Kashkari Urges Banks To Sell $200BN In Stock “Now” To Survive The Coming Crash And Avoid Another Bailout

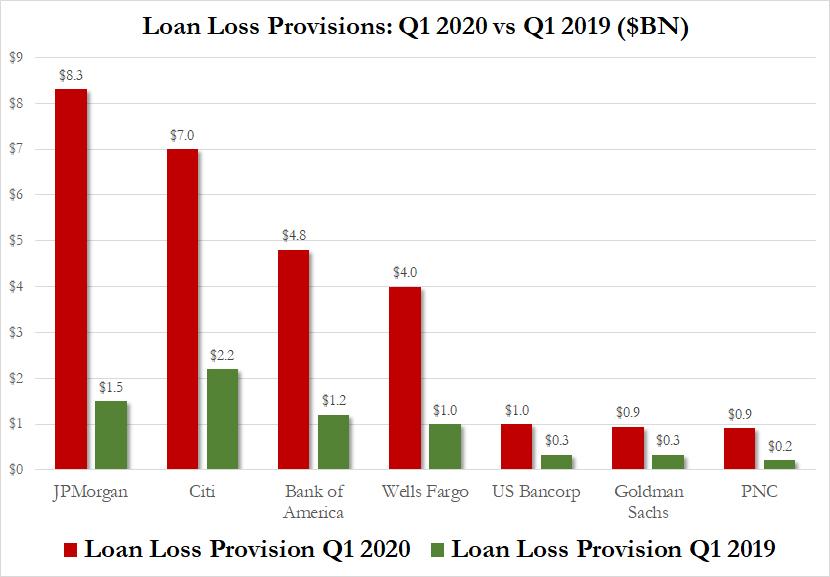

Yesterday, when looking at the latest credit loss reserve numbers from America’s top banks which amounted to $27 billion among the big 7 banks, a number which was understandably 4x greater than the total provisions set aside a year ago…

