Mexico Downgraded To Baa1 By Moody’s; “Negative Outlook” Means Junking Imminent

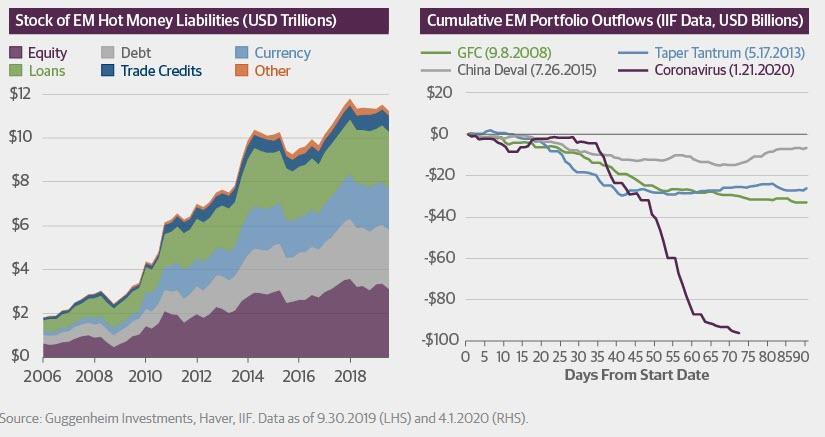

Just days after Scott Minerd warned of an emerging markets “apocalypse”, which he thinks would be the next shoe to drop in the ongoing global covid crisis as unlike developed nations emerging markets can’t just print their way out of a sharp recession at a time when EMs are suffereing massive FX reserve (read dollar) outflows…

… Fitch two days ago downgraded the one country many believe could be the ground zero of the next phase of the crisis, Mexico, to the lowest notch above junk, warning that “the economic shock represented by the coronavirus pandemic will lead to a severe recession in Mexico in 2020” and that “the outlook for the public finances is much less favorable than at the time of the last rating review in December 2019.”

But while Fitch’s new rating has a stable outlook, meaning a downgrade to junk isn’t imminent, Moody’s wasn’t as forgiving and moments after the close of FX trading (hardly a coincidence), the rating agency followed in Fitch’s footsteps, and also downgraded Mexico to the lowest investment grade rating, however this action had a negative outlook, meaning that a downgrade to junk can come at any moments, at which point the trickle of FX reserves out of Mexico would become a flood as foreign investors – prohibited by their mandate from investing in junk rated sovereigns – pull their capital.

Commenting on the action, Moody’s said that the key drivers behind the rating downgrade are: 1) Mexico’s medium term economic growth prospects have materially weakened; 2) The continued deterioration in Pemex’s financial and operational standing is eroding the sovereign’s fiscal strength, which is already pressured by slower revenue growth due to a weaker economy; and 3) Weakened policymaking and institutional capacity.

More importantly, this is why Moody’s kept a negative outlook:

The negative outlook captures the risk that the absence of effective measures to address the country’s economic challenges and contain the contingent liability stemming from Pemex could erode economic and fiscal strengths beyond what is contemplated by the downgrade to Baa1. In Moody’s view, the policy response has become less predictable and the spectrum of possible economic and fiscal policy outcomes has widened.

Mexico’s economic contraction in 2020 could be even deeper and the recovery could take longer than what Moody’s anticipates. If the pandemic worsens, pressures to increase government spending would add to the deteriorating fiscal and debt dynamics. Legislative as well as state and local elections in 2021 increase the risk that the federal government will boost spending ahead of the elections.

In short get out while you can, which will be less than welcome news for all those Mrs Watanabes who bought the MXN today after Fitch’s downgrade will simply because the currency had upward momentum. Newsflash: the Fed may be buying junk bonds, but they are domestic junk bonds. Nobody will buy Mexican junk.

* * *

Full Moody’s downgrade below:

Moody’s Investors Service, (“Moody’s”) has today downgraded the Government of Mexico’s long-term foreign-currency and local-currency issuer ratings to Baa1 from A3. The outlook remains negative.

The key drivers behind the rating downgrade are:

1) Mexico’s medium term economic growth prospects have materially weakened

2) The continued deterioration in Pemex’s financial and operational standing is eroding the sovereign’s fiscal strength, which is already pressured by slower revenue growth due to a weaker economy

3) Weakened policymaking and institutional capacity

The Baa1 takes into account the country’s large and diversified economy, the lack of major macroeconomic imbalances, and its fiscal strength, which despite deteriorating, is comparable to that of Baa1-rated peers. The credit profile is also supported by a healthy financial system and a sound monetary policy setting.

