Global Markets Tumble Amid Dismal Earnings After WTI Crashes To 18 Year Low

US index futures slumped on Wednesday for a second time this week, reversing Tuesday’s sharp gains after a plunge in oil prices pressured energy stocks ahead of what is expected to be a dismal round of first-quarter earnings reports. The dollar and Treasuries gained as investors fled risk assets, while WTI crude plunged below $20, to the lowest level since 2002 after the IEA said oil demand will drop by over 9 million barrels a day this year, wiping out a decade of consumption growth.

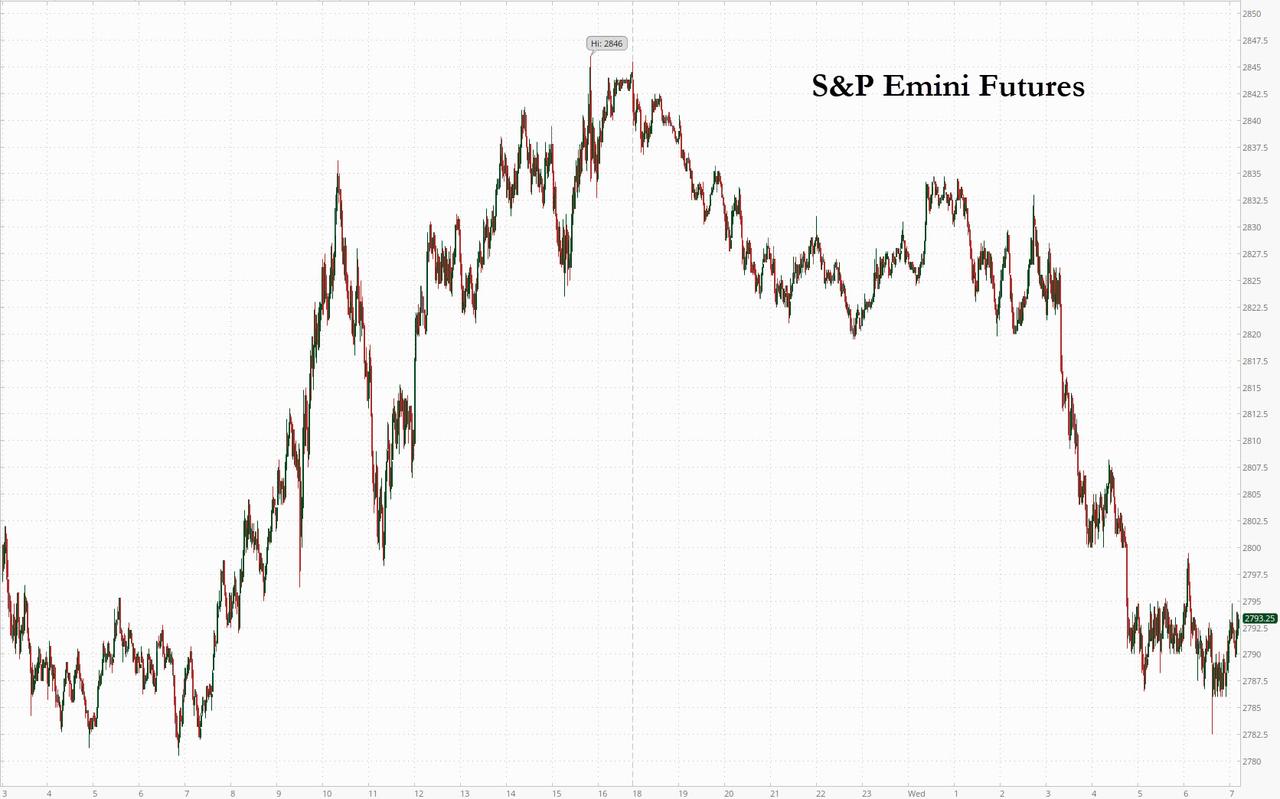

Contracts on all three major U.S. gauges retreated after the S&P 500 closed at a one-month high on Tuesday, with the Emini trading back under 2,800. UnitedHealth Group, the biggest U.S. health insurer, reported a fall in quarterly profit, but its shares rose 2.6% in premarket trading as it maintained its 2020 profit outlook at a time when major companies have withdrawn forecasts due to the coronavirus pandemic. J.C. Penney slumped 14.7% as sources said the retailer was exploring filing for bankruptcy protection after the virus outbreak upended its turnaround plans.

