Ford Scrambles To Raise Money As Dwindling Cash Balance Becomes A Focus

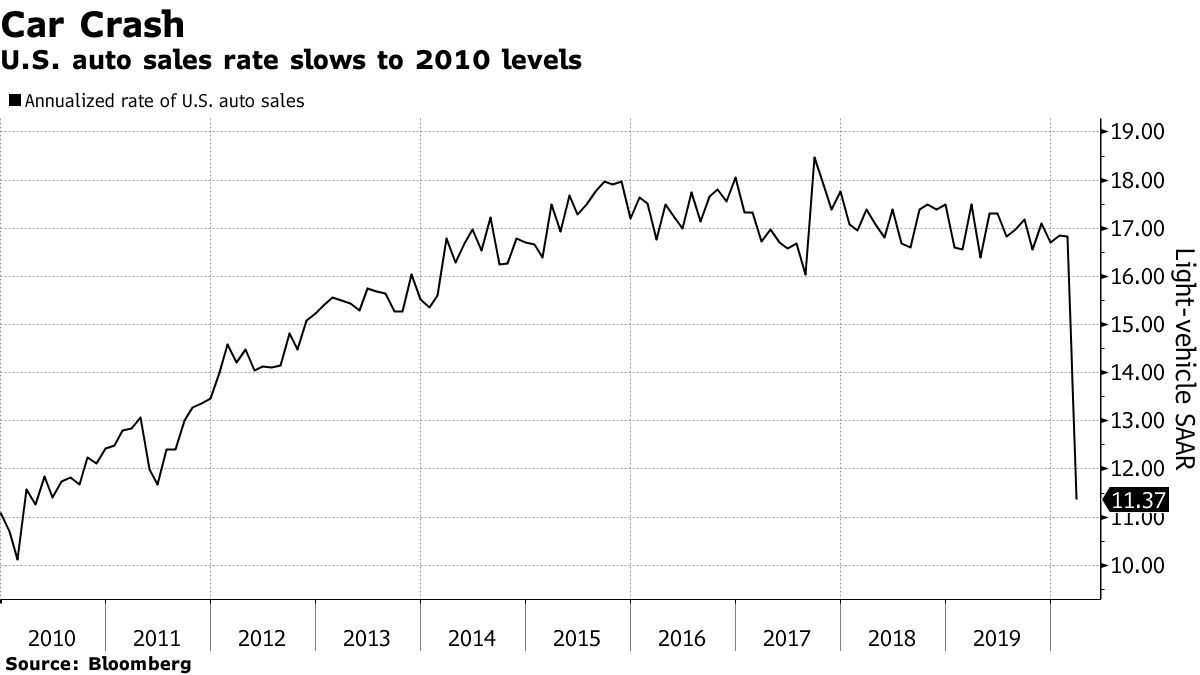

Ford, already in a precarious position from the pandemic shutdown and an auto market that was in recession prior to the coronavirus, is now starting to look at options to raise cash.

On Monday, Ford said it expects to report a loss later this month and that it had about $30 billion on its balance sheet as of April 9. This indicates the company has burned through about $8 billion since the end of last year, according to Bloomberg. The company says it is expecting a Q1 loss of about $600 million before interest and taxes. Revenue is expected to be down 16% from a year ago.

CEO Jim Hackett has already suspended the company’s dividend and has drawn $15.4 billion from two credit lines last month to free up liquidity. As the manufacturer waits for the all-clear to start producing vehicles again, it is considering raising even more cash.

Tim Stone, Ford’s chief financial officer, said:

“We continue to opportunistically assess all funding options to further strengthen our balance sheet and increase liquidity to optimize our financial flexibility. We also are identifying additional operating actions to enhance our cash position.”

Ford has several options it can consider, including tapping the U.S. asset-backed securities market. The Federal Reserve’s Term Asset Backed Securities Loan Facility should “aid in a revival” for that market (actually, it is the market), BI analyst Joel Levington notes.

But for now Ford thinks it has adequate cash to make it through the third quarter at least. Recall, in 2006, Ford was well known for lining up $23 billion that allowed it to avoid bankruptcy.

Just yesterday we noted that the used car market is bracing to experience a collapse that could wind up costing the industry billions.

The collapse is coming as a result of used vehicle auctions grinding to a halt – along with the rest of the country – and vehicles piling up at places where buyers and sellers transact secondhand cars.

Levington said: “GM assumed a 4% decline in residual values this year. If the 10% drop Manheim has seen recently persists, depreciation expense could counter the $1.9 billion that GM Financial earned in pretax profit last year.”

A similar headwind could be felt by rental car companies, who would likely get less money from selling their used fleet of vehicles, which are also sitting idly by as the pandemic paralyzes the nation.

Hertz, Avis and Enterprise have all sought help from the Treasury Department for loans, tax breaks and other types of support.

Hamzah Mazari, a Jefferies analyst, said: “For Hertz and Avis, every 1% increase in fleet costs saps about $20 million from earnings before interest, taxes, depreciation and amortization.”

Tyler Durden

Wed, 04/15/2020 – 05:30

via ZeroHedge News https://ift.tt/2Xz25bH Tyler Durden