Dimon Warns Of “Severe Recession” As JPM Profit Plunge To 7 Year Low On Billions In Covid-Linked Credit Losses

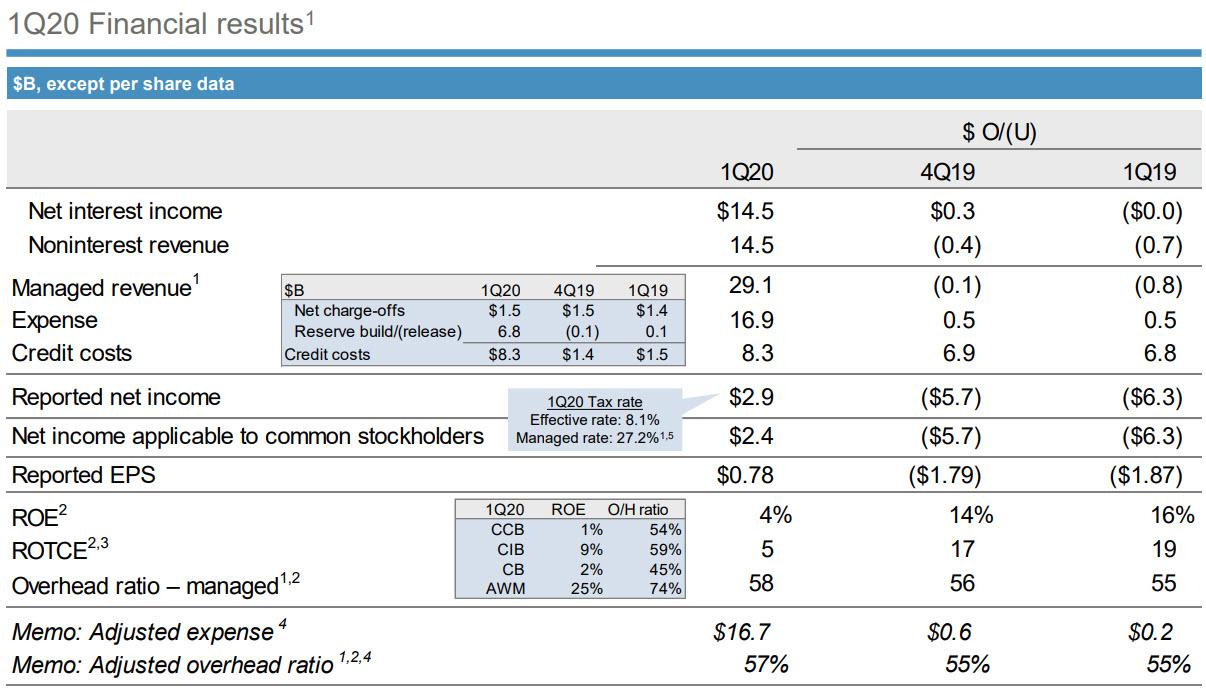

And so the worst quarterly earnings season since the financial crisis (at least until the catastrophic Q2 earnings) is off, when moments ago JPMorgan reported that it missed expectations, with earnings plunging from a year ago, reporting Q1 adjusted revenue of $29.07 billion, which was -2.6% y/y, and missed the estimate of $29.52 billion, while Q1 EPS was 78c, down 71% from the $2.65 reported a year ago.

Breaking these down, net interest income was $14.5 billion, flat versus the prior-year, with the impact of lower rates offset by balance sheet growth and mix as well as higher net interest income in CIB Markets. Noninterest revenue was $14.5 billion, down 5%, and included a $951 million loss in Credit Adjustments & Other in CIB driven by what the bank said was “funding spread widening on derivatives and $896 million of markdowns on held-for-sale positions in the bridge book”. Noninterest expense was $16.9 billion, up 3%, driven by higher volume- and revenue-related expense and investments, as well as higher legal expense, partially offset by lower structural expense.

As a result, JPM recorded profits of just $2.865BN, down 69% Y/Y, and the lowest since 2013 as the largest US bank recorded a surge in credit losses to $8.3BN, up from $1.5 billion a year ago, mostly in the form of a reserve build as JPM braced for a surge in defaults linked to the coronavirus crisis.