The S&P 500 index climbed about 30% from its March trough, lifted by a raft of U.S. monetary and fiscal stimulus and on early signs that coronavirus cases were peaking in some hotspots, but is still down about 16% from its record high. The index jumped another 3% on Tuesday on hopes the Trump administration could move to ease lockdowns as the outbreak showed signs of ebbing. However, hotspot New York later sharply raised its official virus death toll to more than 10,000. Oil majors Exxon Mobil Corp and Chevron slipped about 3% as oil prices tumbled, pressured by reports suggesting persistent oversupply and collapsing global demand.

JPMorgan Chase and Wells Fargo kicked off the earnings season on Tuesday by reporting a slump in quarterly profits and setting aside billions of dollars to cover potential loan defaults. Moments ago Bank of America joined them (post coming shortly).

“It’s really going to be about forward guidance,” Erin Gibbs, president and CEO at Gibbs Wealth Management LLC, said on Bloomberg TV. “What we’re really going to be looking for is, are companies giving us an idea of when they think they’ll return to profitability, or, are they talking about more layoffs?”

In Europe, the Stoxx Europe 600 index headed for its first drop in six sessions, led by energy companies, as crude oil in New York fell below $20 a barrel amid a global slump in demand. French shares fell 0.9% as France became the fourth country to report more than 15,000 deaths due to the coronavirus after Italy, Spain and the United States. ASML Holding NV, a supplier to Samsung Electronics Co., reported a 40% drop in first-quarter earnings and refrained from providing guidance amid uncertainty caused by the pandemic. Dutch GPS and digital mapping company TomTom shed 2.7% after saying it expected negative free cash flow this year and lower revenue from its automotive and consumer businesses due to the pandemic. London-based asset manager Jupiter Fund Management dropped 5.6% after reporting an 18.3% drop in assets under management in the first quarter as fears over the pandemic rattled financial markets.

Much economic damage has also already been done, with the International Monetary Fund predicting the world this year would suffer its steepest downturn since the Great Depression of the 1930s. Ahead of a steady stream of results due in the coming weeks, signs of corporate stress caused by the pandemic are widespread.

“A lot of good news has been priced in and we’re due for some consolidation, particularly as we head into earnings season as we all know the numbers will not be good,” Francois Savary, chief investment officer at Swiss wealth manager Prime Partners.

Earlier in the session, Asian stocks fell, led by energy and finance, after rising in the last session. Shares in Tokyo were little changed, Chinese and Hong Kong stocks slipped, with the Shanghai Composite Index retreating 0.6%, with Baotou Huazi Industry and Wuxi Shangji Automation posting the biggest slides. Australian equities dropped as a record slump in consumer confidence reminded investors of the impact of the pandemic on spending. The yuan dipped after China’s central bank eased policy further. Markets in the region were mixed, with Taiwan’s Taiex Index and India’s S&P BSE Sensex Index rising, and Jakarta Composite and Thailand’s SET falling.

European Union and U.S. federal officials are drafting plans to lift restrictions in an effort to mitigate the economic devastation, even as global virus infections edge closer to the 2 million mark. The earnings season should provide a better sense of how the pandemic will affect commerce as the global economy heads for a deep recession. Johnson & Johnson, JPMorgan Chase & Co.and Wells Fargo & Co. offered a mixed picture Tuesday, with Goldman Sachs Group Inc., Citigroup Inc. and Bank of America Corp. next up.

