BofA Profit Plunges 45% On $4.8 Billion In Expected Credit Losses From Coronacrisis

Bank of America joined JPMorgan and Wells Fargo in setting aside billions of dollars for upcoming loan losses as the bank braces for a surge in defaults and delinquencies on its loans amid the complete US economic shut down.

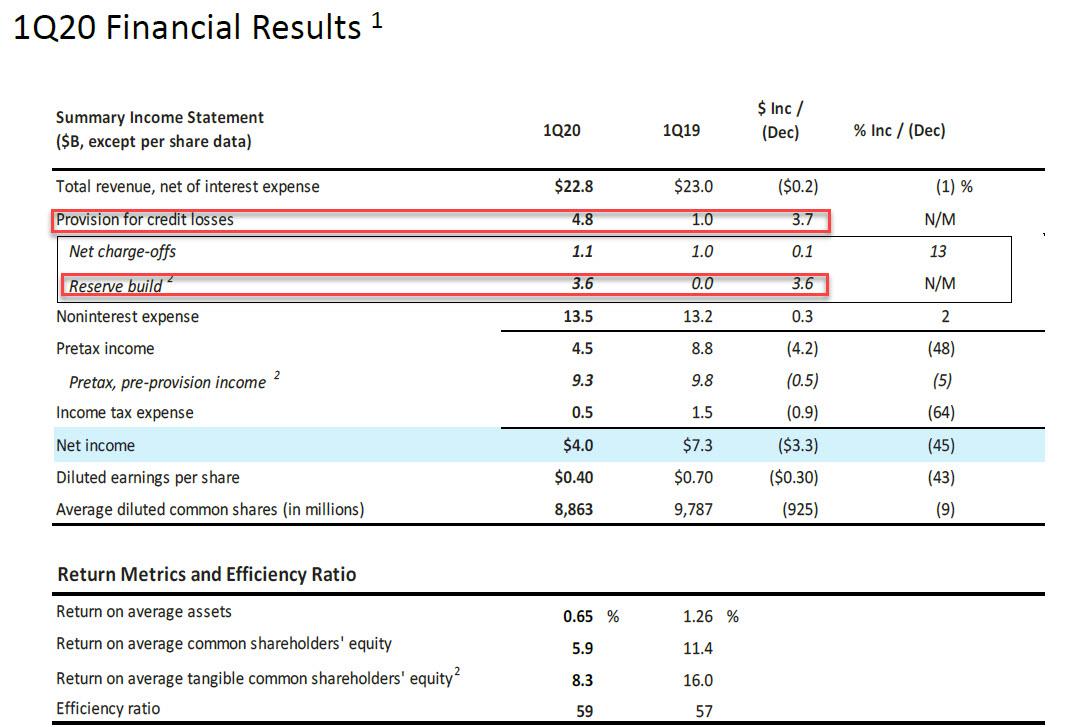

The bank reports $22.8 billion in revenue (missing the exp. $22.91BN) generating $0.40 in EPS (missing the exp. $0.46) and $4.0 billion in profit, which was down 45% from the $7.3 billion last year…

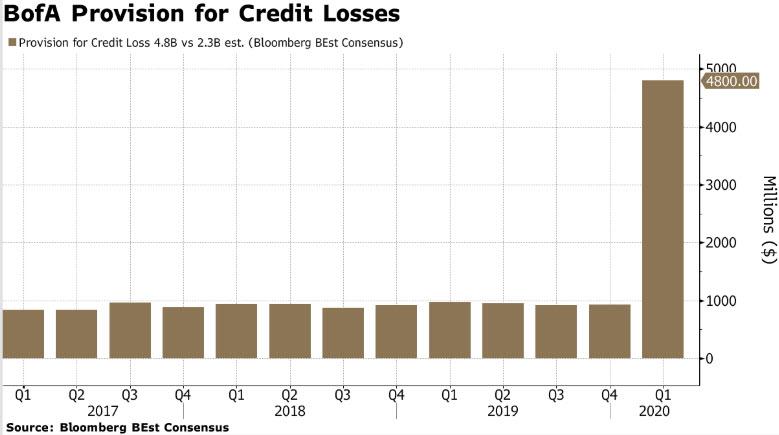

… as the bank allocated $4.76 billion for loan losses (above the $3.93BN expected), an increase of $3.7 billion Y/Y and the most since 2010, as its business and household clients reel from the coronavirus pandemic. The bank joins competitors JPMorgan and Wells Fargo which posted their highest provisions in a decade Tuesday (JPMorgan set aside a little over $8 billion, Wells used $4 billion as the appropriate number).