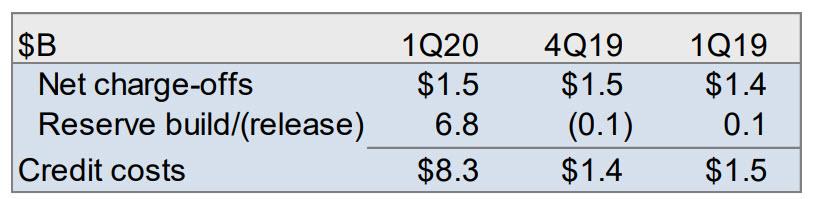

Before we dig into the rest of the results, here is what everyone was looking for: the bank announced that it had added a whopping $6.8 billion in reserves this quarter, while keeping its net charge offs flat on Q/Q and Y/Y. The total provision for credit losses was $8.3 billion, “driven by reserve builds which reflect deterioration in the macro-economic environment as a result of the impact of COVID-19 and continued pressure on oil prices.”

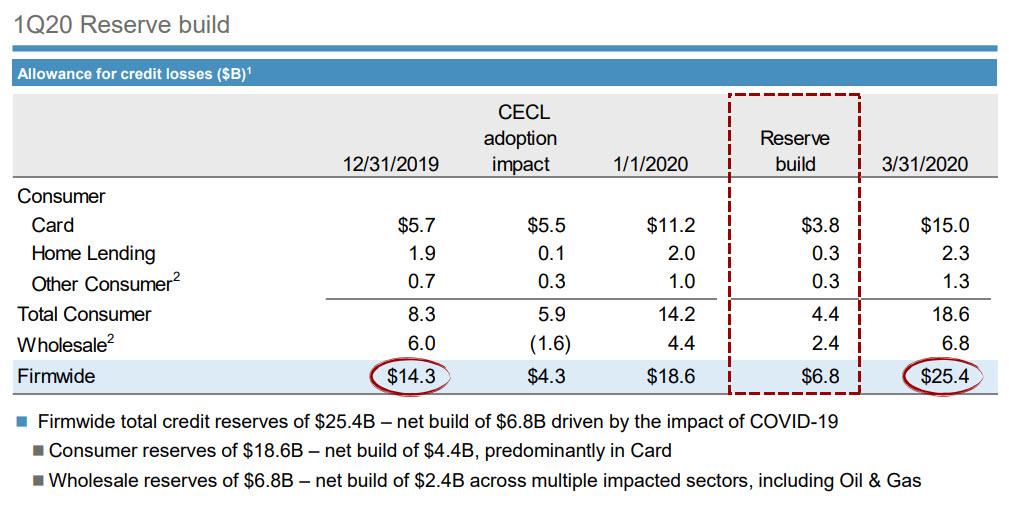

Separately, JPM also reported that the impact of CECL adoption lifted reserves by $4.3 billion, which together with the $6.8 billion Covid-19 related reserve build, took the firmwide total of $14.3BN at the end of 2019 and almost doubled it to $25.4 billion.

Detailing the breakdown, JPM said that the Consumer reserve build was $4.4 billion, predominantly in Card, and the Wholesale reserve build was $2.4 billion across multiple sectors, with the largest impacts in the Oil & Gas, Real Estate, and Consumer & Retail industries.

And this is just the start: looking ahead, JPM said that expects more net reserve builds in Q2 2020.

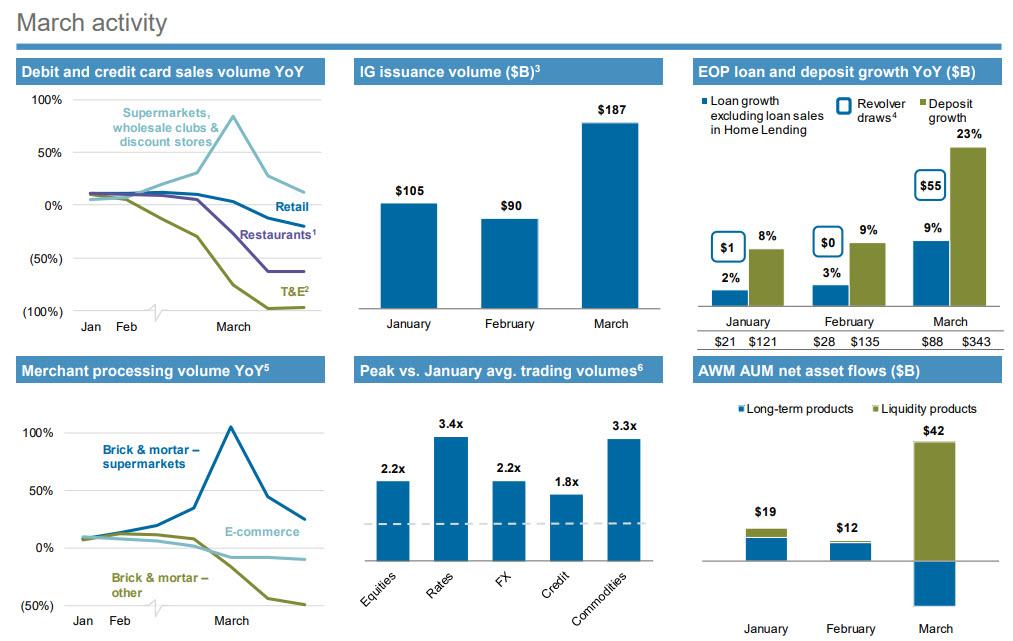

To demonstrate just how major the impact from Covid-19 – for which the bank had reserved $6.8 billion – was, the bank showed a chart detailing the changes in March activity.