The big overnight mover was WTI, which tumbled fell below $20 a barrel after the International Energy Agency said demand would slump by a record this year despite a historic production cut deal. WTI futures fell as much as 4.5% in New York to the lowest since 2002. Oil demand will drop by over 9 million barrels a day this year, wiping out a decade of consumption growth, the IEA said, exhausting storage by mid-year. While Saudi Arabia and other Gulf producers have pledged to cut supply starting next month, they continue to flood the market in April. Stockpiles are rising everywhere and weakening key physical market gauges. New York oil futures moved deeper into contango, signaling an expanding glut, while swap prices indicate North Sea cargoes are trading at bumper discounts.

The IEA said consumption in April will fall by almost a third to the lowest level since 1995, and make this year the worst in the history of the oil market. Despite OPEC+’s efforts to balance supply, global inventories will accumulate by 12 million barrels a day in the first half of the year and “overwhelm the logistics of the oil industry” in the coming weeks, it warned. The massive OPEC+ deal to cut production starts next month. Until then the battle for market share persists with Abu Dhabi cutting its crude pricing for Asia. It follows a similar move by Saudi Arabia earlier in the week.

In Rates, 10Y Yields dropped as low as 0.67% after trading closing at 0.75% on Tuesday. Italian bonds remained under pressure amid lingering disappointment with the half-a-trillion euro plan to support coronavirus-hit economies agreed by euro zone finance ministers last week. Italy’s 2-year bond yield was last up 5 basis points to 0.89% after rising nearly 20 bps on Tuesday Ten-year yields were flat at 1.79%. The closely watched gap with Germany’s 10-year bond yield, effectively the risk premium Italy pays investors, continued to rise, last at nearly 220 bps, the highest since mid-March.

In FX, the dollar surged after several days of losses, as investors sought safety in the world’s reserve currency amid a wave of risk-off sentiment sweeping across global markets, with commodity currencies tumbling and oil prices sliding below $20 per barrel. The pound fell almost 1%, snapping a two-day advance. The Bloomberg Dollar Spot Index jumps as much as 0.8%, after three days of losses, as European stocks tumbled alongside U.S. equity futures as what is expected to be a turbulent earnings season gets underway. The BBDXY was last up 0.7%, with the dollar outperforming all Group-of-10 currencies; 10-year Treasury yield fell eight basis points to 0.67%.

The Australian dollar tumbled during Asian hours, and the Norwegian krone followed suit as oil prices slid with the International Energy Agency warning that a glut may overwhelm storage despite the recent OPEC deal. It says global oil demand will plunge by a record 9% this year due to coronavirus lockdowns

The pound and euro both fell versus the dollar, with sterling unwinding around half of this week’s rally as the U.K. Office for Budget Responsibility warned that Britain’s economic output could shrink 13% this year. “The combination of weak economic data and cautious corporate earnings outlook could put the latest risk rally to the test and may even help the safe- haven USD,” said Valentin Marinov, a strategist at Credit Agricole. “The rally in commodity currencies is starting to look overextended and could be put to the test in the near term.” Cable fell as much as 1% to $1.2499, though still up around 0.6% this week. EUR/USD declined 0.5% to $1.0931 with the Stoxx Europe 600 index dropping for the first time in five trading days.

Gold prices fell on Wednesday as investors locked in profits after strong recent gains which sent the yellow metal just shy of its 2011 all time high. It was last at $1,721 an ounce.

Expected data include retail sales and industrial production. Bank of America, Citigroup and Goldman Sachs are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 1.9% to 2,788.75

- STOXX Europe 600 down 1.2% to 329.77

- MXAP down 0.3% to 143.35

- MXAPJ down 0.5% to 460.62

- Nikkei down 0.5% to 19,550.09

- Topix up 0.04% to 1,434.07

- Hang Seng Index down 1.2% to 24,145.34

- Shanghai Composite down 0.6% to 2,811.17

- Sensex up 0.4% to 30,796.51

- Australia S&P/ASX 200 down 0.4% to 5,466.67

- Kospi up 1.7% to 1,857.08

- Brent futures down 4.2% to $28.35/bbl

- Gold spot down 0.8% to $1,713.56

- U.S. Dollar Index up 0.4% to 99.32

- German 10Y yield fell 3.9 bps to -0.416%

- Euro down 0.4% to $1.0935

- Italian 10Y yield rose 19.2 bps to 1.611%

- Spanish 10Y yield fell 0.4 bps to 0.839%

Top Overnight News from Bloomberg

- IEA says oil glut may overwhelm storage despite OPEC+ cut and revised global demand for 2020 to 90.5m b/d, from previous 99.9m

- Germany is set to agree on an extension of nationwide lockdown measures until at least May 3 as the government debates with regional leaders on how to gradually relax restrictions on public life in the coming weeks.