The three big lenders have collectively stashed away more than $17 billion to cover defaults. A full breakdown of all reported credit provisions so far is as follows:

- JPM: provisions $8.3b (+$6.8b)

- C: provisions $7b (+$4.8bln)

- BAC: provisions $4.8b (+$3.6b)

- WFC: provisions $4b (+$3b)

- USB: provisions $993m (+$600m)

- GS: provisions $937m (+$601mln)

- PNC: provisions $914m (+$702m)

Banks are trying to get ahead of the tsunami of loan losses they expect to come from the pandemic bringing large swaths of the global economy to a virtual standstill. While defaults haven’t yet spiked, bank efforts to build up their reserves show they’re bracing for a major recession.

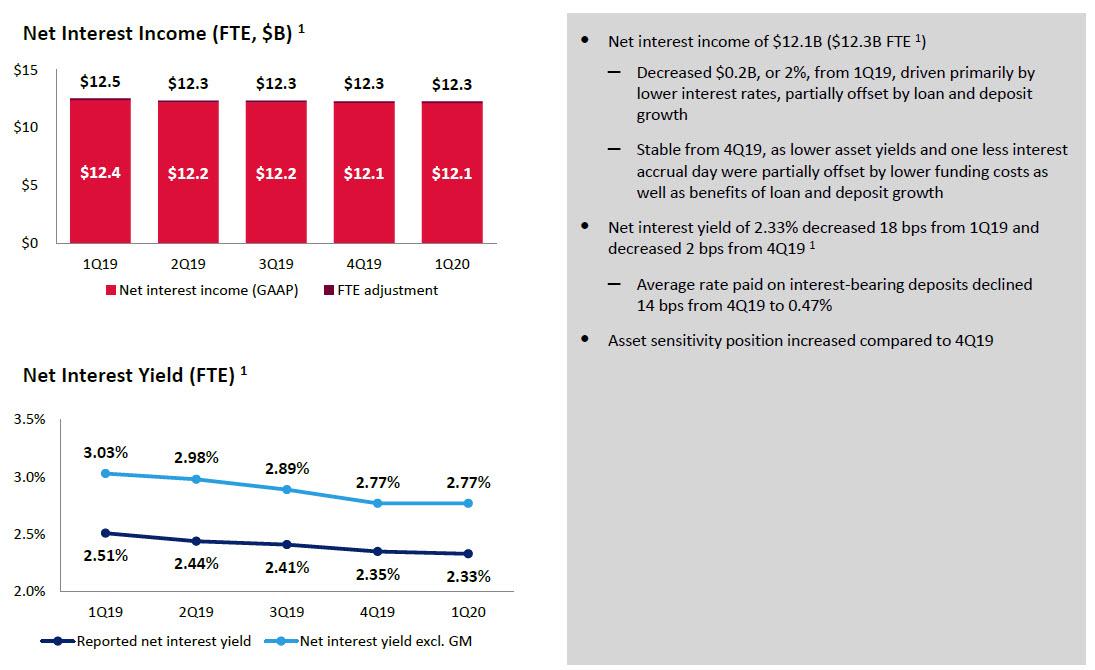

Separately, BofA reported net interest income of $12.1B (or $12.3B on an FTE basis), down 2%, driven primarily by lower interest rates, partially offset by loan and deposit growth. The closely watched Net Interest Income was unchanged at 2.77% compared to 4Q19.