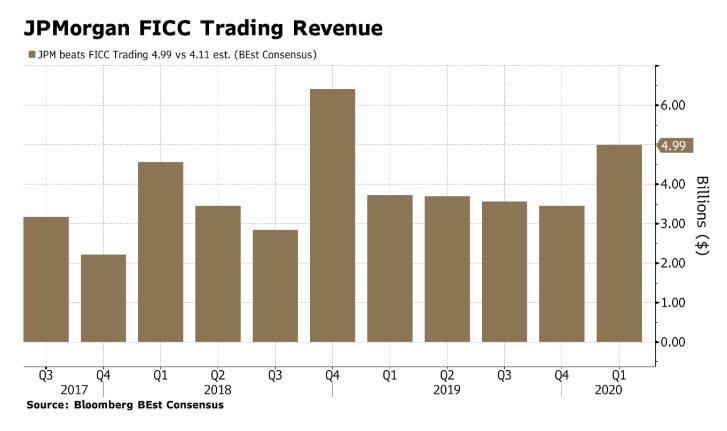

We’ll get back to the bank’s balance sheet shortly, but first let’s look at the rest of the company’s operations, starting with investment banking and trading, where we saw an impressive surge in results with JPM reporting FICC sales & trading revenue of $4.99 billion, a whopping +34% increase and far better than the estimate of $4.11 billion “driven by strong client activity across products”

And while Q1 equities sales & trading revenue also surged on the March market chaos, rising to $2.24 billion, or up +28% y/y, high above the estimate of $2.05 billion “predominantly driven by higher revenue in derivatives“, investment banking revenue collapsed nearly in half, and at just $886 million it was down 49% y/y, missing badly the estimate of $1.79 billion. And even as IB fees were up 3%, reflecting higher debt and equity underwriting fees, largely offset by lower advisory fees, JPM reported that it recorded $820mm of markdowns on HFS positions in the “bridge book.” What is the bridge book? “The bridge book consists of certain held-for-sale positions, including unfunded commitments, in CIB and CB.” Expect manyu questions on the earnings call for more details on these markdowns.

Stepping away from FICC, JPM reported that its Q1 net yield on interest-earning assets was 2.37%, sharply below the 2.56% last year y/y, but above the estimate of 2.34%.

Jamie Dimon also said that the bank’s clients drew over $50 billion on their existing lines, and that the bank provided over $25 billion of new credit extensions in March for companies most impacted by the crisis and helped our clients execute record Investment Grade bond issuances this quarter