The negative outlook reflects the risk that economic and fiscal strength deteriorate beyond what is captured in a Baa1 rating due to ongoing uncertainties related to policy direction in the medium term and policy responses that have been insufficient to effectively address both the country’s economic challenges and Pemex’s continued financial and operating problems.

Moody’s also downgraded Mexico’s long-term foreign-currency and local-currency senior unsecured debt ratings to Baa1 from A3, the senior unsecured MTN ratings to (P)Baa1 from (P)A3, and the foreign-currency senior unsecured shelf rating to (P)Baa1 from (P)A3.

All of Mexico’s long-term country risk ceilings were revised down by one notch. Its long-term local-currency bond and bank deposits ceilings were revised down to A1 from Aa3, and the long-term foreign-currency bond ceiling to A2 from A1. The short-term bond foreign-currency ceiling remained unchanged at Prime-1. Moody’s also lowered the long-term foreign-currency bank deposits ceilings to Baa1 from A3 and the short-term foreign-currency bank deposits ceiling was maintained at Prime-2.

RATIONALE FOR THE RATING DOWNGRADE TO Baa1

MEXICO’S MEDIUM TERM ECONOMIC GROWTH PROSPECTS HAVE MATERIALLY WEAKENED

Moody’s expects medium term growth to remain depressed, even when removing this year’s severe economic contraction due to the coronavirus shock, with the economy growing at best 2% on average in 2021-23. This represents a marked deterioration from the 2.7% average growth rate Mexico reported between 2010-19.

When Moody’s upgraded the ratings to A3 from Baa1 in 2014, the rating agency expected at that time that the implementation of a broad range of structural reforms would lead to an increase in Mexico’s potential growth north of 3%. Since then, however, implementation has been uneven at best, with the energy reform being de facto reversed and other reforms not yielding the anticipated impact on total factor productivity and potential growth, in some cases due to poor execution.

Economic policy decisions and mixed policy messages under the current administration have materially altered business sentiment and will likely continue to dampen private sector investment in the coming years, further lowering Mexico’s medium term growth prospects. The first policy decision was the cancellation of Mexico city’s new airport in October 2018, a political decision that dismissed clear warnings about negative economic ramifications. The lack of clarity over the role private investment will have in the electricity sector also poses risk to investment in renewable projects and natural gas pipelines, since the government has yet to define an agenda. More recently, the government’s cancelation of a large brewery project already under construction was considered a strong blow to investor confidence by business chambers in Mexico.

THE CONTINUED DETERIORATION IN PEMEX’S FINANCIAL AND OPERATIONAL STANDING IS ERODING THE SOVEREIGN’S FISCAL STRENGTH

The government’s change in Pemex’s business model is adding to the severe financial and operational challenges of the company. The government has discontinued and reversed many aspects of the energy reform of 2014. In the absence of private sector investment to help Pemex increase production and maintain reserves, support is coming from the government. The current oil price shock has further impacted Pemex’s profitability and increased its liquidity needs, adding to the need for ongoing sizable support that is pressuring government finances.

Moody’s believes that given Pemex’s negative free cash flow and upcoming debt obligations, supporting the company in 2020-22 for liquidity purposes will cost the sovereign up to 2% of GDP each year during that period. If in addition the government were to decide to provide the support needed to increase capital expenditures required to meet current oil production targets and fully replace reserves, the overall level of support would rise to up to 3% of GDP each year, according to the rating agency. Even though the government is cutting government spending to try to adhere to fiscal targets, the impact of higher support to Pemex, anemic government revenues amid weaker GDP growth and rising interest burden will lead to higher fiscal deficits and increased debt ratios. Under Moody’s baseline scenario, the debt burden is likely to increase 10 percentage points to 46.2% of GDP bu 2022 from 36.4% of GDP in 2019. If the impact of the coronavirus outbreak is more severe and the government responds with increased fiscal measures, debt burden would likely rise beyond the 50% mark by 2022, and even more so if in addition the government were to fully fund PEMEX’s capital expenditure needs.

WEAKENED POLICYMAKING AND INSTITUTIONAL CAPACITY

The third factor informing today’s rating action is Moody’s view that the quality of policymaking and the institutional capacity to respond to shocks, elements which the rating agency considers a governance factor under its ESG framework, have weakened.