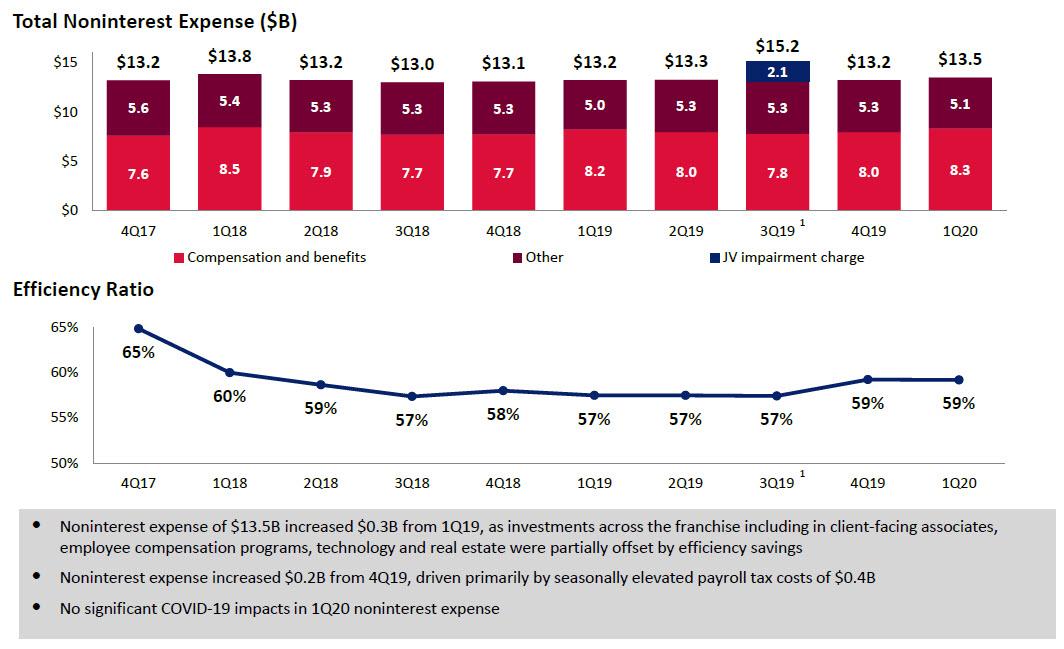

Noninterest expense of $13.5B increased $0.3B, or 2%, as investment spending was offset by cost-saving initiatives.