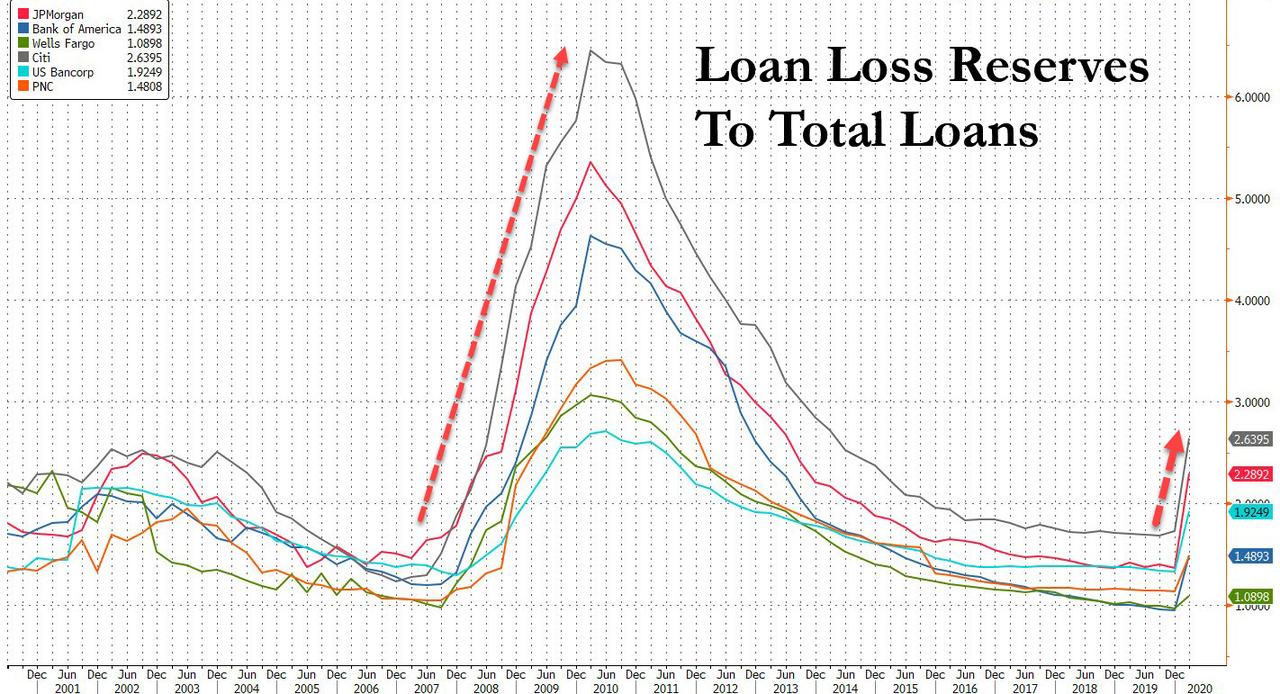

… we said that despite the significant increase (mostly at JPMorgan which traditionally has been one of the most conservative banks), the number won’t be nearly sufficient by the time the corona-cession is over. Why? Because as we also showed, the last time the US economy suffered a horrific recession, similar to the one right now, the total loan loss reserve to total loans ratio soared to between 4 and 6%. It is now only between 1.5% and 2.5%.

This also explains the reason why banks did not want to discuss what their future loan loss provisions would and could be – because they know very well that if the financial crisis is a template, there is a long way to go before banks are properly provisioned and the cost of this provisioning would be billions in losses as well as billions in new capital. As an aside, BofA CFO Donofrio was almost angry on a few occasions when responding to questions how much more reserves in Q2 the bank would need, saying the bank reserves based on what we know at the moment, and that if he knew how much higher reserves would be he’d “add them now.”

Well, if he won’t add them now, he will add them in Q2, when loan loss provisions will explode, and we expect bank loss expectations will soar by double digits across most banks as the ghost of 2009 loan losses fully materializes.

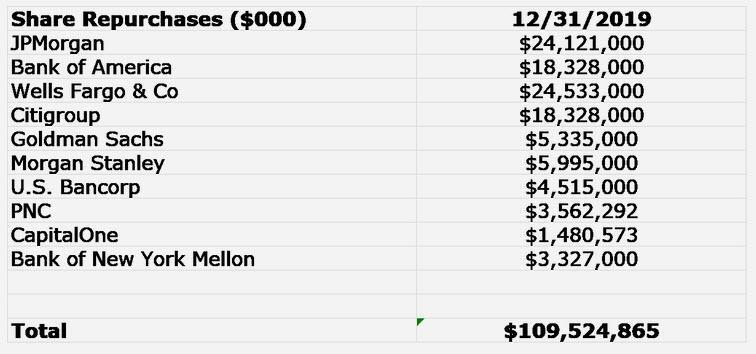

So to put it all in context, so far the “Big 4” banks have reserved an additional $24BN in Q1 for future loses. But if the GFC is any indication of the defaults that are about to be unleashed, the real amount of losses, discharges and delinquencies will increase 3x-4x compared to the current baseline, meaning that over the next several quarters, banks will have to take another $75-$100BN in reserves on loans that go bad, wiping out years of profits, which were used not for a rainy day fund but to pay for – drumroll – buybacks. As Chris Whalen showed, the banks most recently repurchased over $100BN in stock (which is also why the banks better NOT come begging for bailouts in a few months).

In any case, such a sharp surge in loan losses could be a major problem for banks which until now were seen as generously overcapitalized, because if the US banking sector is facing $100BN (or more) in loan losses, then the Fed will have no choice but to once again step in and bail out the US financial sector.

It now turns out that even our aggressive estimate of $100 billion in potential losses may have been too low, because in what may be the only useful public address from Minneapolis Fed Neel Kashkari who generously took some time away from trolling all those who have exposed the Fed as a market manipulating vehicle for the benefit of the “0.01%”, has written an op-ed in the FT in which he doubles our estimate of potential losses, and urges bank to raise $200BN in new capital “now”, a move which while prudent – and frankly laudable – will never happen as it will send bank stock prices crashing since it would dilute the market cap of US banks by double digits.

And something else that banks won’t do is suspend dividends – until the coronacrisis gets much worse of course – even though Kashkari, useful for the first and probably last time in his career, urges them to suspend dividends now:

Large banks are eager to be part of the solution to the coronavirus crisis. The most patriotic thing they could do today would be to stop paying dividends and raise equity capital, to ensure that they can endure a deep economic downturn. Unlike the rest of us, banks have the ability to essentially vaccinate themselves against this crisis. They should do so now.

