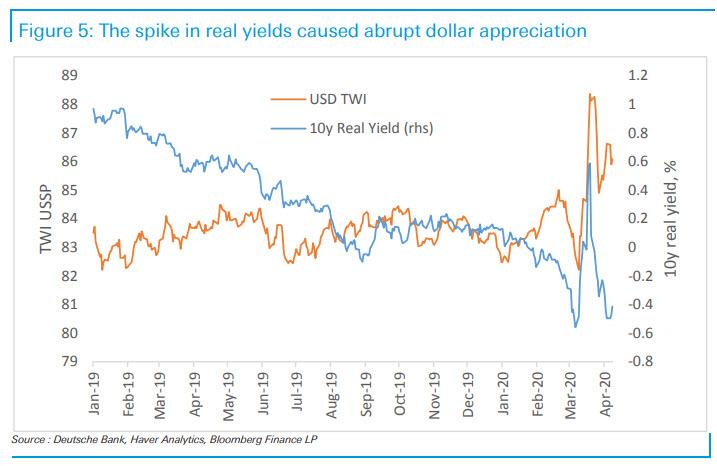

Second, high real yields keep the dollar strong, which keeps downward pressure on commodity prices and hence headline inflation. Note that the spike in real yields as BEI declined coincided with the sharp dollar appreciation during March. Moreover, we think it is important that the broad dollar is stronger than before the Fed began to ease, and remains higher than end-2019 levels in spite of the fact that 10y real yields have fallen 50 bp. The implication is that real yields likely need to fall further to stabilize the dollar and improve the prospects for persistent increases in headline and core inflation, the Fed’s true stated mission.

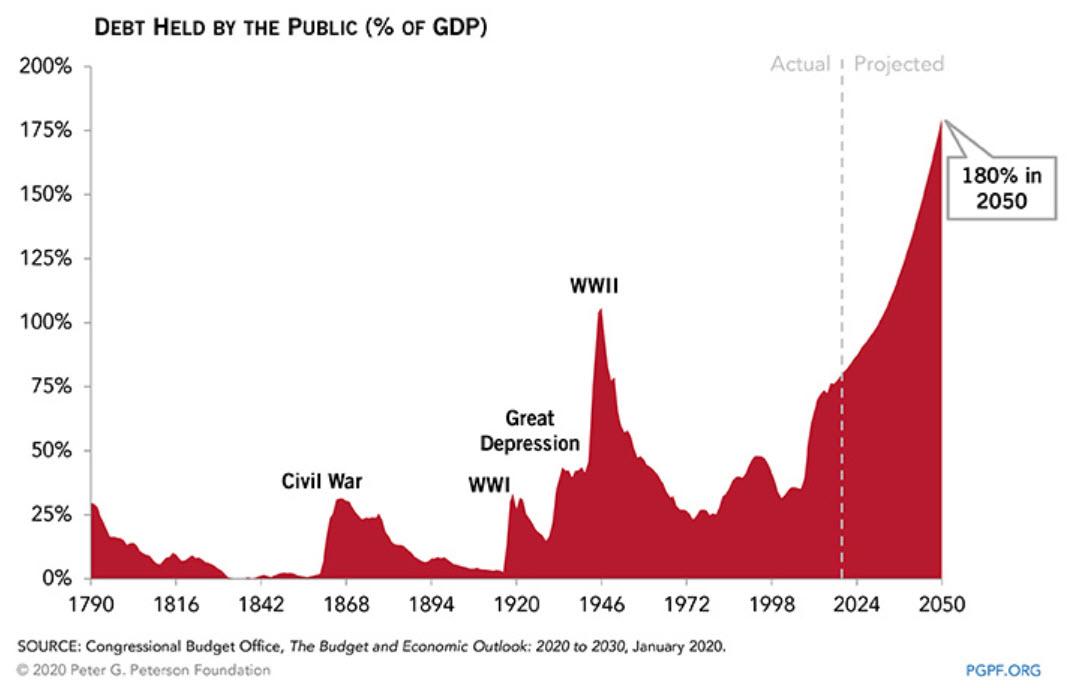

Which brings us to the key question: what happens once we reach the Treasury supply/demand crossover point, and the answer is most that either the Fed doubles down voluntarily, or the Fed loses control and doubles down because it is forced to keep on monetizing all US debt issuance, which is now in its exponential phase (a lot of exponential curves in recent weeks)…

… as the alternative is that everything that the Fed has been working on for the past decade (and really, 107 years) can be thrown out, and the US – and global – economy implodes.

How long can this can-kicking last? Simple: as long as the world has faith in the dollar as a reserve currency (as discussed earlier) – while that particular fiction persists, the now co-joined Fed and Treasury will be able to pick the US economy up by its bootstarps while giving everyone the impression that printing money somehow makes people richer, when in reality it just devalues purchasing power, cripples labor and makes the “top 0.1%” holders of assets wealthier beyond their wildest dreams.

Tyler Durden

Sun, 04/12/2020 – 21:45

via ZeroHedge News https://ift.tt/2V63SDA Tyler Durden