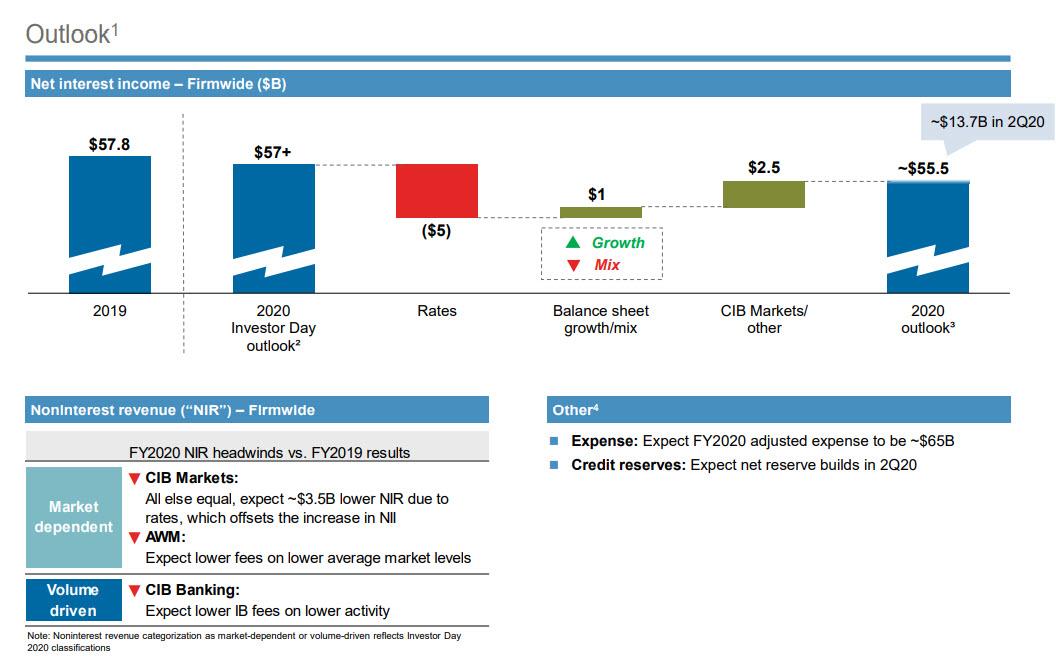

The outlook was cloud: looking ahead, JPM cut its 2020 Net Interest Income forecast, and now sees $55.5BN for the full year, down from $57BN guided in its investor day, and down from $57.8BN for the full year 2019. JPM also sees FY 2020 adjusted expense of $65B.Up

The Q1 letter was notable for a lengthy letter and comments from CEO Jamie Dimon.

Jamie Dimon, Chairman and CEO, commented: “My heart goes out to the communities and individuals, including healthcare workers and first responders, most deeply hit by the COVID-19 crisis. Throughout our history, JPMorgan Chase has built its reputation on being there for clients, customers and communities in the most critical times. This unprecedented environment is no different. We will do everything in our power to help the world recover from this global crisis.”

Dimon added: “The company entered this crisis in a position of strength, and we remain well capitalized and highly liquid – with a CET1 ratio of 11.5% and total liquidity resources of over $1 trillion. And JPMorgan Chase performed well in what was a very tough and unique operating environment – growing deposits in every line of business and providing loans as we extended credit and served as a port in the storm for our clients and customers. In the first quarter, the underlying results of the company were extremely good, however given the likelihood of a fairly severe recession, it was necessary to build credit reserves of $6.8B, resulting in total credit costs of $8.3B for the quarter.”

Dimon commented on the results: “The first quarter delivered some unprecedented challenges and required us to focus on what we as a bank could do – outside of our ordinary course of business – to remain strong, resilient and well-positioned to support all of our stakeholders. In Consumer & Community Banking, we have remained focused on meeting our customers’ needs. Approximately three quarters of our 5,000 branches have been open – all with heightened safety procedures and many with drive-through options – and the vast majority of our over 16,000 ATMs remain open. In March alone, we opened half a million new accounts for our card customers and extended over $6 billion of new and increased credit lines, and we were active in Home Lending and Auto. We lent over $500 million to small businesses in the month and we’re now actively supporting the SBA’s Paycheck Protection Program. For the quarter, we continued to see flows into both client investment assets and deposits.”

Dimon continued: “We continued to support our wholesale clients throughout this challenging period, as they drew over $50 billion on their existing lines. We also provided over $25 billion of new credit extensions in March for companies most impacted by the crisis and helped our clients execute record Investment Grade bond issuances this quarter. In Commercial Banking, we partnered closely with clients on their liquidity needs, increasing loans $25 billion and deposits $40 billion in the quarter. The Corporate & Investment Bank turned in another solid quarter with record Markets revenue, as we helped clients navigate extremely tough and volatile market conditions, and we maintained our #1 rank in Global IB fees as clients turned to us for financing and advice. And in Asset & Wealth Management, we saw strong growth in both loans and deposits, we took in $75 billion in liquidity flows, and more importantly we proactively reached out and helped clients manage their risk. In addition, JPMorgan Chase made a $50 million commitment to help address the immediate humanitarian crisis, as well as the long-term economic challenges that the most vulnerable people face. And the firm announced a $150 million loan program to help community partners get capital to underserved small businesses and nonprofits, particularly in the hardest hit communities.”

Dimon concluded: “I want to thank our more than 250,000 employees for remaining steadfast in helping our clients, customers, communities and governments and continuing to operate with the highest standards every day. I’m proud of the extraordinary effort by our call center employees, traders, bankers, portfolio managers, technology and operations teams across the globe. I also want to thank Daniel Pinto, Gordon Smith, our Operating Committee and our senior leaders for the exceptional leadership they have shown under the most difficult of circumstances. Finally, the countries and citizens of the global community will get through this unprecedented situation, undoubtedly stronger for it. Together, we will rise to the challenge.”

Tyler Durden

Tue, 04/14/2020 – 07:43

via ZeroHedge News https://ift.tt/3cgQ8vd Tyler Durden