Fed Cuts Pace Of Treasury QE By 50% To “Only” $15 Billion Per Day, Yields Spike

From an initial $75 billion per day when the Fed announced the launch of Unlimited QE, the us central bank reduced its daily buying to $60 billion per day, then two weeks ago announced another ‘taper’ in its bond-buying program to $50 billion per day, which was followed by last week’s reduction to 30 billion per day. Now, the Fed has slashed its buying by another 50%, to “only” $15BN per day.

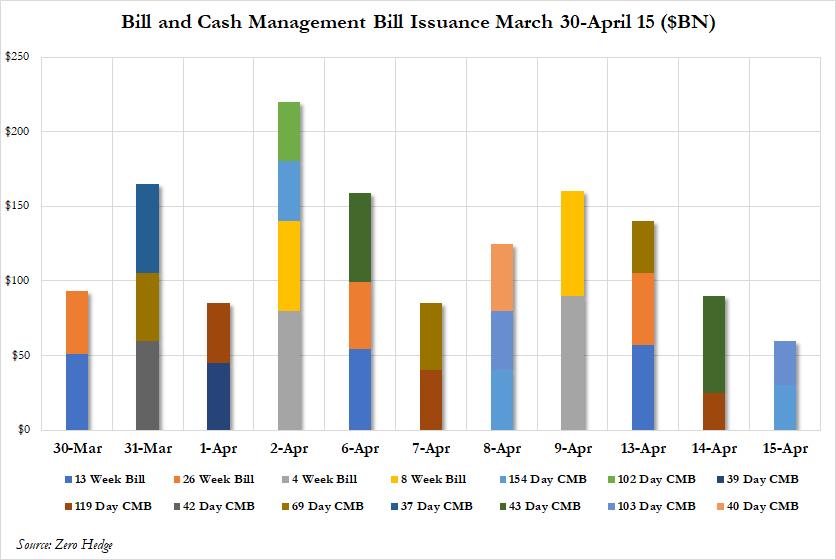

Having implicitly confirmed there is now a shortage of bonds – at least coupon bonds considering the $1.382 trillion flood in T-Bills and Cash Management Bills in the past two weeks to fund the stimulus package…

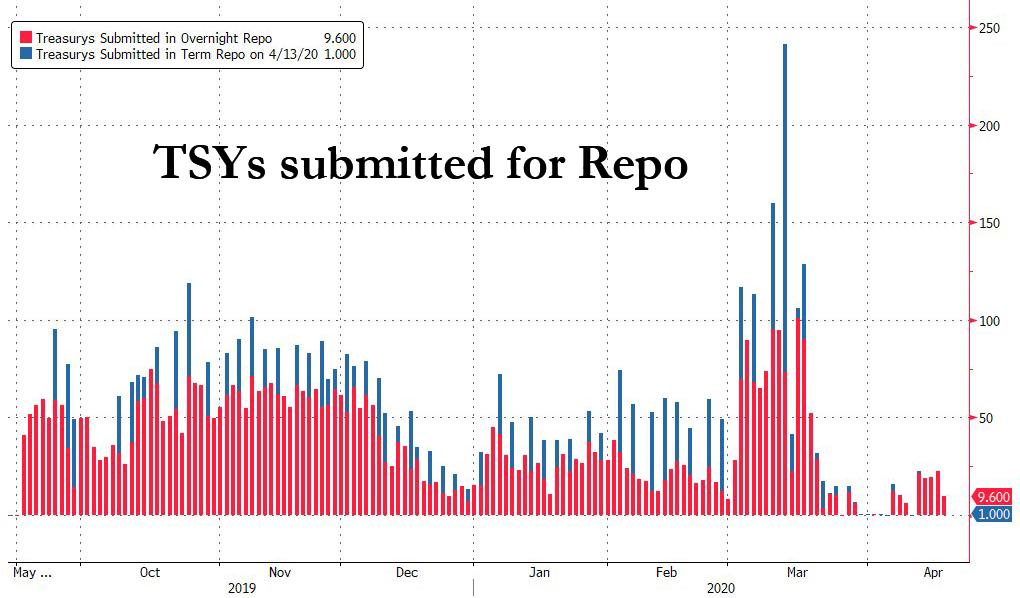

… as demonstrated by the recent repo ops that saw zero submissions as instead of using repo to park bonds with the Fed Dealers merely sell them back to the Fed, the NYFed has announced it will continue cutting back, or tapering, its “unlimited QE” bond-buying next week.