Of course, this being Kashkari, the former Goldman banker is purposefully clueless about the Fed’s role in promoting and encouraging bad bank behavior for the past decade; so instead of targeting the Fed, Kashkari lashes out at the banks instead:

When financial strains emerged in 2007, US officials urged large bank chief executives to raise equity to make sure they had the wherewithal to survive a crisis. The most common answer was: “We’re fine. We don’t need it. Our balance sheet is rock solid.” They only realised that they had serious problems after the deep losses were obvious to everyone, especially financial markets. At that point it was much more difficult, if not impossible, for them to issue equity because their stock prices had already collapsed. And that was when governments in the US and elsewhere had no choice but to step in with bailouts.

That’s funny because we remember another institution in 2007 which said that “we’re fine” – Kashkari’s current employer, the Federal Reserve itself. And once the US central bank found itself catastrophically behind the curve, it panicked and unleashed a wave of unprecedented moral hazard that appeared unsurpassable… until last week when the Fed doubled down and did something not even Bernanke was willing to do – buy investment grade bonds first, and then junk bonds.

It gets better: some of us actually recall in 2017 when Kashkari said – in response to a question from Zero Hedge, asking “what is the biggest S&P drop the Fed will accept before intervening?” – that he doesn’t “care about stock market fall itself. Care abt potential financial instability. Stock market drop unlikely to trigger crisis. “

Don’t care about stock market fall itself. Care abt potential financial instability. Stock market drop unlikely to trigger crisis. #AskNeel https://t.co/Cv7ENuJuqU

— Neel Kashkari (@neelkashkari) March 21, 2017

Oh how delightfully ironic it is then that the Fed waited until the stock market was down 35% on March 23 from its February highs before announcing it would unleash Unlimited QE and started buying corporate bonds. Would you care to revise your answer now, Neel?

Kashkari’s self-serving narrative – which nobody believes anymore – aside, he actually does bring up a valid point: we say that because it’s precisely the point we brought up yesterday, namely the banks have no idea how bad it will get, and they have a duty to prepare for the worst, something they clearly have not done now, and won’t do until they absolutely have to, at which point their loss reserves will explode. Here is Kashkari this morning in the FT, effectively reading from our post:

We simply do not know how large the losses from this crisis will be, because the depth and duration of the downturn depends on how the virus progresses and how our healthcare systems respond. Experts say a vaccine will not be ready for 18 months. Will new therapies emerge sooner that allow us to relax the economic shutdown while still protecting people? Nobody knows.

It is not hard to see scenarios where we have to impose some economic controls for months on end. In 2009, according to the Centers for Disease Control and Prevention, 61m Americans, or roughly 20 per cent of the population, contracted swine flu. Fortunately the mortality rate was low. There is still tremendous uncertainty around the Covid-19 death rate.

Shockingly, Kashkari actually makes another good point: not if, but when the banks come begging for another bailout – because, you know, everyone else is doing so thanks to the tsunami of moral hazard the Fed launched with LTCM in 1998 and then with the financial crisis ten years later, they should not get it because they had more than enough time to prepare.

Banks will argue that this crisis is not their fault, any more than it is the fault of airlines or hotel operators. So why should they not get a bailout too? There is an important difference: we can see this risk coming and banks have time to prepare for it. Airlines and hotel companies did not have advance warning.

Here’s the funny bit: while Kashkari is acting the tough guy in his oped, the moments his former employer Goldman Sachs tells the Fed it needs another $15Bn in capital right now, the Minneapolis Fed president – whose ambitions to replace Powell are all too obvious to everyone – will be the first to bend over.

In any case, his conclusion is correct – banks should raise $200BN in capital now while they can, not when they have to, at which point they will skip the song and dance entirely, and proceed to demanding taxpayer funds immediately.

In 2008, US taxpayers injected about $200bn of capital to strengthen banks. Raising that amount from private investors today, as a strong, preventive measure, would ensure that large banks can support the economy over a broad range of virus scenarios.

If the crisis turns out less serious than we fear, banks can return the capital through buybacks and dividends once the crisis passes. We will then celebrate their action to support the public during a national emergency. As bankers are fond of telling their clients: no one has ever regretted raising capital.

Right… except the banks themselves, who know very well the stock prices go up only when a company buys back its own stock. We hope that even a Fed president should be able to figure out what happens when a bank sells stock instead…

Tyler Durden

Thu, 04/16/2020 – 14:54

via ZeroHedge News https://ift.tt/3ciwpvc Tyler Durden