Conviction-Less Comeback In Stocks Smells Like A Big Bull Trap

Authored by Eddie van der Walt via Bloomberg,

Low volume at the start of the recent stock rally suggests it’s a bull trap, not a journey to record highs, based on algorithmic analysis of 30 years of data.

Momentum in the S&P 500, Dow Jones Industrial Index and Stoxx 600 turned in March, thanks to collective action by central bankers.

Since then, the question in financial markets has been palpable: are the lows in?

History suggests not.

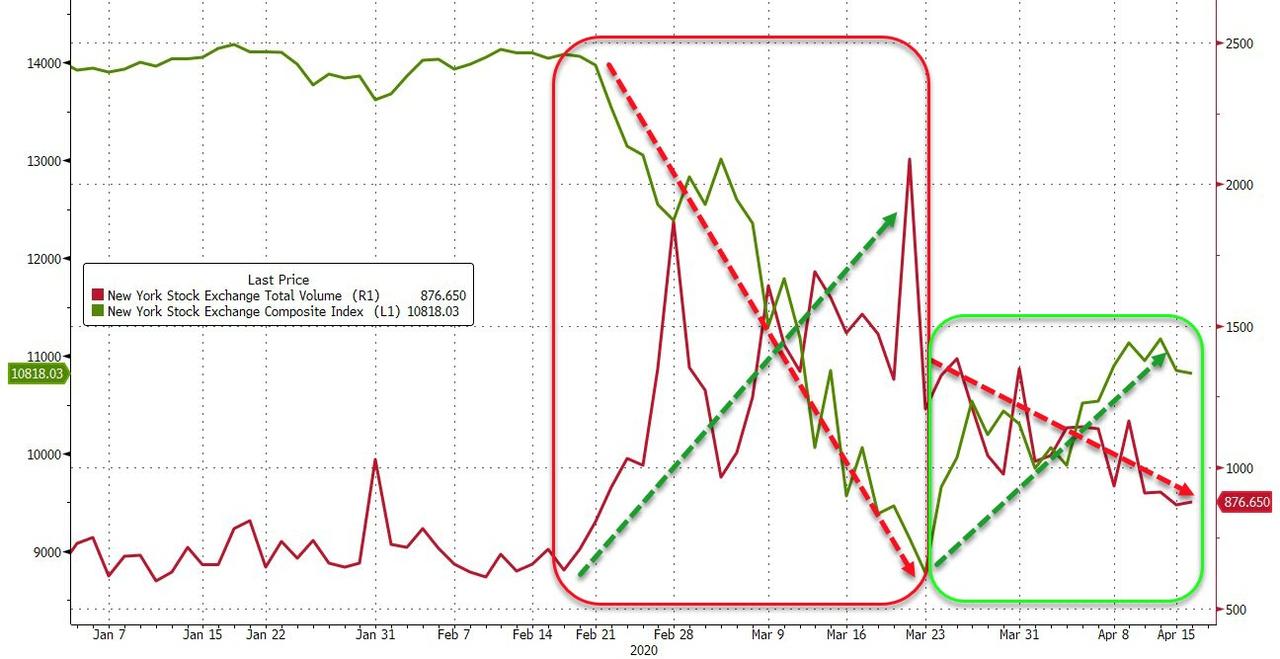

In eight bear markets across the three indexes since the 90s, the bottom was usually marked with a bang, not a whimper. Trading volume in the first 10 days of the turnaround on all but one occasion (the Stoxx 600 in March 2009) was at least 10% higher than the volume in the bear market as a whole.

And that makes sense. If a groundswell of money is ready to overturn a bearish consensus, volume is likely to pick up in an epic tug of war.

Across the series, volume below 110% of the bear-market average in the first 10 days of an advance correctly identified five false dawns, where the index rallied 15%, then continued to lower lows.

Volume is, however, a reasonable prerequisite, not a sufficient condition. Heavy trading would have triggered 12 false positives, which suggests that the study is best used to negatively screen rallies.

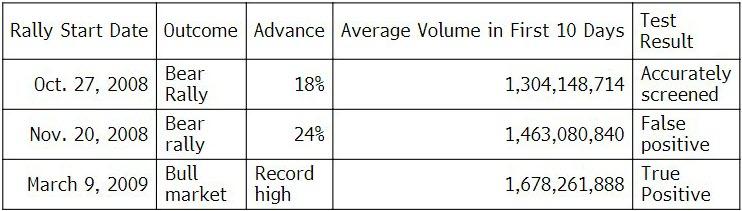

For the most recent S&P 500 bear market that started on Oct. 9, 2007 and ended on March 9, 2009, the total drawdown was 57% and average daily volume was 1,310,603,671.

Yet the bear-market rallies in this period offered mixed signals, as summarized in this table:

This year, all three indexes failed the test. The first 10 sessions after the local low saw average trading volume of ~98% the bear-market average for the S&P 500, ~94% for the Dow Jones and ~104% for the Stoxx 600.

As with all statistical analysis, this data should be treated with care and seen in context. The sheer velocity of the descent — the fastest in history — has meant that volume is probably skewed upwards. Volatility begets volume.

Yet conviction was stronger on the way down than on the way up, and that’s a worrying sign. More study is needed, but on volume alone, this bear market doesn’t appear to be over

Tyler Durden

Fri, 04/17/2020 – 10:50

via ZeroHedge News https://ift.tt/34LP001 Tyler Durden