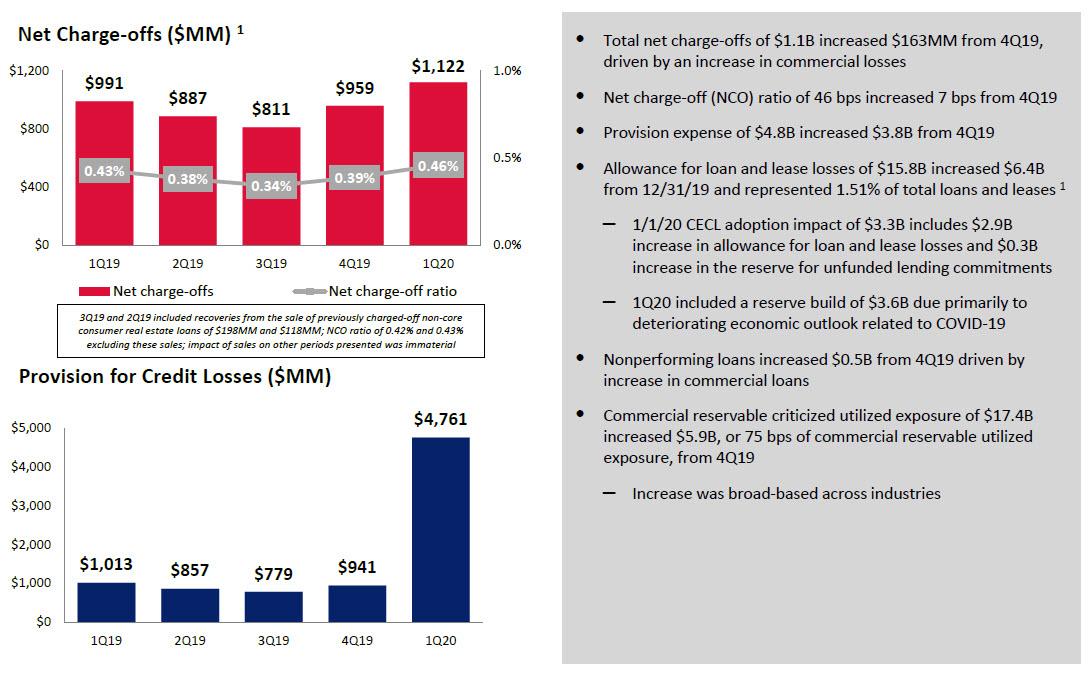

Curiously, net charge-offs increased by just $163MM to $1.1B from 4Q19, driven primarily by Commercial losses, which means that the real pain from the pandemic and the default wave has yet to hit. BofA’s Net charge-off (NCO) ratio of 46 bps increased 7 bps from 4Q19, while the provision expense of $4.8B increased $3.8B from 4Q19; allowance for loan and lease losses of $15.8B increased $6.4B from 12/31/19 and represented 1.51% of total loans and leases.

At the same time, nonperforming loans increased $0.5B from 4Q19 driven by increase in commercial loans. Commercial reservable criticized utilized exposure of $17.4B increased $5.9B, or 75 bps of commercial reservable utilized exposure, from 4Q19. The “increase was broad-based across industries.”

Putting it in context, the bank’s first-quarter provision for credit losses was almost five times the $1 billion it set aside a year earlier.

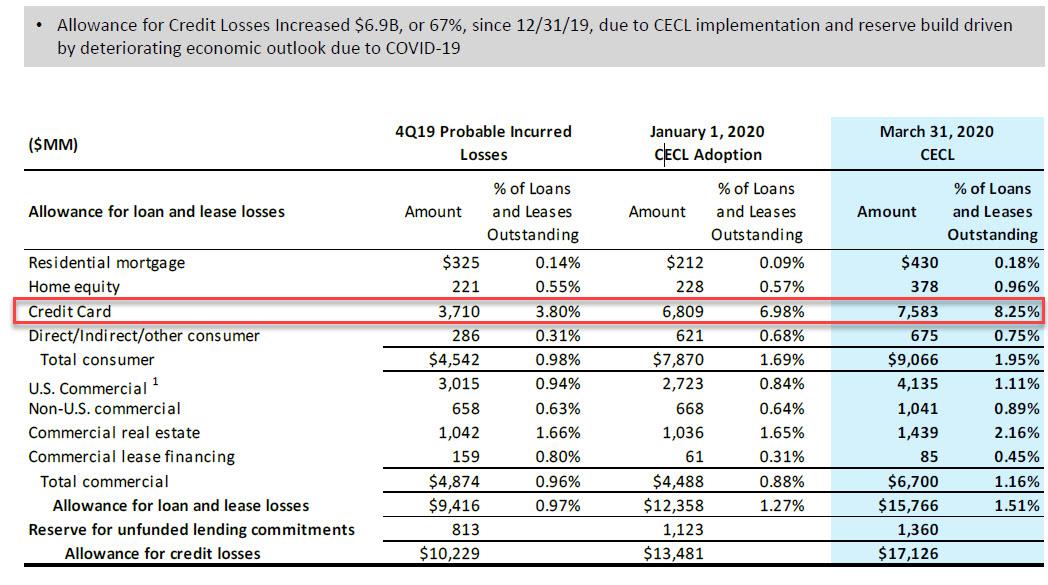

For those wondering what the impact of CECL was on BofA, the bank reported that the adoption impact of $3.3B includes $2.9B increase in allowance for loan and lease losses and $0.3B increase in the reserve for unfunded lending commitments; 1Q20 included a reserve build of $3.6B due primarily to deteriorating economic outlook related to COVID-19. In total, the allowance for Credit Losses Increased $6.9B, or 67%, since 12/31/19, due to CECL implementation and reserve build driven by deteriorating economic outlook due to COVID-19.