Economic policy decisions over the last year and a half and mixed messages are dampening business sentiment and investment prospects. In addition, conflicting social, fiscal and energy sector policy objectives will make it increasingly difficult for the authorities to sustain the current policy stance over time, leading to uncertainty about the potential sovereign credit consequences of future policy shifts, according to the rating agency. Government measures intended to support Pemex, for instance, have been piecemeal and insufficient to effectively address the company’s longstanding financial and operational challenges, which give rise to the risk of abrupt policy changes.

In Moody’s view, broad based salary and benefit cuts across government ministries have weakened the government’s administrative capacity. Combined with the significant reduction in budget and governance changes to some autonomous regulatory institutions, Moody’s believes that the country’s institutional capacity has been eroded, impacting the capacity to respond and manage shocks effectively and reducing the predictability of the regulatory framework.

RATIONALE FOR A NEGATIVE OUTLOOK

The negative outlook captures the risk that the absence of effective measures to address the country’s economic challenges and contain the contingent liability stemming from Pemex could erode economic and fiscal strengths beyond what is contemplated by the downgrade to Baa1. In Moody’s view, the policy response has become less predictable and the spectrum of possible economic and fiscal policy outcomes has widened.

Mexico’s economic contraction in 2020 could be even deeper and the recovery could take longer than what Moody’s anticipates. If the pandemic worsens, pressures to increase government spending would add to the deteriorating fiscal and debt dynamics. Legislative as well as state and local elections in 2021 increase the risk that the federal government will boost spending ahead of the elections.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE CONSIDERATIONS

Environmental risks are not material to Mexico’s credit profile. While some Mexican states in the coasts are exposed to extreme weather effects that may impact the finances of sub-sovereign states via reduced tourism, and disaster-relief and preparedness expenditure, they carry limited risk to the sovereign credit profile.

Social risks are material for Mexico. Moody’s considers the coronavirus outbreak to be a social factor under its ESG framework, given the substantial implications for public health and safety. The coronavirus crisis is likely to weigh significantly on employment levels in the short term, increasing social needs and therefore pressure on the government’s finances. Moreover, like other middle-income countries in Latin America, Mexico will be faced with a steadily ageing population in the coming decades. This ageing, in the context of a social security system that is both not universal and underfunded, will result in social demands that future administrations will have to contend with.

Governance risks are material for Mexico and, as noted above, a weakening policy framework and reduced administrative capacity contributed to today’s rating action. A deterioration in the decision making process is leading to economic policies that affect investment prospects and limit the government’s ability to respond to shocks. While the strength of key institutions such as the Central Bank supports macroeconomic stability, Mexico has scored poorly on institutional factors for more than a decade, as measured by the Worldwide Governance Indicators, with control of corruption and rule of law among its weakest areas.

FACTORS THAT COULD LEAD TO AN UPGRADE OR DOWNGRADE OF THE RATINGS

Although a rating upgrade is unlikely in the near future, a return to a stable outlook could result from regained confidence in the government’s ability to lay out and implement consistent policies and improve growth prospects in the medium term. A credible plan towards Pemex that would reduce the risk of recurrent and substantial government support to the company, while addressing the challenges facing the sector, would also support a return to stable outlook.

Further evidence that medium-term growth is in decline would put downward pressure on the rating. Rising fiscal deficits that cause the debt trajectory to shift upward beyond what we anticipate in our baseline scenario, whether due to recurrent financial support to PEMEX, a material increase in government spending or given a substantial decline in government revenues, could also lead to a downgrade. A continued deterioration in the policy framework would also add negative pressure to the rating.

GDP per capita (PPP basis, US$): 20,616 (2018 Actual) (also known as Per Capita Income)

Real GDP growth (% change): 2.1% (2018 Actual) (also known as GDP Growth)

Inflation Rate (CPI, % change Dec/Dec): 4.8% (2018 Actual)

Gen. Gov. Financial Balance/GDP: -1.8% (2018 Actual) (also known as Fiscal Balance)

Current Account Balance/GDP: -1.9% (2018 Actual) (also known as External Balance)

External debt/GDP: 36.6% (2018 Actual)

Economic resiliency: baa2

Default history: No default events (on bonds or loans) have been recorded since 1983.

On 14 April 2020, a rating committee was called to discuss the rating of the Mexico, Government of. The main points raised during the discussion were: The issuer’s economic fundamentals, including its economic strength, have materially decreased. The issuer’s fiscal or financial strength, including its debt profile, has materially decreased. Other views raised included: The issuer’s institutions and governance strength, has deteriorated.

Tyler Durden

Fri, 04/17/2020 – 17:51

via ZeroHedge News https://ift.tt/2VilSuz Tyler Durden