- Spain reported the biggest increase in the number of coronavirus cases in six days on Wednesday, while the daily death toll declined. There were more than 5,000 new infections in the 24 hours through Wednesday, taking the total to 177,633, according to Health Ministry data. The number of fatalities rose by 523 to 18,579, compared to Tuesday’s increase of 637

- The IMF wants policy makers to avoid repeating the Depression-era mistake of ratcheting back budget deficits. Instead, it’s urging them to ramp up fiscal stimulus when the coronavirus contagion starts to abate

Asian equity markets traded cautiously as the region failed to follow through on the optimism seen on Wall St where all major indices posted firm gains as liquidity conditions normalized from the Easter break and after comments from President Trump stoked optimism for the US to re-open its economy soon. Nonetheless, the momentum petered out in Asia trade with ASX 200 (-0.4%) dragged lower by heavy losses in the energy sector after WTI crude prices dipped another 7% and briefly tested the USD 20.00/bbl level on demand concerns and with financials subdued after poor earnings results from their stateside peers. Nikkei 225 (-0.5%) exporters were hampered by the ill-effects of a firmer currency and amid the global production shutdown extensions, while KOSPI remained closed for National Assembly elections which is seen as a referendum for President Moon and the government’s handling of the coronavirus outbreak. Elsewhere, Hang Seng (-1.2%) and Shanghai Comp. (-0.6%) traded rangebound and conformed to the indecisive regional tone despite PBoC’s efforts in which it conducted a CNY 100bln 1-year Medium-term Lending Facility at a reduced rate of 2.95% (Prev. 3.15%), while the first phase of its previously announced 100bps targeted RRR cut took effect today but this was also unsuccessful in spurring momentum. Finally, 10yr JGBs were pressured from the open and proceeded lower before finding support near the 152.00 level, while the BoJ Rinban announcement provided little inspiration with the central bank only in the market for JPY 400bln in up to 3yr maturities.

Top Asian News

- China Adds Cash to Banking System, Cuts Interest Rate on Loans

- India Farm Output Lone Bright Spot in an Economy Set to Shrink

- Albayrak Says Turkey Hasn’t Sought Help From Any Institution

European equities extend on losses seen at the cash open (Euro Stoxx 50 -2.1%), after a similarly (albeit to a lesser extent) handover from Asia, as the positive sentiment all Wall Street U-turned overnight. US equity futures also succumb to the broad risk aversion, with E-Mini S&P and Dow June futures back below the 2800 and 23500 marks respectively heading into more earnings. Back to Europe, bourses see broad-based losses with FTSE 100 (-2.4%) seeing more pronounced downside among the majors as the index is pressured by its large-cap Energy, Financial and Material names – three sectors which see steep losses in Europe, with the former the laggard amid price action in the energy complex. Similarly, financials suffer amid the lower yield environment and materials fall due to declines across the base metals. The sectors also clearly reflect risk aversion, as defensive fare considerably better than the cyclicals. In terms of the sector breakdown, Oil & Gas reside at the bottom, followed by the Travel & Leisure as lockdowns across some countries are set to be extended. In terms of individual movers. ASML (-1.8%) conformed to the decline in the region after opening higher post-earnings, in which its revenue and net printed relatively in-line with estimates, whilst suspending its Q2 buybacks but keeping its three-year programme intact. The CEO also noted that demand outlook is currently unchanged, and the group has not encountered any pushouts or cancellations this year, the group’s order intake remains strong. Sticking with earnings, TomTom (-7.3%) sees hefty losses amid dismal earnings after missing on all its company compiled estimates, withdrawing guidance and suspending share buybacks indefinitely. Finally, Adidas (-1.9%) received approval for a syndicated EUR 3bln loan from KFW contingent on a suspension of dividends.