All we have to say here is watch those surging credit card losses.

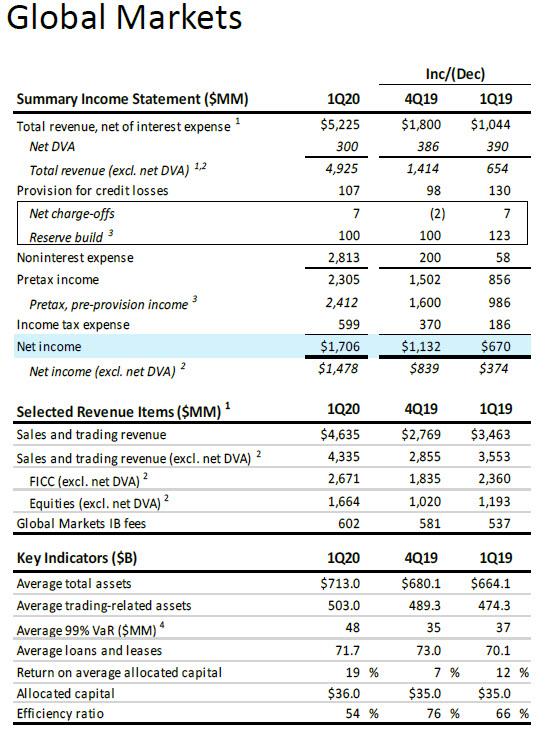

While the balance sheet hit was widespread and will take years to pass through the income statement, there was a silver lining: as was the case with JPMorgan, Bank of America reported strong trading revenue in Q1, which rose 25% to $5.2BN from 1Q19 (and up 15% excluding net DVA). Excluding net DVA, sales and trading revenue of $4.3B increased 22% from 1Q19.

FICC revenue of $2.7B increased 13%, driven by increased client activity and improved market making conditions across all macro products (in particular Rates), more than offsetting weaker performances in the credit-sensitive businesses

Equities revenue of $1.7B increased 39%, driven by increased client activity and a strong trading performance in the more volatile market environment

Also of note, the average VaR was $48MM in 1Q20, up substantially from 35 last quarter and 37 a year ago.

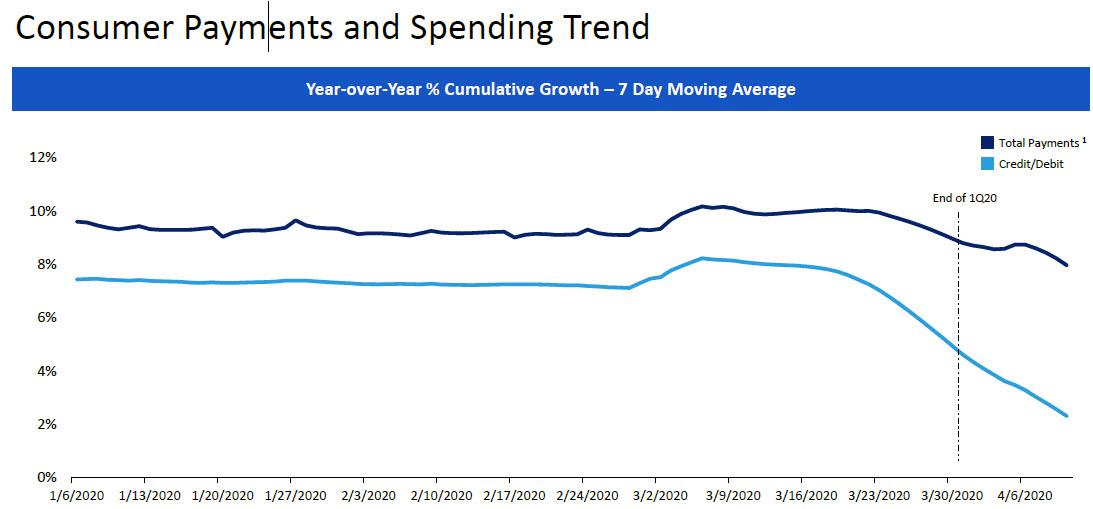

On the other hand, BofA was quick to demonstrate the change in overall consumer payments and spending has been using its infrastructure. Some observations here:

1Q20 total payments increased 9% over 1Q19, with softening in credit and debit spend that began mid-February and accelerated in late March as stay-at-home orders affected a majority of Americans. Card spend for non-essentials declined, even for those not impacted by the pandemic from a cash flow or employment perspective, and purchases of essentials such as groceries increased. Consumers and Small Businesses paying expenses with other payment types slowed consistently as the stay-at-home orders expanded. Combined Credit and Debit Spend increased 4% year-over-year in 1Q20 despite the sharp decline in late March.

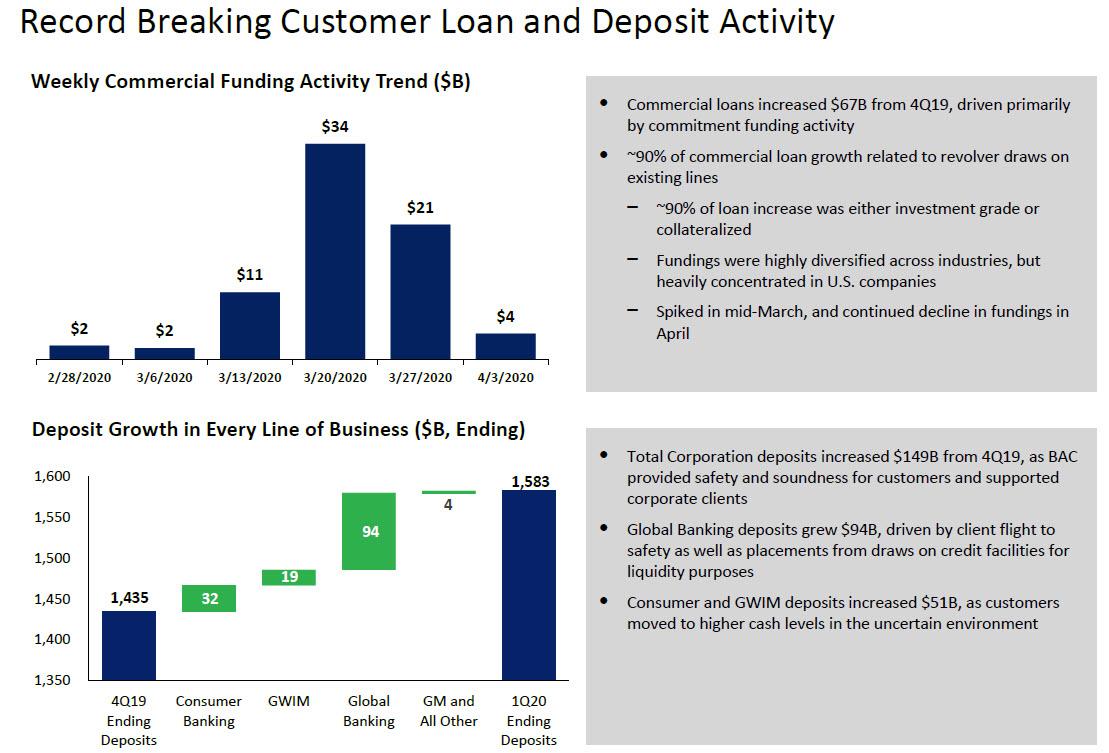

BofA also noted some curious trends in weekly loan and deposit activity, which were both “record breaking” as commercial loans increased $67B from 4Q19, driven primarily by commitment funding activity, by which the bank means the surge in revolver drawdowns. In fact, BofA said that ~90% of commercial loan growth was related to revolver draws on existing lines.

And, amusingly, as clients pulled money out, they deposited it right back in, with total corporation deposits soaring $149B from 4Q19, as BAC provided safety and soundness for customers and supported corporate clients. Global Banking deposits grew $94B, driven by client flight to safety as well as placements from draws on credit facilities for liquidity purposes.

