Treasury Cash Balance Soars To Record $959 Billion Following Bill Issuance Tsunami

It’s not just corporations that are scrambling to raise liquidity as fast as they possibly can (by drawing down on their bank revolver): so is the US Treasury. After fluctuating between $300 and $400 billion since last October (which in turn was a sharp spike from the $150BN at the end of August 2019, which prompted the first repo market crisis as the Treasury sucked out liquidity from banks), the US Treasury’s total cash balance has more than doubled in the two weeks, soaring to a record $959 billion as of April 14.

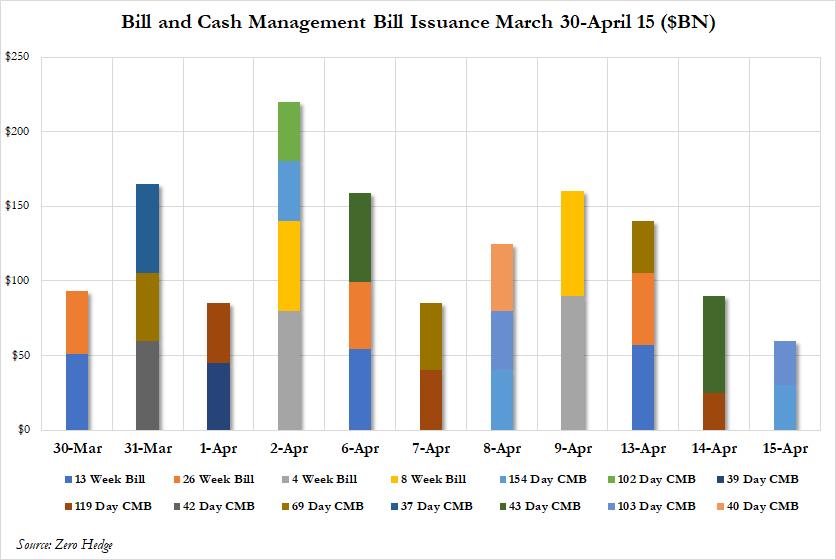

How did the Treasury manage to raise such a massive cash balance on such short notice? By unleashing a record flood of Bill and CMB (Cash Management Bill) issuance starting on March 30 when the Treasury cash balance was still just $408 billion.

As shown in the chart below, in just the past 11trading days, the Fed has sold an unprecedented $1.382 trillion in Bills and CMBs, or $125BN on average every single day.

The reason why the Treasury is stockpiling cash like its going out of style by tapping the short-term Treasury market, is because it will soon need to fund the Treasury’s multi-trillion bailout of America, and spend on countless other program that will only emerge in the coming weeks. But while we know the source and use of funds, one thing we don’t know is how the government will refinance the securities as they come due, Wrightson ICAP economist Lou Crandall wrote on Monday.

As shown in the chart above, the Treasury has announced $740BN in CMBs since the end of March, and while Wrightson sees the pace of CMB issuance slowing in the second half of April, total CMB supply may reach or exceed $1 trillion by the end of the month, an amount which will soon have to be rolled over/refinanced as the Treasury cash balance will soon tumble and it won’t be able to repay CMB maturities.

