“Let Them Eat Stocks”: Top Market Strategist Says “In 20 Years I Have Never Seen Anything Like This”

Submitted by Michael Every of Rabobank

It’s Hard Not to Be ‘Depressed’

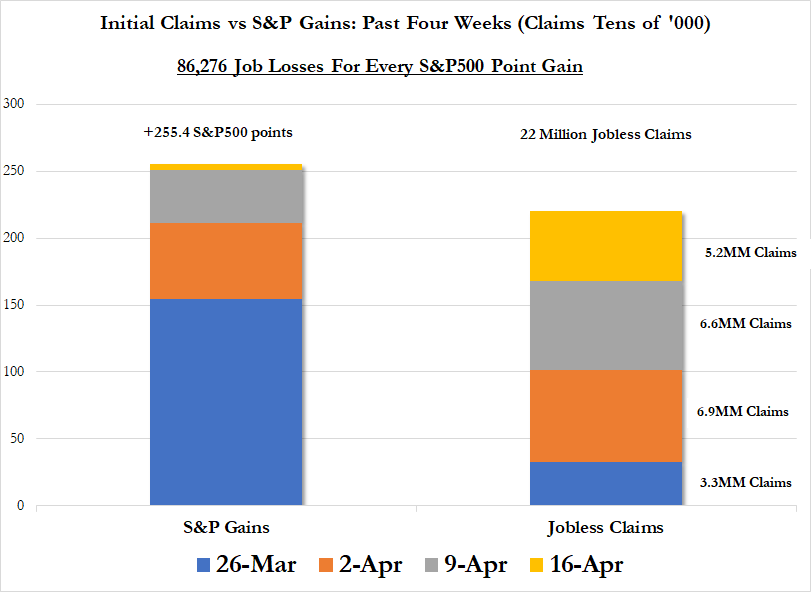

Here come the depression-level data. US jobless claims soared a further 5.2 million in the past week, meaning that around 22 million jobs have now been shed in the past four weeks. That undoes all the jobs created since the end of the Global Financial Crisis, which is seen as unprecedented in the structural economic damage that it wrought. Yet we are still only four weeks in to this: does anyone think the sudden slump in demand from 22 million newly unemployed, let alone the broader impact of ongoing lockdowns, won’t see a further massive initial claims print next week, and the week after, and the one after that, and so on?

I have written about economics and markets for over 20 years and try (and often fail) to detach myself from some of the wilder, more unusual, or more illogical and/or unsustainable movements one sees. However, US equities rallying for a fourth successive week on the back of a fourth successive print showing millions of US citizens losing their jobs is a real splinter in the mind’s eye: maybe if everyone loses their job equities could double?

This all goes far beyond the pre-Covid metric of ‘bad news is good news’ because we already have zero rates and apparently infinite quasi-fiscal Fed liquidity on offer: what more is being priced in by further economic misery? To the increasingly depressed it smacks dangerously of depression alongside a Marie Antoinette-esque “Let them eat stocks” from Wall Street – as does Treasury Secretary Mnuchin stating in a TV interview that a check for $1,200 is bridge finance supposed to last the recipient for 10 weeks: I am sure he has vast experience of living on that kind of breadline.

Yes, US President Trump is now flagging that some parts of the US economy can open up again in four weeks – but that’s another month of massive job losses to then try to recover from, and to eke out on USD1,200. Moreover, as we keep repeating, one cannot assume that there is going to be a binary switch back to normal. Voluntary lockdowns, in terms of consumers not going out to many places, are going to linger for a long time – we have evidence of that from China, where things are still not back to normal at all, and from Sweden, where things aren’t locked down and yet where people won’t go to cinemas, etc. Add on top recent evidence that social distancing needs to be MUCH more than two meters OR that masks must be worn inside and outside at all times to ensure that two metres is enough, and normal economies are not on the horizon.

On that front, the headlines today are that China’s GDP collapsed -9.8% q/q and -6.8% y/y in Q1, the inverse of what one would normally expect to see in a series that is carefully pruned and polished before public outings. That was actually better than the -12.0% q/q consensus but oddly worse than the -6.0% y/y consensus – but this is all probably still the market-friendly version of the actual facts in many places.

We also saw industrial production for “back to normal” March at -1.1%, far better than the -6.2% expected, and fixed investment was -16.1% y/y YTD, although up from -24.5%. Yet retail sales, on which hopes for Chinese recovery are based given global demand is absent, were -15.8% y/y, worse than the -10.0% the market was looking for. Lastly, the unemployment rate was DOWN to 5.9% from 6.2%, which is why nobody pays any attention to it at all. Also worth noting was a survey on SME activity released yesterday by the PBC School of Finance at Tsinghua University. It shows daily revenue is running around half the level it was in 2019, and monthly revenue for March is -60% y/y. That is with an economy that has been opened up – and those are still depression level data.

Even some Fed members are hedging their bets. Bullard notes that while a V-shaped US recovery is possible, so is a “depression”. Yes, he mentioned the D word. Kaplan sees unemployment hitting the high teens (it’s already there, so that’s another great Fed look into the distant future) and is “open minded” about the Fed now including financial aid to non-profits. One could quip that by covering junk bonds the Fed is already bailing out non-profits: that as GOP Senator Crapo (no typo), who heads the powerful Banking Committee, is stressing that transparency over the eligibility for the coming flood of trillions of USD is required.

Meanwhile, Europe is having its own drama. French President Macron has given an interview with the FT in which he argues that fiscal transfers are needed if the EU is to “hold on” through this crisis, underlining that globalisation as we knew it is over, and that tomorrow belongs to populists and Euroskeptics if the EU won’t agree to burden sharing. With opinion so split on the issue of coronabonds, and the nuts and bolts of it so complex, large parts of the EU are going to face ‘depression’ in a least one sense no matter how this binary issue is finally resolved – though if that will be at next week’s virtual summit remains to be seen.

Finally, more international drama. Stand-in UK PM Dominic Raab has decided to go on a “Raab araaand” (apologies to the late Mike Reid) on the foreign policy front, stating “There is no doubt we can’t have business as usual” with China and that “After this crisis, we’ll have to ask the hard questions about how it came about and how it couldn’t have been stopped earlier.“ Anglo-US solidarity? One wonders if the Huawei greenlight still stands when Boris gets back to No. 10.

Likewise, Reuters reported yesterday that the US has blocked the IMF from issuing more SDR to free up lending capacity specifically over objections to USD funding being made without conditions to Iran….and China. Why does China need USD from the IMF? Why doesn’t the US want the IMF to lend them to it? And why is China on the same list as Iran at all? Perhaps this is nothing – but for those who want to see, it looks a lot like another facet of USD/Eurodollar power-play akin to the “He who controls the spice controls the universe!” going on inside the US in terms of who the Fed/Treasury channel cash to.

It really is all very depressing – and so I get why people don’t want to see it.

Tyler Durden

Fri, 04/17/2020 – 12:25

via ZeroHedge News https://ift.tt/2VBaJnx Tyler Durden