Airlines Plunge After United Sees”Essentially Zero” Demand, No Recovery

The mini bounce after US airlines reached a bailout deal on Tuesday with the US Treasury lasted exactly one day, and on Thursday US airlines stocks sank after United Airlines warned that travel demand was “essentially zero,” and showed no signs of in the near term.

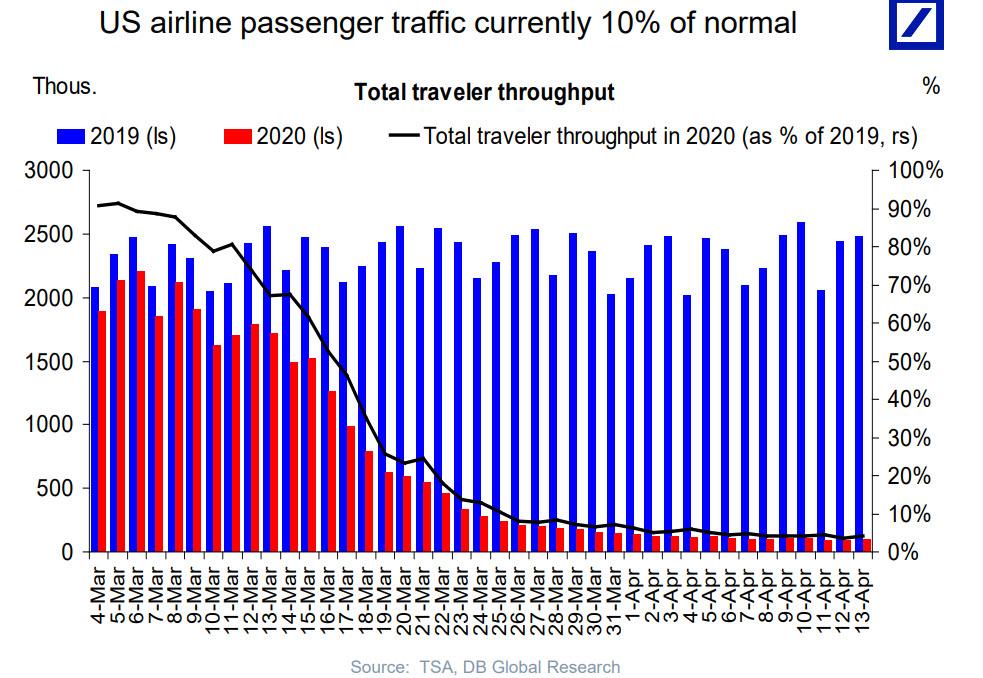

The US carrier warned its employees of bleak times and potential long-term payroll cuts despite billions of dollars in U.S. taxpayer assistance, saying the outlook for travel demand will remain depressed into next year. In response to the collapse in demand, United said it will further cut its flight schedule in May to roughly 10% of the capacity it had planned at the start of 2020, and similar cuts are in store for June, said Chief Executive Officer Oscar Munoz and President Scott Kirby. As an example of the shortfalls, the carrier will fly fewer people during all of next month than on a single day in May 2019.

“Travel demand is essentially zero and shows no sign of improving in the near term,” Munoz and Kirby wrote in a message to employees late Wednesday. “While we have not yet finalized changes to our schedule for July and August, we expect demand to remain suppressed for the remainder of 2020 and likely into next year.”

As Bloomberg adds, “the dire tone underscored the depth of the crisis facing airlines as the Covid-19 pandemic and government travel restrictions force people to stay home.” Rescue funds contained in the U.S. stimulus package signed into law last month will help airlines pay employees while obliging them not to cut jobs through Sept. 30. But United signaled that even with the bailout funds – many of which are in the form of grants – deep cost reductions will be necessary for the company to survive. Translation: we will need a bigger bailout.

As a reminder, United will collect about $5 billion from the government in grants and a low-interest loan, part of $25 billion in airline assistance being doled out by the U.S. Treasury. Carriers are also in line for $25 billion in additional loans as part of the overall economic rescue plan of about $2 trillion.

“The challenging economic outlook means we have some tough decisions ahead as we plan for our airline, and our overall workforce, to be smaller than it is today, starting as early as October 1,” Munoz and Kirby said.

Meanwhile, more than 20,000 United employees have accepted voluntary leave and separation programs that the company has offered in recent weeks as it seeks to reduce labor expenses. The Chicago-based airline, which had a workforce of about 95,000 at the start of the year, said it would renew efforts to interest more workers in the programs.

“The challenge that lies ahead for United is bigger than any we have faced in our proud 94-year history,” Munoz and Kirby said. “We are committed to being as direct and as transparent as possible with you about the decisions that lay ahead and what impact they will have on our business and on you.”

Kirby assumes the role of CEO on May 20, when Munoz becomes becoming executive chairman.

Late on Wednesday, American Airlines released a somewhat more upbeat video late Wednesday in which CEO Doug Parker told employees that the almost $11 billion the carrier expects to receive in U.S. grants and loans should help get the company through the crisis.

“It feels strange and even a little frightening when we don’t have as many people to care for as we’re used to,” Parker said. “But this will pass and when it does, the American team will be ready to safely care for our customers.”

We’ll timestamp that and revisit in one month.

Following the United warning, the S&P Supercomposite Airlines Industry Index dropped as much as 7.6%, with UAL, AAL, HA, ALK, DAL the biggest decliners.

The index is down 57% since mid-February when the market meltdown in the U.S. took hold; the SPX is down about 18% over the same period.

Tyler Durden

Thu, 04/16/2020 – 11:43

via ZeroHedge News https://ift.tt/3bapyns Tyler Durden