Top European News

- Germany Likely to Extend National Lockdown Measures Until May 3

- Germany Mulls Easing Curbs as Europe’s Virus Struggle Progresses

- Energy Shares Drag European Stocks Lower After Five- Day Rally

- Swedish Debt Plan Triggers Backlash as Fiscal Hawks Under Attack

In FX, tthe Dollar was already clawing back losses across the board, but in particular relative to high beta and commodity based counterparts as Gold lost its lustre above Usd 1750/oz, but a more pronounced pull-back in crude prices following a bearish IEA monthly report gave the Greenback an extra fillip with the DXY back within striking distance of 99.500 compared to 98.828 lows. However, the index may encounter some technical resistance around recent recovery highs and run in to fundamental hurdles given bleak forecasts for upcoming US retail sales and ip data, not to mention the downside bias vs consensus.

- AUD/NZD/CAD/NOK/RUB/MXN – Aside from renewed risk aversion fuelled by the aforementioned about-turn in oil and metals, the Aussie has been undermined independently by a sharp deterioration in consumer sentiment per Westpac’s April survey, while the Kiwi is down in sympathy even though the Aud/Nzd cross has reversed from circa 1.0570 towards 1.0500. Aud/Usd got tantalisingly close to a hefty 1 bn 0.6450 option expiry at one stage, but now appears more inclined to hit 0.6300 and Nzd/Usd is even nearer 0.6000 from 0.6100+ overnight. Elsewhere, the Loonie is back below 1.4000 vs 1.3876 and still nervous ahead of the BoC, Eur/Nok is hovering just shy of 11.5000, Usd/Rub is pivoting 74.0000 and Usd/Mxn is paring back following a marginal breach of 23.9800.

- GBP/EUR/CHF/JPY – Also victims of the Buck’s broad revival, but to varying degrees as Cable reverses from 1.2630 to test 1.2500 and the Euro wanes 10 pips or so before 1.1000 to 1.0920, though not far enough to disturb decent expiry interest between 1.0890-1.0900 (1.3 bn). However, Eur/Usd may lose more momentum on a closing basis if the pair cannot reclaim 1.0950 and a Fib level just above, while the Pound will be eyeing the resumption of Brexit trade negotiations with the EU. Turning to the Franc, gains vs the Dollar have been eroded within a 0.9597-0.9648 range, but not against the single currency as prior support around 1.0550 seems to be morphing into a Eur/Chf cap. Similarly, the Yen has retained a solid safe-haven premium in cross terms, but Usd/Jpy failed to extend through 107.00 and subsequently rebounded to 107.50 or so amidst reports of fresh long positions being instigated on trading platforms.

- SEK/EM – Firmer than expected Swedish CPI metrics have helped the Swedish Krona evade much of the general risk-off positioning, but no such luck for Lira or Rand with the latter succumbing to further heavy post-SARB rate cut depreciation in wake of the SA Government supposedly reneging on wage deals according to the PSU.

