What Is The Stock Market Telling Us?

Authored by Bill Blain via MorningPorridge.com,

“Shoebox in middle of road? Luxury… You had it lucky..”

What is the stock market telling us?

-

It believes in the Central Bank Put….?

-

It buys the story the recent slew of positively-trending Coronavirus numbers means a swift economic reopening and sharp recovery is around the corner?

-

Surely every sane, rational and competent asset manager understands the virus is long-term, and sees the coming depression, job losses, crashing incomes, demand and deflationary shocks, zero returns, defaults, bankruptcies and slashed real asset values from aircraft, factories and property, mean long term crisis?

Yep. They probably do.

But their job is to generate returns. 2020 will be an economic write off – but if state interventions, and hopes of an early end to lockdown, can keep pushing markets higher, they have to play it. They know tumbling and zero dividends will cripple returns this year – therefore they need to lock in returns now – hence the scramble for assets by investment managers, even as corporates desperately seek cash to get them through the next 3-9 months of lockdown. The risk is the mirror cracks and the market splinter…

Investors seek returns from some very unlikely places. AirBnB raised another $1 bn from investors to shore up its crumbling balance sheet – based on being back in full business by January 2021. (Note I did not say profit.. that’s still a filthy word for “tech” marvels.) But perhaps it makes sense if we see a travel and spending rebound as social distancing winds down. It’s a risk – some virus modellers say social distancing could be necessary for up to 2 years!

And talking of unlikely assets, Investors are apparently all over Softbank offering funding and acquisition packages.

Tesla stock is up another bazillion points (20% in two days) after investment banks slathered over each other to slap buy-recommendations on it because of “revenue growth” expectations. Sure… if every other car company dies… Tesla will do swimmingly well… But… it makes a kind of bizarre sense.. As a chum asked this morning:

“Would you rather take the red pill and go for an exciting all or nothing Tesla ride, or would you take the blue pill and remain with zero-dividend, dull, boring and badly managed HSBC?”

He has a point.

Global Growth

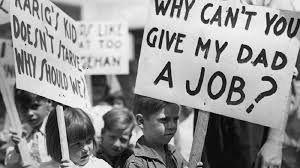

Some scary growth numbers were being banded about yesterday. As expected the IMF came out with some choice negativity – predicting Global GDP falling 3% (a 6.1% percentage point decline from its previous estimate of 3% global growth in 2020.) That exceeds the downturn following the GFC in 2008 – and is the worst since the 1930s. There will be a rebound, but output will still be 5% down in 2021. Unemployment will rise and incomes will drop.

Aside from a few centenarians, it looks like we’re in for the worst recession in living memory. Therefore, it might be worth recalling some quotes from the definitive book on the Great Depression, JK Galbraith’s The Great Crash of 1929 – see how many boxes you tick.

“The fact was that American enterprise in the twenties had opened its hospitable arms to an exceptional number of promoters, grafters, swindlers, imposters and frauds..”

“At best, in such depression times, monetary policy is a feeble read on which to lean.”

“In the autumn of 1929 the mightiest of Americans were, for a brief time, revealed as human beings.”

“The values of a society totally preoccupied with making money are not altogether reassuring.”

“The autumn of 1929 was, perhaps, the first occasion when men succeeded on a large scale in swindling themselves.”

“Wall Street’s crime… was less its power than its morals.”

“Financial capacity and political perspicacity are inversely correlated…Here at least equally with communism, lies the threat to capitalism. It is what causes men who know that things are going quite wrong to say that things are fundamentally sound.”

There are lessons to learn – the main one being not to roll back stimulus too early.

The IMF is calling for global coordination on recovery stimulus – but there is a rising protectionism risk there. I expect the tensions between China and US to escalate as the virus panic recedes.

Stepping up the dial to 11, even more shocking was the UK’s Office for Budget Responsibility which issued a scenario analysis where UK output tumbles 35% in Q2 following a three-month lockdown. The deficit will rise to 14% of GDP, and unemployment surge to over 2 million. The OBR is not some flaky bunch of doomsters, but calm, sober, rational economists. One of my smarter chums is among them. She doesn’t panic. She says it like it is.

Interestingly the IMF predicts positive growth in China and India – fuelling many of the conspiracy theories about China’s responsibility for the crisis. As the wise and all-seeing leader of the West halts payments to the WHO because it trusted China, there is all kinds of conspiracy stuff on the internet about how the virus must have been genetically engineered, specifically targeted to weaken the west by collapsing our health services.

Like most things we desperately want to find someone to pin the blame on, the likely explanation is the virus was an accident waiting to happen. China would be wise to fess up and admit the fault of wet markets, and be open about how dodgy the numbers it has published look.

I will accept the US Chair of Joint Chiefs of Staff when he said a natural origin is the most likely explanation for the genesis of the virus. (I can guarantee I’ll be trolled and get a screed of emails providing irrefutable proof it was the Chinese, but after burning down all our local G5 phone masts last night, I’m really too tired to care…)

Banks

JP Morgan and Wells Fargo reported their expected shocking Q1 numbers. Both hiked credit loss provisions, anticipating major losses from consumer lending and credit cards, and SMEs. Less than 4% of JPM’s mortgages had missed payments in Q1 – but with US unemployment likely to hit 23 million in the next few weeks (and its beginning to bite the middle classes), where do bank losses go next?

If it’s bad in the US – where the banks were fixed post 2008 – how bad is it going to get in Europe. Ouch.

Tyler Durden

Wed, 04/15/2020 – 11:11

via ZeroHedge News https://ift.tt/2wKh3AE Tyler Durden