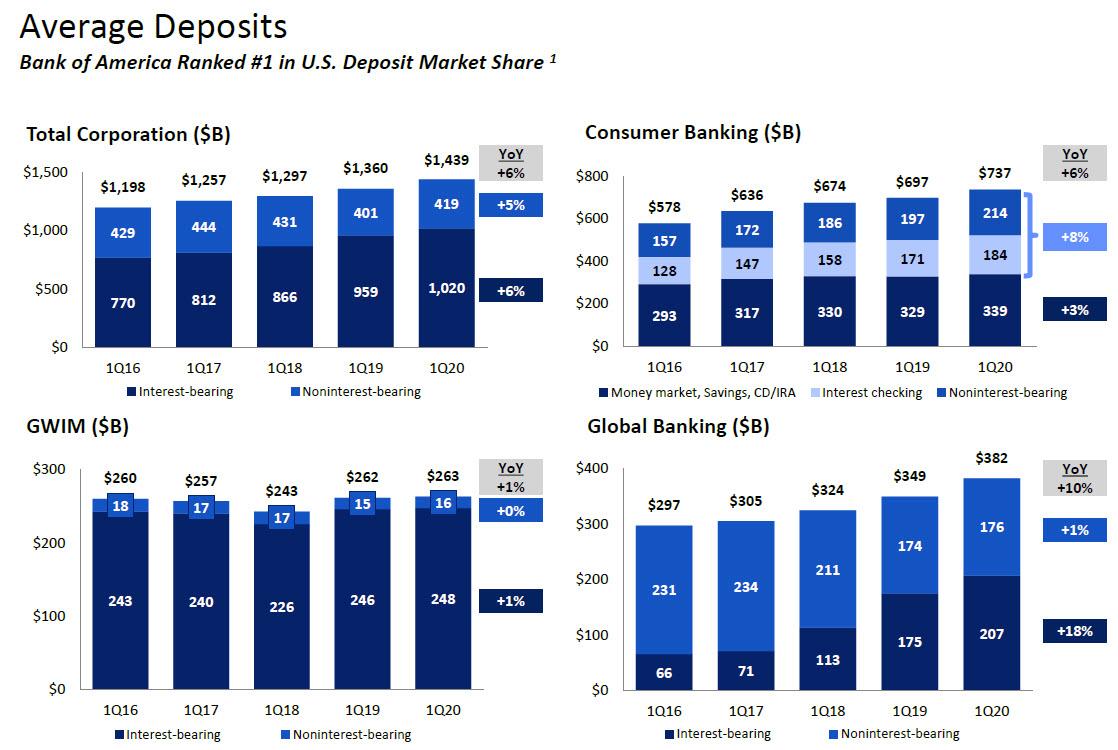

And with clients scrambling to pull money out of the market in Q1, what do they do with the proceeds? Why, they park it with their neighborhood Bank of America, which saw a 6% surge in total deposits Y/Y, which rose to a record $1.439 trillion.

“Despite increasing our loan loss reserves, we earned $4 billion this quarter, maintained a significant buffer against our most stringent capital requirement, and ended the quarter with more liquidity than when we began,” Chief Executive Officer Brian Moynihan said in a statement.

Moynihan has been a prominent voice in business since the Covid-19 crisis began, appearing alongside other bank CEOs at the White House in early March to discuss its economic impact. He’s pledged to retain staff and boost pay, and highlighted the lender’s forbearance efforts and its participation in the government’s small-business rescue program.

However, as Bloomberg notes, it hasn’t all gone smoothly. Despite being the first bank to accept applications for the rescue program, the company is fending off a lawsuit for favoring existing borrowers. Following a Zero Hedge report which first addressed the issue, last week, CNBC and the New York Times reported Bank of America’s sales and trading staff are facing pressure to come to the office even as they become increasingly concerned about the spread of the virus.

The full investor presentation is below

Tyler Durden

Wed, 04/15/2020 – 08:18

via ZeroHedge News https://ift.tt/2RFHDlx Tyler Durden