In commodities, WTI and Brent futures gave up gains early-doors having had somewhat of a rangebound APAC session. Desks argue that participants are realizing that the OPEC+ cuts are not going to balance the markets over Q2, whilst cuts outside the group are more likely to be market-driven, thus the curtailments are to be gradual as opposed to immediate. Elsewhere, the oil and gas regulator in Texas – the Texas Railroad Commission – voiced disagreement on whether mandated cuts should be implemented. Bigger producers largely opted for market-driven declines whilst the smaller players supported cuts. Whilst the situation in Texas will be followed, Oklahoma are to conduct a meeting on 11th May to discuss mandated output curbs. Prices saw renewed pressure upon the release of the IEA Monthly Oil Market Report which stated that global oil demand is set to fall by a record 9.3mln BPD in 2020. Both the EIA and IEA unsurprisingly cut world oil demand outlook, although the latter by a considerably larger amount than the former, which forecasts a fall of 5.6mln BPD this year. The Agency also stated that it can reach SPR purchases of 200mln BPD over the next three months – a longer timeframe than the touted 2 months by the Saudi Energy Minister. The report also echoed some recent comments from IEA Chief Birol, stating that no feasible agreement could cut supply by enough to offset the near-term decline in demand. The OPEC Monthly report is set to be released on April 16th; participants will be on the lookout for synchrony among the three reports. Meanwhile, the weekly Private Inventories added further fuel to the bearish bias after printing a larger-than-expected build of 13.1mln vs. Exp. +11.7mln. WTI and Brent prices saw a fresh bout of weakness which coincided with the IEA report, with the former hitting levels last seen in 2002. WTI resides below USD 20/bbl and printed a current base at around USD 19.15/bbl. Brent front-month dipped below USD 28/bbl amid the concoction of bearish factors. Over in the metals complex, spot gold succumbs to a firmer Dollar alongside potential retracement of its recent rally, with prices closer to USD 1700/oz, having risen to a whisker away from USD 1750/oz (USD 1747/oz at best) in the prior session. Separately, Copper prices are under pressure from USD action alongside the risk aversion seen across the market. The red metal still resides above USD 2.25/lb having waned off overnight highs of USD 2.34/lb.

US Event Calendar

- 8:30am: Retail Sales Advance MoM, est. -8.0%, prior -0.5%

- Retail Sales Ex Auto MoM, est. -5.0%, prior -0.4%;

- Retail Sales Ex Auto and Gas, est. -5.2%, prior -0.2%

- 8:30am: Empire Manufacturing, est. -35, prior -21.5

- 9:15am: Industrial Production MoM, est. -4.0%, prior 0.6%; Capacity Utilization, est. 74.0%, prior 77.0%

- 10am: Business Inventories, est. -0.4%, prior -0.1%

- 10am: NAHB Housing Market Index, est. 55, prior 72

- 2pm: U.S. Federal Reserve Releases Beige Book

- 4pm: Net Long-term TIC Flows, prior $20.9b; Total Net TIC Flows, prior $122.9b

DB’s Jim Reid concludes the overnight wrap

Global equity markets advanced further yesterday as the market decided that flattening new case and fatality growth rates pretty much everywhere across the developed world is more important at the moment than working out how successful the exit strategies will be and how protracted the economic impact will be. Equities also liked comments from White House economic adviser Kudlow suggesting Mr Trump will make some “important announcements” over the next few days regarding state guidelines on reopening the economies even if Director of the National Institute of Allergy and Infectious Diseases, Anthony Fauci, said that a May 1 target to reopen is “a bit overly optimistic” for many areas of the country.

Overall it feels like we’re pricing in closer to a “V-shaped” recovery at the moment but it’s clearly difficult to disentangle the impact that the extraordinary support from the authorities is having. The Fed’s kitchen sink is still reverberating around markets. All is not well everywhere though as Italy and Oil had a bad day yesterday as we’ll touch on below.

The very latest on the coronavirus shows the growth rate of both new cases and fatalities over the past 24 hours were the lowest since the first week of March, before the outbreaks had really spread around Europe or the US. Global cases rose by 3.1% or by just over 60,000 cases to just shy of 2 million. Meanwhile fatalities rose by 5.8% or nearly 6,890 people globally, meaning the number of people confirmed to have passed away from Covid-19 now sits at 126,557. For more see our Corona Crisis Daily.

The S&P 500 ended the session up a further +3.06% to put it +27.20% above its closing low back on March 23rd. Meanwhile the VIX index of volatility continued to decline, falling for the 7th time in the last 8 sessions as it reached its lowest level in over 5 weeks (at 37.89). Over in Europe, the STOXX 600 (+0.61%) also nearly made it into bull market territory as well, before giving up some of its gains at the end of the session to put it up +19.40% since its own closing low on March 18th.