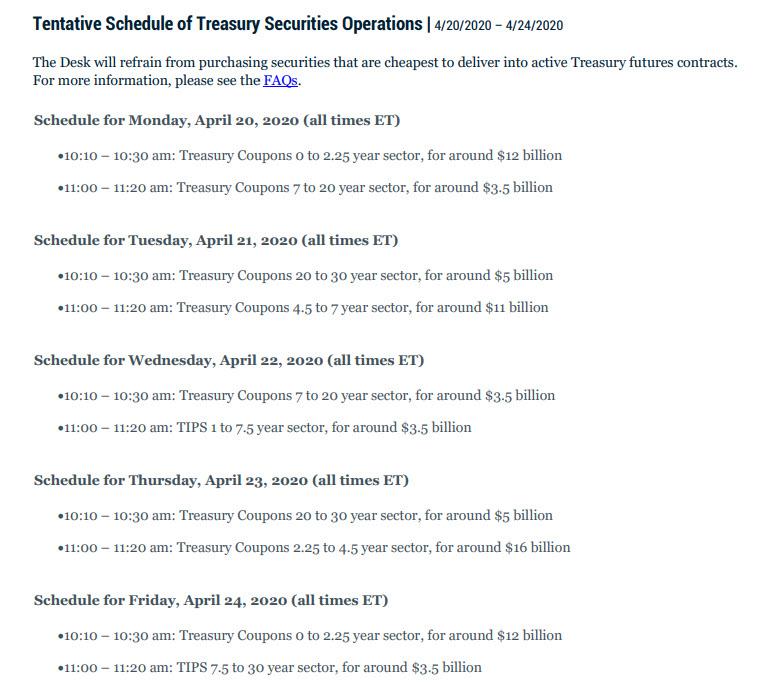

Here is the full schedule for the week ahead.

Additionally, the Fed will also taper its MBS buying from $15 billion to $10 billion in MBS per day next week:

- Mon: $10.709

- Tue: $8.938

- Wed: $10.709

- Thur: $8.938

- Fri: $10.7019

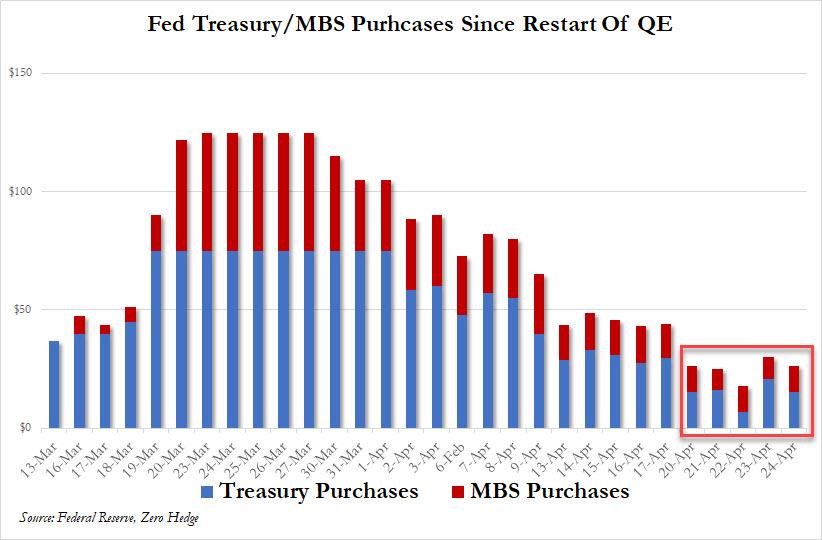

The chart below summarizes all the Fed Treasury and MBS buying completed and scheduled since the relaunch of QE on March 13:

So, in aggregate, The Fed will buy a total of $125 billion of MBS/TSYs next week, still vastly more on a weekly basis than the largest QE programs monthly totals before this crisis, if well below the $625 billion in purchases conducted in the week starting March 23, when the financial system was once again on the verge of collapse and only the Fed could bail it out… just don’t call it a bail out because nobody could have possibly anticipated an economic shock especially after banks repurchased trillions in their own stock in the past decade.