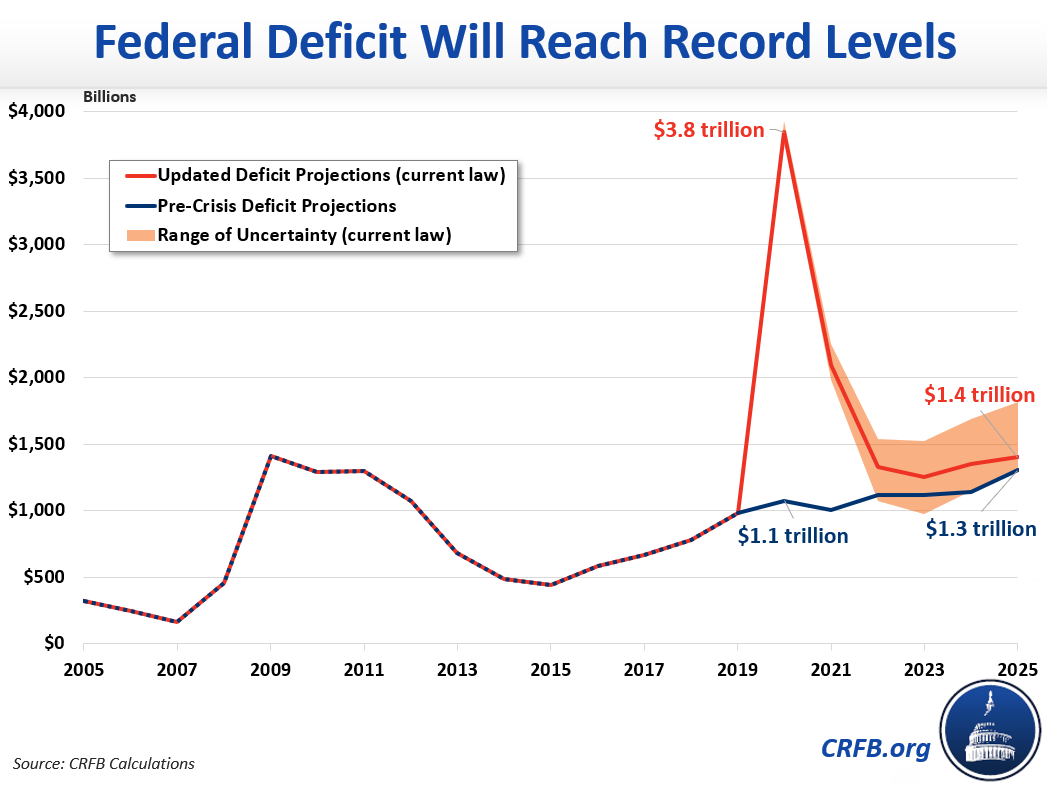

Looking ahead at the upcoming refinancing deluge, Crandall says that given that all of Treaury’s recent CMBs have Tuesday or Thursday maturity dates, one option is to increase the size of regular weekly auctions to cover the scheduled redemptions. Other options would be to increase regular bills enough to cover part of the rollover and supplement with ongoing CMBs, or refinance a portion of maturing CMBs with other instruments, such as floating-rate notes. Sooner or later, the Treasury will have to start raising coupon sizes too – after all the US budget deficit this year will quadruple to $3.8 trillion (at least) according to the CRFB…

… and will need to be somehow as well (mostly by debt as tax receipts are about to plunge to nothing). But we’ll cross that bridge when we get to to.

Going back to Crandall’s assessment, the ICAP strategist writes that the Treasury could refinance all of the CMBs anticipated in April without pushing its regular offering sizes “dramatically above current levels”, noting that when Treasury introduced FRNs in 2014, one of the objectives was to allow the government to meet demand for short-duration instruments in a low-rate environment “without expanding its auction footprint at the front end excessively.”

“That is suddenly a very relevant consideration again” he notes, which segues into the latest Zoltan Pozsar note released on Tuesday and which we will discuss shortly, in which the former Fed repo guru warns that soon the Fed may have to cap Bill yields as a result of the ongoing issuance flood.

Issuance concerns aside, the record surge in Bills will soon have a direct impact on the repo market, and as Curvature’s Scott Skyrm wrote earlier this week “term rates are moving higher because overnight rates are moving higher, which is because of all the bill issuance hitting the market this week.”

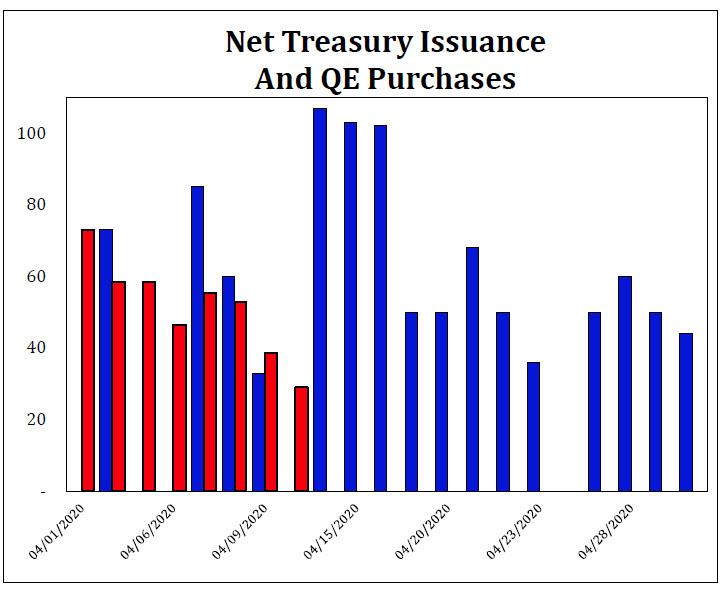

On Tuesday, Wednesday, and Thursday over $100 billion net new Treasurys [blue] settle each day with another $50 billion on Friday. This, combined with less QE [red], and declining RP operations means there’s a ton of collateral coming into the Repo market

This means that suddenly the Fed – which as we said yesterday is monetizing every new dollar of issuance as part of “helicopter money” – is locked to doing roughly the same amount of POMO as net Treasury issuance every day. And with Powell easing off the QE pedal in recent days, is the market about to suffer another major liquidity freak out as banks are forced to convert their much needed cash into Bills and coupons? If so, keep an eye on repo usage. While in recent weeks it has plunged…

… any increase in repo usage in the coming days will signify that another liquidity crisis may be imminent.

Tyler Durden

Wed, 04/15/2020 – 16:46

via ZeroHedge News https://ift.tt/34KU8Sf Tyler Durden