The moves higher for equities came as earnings season saw a number of companies report even if there was some mixed results. JPMorgan Chase reported that net income was $2.9bn, down 69% on the same quarter a year ago, with an $8.3bn provision for credit losses, up from just $1.5bn a year ago. Total trading revenues were +32% on Q1 2019, which beat investor day guidance of up mid-teens. The stock was -3.17% as bank stocks broadly were sold (S&P 500 Bank Industry group down -2.22%) in favour of Technology and Consumer stocks (both over +4%) for the second day in a row. Over at Wells Fargo (-4.40%), net income was $653m, down from $5.9bn in Q1 2019, while their own provision expense for credit losses was $4.0bn. Meanwhile Johnson & Johnson (+4.02%) lowered their 2020 guidance, now seeing full-year operational sales of $79.2-$82.2bn, down from $85.8-86.6bn back in January, but increased their dividend. The increased dividend and comments around a possible coronavirus vaccine saw sentiment in the stock improve even as guidance was cut. They are aiming to have a single-dose vaccine available for broad use early in 2021, and also is testing two backup vaccine candidates. They aim to produce 600 to 800 million doses in the first half of next year alone according to comments released after their earnings announcement. Today the main earnings highlights will be from UnitedHealth Group, Bank of America, ASML, Citigroup and Goldman Sachs.

Markets in Asia have been a bit less enthusiastic with most major bourses close to flat this morning. That includes the Nikkei (+0.07%), Hang Seng (-0.11%) and Shanghai Comp (-0.15%) while the ASX is down a steeper (-1.08%). In currencies, the Australian dollar is down -0.50% following data that showed Australia’s household sentiment fell to 75.6 in April (from 91.9 in last month), the biggest fall in the 47-year history of the survey. In commodities, Brent crude oil prices are up +1.28% this morning while most base metals are also trading up with iron ore +0.83%.

Overnight, China added another drip of stimulus to its economy with the PBoC injecting CNY 100bn via the one-year medium-term lending facility in to the economy at a rate of 2.95% vs 3.15% previously. The operation comes ahead of CNY 200bn of loans maturing on Friday.

In other news, the Washington Post is reporting that Federal health officials have begun drafting plans to end social-distancing measures and reopen businesses called the “Framework for Reopening America”. The document describes a phased program that would split the country into areas based on risk, with low-, moderate- and high-risk sections. Low-risk areas could open first, no earlier than May 1, with moderate- and high-risk areas later. The report added that the document says that none of the steps should be taken until widespread testing capabilities are in place. Futures on the S&P 500 are trading down -0.51% this morning.

Prior to this, President Trump announced during his press briefing yesterday that he would be instructing his administration to stop all funding for the World Health Organization on the basis that the body should not have taken China’s data at “face value” and that they failed to share information on the coronavirus early enough. According to WHO, the US has given $893 million to the organization in the current 2-year funding cycle.

Sticking with the US, after the market closed yesterday major US airlines and the Treasury reached an initial agreement on the aid that the government votes on in the recently passed fiscal stimulus bill. There is a total of $25billion in payroll assistance being allocated across all major airlines. Airlines that agreed to participate also included Alaska Air Group, Delta Air Lines, JetBlue Airways, United Airlines Holdings, Allegiant Airlines, Frontier Airlines, Hawaiian Airlines and SkyWest. Further, American Airlines Group and Delta Airlines said overnight that they will get $5.8bn and $5.4bn in support respectively. That accounts to almost 45% of the agreed assistance. Delta Chief Executive Officer Ed Bastian said in a message to employees that “The funding, along with self-help measures we have taken, will prevent furloughs and pay rate reductions through the end of September, despite the 95% drop we’ve seen in passenger traffic.” Shares of American Airlines (+10.7%), Delta (+9.29%) and JetBlue (+16%) are all up in afterhours trade along with those of other carriers.