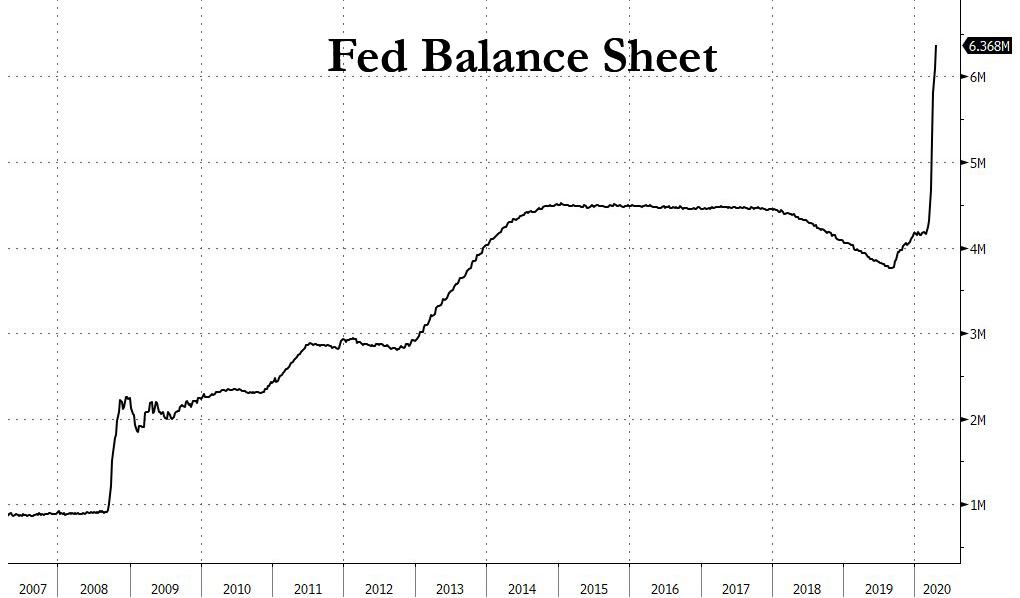

Meanwhile, after the Fed mysteriously delayed the publication of its closely followed H.4.1 statement laying out the size of its balance sheet on Thursday, the central bank updated the numbers this morning, which showed that as close of Aptil 15, the Fed’s balance sheet was a record $6.368 trillion, up $285 billion on the week and up $2.4 trillion from a year ago. Just staggering numbers and unprecedented dollar debasement.

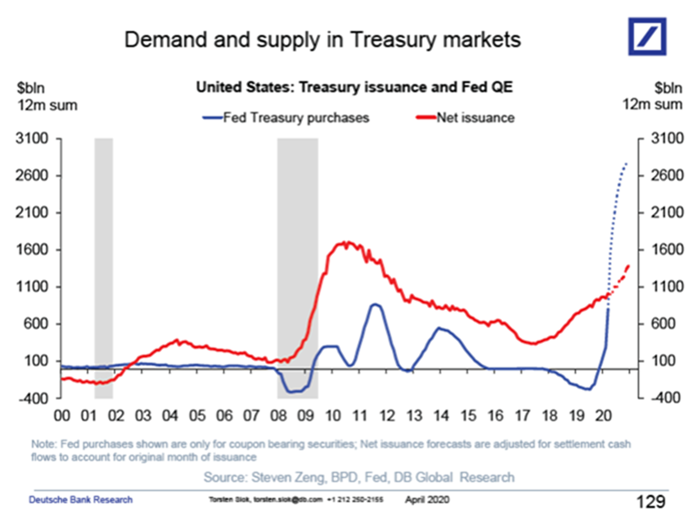

For those curious what the “helicopter money” big picture looks like, now that the Fed and Treasury are effectively merged with the Fed stuck monetizing Treasury issuance indefinitely, here it is: as we reported last night when the Fed did QE in the years following the 2008 financial crisis monthly Treasury purchases never exceeded US Treasury net issuance, but the Fed is now on track to buy double the amount of net issuance.

Finally, and perhaps most ominous, is that treasury yields were clearly unhappy with the latest POPO taper (unlike last week’s cut to $30BN which the bond market largely ignored) with 10Y yi8elds spiking by 5bps, which suggests that $15BN is where the Fed will be stuck with QE going forward as any further cuts to the daily monetization amount will lead to a major repricing in the long-end, in a clear shock to fans of the Magic Money Tree paradigm who believe that the US can float quadrillion dollar deficits without penalty.

This also means that if the Fed does taper again next week, watch out as Treasury volatility returns with a vengeance and the spread to all other asset classes, again.

Tyler Durden

Fri, 04/17/2020 – 14:26

via ZeroHedge News https://ift.tt/2yqN0OF Tyler Durden