Back to yesterday and over in fixed income, there was another notable widening in European sovereign bond spreads yesterday as the Eurogroup meeting from last Thursday has yet to convince markets that it is workable for all. As we highlighted yesterday Italy have said they won’t use the ESM and are putting a lot of faith in the recovery fund element of Thursday’s deal. This will be fleshed out at the April 23rd Eurogroup meeting. See our Italian economist Clemente’s piece (link here) yesterday on this and the domestic political tensions that have built up before and after last week’s meeting and agreement. Basically the Five Star are adamant that the ESM is not an option. Their coalition PD partners are a bit more pragmatic and are also putting a lot of hopes on the recovery fund. Meanwhile Salvini’s main opposition League party are capitalising on the situation and are stepping up the rhetoric against the Government and Europe. The Brothers of Italy party are also doing the same. So this story still has a lot of unfinished business to it.

The spread of Italian 10yr yields over bunds rose by +22.4bps to 216bps yesterday, its highest level since March 18th. It was a similar theme for other southern European countries, with the spread on Greek (+16.7bps), Spanish (+9.0bps) and Portuguese (+7.2bps) bonds all rising. Bunds themselves though made small gains, with 10yr yields falling by -3.0bps, while those on US Treasuries also fell by -2.0bps. The other big story from last Thursday namely credit continued to grab headlines. After the Fed’s foray into HY, markets continued to tighten with US HY and IG -35bps and -11bps tighter with Euro HY and IG -67bps and -10bps tighter. Oil fell on demand worries based on a report from the IMF on the global economic outlook that we get into below, as well as signals of continued oversupply with an American Petroleum Institute report showing that U.S. crude stockpiles surged 13.14 million barrels last week. Brent crude closed down -6.74% and WTI fell -10.26%. Our analyst Michael Hsueh put out another bearish piece yesterday. See here for more details.

These moves in financial markets came against the backdrop of yet another set of dire forecasts on the global economy yesterday, this time from the IMF’s semi-annual World Economic Outlook. In the report, which was entitled “The Great Lockdown”, they forecast that world GDP would contract by -3.0% this year, which would far exceed the -0.1% global contraction in 2009. Furthermore, unlike 2009 they forecast that both the advanced economies (-6.1%) as well as the emerging markets and developing economies (-1.0%) would see declines in GDP. Looking at the most severe declines, they see the Euro Area economy contracting by -7.5% this year, which includes large declines for Spain (-8.0%), Italy (-9.1%) and Greece (-10%). Meanwhile the volume of global trade would fall by -11.0%.

Against this backdrop, G7 finance ministers and central bank governors met virtually yesterday, with their statement saying that they “reiterated their pledge to do whatever is necessary to restore economic growth and protect jobs, businesses, and the resilience of the financial system.” However, ahead of this call, French finance minister Le Maire told reporters that the US was preventing attempts to boost the IMF’s capacity through the creation of more special drawing rights. That said, the statement released by the US Treasury department afterwards did call “for more and urgent contributions to the IMF’s Catastrophe Containment and Relief Trust and the poverty Reduction and Growth Trust to address critical funding needs.” There’ll be a call between G20 finance ministers and central bankers today.

Looking at other unprecedented forecasts, the UK’s Office for Budget Responsibility, which is the government’s independent fiscal watchdog, published a scenario that sees the economy contracting by an unprecedented -35% in Q2, with the deficit rising to 14% of GDP in 2020-21, which would be the highest level since WWII. This is a scenario rather than a forecast, and assumes that the lockdown lasts for 3 months, followed by a partial lifting over the following three months. The news was no better in France either, where finance minister Le Maire said that the economy would shrink by -8% this year, and the budget minister said that the budget deficit would rise to 9% of GDP.

To the day ahead now, and there’s a raft of data releases from the US, including February’s business inventories, March’s retail sales, industrial production and capacity utilisation, April’s Empire State manufacturing survey and NAHB housing market index, along with the weekly MBA mortgage applications. Over in Europe, there’ll also be the final March CPI reading from France and Italy. From central banks, the Bank of Canada will be deciding on rates, the Federal Reserve will release its Beige Book, while Atlanta Fed President Bostic will speak. And finally, earnings releases include UnitedHealth Group, Bank of America, ASML, Citigroup and Goldman Sachs.

Tyler Durden

Wed, 04/15/2020 – 07:34

via ZeroHedge News https://ift.tt/3abyQhV Tyler Durden